Investment Heroes 2022: Fighting Inflation with Capital Investment

By: / / 07.15.2022

Download PDFINTRODUCTION

The theme of this year’s Investment Heroes report is the powerful link between high investment and low inflation. Every year, the Progressive Policy Institute (PPI) analyzes the financial reports of large U.S. companies and ranks them by their capital investment in the United States. Nine of the top 11 companies on this year’s Investment Heroes list are in tech, broadband, or e-commerce industries. Amazon is at the top of the list, investing $46.7 billion in the United States in 2021 according to estimates by PPI. Tied for second are AT&T and Verizon, followed by Alphabet, Meta Platforms, Microsoft, Intel, Walmart, Comcast, Duke Energy, and Apple.

But here’s an important point for policymakers: As shown in a recent PPI paper, inflation in these digital industries has been extraordinarily low.1 High and sustained investment in new equipment and technology has created enough capacity to hold down most price increases in the digital sector, even as inflation has soared in other parts of the economy. For example, the price of wireless services at the consumer level was down by 0.7% in the year ending May 2022. In the year ending May 2022, the price of online advertising by internet publishing and web search portals only rose 0.6%.2

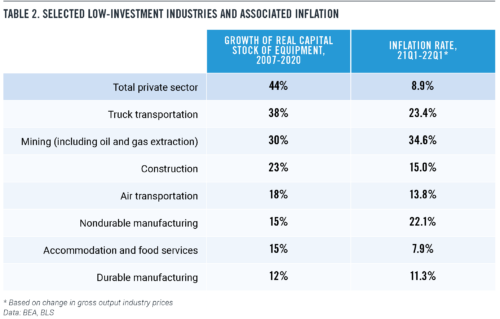

Policymakers should note that the link between investment and inflation works in the other direction as well: Low-investment industries are typically supply-constrained and more likely to boost prices when hit by an unexpected shock. Indeed, low-investment industries — including most of manufacturing, construction, trucking, air transportation, accommodations and food service, and mining — have all shown moderate to high inflation rates. And it’s generally agreed that domestic capital investment in the semiconductor industry has lagged, one of the few sectors of the digital economy contributing to inflation.3

For better or for worse, the case of the oil and natural gas industry illustrates the ways that low investment can lead to higher inflation.

Domestic investment in oil and gas drilling and exploration peaked in 2014 and collapsed by nearly two-thirds by 2016, according to data from the Bureau of Economic Analysis (BEA), as oil and gas companies faced a combination of low prices, pressures to use less fossil fuels for environmental reasons, and problems of pipeline and refinery capacity. And even though several energy production companies are still on our Investment Heroes list, their domestic capital outlays have continued to fall in the face of clear signals discouraging investment in fossil fuels. Exxon Mobil, in particular, decreased its U.S. capital spending by 43% from $11.2 billion in 2020 to $6.4 billion in 2021. This left the U.S. vulnerable to rising oil and gas demand and the unexpected shock of Russia’s invasion of Ukraine.

The key word here is “vulnerable.” No one is denying that free trade and globalization helped hold down prices for years. But when globalization is accompanied by a lack of domestic investment, the result is an inevitable increase in vulnerability and a loss of resilience. American workers become more vulnerable to foreign competition and downward pressure on real wages; American consumers become more vulnerable to domestic and international shocks and higher inflation; the country as a whole becomes more vulnerable from a national security perspective.

The policy and political implications are clear: Policymakers should praise and encourage those companies who invest in the United States, keep prices low, and reduce vulnerability against future shocks. That’s a clearcut win for consumers, workers, and the American economy. In some cases, like the semiconductor industry, it may be appropriate to use government funds to support domestic investment.

Conversely, government leaders can’t pursue policies that reduce or discourage domestic capital investment and then complain when we don’t have enough capacity to meet our changing needs at an affordable price, whether it’s energy or semiconductor chips or anything else. In particular, it is perplexing that Congress is putting so much energy into tech antitrust, when the sector has been a low-inflation, high-investment star performer. We would be better off as a country if other industries followed the tech/ecommerce/broadband lead and invested in America.

THE LINK BETWEEN INVESTMENT AND INFLATION

Over the past four years, Amazon, the top company on our list this year, has invested more than $115 billion in the United States, according to PPI estimates. This level of capital spending has powered unprecedented job creation, as Amazon operates e-commerce fulfillment centers across the country, and now employs more than 1.1 million workers in the United States.4

But perhaps equally important to U.S. consumers, Amazon’s investments in new logistics capacity have also helped keep down inflation, despite pandemic-related shocks. According to the Bureau of Labor Statistics (BLS), margins in “electronic and mail-order shopping” have shrunk by 6.4% in the year ending May 2022, compared to a 9.3% increase in margins for retail overall.5 Narrower margins for e-commerce means lower prices for consumers who shop online.

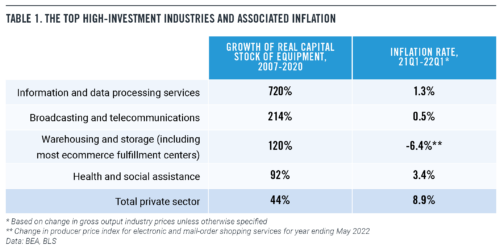

Indeed, tech, broadband, and ecommerce have all shown extraordinarily high long-term growth in their stock of productive capital (Table 1). For example, from 2007 to 2020, the stock of productive equipment in the information and data processing services rose by 720%, compared to a 44% increase for the private sector as a whole. The second biggest percentage gain was in the telecommunications and broadcasting industry, and the third biggest percentage gain was in the warehousing industry, which reflects the growth of e-commerce fulfillment centers.

At the same time, the tech, broadband and e-commerce industries have shown extraordinarily low rates of price increases during this inflationary surge. In addition to the shrinking margins in e-commerce already mentioned, the price of broadband access is down by 0.2% at the producer price level in the year ending May 2022. Overall, prices in the telecommunications and broadcasting industry have only risen by 0.5% in the year ending the first quarter of 2022, according to the BEA, despite everyone’s increased need for broadband and wireless connections. Prices in the information and data processing industry, which includes most internet companies, are up by only 1.3% in the year ending with the first quarter of 2022.

On the other hand, low-investment industries are more likely to be prone to inflation. Consider the paper and wood product industries. Since the pandemic began, Americans have been bedeviled by a series of seemingly inexplicable shortages of paper products, running from the great toilet paper gap of early 2020, to more recent shortages of disposable coffee cups6 and tampons.7 The shortages become less surprising when you realize that paper product companies have reduced their domestic manufacturing capacity by 17% since the beginning of the financial crisis in 2007. Capacity in the domestic wood product manufacturing industry is down 23% over the same period.8

Moreover, anyone who studied the economics of supply and demand in college won’t be surprised that prices rose in the paper and wood industries as paper mills closed and capacity shrank. Producer prices in the paper industry have soared by 16% over the past year. And since the pandemic began, producer prices in the wood industry are up a startling 67%.

And the disinvestment continues. Consider paper-making giant Georgia-Pacific, part of privately-owned Koch Industries. In March 2022, GP executives announced that they were shutting down a paper mill in Green Bay, Wisconsin, that had been making tissues and toilet paper since 1901.9 This followed a string of other paper mills and related manufacturing facilities that Georgia-Pacific’s managers had closed in recent years, including GP’s January 2021 announcement that it was shutting a Dixie Cup factory in Easton, Pennsylvania.10 GP has announced specific investments, but the private company is not required to release its overall capital investment figures publicly.

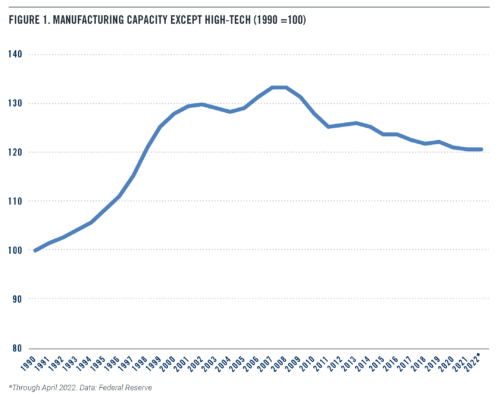

Overall, domestic manufacturing capacity, outside of high-tech, peaked in 2007, and since then has fallen by almost 10% (Figure 1). Over the same period, consumer purchases of goods, outside of high-tech, are up about 45%. With this growing mismatch between supply and demand, the U.S. has become ever more vulnerable to shocks in the global trading system.

Similarly, domestic iron and steel product capacity peaked in 2009, and since then has fallen by 25%, including a continued decline during the pandemic. Not surprisingly, the domestic price of steel has skyrocketed, because there is much less domestic capacity that can be brought online when needed.

When we look outside of manufacturing, we see the same pattern: For example, the stock of equipment such as airplanes owned by the air transportation industry rose by only 18% from 2007 to 2020, far slower than the 44% gain for the private sector as a whole.11 Not surprisingly, producer prices charged by the airline industry, including passengers and freight, jumped by 27% in the year ending May 2022 to their highest levels ever.

THE BIG PICTURE

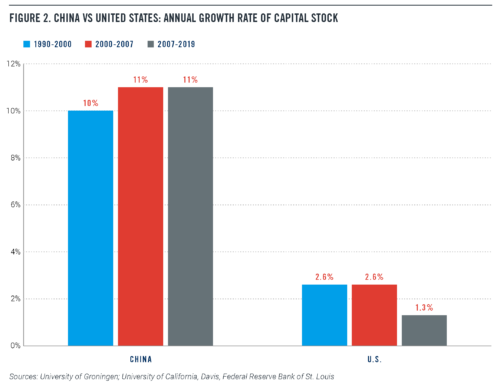

The United States entered the pandemic struggling with a capital investment drought that had lasted more than a decade. During the financial crisis of 2008-2009, domestic nonresidential investment in structures and equipment plunged as a share of gross domestic product, and never really recovered. As a result, the rate of U.S. capital stock growth fell in half, going from an average annual rate of 2.6% from 1990 to 2007, to only 1.3% from 2007 to 2019.

Meanwhile the capital stock in China has been growing at an 11% annual rate. As long as global supply chains worked well, the U.S. domestic investment shortfall didn’t matter too much to consumers (though it did matter to U.S. workers whose productivity and real wages weren’t rising). Inflation was low, held down by a flood of cheap goods coming out of China, the rest of East Asia and Europe.

However, this capital investment drought set up the conditions under which the United States has become more vulnerable to inflation, just like a dried-out forest is ready to burst into flames from an errant spark or lightning strike. Any kind of a shock — like the pandemic, supply chain disruptions, armed conflicts — can translate into price increases.

But some companies have been fighting the prevailing trend of capital spending weakness. Since 2012, PPI has provided unique estimates of domestic capital spending for individual major U.S. companies. Currently, accounting rules do not require companies to report their U.S. capital spending separately. To fill this gap in the data, we created a methodology using publicly available financial statements from non-financial Fortune 200 companies to identify the top companies that were investing in the United States.

We call these companies “Investment Heroes” because their capital spending is helping to create good jobs, boost capacity, and reduce inflation across the country. In 2021, the 25 companies on our list invested $260 billion in the U.S. This year’s list includes 10 tech, broadband, and e-commerce companies; seven energy production and distribution companies; two transportation companies; three automotive companies; two retail companies; and one health care company (Table 3). Later in this paper, we discuss the methodology that we use to estimate these figures.

Let’s look at each company on the list individually:

1. Amazon’s 2021 estimated U.S. capital spending was $46.7 billion, a 38% increase compared to its already impressive 2020 total. Principally, its increase in spending was directed toward augmenting the capacity of its fulfillment centers and growing its cloud services.

2. (tie) AT&T was tied for second with Verizon, spending an estimated $20.3 billion in the U.S. in 2021, up from $17.8 billion in 2020 (adjusted for the change in methodology described below). Its U.S. investment focused on expanding its network capacity.

2. (tie) Verizon Communications, tied for second with AT&T, increased its domestic capital expenditures to $20.3 billion in 2021, up from $18.2 billion in 2020 (adjusted for the change in methodology described below). The company continued to invest in adding capacity and density to its 4G network while building out its 5G network.

4. We estimate that Alphabet invested $18.8 billion dollars on U.S. capital expenditures in 2021. The company directed its investments toward technical infrastructure including servers, network equipment, and data center construction as well as office facilities and building improvements.

5. Meta Platforms came in fifth this year with an estimated $15.6 billion in U.S. capital spending. The social media company continues to invest in data center capacity, servers, network infrastructure, and office facilities. In 2021, the company increased metaverse-related investments.

6. Sixth is Microsoft with an estimated $13.1 billion in domestic capital spending based on its July 2021 10-K, the most recent available. The software company continues to invest in new facilities, data centers, computer systems for research and development, and its cloud offerings.

7. Intel slightly increased its domestic capital expenditure in 2021 to $12.9 billion, up from our estimate of $12.5 billion in 2020. Intel started work on two new fabs in Arizona, and announced investments in Ohio and New Mexico.

8. Walmart spent a reported $10.6 billion on U.S. capital expenditures in its fiscal year ending January 31, 2022, up sharply from $7.8 billion the previous fiscal year. Its investments were principally directed toward supply chain and customer service improvements. In addition, the company invested in online grocery services and selected Spartanburg County, South Carolina, as the location for its new hightech grocery distribution center.12

9. We estimate in 2021 that Comcast invested $10.1 billion in the U.S. Increases in capital spending were directed toward scalable infrastructure and line extensions.

10. Duke Energy invested $9.7 billion, slightly less than its 2020 figure. The decrease in spending was due to lower investment in the commercial renewables segment.

11. Apple is eleventh on this year’s list, investing an estimated $8.1 billion, a 37% increase in domestic capital spending from the previous year. Our estimates are based on Apple’s October 2021 10-K, which is the most recent annual report. The company began plans for a North Carolina campus with 3,000 employees.13

12. Exelon spent $8.0 billion on capital investments in 2021, a slight decrease from 2020.

13. PG&E invested $7.7 billion in 2021, about even with 2020 levels. In 2021, the company announced the beginning of a decade of spending to bury its powerlines as a wildfire prevention strategy.23

14. Fourteenth on the list is Charter Communications with domestic capital expenditures of $7.6 billion, a slight increase from the 2020 figure of $7.4 billion. The increase is due to payments for scalable infrastructure and network upgrades.

15. Exxon Mobil decreased its U.S. capital spending by 43% from $11.2 billion in 2020 to $6.4 billion in 2021. The company decreased its upstream, downstream, and chemical spending. In 2022, the company announced plans for a carbon capture and storage project in Baytown, Texas.

16. Dominion Energy invested $6.1 billion on U.S. capital expenditures, a slight decrease from $6.3 billion in 2020. Dominion is involved in the construction of an American-built wind turbine installation vessel.

17. Chevron’s reported U.S. capital expenditure in 2021 was $5.8 billion, a slight decrease from $6.1 billion in 2020.

18. General Motors invested $4.9 billion dollars in the U.S. in 2021 according to our estimates, a 28% increase from 2020. The company has announced large investments in electric vehicles and battery plants.

19. FedEx’s domestic capital expenditures in 2021 were estimated at $4.5 billion, a very small decrease from our 2020 estimate, based on its July 2021 10-K. The company’s capital spending was directed toward package handling and sorting as well as to aircraft and vehicle spending in their transportation segment.

20. The twentieth company on the list this year is Ford Motor with an estimated $4.3 billion in U.S. capital spending in 2021. The company announced new factories in Kentucky and Tennessee to support electric vehicle production.15

21. ConocoPhillips increased its U.S. capital spending by 41% in 2021 to $4.2 billion. Development activities included investment in the Permian, Eagle Ford, and Bakken regions.

22. Tesla is No. 22 with a big increase in estimated domestic capital spending to $4.1 billion. The increase is due to the construction of a Gigafactory in Texas and expansion of a factory in Fremont, California.

23. HCA Healthcare directed $3.6 billion to capital investments in 2021, an increase from 2020. HCA announced plans to build 3 new hospitals in Florida and 5 in Texas.

24. Target invested $3.5 billion in the United States this year, up 34%.The additional spending was targeted at store remodels, store reopening, and supply chain initiatives. In 2021, the company remodeled 145 stores around the country and expanded digital fulfillment capabilities.

25. The twenty-fifth company to make the list is Delta Airlines with an estimated $3.2 billion in U.S. capital expenditures in 2021. The airline’s capital spending was primarily related to aircraft and airport improvements, in mid-2021, it announced adding 30 new Airbus A321neo models to its fleet.16

METHODOLOGY

Our U.S. Investment Heroes ranking for 2022 follows the same methodology as our most recent report in 2021, with a few small tweaks. We started with the top 200 companies of the 2021 Fortune 500 list as our universe of companies, expanded from the previous 150 companies. We removed all financial companies and all insurance companies except health insurance companies. We also omitted the financing operations of non-finance companies when possible.

Except as noted, we use the global capital expenditure reported on the most recent 10-K through April 2022 as the starting point for the analysis. In this report, we refer to all estimates as “2021,” even if the fiscal year ended in 2022. Capital expenditures generally cover plant, equipment, and capitalized software costs. For energy production companies, capital expenditures can include exploration as well.

For wireless companies, we did not include their often sizable spending on purchases of wireless spectrum as part of capital expenditures, since that category is not counted as investment spending by the economists at the Bureau of Economic Analysis. Companies purchasing spectrum in 2021 notably includes Verizon (which paid $45.5 billion for the licenses it won in a February 2021 spectrum auction) and AT&T (which paid $22.9 billion for spectrum won at the same auction).

The companies in these rankings are all based in the United States. Non-U.S.-based companies were not included in this list because of data comparability issues, although there are many non-U.S. companies that invest in America. Notably, T-Mobile US, with more than $12 billion in purchases of property and equipment in 2021, would have made the Investment Heroes list if it was not owned by Deutsche Telekom.

For transportation companies, our report estimates the booked location of spending on capital expenditures for the company’s most recent fiscal year, rather than how much of those acquired assets are actually being used within the U.S.

Most multinational companies do not provide a breakdown of capital expenditures by country in their financial reports. However, PPI has developed a methodology for estimating U.S. capital expenditures based on the information provided in the companies’ annual 10-K statements and other financial documents. After developing our internal estimate, we contact the investor relations offices of the companies on our top 25 list to ask them to point us to any additional public information that might be relevant. Notwithstanding these queries, we acknowledge that the figures in this report are estimates based on limited information.

Our estimation procedure goes as follows:

- If a company has no foreign operations, we allocated all capital spending to the United States.

- If a company reported U.S. capital spending separately, we used that figure.

- If a company did not report U.S. capital spending separately, but did report changes in global and U.S. long-lived assets or plant and equipment, we used that information plus depreciation to estimate domestic capital spending. As appropriate, we adjust for large acquisitions. That was not necessary this year.

- If a company has small foreign operations that were not reported separately, or if the company’s net capital stock is falling, we allocated capital spending proportionally to domestic versus foreign assets, revenues, or employees.

Some adjustments of note:

- For Amazon, the methodological issue was their extensive use of finance leases. We chose to specify global capital expenditures as purchases of property and equipment (net of proceeds from sales and incentives) plus principal repayments of finance leases. We then used reported changes in U.S. and non-U.S. property and equipment, net, and operating leases to allocate global capital expenditures, taking into account depreciation and removing the effect of operating leases.

- Similarly, as part of our process for estimating domestic capital spending for Microsoft, Meta Platforms, UPS, and Kroger, we included principal repayments on finance leases reported on the company’s 10K, or amortization of finance leases based on 10K data, as part of capital spending.

- In previous years for Verizon, we made a small adjustment for foreign operations, even though non-U.S. assets or revenues are not broken out in the company’s 10K. This year we made the judgment call to stop making that adjustment, which had the effect of somewhat increasing Verizon’s estimated domestic capital spending.

- AT&T reported vendor-financed purchases of equipment separately from capital expenditures. We made the decision this year to add them back in. We allocated capital spending domestically in proportion to the U.S. share of net property, plant, and equipment.

- In the case of Comcast, we allocated all of its cable operations and corporate capital expenditures, including cash paid for intangible assets such as capitalized software, to the U.S. NBC Universal’s capital expenditures was allocated to the U.S. in proportion to our estimate of the US share of NBC Universal’s revenues.

- For consistency, we omitted capital spending by the finance arm of companies such as General Motors and Ford, which reflects the financing of leased equipment rather than actual direct investment.We then used our estimates to construct two lists, the main list (Table 3) and an additional list (Table 4) which omits non-energy companies. The second list is relevant because capital spending by energy exploration and extraction companies tend to fluctuate sharply with the price of energy.

DOWNLOAD THE FULL REPORT:

ABOUT THE AUTHORS

Michael Mandel is Vice President and Chief Economist at the Progressive Policy Institute.

Jordan Shapiro is Economic and Data Policy Analyst at the Progressive Policy Institute.

REFERENCES

1. Marshall Reinsdorf, “Is Inflation Still Low in the Digital Economy?” Innovation Frontier Project, Progressive Policy Institute, June 8, 2022, https://innovationfrontier.org/is-inflation-still-low-in-the-digital-economy/.

2. Based on the Producer Price Index data released by the Bureau of Labor Statistics on June 14, 2022.

3. Jeanne Whalen and Marianna Sotomayor, “2 huge chip makers warn of expansion delays as subsidies bill languishes,” The Washington Post, June 23, 2022. https://www.washingtonpost.com/technology/2022/06/22/chips-act-funding-congress/.

4. “Investing in the U.S.,” Amazon, last updated February 2022,

https://www.aboutamazon.com/investing-in-the-u-s.

5. Based on Producer Price Index data released by the Bureau of Labor Statistics on Jun 14, 2022.

6. Mike Pomranz, “Starbucks Is Struggling to Keep Stores Stocked with Coffee Cups,” Food & Wine, February 10, 2022, https://www. foodandwine.com/news/disposable-paper-cup-shortage-starbucks.

7. Taylor Telford, “Yes, There’s a Tampon Shortage. Here’s Why,” The Washington Post, June 13, 2022, https://www.washingtonpost.com/ business/2022/06/13/tampon-shortage-product-shortages-inflation-supply-chain/

8. Based on data from the Federal Reserve.

9 Jeff Bollier, “Georgia-Pacific to Shut down the 121-Year-Old Day Street Paper Mill in Green Bay,” Green Bay Press-Gazette, March 17, 2022, https://www.greenbaypressgazette.com/story/money/2022/03/16/georgia-pacific-shut-down-production-green-bay-papermill/7069678001/.

10. “GP to Expand Dixie Capacity in Lexington, Ky.; Will Close Operations in Easton, Pa., End of 2021,” Georgia-Pacific News, https://news. gp.com/2021/01/gp-to-expand-dixie-capacity-in-lexington-ky-will-close-operations-in-easton-pa-end-of-2021

11. A sizable number of planes are owned by leasing companies. But even taking those into account, the capital stock of aircraft only rose by 26% over this period, well below the average for the private sector as a whole.

12. “Walmart Selects Spartanburg County for New, High-Tech Grocery Distribution Center,” South Carolina Office of the Governor Henry McMaster, October 19, 2021, https://governor.sc.gov/news/2021-10/walmart-selects-spartanburg-county-new-high-tech-grocerydistribution-center.

13. Stephen Nellis, “Apple to Establish North Carolina Campus, Increase U.S. Spending Targets,” Reuters, April 26, 2021, https://www. reuters.com/technology/apple-establish-north-carolina-campus-increase-us-spending-targets-2021-04-26/.

14. Bryan Pietsch, “After a Slew of Disastrous Wildfires, PG&E Will Bury 10,000 Miles of California Power Lines,” The Washington Post, July 22, 2021, https://www.washingtonpost.com/nation/2021/07/22/pge-power-lines-california-wildfires/.

15. Phoebe Wall Howard, “Ford to Build New Plants in Tennessee, Kentucky in $11 Billion Investment in Electric Vehicles,” Detroit Free Press, September 28, 2021, https://www.freep.com/story/money/cars/2021/09/28/ford-motor-company-electric-vehicle-plants-batterieskentucky-tennessee/5896095001/.

16. Woodrow Bellamy, “Delta Air Lines Expands Fleet with New Airbus A321neo Order,” Aviation Today, August 24, 2021, https://www. aviationtoday.com/2021/08/24/delta-air-lines-expands-fleet-new-airbus-a321neo-order/