One of the biggest obstacles to ending the government shutdown is partisan disagreement about how to address the looming expiration of a pandemic-era expansion of the Affordable Care Act’s (ACA) premium tax credit (PTC). Established in 2014, the PTC gave subsidized health insurance to Americans who didn’t receive it through their employer or the government. The American Rescue Plan (ARP) made this program substantially more generous, including to higher-income households that were never supposed to receive assistance under the original ACA. Democrats want to continue the pandemic PTC expansion in its entirety, while most Republicans want it to expire.

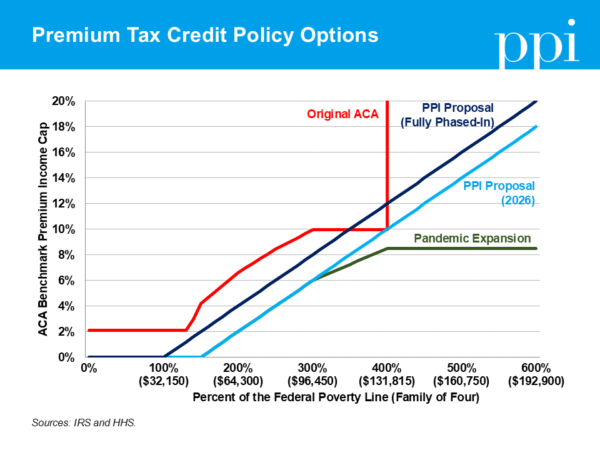

A bipartisan consensus appears to be emerging that the way to better target assistance moving forward and end the shutdown is to impose an income cap on eligibility for the PTC. Unfortunately, this compromise would restore the biggest flaw in the original ACA design that ARP solved: the benefit cliff. Before ARP expanded the PTC, households with income greater than 400% of FPL were not eligible for the ACA subsidy. That meant a single extra dollar of income could trigger thousands of dollars in higher premiums — an abrupt cutoff that discouraged work. Bringing back an income cap today would leave households vulnerable to sudden increases in health-care costs as a penalty for working.

Instead of repeating past mistakes, a better approach would be to establish a gradual phase-out of benefits for households as their income increases. This would smooth out the benefit cliff established under the ACA and avoid giving windfalls to high-income households.

Under PPI’s preferred approach, households with incomes under 300% of FPL would be eligible for the same expanded subsidies next year that they are today. But rather than capping health-care premiums at a certain percentage of recipients’ income, premiums would steadily increase as household income increases. As a result, high-income households’ subsidies would taper off as their earnings increase, thus reducing unnecessary benefits for high earners without recreating the benefit cliff. Subsidies would also fully phase out at lower income levels than they do today.

If lawmakers are concerned about high-income households still qualifying for subsidized health insurance, the best solution is to adjust the phase-out such that a household’s premiums are set to increase starting at a lower level of income. Accordingly, PPI proposes that the phase-in threshold gradually decreases for each of the next two years — similar in concept to a recent proposal from Sen. Mike Rounds (R-S.D.) to gradually phase down the credits back to pre-pandemic levels. But PPI’s proposal preserves free health insurance for families in poverty while still requiring reasonable contributions from middle-income households that can afford it, and lowering benefits for high-income households that don’t need the support.

Along with providing generous support to those who don’t need it, the other problem with simply extending the pandemic PTC expansion is that it is expensive, costing at least $23 billion per year. Rather than cutting health-care costs, it merely shifted the burden onto taxpayers. Fortunately, there are solutions that will both pay for the proposed expansion — letting taxpayers off the hook — and cut health-care costs in the long run.

Medicare Advantage, which allows seniors to receive their Medicare benefits from private insurers, costs taxpayers tens of billions of dollars per year because certain loopholes allow insurance companies to make patients appear sicker than they actually are, which artificially increases their government reimbursements. The No UPCODE ACT would end this practice and save at least $125 billion over 10 years, according to the Committee for a Responsible Federal Budget. Medicare also currently pays far more for services provided in hospital outpatient departments than in independent physician offices, a disparity that encourages hospitals to buy up clinics and drive consolidation — raising costs for patients and taxpayers alike. Adopting site-neutral payments could save $175 billion over the next decade.

Together, these two reforms would fully offset the cost of PPI’s proposed PTC expansion extension on a permanent basis. By eliminating the benefit cliff under the original ACA and establishing gradual phase-outs, PPI’s plan would prevent middle-class families from experiencing a sudden loss in benefits, ensure the poorest families remain protected, and avoid unnecessary tax subsidies for high-income households. These values reflect the goals of the ACA: affordable coverage and strong work incentives. Now is an opportunity for Democrats to push Republicans to adopt thoughtful reforms to the PTC. Millions of Americans are depending on them to get it right.