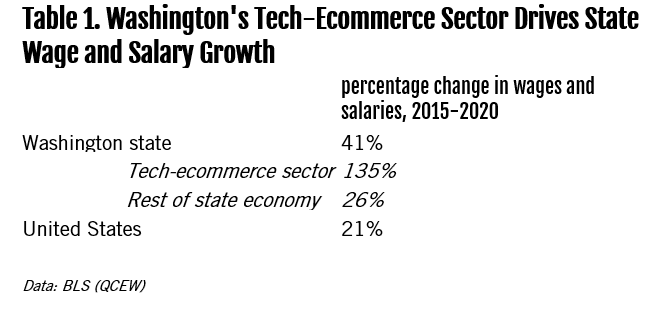

Between 2015 and 2020, total wages and salaries in Washington state rose by 41%, the biggest gain of any state, and almost double the 21% gain for the country as a whole. (See Table 1). This was not simply a pandemic effect, since Washington wage and salary growth was also first in the country in the 2014-2019 period as well.

To a large extent, Washington’s country-leading position in labor income is being driven by job and wage gains in the tech-ecommerce sector. Building on previous research and recent blog posts, we define the tech-ecommerce sector as including five tech industries and three ecommerce industries. The tech industries are computer and electronic production manufacturing (NAICS 334); software publishing (NAICS 5112); data processing and hosting (NAICS 518); Internet publishing and search, and other information services (NAICS 519); and computer systems design and programming (NAICS 5415). The three ecommerce industries are electronic shopping and mail order houses (NAICS 4541); local delivery (NAICS 492); and ecommerce fulfillment and warehousing (NAICS 493). We draw on Bureau of Labor Statistics data from the Quarterly Census of Employment and Wages (QCEW). This dataset reports on all jobs in each industry, as well as wages, salaries, and bonuses, including ordinary income from exercised stock options.

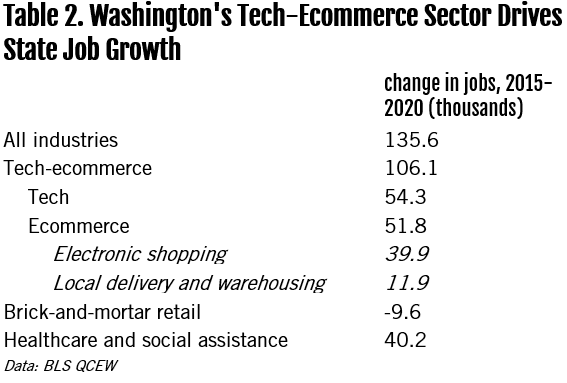

Let’s look at jobs first. From 2015 to 2020, the tech-ecommerce sector added over 100,000 new jobs to the Washington economy. Tech-ecommerce accounted for more than three-quarters of total job creation over that span, far outpacing the contribution of the healthcare and social assistance sector, which has long been the most dependable source of job growth (table 2).

Within the new jobs created by tech-ecommerce, roughly about half of those were in tech industries, and about half were in ecommerce industries (note that the BLS generally assigns establishments to industries according to the type of work being done at that establishment, not the industry of the parent company. So that an ecommerce fulfillment center is typically categorized in warehousing, no matter who owns it).

It’s important to note that the roughly 52,000 jobs being created in ecommerce over the past five years far exceeds the 10,000 jobs lost in brick-and-mortar retail in Washington. Average annual pay in the local delivery and warehousing industries in Washington came to about 30% higher than average annual pay in brick-and-mortar retail in the state. That’s the typical spread we found nationally in past research.

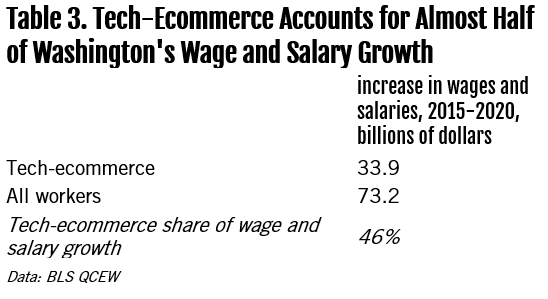

Now consider labor income in the state. Total wage and salary payments in Washington’s tech-ecommerce sector rose by $34 billion from 2015 to 2020, according to BLS data. That’s compared to the $73 billion increase in total wage and salary payments across the state. To put it another way, the tech-ecommerce sector accounted for 46% of the increase in wages and salaries in Washington from 2015 to 2020. (Table 3)

Finally, we turn to the question of the impact of the tech-ecommerce sector on state tax revenues in Washington. Tax collections have come in much stronger than expected, with forecasts repeatedly being raised. In particular, taxes for the 2020-21 fiscal year are currently forecast to come in 13.4% higher than the 2019-2020 fiscal year, and roughly 60% above 2014-2015 levels (See June 2021 Revenue Review from the Washington State Economic and Revenue Forecast Council, page 27).

How much of that gain is accounted for by the tech-ecommerce sector? There are several issues with making this calculation. The state government reports and forecasts tax revenue data on a fiscal year basis, while our data on the tech-ecommerce sector is on a calendar year basis and stops with 2020. In addition, states with a personal income tax have a direct connection between wage and salary payments and state tax revenues Washington, however, has no personal income tax, and relies instead on a variety of other taxes, including a retail sales taxes, a business and occupation tax, a property tax, and a real estate excise tax.

Usually we think of taxes like these as being less immediately responsive to changes in wages and salaries than an income tax would be. Indeed, there was a stretch, around the time of the financial crisis and the years after, when the state’s “General Fund” tax revenues languished, even as the state’s wages and salaries started to rebound.

In recent years, however, the combined and diverse flows of tax revenues into the state’s coffers appear to be rising more or less in parallel with the QCEW wage and salary measure, when adjusted for fiscal years. That makes it plausible that we can use the tech-ecommerce share of wage and salary growth as a proxy for tech-ecommerce share of tax revenue gains.

There are two possible tax revenue measures we can use for our back-of-envelope calculations — either “General Fund” taxes, or a somewhat broader category of state tax revenues, which starts with “General Fund” taxes and then adds in several taxes earmarked for education and training. That broader tax concept has been growing somewhat faster in recent years. Noting that Washington is on two-year budget cycles (also known as “Bienniums”), General Fund tax revenues rose by $17.1 billion from the 2013-15 budget cycle to the 2019-21 budget cycle, while the broader measure of tax revenues rose by $18.9 billion.

We then apply the 46% tech-ecommerce share of wage and salary growth to the increases in the two measures of tax revenues. We estimate that the growth of tech-ecommerce jobs and incomes accounts for $8.0-8.8 billion in higher tax revenues funding the 2019-21 budget cycle compared to the 2013-15 budget cycle. This should be viewed as a roughly estimate and not a final figure.

The tech-ecommerce sector is a massive positive for jobs, incomes and taxes in the state of Washington. That suggests Washington-headquartered Amazon and Microsoft, rather than “blocking the sunlight” for other companies in the state, play a central role in a thriving ecosystem that benefits workers, raises wages and generates tax revenues. As the saying goes “if it ain’t broke, don’t fix it.”