Expanding the Child Tax Credit: A Better Way to Unite Democrats

04.27.2020

Financing Child Tax Credit refundability with taxes on high unearned incomes is a progressive anti-poverty model that Biden should take inspiration from.

By Brendan McDermott | Fiscal Policy Analyst for PPI

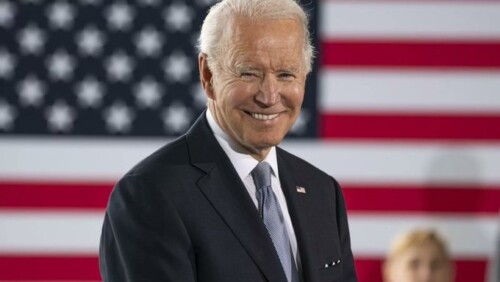

Vice President Joe Biden has begun the hard work of uniting the party against Donald Trump. Biden has tried to appeal to the party’s left wing with proposals to eliminate student loan debt and lower the age at which people qualify for Medicare from 65 to 60. But a better approach would be to adopt cost-effective policies that are targeted to support struggling families. A particularly promising example is a proposal former presidential candidate Sen. Michael Bennet introduced alongside Sen. Mitt Romney to extend the Child Tax Credit to the poorest families and offset the cost through progressive tax reforms.

Raising a child is expensive. Food, clothing, child care, and birth-related health care for both the mother and her child can easily strain a family’s finances. In spite of these high and rising costs, the Urban Institute projects that the federal government’s expenditures on children will fall from 2.4 percent of U.S. gross domestic product in 2018 to 2.1 percent by 2029. Although there are many causes of this decline (not all of which are cause for concern), a particularly worrying contributor is the fact that spending on children will compete for funding with programs that benefit the elderly, which are growing more expensive as America’s population ages.

The federal government provides the Child Tax Credit to help parents afford the cost of raising a child. The credit’s value phases in with parents’ income (families with no earned income receive no credit), until it reaches its maximum value of $2,000 for each child under 17 years old. The credit’s value begins phasing out if the parent earns more than $200,000 ($400,000 for married couples). If the credit is larger than the parent’s tax liability, the parent can receive a tax refund for up to $1,400 of the credit, but parents still need to earn at least $2,500 to qualify for any refund at all.

The Child Tax Credit lifted over four million children out of poverty in 2018. But because parents with very low incomes do not qualify for the credit or only qualify for a partial credit, the children who need financial support the most are often the ones whose families receive the smallest credit or none at all. The Tax Policy Center estimates that while almost all upper-middle and middle-income families receive the Child Tax Credit, just 75 percent of the poorest fifth of families do. PPI called for making the Child Tax Credit refundable in our budget proposal, Funding America’s Future, released last year. Democratic lawmakers also proposed making the credit fully refundable for six years as part of the negotiations over what would become the Coronavirus Aid, Relief, and Economic Security Act, Congress’ recent bill to mitigate the impact of the coronavirus pandemic.

The centerpiece of Bennet’s presidential campaign was an expansion of the Child Tax Credit, which he introduced in the Senate with Sen. Sherrod Brown. More recently, Bennet and Romney proposed a plan that would give parents of children under six years old a “Young Child Tax Credit” worth up to $2,500, $1,500 of which would be completely refundable regardless of the parents’ income. Parents of children from age 6–17 would receive the same credit they do today, but $1,000 of the credit would be refundable even if the parents had no income, and there would be no limit on how much of the credit a parent could receive as a tax refund if they received a larger credit. Since cash transfers to families are associated with better health, educational, and economic outcomes for children, especially poor children, ensuring that the children of parents with no or very low income still get financial support will pay off throughout the child’s life.

This Bennet-Romney plan is more modest than Bennet’s previous proposals but is the first to receive bipartisan legislative support. And while the plan’s cost has not been scored by the Congressional Budget Office, it is the first to include a pay-for. The senators would offset the cost of the credit by partially closing an egregious tax loophole — the “stepped-up basis” for taxing inherited assets. People pay capital gains taxes on the income they make by selling an asset for more than they bought it for. But if someone inherits an asset and sells it, they only have to pay tax on the increase in the item’s value since they inherited it, lowering their tax burden. Wealthy people are far more likely to have both capital and inheritances, so the stepped-up basis loophole specifically benefits the people who need it the least. The Bennet-Romney plan would still exempt $1.6 million of inherited assets per person ($3.7 million for spousal inheritance) from new capital gains taxes.

It is unclear whether this tax change would raise enough revenue to offset the full cost of expanding the Child Tax Credit under the Bennet-Romney plan, and Biden has already proposed using this revenue source to pay for some of his other priorities. Still, financing Child Tax Credit refundability with taxes on high unearned incomes is a progressive anti-poverty model that Biden should take inspiration from, both to substantively strengthen his platform and to help appeal to the party’s left without plunging the nation deeper into debt.