Introduction

The coronavirus pandemic has not deterred President Trump and Republicans from trying to kill the Affordable Care Act (ACA), which would strip millions of Americans of health care coverage at the worst possible time. However, Medicaid — significantly strengthened in the ACA — will be a lifeline for the country during this crisis.

The pandemic and the related economic downturn have already led over 40 million people to file jobless claims. Estimates of the number of Americans who may be joining the ranks of the uninsured range from 18 million (1) to 25 million (2) to as high as 45 million. (3)

This is in addition to the 28 million people who were uninsured prior to the COVID-19 pandemic. In a new survey from the Kaiser Family Foundation on the impact of the current crisis, “55 percent of Americans say Medicaid is personally important to them and their families and about one in four adults (23%) who are not currently on Medicaid say it is likely they or a family member will turn to Medicaid for health insurance in the next year.”(4)

However, the safety net provided by Medicaid will differ dramatically depending on where you live. People who live in states that embraced the ACA’s Medicaid expansion will be a lot better off than those who don’t. Since the Supreme Court made Medicaid expansion optional in 2012, 36 states and the District of Columbia have accepted the expansion. (5)

Before the pandemic struck, states that expanded Medicaid covered over 35 percent of unemployed adults compared to just 16 percent in non-expansion states.” (6) Now, the Urban Institute and the Robert Wood Johnson Foundation estimate that about 47 percent of those who have lost their job-based insurance will receive coverage from Medicaid. (7)

The Kaiser Family Foundation estimated a similar 50 percent. (8) Drilling down more specifically, in expansion states, 53 percent of those losing employer insurance are expected to turn to Medicaid, while 23 percent will remain uninsured (the rest will be eligible to purchase insurance on the ACA exchanges). (9) In non-expansion states, just 33 percent will receive Medicaid and 40 percent will likely wind up uninsured. (10)

In Texas alone, the largest state that declined to expand Medicaid, an estimated 1.6 million individuals have lost their employer-provided health insurance. About half of them will wind up without health care coverage because they will earn too much income to join Texas’ Medicaid program and too little income to be eligible for ACA subsidies for the exchanges. For the country as a whole, over one-quarter of individuals falling into that coverage gap will be in Texas. (11)

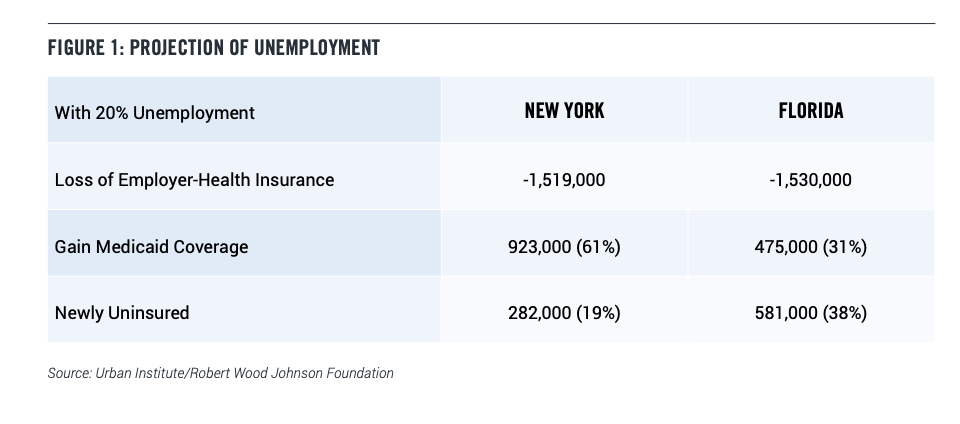

The Urban Institute estimated the state by state effects of different unemployment scenarios on insurance coverage. (12) Taking two states from this analysis, New York and Florida, allows us to more clearly understand the fate of people who lose their jobs and employer-provided health care insurance in expansion states vs. those in non-expansion states.

Under a projection of 20 percent unemployment, New York (an expansion state) and Florida (a non-expansion state) are both estimated to see around 1.5 million people lose their job-based coverage. In New York, 923,000 are projected to gain Medicaid coverage (61 percent) with 282,000 left uninsured (19 percent). In Florida, only 475,000 would gain coverage (31 percent) with 581,000 (38 percent) left uninsured. (13) (See Figure 1)

MEDICAID EXPANSION UNDER THE ACA

Medicaid has always been a crucial backstop for low-income families with children. In addition, Medicaid spending goes up when the economy turns down, making it an important part of the government’s suite of countercyclical tools for mitigating recessions. Before the coronavirus pandemic appeared, Medicaid provided insurance for one in five Americans and about 40 percent of children.

Prior to expansion in 2013, Medicaid targeted coverage to children in low-income families and some low-income parents. The expansion in the ACA included childless adults, making Medicaid a true safety net program for low-income Americans. The program now largely covers anyone with annual income below 138 percent of the federal poverty line (in 2020 that is $17,236 for an individual). About 13 million people have received Medicaid coverage in the expansion states. Since 2013, 21 of these states saw increases in Medicaid enrollment of at least 25 percent. (14) In non- expansion states, says the Kaiser Family Foundation, “eligibility levels for parents remain very low, often below half of poverty, and, with the exception of Wisconsin, other adults are not eligible regardless of their incomes.” (15)

The best way to mitigate a Covid-19 induced explosion of uninsured Americans would be for the 14 outlier states to expand their Medicare programs under the ACA. Unfortunately, this is unlikely to happen since the reasons for not expanding up until this point have been partisan and ideological, not related to the underlying levels of uninsured in the states or state budget problems.

In fact, Medicaid expansion is a good deal for the states, since the federal government picks up 90 percent of the costs. And it’s worth recalling how shortsighted the 14 states were in rejecting expansion initially given the desperate need now — especially considering the federal government promised to pay for 100 percent of costs for the first three years.

It is true that the remaining 10 percent contribution would now be a difficult lift given the pandemic-induced fiscal crises in most states. Congressional Democrats should thus propose returning to the 100 percent inducement for expansion in upcoming negotiations over further federal aid. (16)

STATE BUDGETS NEED HELP

The amount of economic suffering in general, and availability of Medicaid as a comprehensive safety net specifically, will also depend on whether national leaders enact further economic relief legislation. The Congressional Budget Office (CBO) projects that if Congress fails to pass additional economic support, even by the end of 2021 there would still be 10 million more unemployed than before the crisis.

The nation’s leaders must take further action and their top priority should be aid to state and local governments. With most businesses closed, state sales tax revenues are falling off a cliff even as costs for unemployment insurance and health care are exploding. PPI estimates that state and local governments will need between $445 and $835 billion in additional federal support between now and the end of 2021. (17)

Without that support they will be forced, by state balanced budget requirements, to cut employees and services, and to raise taxes — both of which would prolong the economic downturn. That, in turn, would mean many more people will lose their jobs and the ranks of the uninsured will swell.

And, it means pressure on Medicaid — often the largest and fastest growing expense in a state’s budget (in 2019, estimated at 30 percent of total state spending across all states). (18) States have reported the near certainty of Medicaid budget shortfalls and some have already begun cutting by hundreds of millions of dollars. (19)

Given the centrality of Medicaid as a comprehensive health care safety net for those with low incomes and those who have lost their employer-provided health insurance, states’ abilities to administer and maintain robust programs will be incredibly important for people for as long as the Covid-19 crisis lasts.

House Democrats have passed a $3 trillion relief bill, the HEROES Act, that whatever its flaws, (20) includes around $900 billion for state and local governments. The Trump administration and Senate Republicans, however, are balking at providing further aid.

It is worth noting that in the “Families First Coronavirus Response Act,” the second piece of emergency legislation passed so far, there was a small and restricted increase in aid-to-states funneled through the federal government’s Medicaid funding system. Importantly, this funding included Medicaid maintenance of effort” requirements. In exchange for taking the funding, states had to agree to not cut people already from the state’s Medicaid rolls or impose new restrictions on who is eligible to receive benefits. States are then bound by these requirements for as long as the health emergency lasts. (21)

Making sure those requirements are not watered down or eliminated in future relief bills will be essential. Nonetheless, given the enormous funding challenges states face, and the amount of jobless people now requiring health care insurance, Medicaid beneficiaries will still be at risk over the longer term. Studying the effects of the Great Recession, Rice University researchers found that, despite maintenance of effort requirements,

“On average, states suffered a $222 per capita negative revenue swing in 2009, which in the long term led to a $64 cut in Medicaid spending per child beneficiary, a 1 percent reduction in the number of elderly people enrolled in Medicaid and an $82 per capita cut in long-run state education spending. Such cuts are sobering, given that other economists have found that Medicaid coverage is effective in reducing infant and child mortality.” (22)

What’s more, the Trump administration and Republican state leaders in recent years have been probing the edges of legality to cut their Medicaid rolls, impose new restrictions on eligibility, and to cut Medicaid benefits. (23) So there is always a threat to this crucial safety net program – especially in the Republican-led states who have yet to expand their programs.

CONCLUSION

The Covid-19 crisis is far from over. Thanks to the ACA’s expansion of Medicaid, the program is poised to provide a crucial backstop for millions of Americans who have lost their jobs and their health coverage. For those who happen to live in the 14 Republican-dominated states that did not expand Medicaid, however, the picture looks bleak.

Medicaid expansion started out as the less-flashy, sometimes forgotten achievement of the ACA. It was originally projected to insure substantially less people than the ACA’s insurance exchanges and it built on an existing program, so it didn’t suffer from a website meltdown or a new, broadly unpopular “mandate” — which were certainly attention grabbing. But, there was also the fact that it focused support on low-income, childless individuals – a class of Americans often overlooked by national policymakers.

More attention was paid to the expansion’s success when Republican bills to “repeal and replace” the ACA were debated and failed — in part, because even Republicans had a hard time swallowing the huge numbers of people who would lose Medicaid coverage in their states. (24)

Ultimately, during the decade since passage of the ACA, those with insurance from the Medicaid expansion have outnumbered those getting insurance through the private market insurance exchanges. (25) As both ramped up during the 2013-2016 period, they insured roughly the same amount annually (reaching 13 million each by 2016). Since 2017, Medicaid expansion has maintained enrollment, while enrollment in the exchanges has shrunk by about 3 million people (largely due to Trump Administration

sabotage). (26)

The ACA’s Medicaid expansion is a sterling example of a federal government program accomplishing what it set out to accomplish. Now, progressive supporters of the ACA should focus on two critical goals. The first is passing federal aid to state and local governments, which will relieve pressure for cutting back on Medicaid during the pandemic. This step is supported by bipartisan majorities, who are also specifically averse to cutting Medicaid as a means of addressing upcoming budget shortfalls. (27) The second goal should be to build public pressure on the 14 recalcitrant states to put the needs of their citizens for health coverage over partisan enmity.

Authored by Josh Gordon, Ph.D., Senior Health Care Policy Fellow

PPI_Medicaid-Will-Be-Crucial-Safety-Net-in-Covid-Crisis

References

1 University of Minnesota, “As many as 18.4 million Americans face disruption, loss of health insurance in pandemic,” MedicalXpress, April 28, 2020. https://medicalxpress.com/news/2020-04-million-americans-disruption-loss-health.html

2 Garrett, Bowen and Anuj Gangopadhyaya, “How the COVID-19 Recession Could Affect Health Insurance Coverage,” Urban Institute and Robert Wood Johnson Foundation, May 4, 2020.

https://www.urban.org/research/publication/how-covid-19-recession-could-affect-health-insurance-coverage

3 Urban/RWJF projected the amount of uninsured at different levels of the unemployment rate and developed a baseline and high scenario for each. In this paper, I used their 20 percent unemployment rate analysis and their baseline (25 million) scenario not their high (45 million) scenario.

4 KFF Health Tracking Poll – May 2020. Published May 27, 2020. https://www.kff.org/report-section/kff-health-tracking-poll-may-2020-health-and-economic-impacts/

5 Nebraska, one of the 36 states, has adopted the expansion but isn’t scheduled to implement until October 1, 2020. See also the AdvisoryBoard, “Where the states stand on Medicaid expansion,” January 13, 2020, https://www.advisory.com/daily-briefing/resources/primers/medicaidmap

6 Center on Budget and Policy Priorities, “Larger, Longer-Lasting Increases in Federal Medicaid Funding Needed to Protect Coverage,” May 5, 2020. https://www.cbpp.org/research/health/larger-longer-lasting-increases-in-federal-medicaid-funding-needed-to-protect. And Anuj Gangopadhyaya and Bowen Garrett, “Unemployment, Health Insurance, and the COVID-19 Recession,” Urban Institute, April 2020.

7 Garrett, Bowen and Anuj Gangopadhyaya, “How the COVID-19 Recession Could Affect Health Insurance Coverage,” Urban Institute and Robert Wood Johnson Foundation, May 4, 2020. https://www.urban.org/research/publication/how-covid-19-recession-could-affect-health-insurance-coverage

8 Garfield, Rachel, et. al. “Eligibility for ACA Health Coverage Following Job Loss,” Kaiser Family Foundation, May 13, 2020. https://www.kff.org/coronavirus-covid-19/issue-brief/eligibility-for-aca-health-coverage-following-job-loss/

9 Park, Edwin, “New Urban Institute State-Level Health Coverage Estimates as Unemployment Rises,” Georgetown University Health Policy Institute Center for Children & Families (CCF), May 5, 2020. https://ccf.georgetown.edu/2020/05/05/new-urban-institute-state-level-health-coverage-estimates-as-unemployment-rises/

10 ibid.

11 Johnson, Kim and Dallas Williams, “1.6M Texans Lost Employer-Sponsored Health Insurance Because Of The Pandemic,” Texas Public Radio, May 26, 2020. https://www.tpr.org/post/16m-texans-lost-employer-sponsored-health-insurance-because-pandemic

12 Garrett, Bowen and Anuj Gangopadhyaya, “How the COVID-19 Recession Could Affect Health Insurance Coverage,” Urban Institute and Robert Wood Johnson Foundation, May 4, 2020.

13 ibid. Author calculations based on study.

14 The Medicaid and CHIP Payment and Access Commission, “Medicaid enrollment changes following the ACA,” Accessed on February 24, 2020, https://www.macpac.gov/subtopic/medicaid-enrollment-changes-following-the-aca/

15 Artiga, Samantha, Robin Rudowitz and MaryBeth Musumeci, “How Can Medicaid Enhance State Capacity to Respond to COVID-19?,” Kaiser Family Foundation, March 17, 2020. https://www.kff.org/medicaid/issue-brief/how-can-medicaid-enhance-state-capacity-to-respond-to-covid-19/

16 The SAME Act from Democratic Senators Doug Jones (AL), Mark Warner and Tim Kaine (VA) is one ready-to-go option. https://www.modernhealthcare.com/government/senate-bill-wants-sweeten-deal-states-expand-medicaid

17 McDermott, Brendan, Interactive Calculator: How Much Federal Support Do State and Local Governments Need?,” Progressive Policy Institute, May 7, 2020. https://www.progressivepolicy.org/publications/interactive-calculator-how-much-federal-support-do-state-and-local-governments-need/

18 National Association of State Budget Officers, “State Expenditure Report,” https://www.nasbo.org/reports-data/state-expenditure-report

19 Zeballos-Roig, Joseph, “3 cash-strapped states are making deep cuts to Medicaid as coronavirus devastates their budgets — and millions of jobless people lack health insurance,” Business Insider, May 6, 2020. https://www.businessinsider.com/states-medicaid-cuts-coronavirus-devastates-economy-budgets-ohio-dewine-2020-5

20 Ritz, Ben. “House HEROES Act Gets The Trade-Offs Wrong,” Progressive Policy Institute, May 15, 2020. https://www.progressivepolicy.org/projects/center-for-funding-americas-future/house-heroes-act-gets-the-trade-offs-wrong/

21 Aron-Dine, Aviva, “Medicaid ‘Maintenance of Effort’ Protections Crucial to Preserving Coverage,” Center on Budget and Policy Priorities, May 13, 2020. https://www.cbpp.org/blog/medicaid-maintenance-of-effort-protections-crucial-to-preserving-coverage

22 Rice University, “State revenue declines lead to cuts in children’s Medicaid benefits, education spending, Rice experts say,” May 11, 2020. https://news.rice.edu/2020/05/11/state-revenue-declines-lead-to-cuts-in-childrens-medicaid-benefits-education-spending-rice-experts-say/

23 See Gordon, Joshua, “Getting Back to Basics on Health Care,” Progressive Policy Institute, March 2020. https://www.progressivepolicy.org/publications/getting-back-to-basics-on-health-care/

24 ibid.

25 Author’s calculations based on the regularly updated Congressional Budget Office report “Federal Subsidies for Health Insurance.”

26 ibid.

27 KFF Health Tracking Poll – May 2020. Published May 27, 2020. https://www.kff.org/report-section/kff-health-tracking-poll-may-2020-health-and-economic-impacts/