What’s Really Behind Bain Capital(ism)

By: / 02.02.2012

Republican presidential candidate Mitt Romney has taken a beating over the past few weeks regarding his long tenure at the private equity firm, Bain Capital. After distinguishing himself from President Obama as someone who truly knows how to create jobs, Romney likely did not expect to have his business credentials challenged—let alone by his Republican rivals. Among other things, Bain has been accused of “looting” companies and destroying jobs and lives along the way.

Some have sprung to Romney’s defense, often relying on the idea “creative destruction,” a term coined by economist Joseph Schumpeter several decades ago to describe the persistent process by which entrepreneurs challenge existing companies, often leading to the latter’s demise. Such creative destruction reached new levels in the 1980s, precisely the period now under scrutiny in the Bain recriminations.

Not surprisingly, this controversial issue isn’t new: liberals and conservatives have been quarreling over the economic lessons of the 1980s for twenty years. Wall Street Journal columnist Daniel Henninger argues that, in contrast to the narrative presented in movies like Wall Street, firms such as Bain “saved” the U.S. economy: “This was a historic and necessary cleansing of the Augean stables of the American economy. … It led directly to the 1990s boom years.”

The debate, however, glosses over the long-term economic trends in America that should be of very real concern. Many people have pointed out that the decade from 2000 to 2009 was the weakest in terms of job creation since World War Two. Even leaving aside the recessionary years of 2008 and 2009, the expansion from 2002 to 2007 was the weakest in postwar history—a hedge fund manager interviewed in Michael Lewis’ recent book, Boomerang, describes it as a “false boom.”

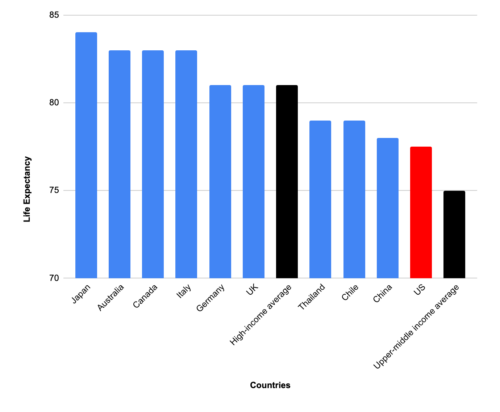

What connects the argument over the 1980s with today’s economic challenges? See this chart:

Gross Job Flows

Economists at the Census Bureau and elsewhere have laboriously compiled a detailed breakdown of labor market “flows” over the past three decades. While the United States maintains a relatively high level of job churn, with millions of people changing jobs each quarter (for better or worse), overall job creation has slowed markedly.

There are many reasons for this. One is the falling job contribution of new and young companies, a trend that began prior to the Great Recession. My Kauffman Foundation colleagues, E.J. Reedy and Robert Litan, have documented what they call a trend of companies “starting smaller, staying smaller.”

The fact that new companies start with fewer employees today than they did several years ago probably won’t surprise too many people—technological advances likely account for some of this. Likewise, sectoral shifts in the types of new companies have probably also played a role: construction firms tend to be smaller than manufacturing companies, and many more of the former were started over the past decade. More worrisome is the second part of the research by Reedy and Litan: namely, that young companies are growing more slowly than their predecessors in the 1980s and 1990s.

How can we account for this phenomenon?

For one, demographic trends may be at work: labor force participation has fallen over the past several years and so slower job creation could reflect lower availability of workers, as strange as that sounds at a time when we have millions of unemployed workers. Second, the productivity revolution that began in the mid-1990s has meant lower levels of job creation. Finally, lower job churn doesn’t necessarily reflect poorer labor market outcomes. Some researchers have argued that job tenure among women remains higher than men because of women’s later large-scale entry into the workforce and, since women now account for a much larger share of the workforce, this could suppress turnover.

Whatever the reason, it is clear that an accusatory debate over Mitt Romney and private equity does little to advance our understanding of deeper economic trends and what might be done about them. Given the complex interaction of these larger trends above, we need a far broader dialogue that matches the scale of our economic challenges.