It’s common for critics to unfavorably compare broadband prices in the U.S. to Europe. The Open Technology Institute’s (OTI) Cost of Connectivity 2020 study reported that “people can still expect to pay more for internet service in the United States than in Asia or Europe.”1 There is often talk of a “broadband affordability crisis,” which presumably Europe is not suffering from.

Indicators of an “affordability crisis” would typically involve consumers getting less for more. An affordability crisis involves price increases outpacing other parts of the economy and the access to the good or service being less attainable to more and more people.

In this paper, we consider a wide range of evidence available and provide our own new analysis to evaluate claims of a “broadband affordability crisis.” First, we review several international comparisons of broadband prices alongside the data on differing deployment. Any consideration of how U.S. broadband prices stack up must take into account such deployment differences as well. Second, we provide a new analysis showing how broadband and telecom industry revenues have significantly declined as a share of the overall economy. This suggests that in an important sense, the broadband and telecom industry is providing far more services to consumers and businesses while absorbing a smaller share of spending.

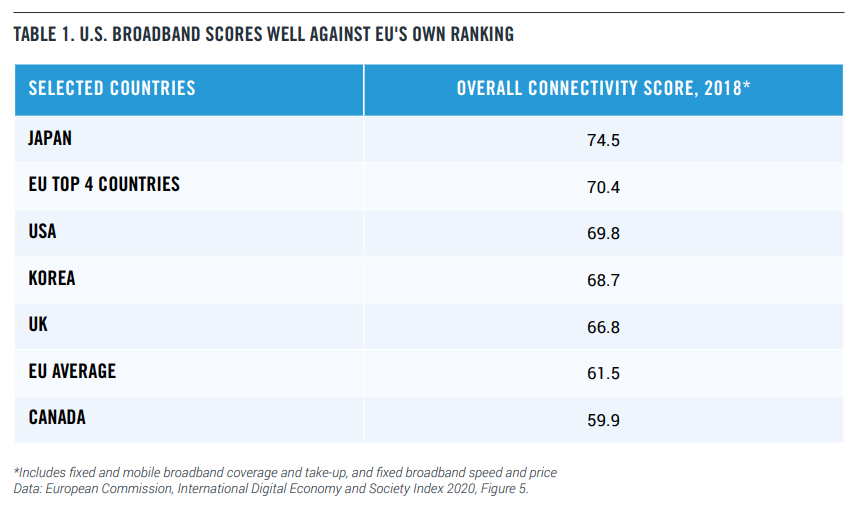

While some in the United States claim the broadband industry is performing poorly compared with the other side of the Atlantic, Europeans are not so sure that they are leading the broadband race. The European Commission’s International Digital Economy and Society Connectivity Index, which measures fixed and mobile broadband deployment and adoption, fixed broadband speed, and fixed broadband price, found the U.S. to rank very close to the top EU countries in 2018, and well above the EU average (Table 1).2

In particular, data shows U.S. broadband providers provide much better coverage than their European counterparts. Consider France, for example. The typical price for broadband in France — when you can get it — is relatively cheap, both compared to the United States and other European countries. However, as of 2019, 50% of French households did not have access

to broadband speeds of 100 megabits per second (Mbps) or more.3 In the same year, only 8% of the U.S. population did not have access to wired broadband speeds of 100 Mbps or more, according to the Federal Communications Commission (FCC).4 Similarly, as of 2019, 38% of French households did not have access to broadband with download speeds of 30 Mbps

or more. The comparable share of the U.S. population was 4%. Even if the U.S. figures overstate the availability of broadband, as some argue, the gap is enormous.

Indeed, the distribution of broadband service at various speeds is extremely uneven in European countries compared to the U.S. For example, Lyon, France, has 98% coverage at the 100 and 30 Mbps speed tiers.5 Yet in the commune of Dagneux, just 15 miles outside Lyon — with a population of roughly 5,000 — only 4% of residences and businesses were eligible for 100 Mbps speeds and only 13% were connectable at 30 Mbps speeds.

Similarly, Bonn, Germany, enjoys 99% coverage at the 100 Mbps speed tier and 100% coverage at the 30 Mbps speed tier.6 But in the Grafschaft municipality, approximately 15 miles outside Bonn — with a population of roughly 11,000 — speeds of 100 Mbps were available to only 29% of the population and 30 Mbps was available to 71%. By contrast, in Columbia, Illinois, 15 miles outside St. Louis, with a population of roughly 11,000, 95% and 100% of the population had access to 100 and 25 Mbps speeds with two or more providers, respectively.7

The link between low prices and weak deployment shouldn’t be a surprise. European broadband providers have been underspending their U.S. counterparts for years, focusing on dense cities rather than the more-expensive-to cover, low-density areas. A network that serves lower-density areas will inevitably be more expensive for everyone, even if an attempt is

made to keep costs segregated.

Our second piece of analysis is a different but complementary way to see if the cost of broadband is increasing or decreasing. Instead of studying individual prices, which are difficult to track given various fees and differing plans,

we look at total revenues from operation booked by broadband and telecom providers as a share of the overall economy. This measure accounts for all charges and fees being collected from consumers and businesses.

Since 2000, total broadband and telecom revenues have grown much slower than the economy as a whole. As a result, broadband and telecom revenues have shrunk more or less steadily from 2.7% of the economy in 2000 to 2.1% in 2019, imposing less of a burden on consumers and businesses even as they use much more data. By contrast, the revenues

being collected by sectors such as healthcare,