Russia invaded Ukraine in February 2022, placing the European Union in a bind and forcing a choice between supporting Ukraine with aid, arms sales, and sanctions on Russia on the one hand, or withholding support to maintain Russian natural gas supplies. Before the invasion, Russia served as the largest supplier of natural gas to the EU through multiple pipeline systems and as Liquified Natural Gas (LNG). Europe chose support for Ukraine, and two key pipelines were shut off following the invasion.

The EU has sought to increase LNG imports from around the world to make up the gap as best as possible, and global gas prices skyrocketed as a consequence. The U.S. has stepped in as a key LNG supplier, sending nearly triple the quantity of LNG to the EU through August 2022 compared to the first eight months of 2021. The U.S., EU, and other allies with ambitious climate agendas should also seize on the crisis as an opportunity to expand and speed up deployment of clean energy and efficiency technologies to the greatest extent possible.

American exports are limited by the available capacity of liquefaction terminals, so the increase in shipments to Europe has come at the expense of other global customers for U.S. natural gas. The EU has spent the past several months purchasing as much LNG as possible to hit storage targets, along with a raft of policies aimed at expanding alternative sources of energy, encouraging conservation, and supporting households with subsidies.

The squeeze on supplies has loosened since September, as storage tanks across Europe have reached their capacity, and warm fall weather lessened seasonal demand. Through a combination of luck with the weather, curtailed industrial output, and expensive inventory buildup through LNG import growth, the European Union has made it nearly to the end of 2022 without a disaster. But the limits of LNG import and storage capacity, the vagaries of winter weather, and success in deploying clean energy and efficiency technologies will each continue to affect the EU, its energy markets, and its climate ambitions for the foreseeable future.

In terms of overall supply, the EU imported 58% of its energy in 2020, down slightly from the pre-pandemic figure of 60% in 2019. Natural gas makes up 24% of all the primary energy consumed in the EU, with import dependency and share of natural gas in overall energy supply varying by country.

In 2019, a “normal” pre-pandemic year, the EU’s total energy supply added up to 16.5 Petawatthours, of which 24% or 3.9 PWh came from natural gas. In that year, the EU imported a total of 440 bcm of natural gas, of which 38% came from Russia through the Nord Stream, Yamal, Turkstream, and Ukrainian pipeline systems and via LNG tanker. The remaining share was supplied by Norwegian, North African, and Turkish-Azerbaijani pipelines and by LNG tankers from around the world. After Russia, the largest exporters of LNG in 2019 were Qatar, Nigeria, and the United States (which supplied 3% of EU gas imports in 2019).

This picture of Europe’s pre-war energy reliance underscores the importance of Russia’s decision to weaponize its energy resources since its invasion of Ukraine. The Yamal Pipeline, running through Belarus to Poland, has been shut off since July. Now, the Nord Stream pipeline in the Baltic, which was running below capacity for several months while Gazprom claimed maintenance issues but is now offline due to suspected sabotage, is permanently out of commission as well. Prior to the invasion and shutoffs, these pipelines would be supplying roughly 800 mcm and 1,200 mcm respectively per week around this time of year.

The set of pipelines running through Ukraine supplied more variable quantities of natural gas in pre-invasion years, but has been supplying between 260-280 mcm of natural gas per week, or roughly 10-20% below prewar maximums ranging from 1550-2250 mcm per week. Unlike the other three main pipeline systems sending Russian gas to the EU, the Turkstream pipeline has not been severely curtailed, but it supplies smaller, variable amounts with a range this year of 34 to 323 mcm per week.

Cumulative Russian gas exports through midOctober to the EU and the U.K., as measured by Bruegel and ENTSOG, dropped by 74.5 bcm compared to the average for the same length of time for the years 2015-2020. That leaves a huge hole in Europe’s energy supply, equivalent to 4.8% of total energy supply for the EU in 2019. If Russian exports continue at 500 mcm per week, roughly continuing the trend since August, the total loss will reach 6.8%.

Imports and storage have helped make up part of this gap, but due to their relatively fixed capacity can only contribute as much as the EU’s present energy infrastructure allows. Data from the EU’s gas transmission system shared by Breugel show that European storage has filled to nearly the all-time maximum as importers rushed to replace cut off Russian supplies even after prices spiked:

While the Breugel data for 2021 and for previous years show that gas stocks usually started drawing down at this time of year, that’s happening more slowly this year as Europe attempts to store the absolute most it can for the winter. But since storage is nearly full and LNG imports do not necessarily have a place to go in the EU, LNG future prices have dropped back to a point comparable to post-invasion, preshutoff levels:

Looking ahead, future markets expect prices to stay elevated for the coming year at least and major uncertainties remain. In the meantime, painful tradeoffs are being made. The EU agreed to union-wide targets for storage, which they have since exceeded, and for reductions in gas demand of 15% through this coming March.

While good weather so far this fall kept building heat demand for gas low, the elevated price of natural gas has still hit consumers in heating, electricity, and especially industry. Industrial gas consumption dropped by 25% in the third quarter of this year, and continued high costs have come to threaten the viability of European plants in energy-intensive industries like chemicals, basic metals, and mineral producers. High gas costs also are passed through electricity prices to other energy-intensive industries that do not consume significant quantities of gas directly, and to households.

In France, where a nuclear-heavy grid might have been expected to lessen the blow to the power system, a set of prolonged maintenance issues have kept reactors from providing a crucial backstop. The EU and its member states are exploring and adopting various policy tools to subsidize households, diversify supplies of gas, and speed deployment of efficiency upgrades, renewables, and electrified end-use technologies like heat pumps that can help replace gas combustion where possible.

Many of these initiatives will take time to bear fruit, and in the meantime nobody in the financial markets or elsewhere can fully predict the most important immediate factor in Europe’s energy shortage: the weather this winter. A cold winter means higher demand for heating and electricity, and fixed import and storage capacity might not be able to keep up without painful tradeoffs for the EU.

Into the Russia-sized hole in European energy budgets step the United States, Qatar, and Nigeria. A major global producer and now exporter of oil and natural gas, America is host to the largest LNG export capacity of any country in the world, with seven liquefaction terminals together averaging 11.1 bcf in exports per day in the first half of this year.

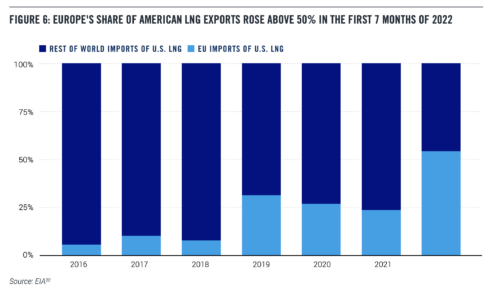

U.S. exports to the EU were already growing for years before the invasion, as the graph above shows. But U.S. firms have stepped up shipments to the EU massively since Russia’s invasion:

U.S. LNG exports to Europe increased by 2.8 times in the first eight months of 2022 compared to the same period in 2021, up from 512 bcf to 1,413 bcf. EU neighbors Turkey and the U.K. also roughly doubled their imports of American LNG over these periods, up by 67 bcf and 123 bcf, respectively. Global US LNG exports increased slightly in that time, to 2.6 trillion cubic feet through August of this year from 2.3 tcf in the first eight months of 2021, but capacity is fixed in the short run (absent maintenance problems like the May 2022 fire at the Freeport terminal, which is expected to resume exports soon).

While the “size of the pie” of overall U.S. gas exports grew ever so slightly, the main way that gas shipments to the EU have increased is by taking a larger slice of it from other would-be importers of U.S. LNG around the world, from 23% last year to 54% through August of this year.

For example, big customers of U.S. LNG in South America and Asia have seen sharp drops in American imports in 2022 so far. Brazil, Argentina, and Chile together imported 213 bcf less in 2022 than the same period in 2021. In East Asia, a slight increase in shipments to Taiwan was dwarfed by the huge drop in aggregate imports of China, India, Japan, and South Korea for a net decrease of 541 bcf. Smaller importers around the globe lost out too, as these decreases among big importers outside of Europe did not entirely offset the ravenous EU. As noted above, the share of overall American LNG exports going to Europe shot up from 23% last year to 54% so far this year.

Diverting shipments to the EU has the benefit of easing Russia-induced shortages across the Atlantic, but this strategy creates tradeoffs. Trading a concentrated, acute shortage in Europe for a diffuse shortage around the world means that the losers of a natural gas bidding war must contend with higher prices and foregone economic activity. Some will take the option of burning more coal instead, releasing more carbon dioxide and air pollution into the atmosphere.

Since the Nord Stream pipeline has now been not only shut off but damaged in a probable sabotage, global LNG suppliers have shipped nearly as much gas as storage can hold. Meanwhile, the war shows no signs of abating as Ukraine continues to claw back territories supposedly “annexed” by Russia. Europe thus could face a prolonged energy shortage and will continue importing significant volumes of LNG for the foreseeable future.

The United States must continue to boost exports of its relatively cleaner natural gas to Europe and the world. Otherwise, EU countries and other would-be gas importers could be forced to burn more coal to keep the lights on, or endure painful energy shortages.

Entering winter with nearly full storage capacity in the EU, global prices are higher than preinvasion benchmarks but dropping from their end-of-summer/fall peak. With futures prices high for the coming years, planned expansions to U.S. export capacity will help as they come online, but will take years. Expansions underway at three more liquefaction facilities are not expected to increase peak capacity from 13.9 bcf per day to 19.6 bcf per day until the end of 2025. With demand dependent on the uncontrollable factor of winter weather and short-run capacity for U.S. exports fixed, there remains much to do outside of direct increases in U.S. exports.

In Europe, supply-side policies to boost alternatives to natural gas such as expanding renewables generation and keeping older nuclear plants online will help keep the kilowatts flowing, emissions down, and energy costs from spiraling. Support on the demand side for electrified appliances to replace gas heaters and stoves and efficiency upgrades like insulation will ease the pressure on limited gas inventories and household finances.

These recommendations apply in equal measure to the U.S., where electrification and climate tech deployment can help add to the suite of available options for American consumers increasingly exposed to fickle international gas markets.

Planned expansions of LNG export capacity, and the pipeline systems required to feed them, should be acknowledged as a means to reduce global power-system emissions wherever they replace marginal coal combustion or natural gas produced in countries with higher leakage rates. As the methane mitigation policies in the Inflation Reduction Act and other potential policies like the new U.S. pledge at COP27 help reduce the impact of U.S. gas extraction upstream, the carbon advantage and climate benefits of globally abundant American LNG will grow.

Finally, as PPI has noted elsewhere, if American natural gas is to help Europe meet its carbon reduction targets, reducing upstream leaks and providing support to complementary energy technologies that speed decarbonization need to be part of the policy package.