Biden’s Budget Demonstrates the Problems With His $400K Tax Pledge

By: / 03.19.2024

Last Monday, the Biden Administration released its budget proposal for 2025, offering a blueprint for what Biden hopes to accomplish in his second term. The budget includes some admirable initiatives and real revenue increases to pay for them, but it also relies on gimmicks to mask the reality that President Biden cannot sustainably finance his proposed agenda while maintaining his pledge not to raise taxes on any household with annual income under $400,000. Instead of allowing this shortsighted campaign promise to bind the remainder of his presidency, Biden should consider a broader set of tax and spending reforms that would allow him to cement a more durable progressive legacy.

The Biden budget proposes more than $3 trillion in new spending over the next decade to fund major initiatives that will help working families, including universal preschool, Medicaid expansion, and an expanded child tax credit. Biden also proposes to raise roughly $5 trillion in additional revenue through tax increases on businesses and wealthy Americans. Among his many corporate tax increases, Biden proposes raising the corporate income tax rate from 21% to 28%, hiking the corporate alternative minimum tax rate from 15% to 21%, and taxing more of businesses’ foreign income. On the individual side, Biden calls for restoring pre-2017 income tax rates on individuals making over $400,000, setting capital gains tax rates at 39.6% for those making over a million dollars, creating a new tax on centi-millionaires that includes unrealized income, and increasing Medicare taxes for high earners.

Thanks to these tax hikes and some modest proposed spending cuts, the president’s budget claims credit for reducing deficits by roughly $3 trillion over the next 10 years. Unfortunately, these savings are largely fiction. Many of the tax cuts enacted in 2017 are currently scheduled to expire in 2025, and the Biden budget proposes to make the tax cuts permanent for all households with incomes under $400,000, which represents about 98% of the population. The costs — which amount to roughly $1.7 trillion over 10 years — are not accounted for in any way beyond a vague reference to “additional reforms to ensure that wealthy people and big corporations pay their fair share.” Other costly tax provisions, such as Biden’s proposed extension of the Child Tax Credit and continuing a temporary increase in health insurance subsidies from the Inflation Reduction Act, are also assumed to be offset by unspecified tax increases after 2025.

Biden’s approach is certainly better than Republicans’ irresponsible plans to extend the 2017 income tax cuts across the board, which would cost $2.6 trillion plus interest over a decade and disproportionately benefit the wealthiest Americans. Yet with the trillions in tax hikes on the rich already proposed in his budget, there is little room for Biden to raise the additional revenue needed to offset the provisions he supports extending without violating his $400K tax pledge.

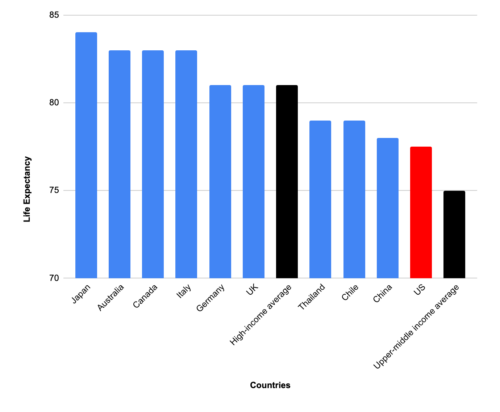

As PPI demonstrated in a recent report, Biden’s pledge takes off the table over 80% of annual income earned by individuals. Enacting the tax policies in Biden’s budget would likely put tax rates on the remaining 20% close to their revenue-maximizing rates, making it virtually impossible for further tax increases on this income to provide additional offsets. For example, when combining the federal and state rates, the 25.8% average tax rate faced by corporations is already at the OECD average. Biden’s proposed reforms would raise it to 33.8% — the second-highest among our peer countries. Moreover, while academics differ on exactly how high capital gains taxes could be raised without dampening growth or reducing revenues, a top federal rate of 39.6% would undoubtedly leave little room for future increases when considering how individuals also often pay state taxes on capital gains.

Even if Biden could squeeze out enough revenue from the ultra-rich to fully offset his new spending proposals, there would be no money leftover to pay for the underfunded promises our government has already made. Spending on Social Security and Medicare is growing faster than the revenue needed to finance them as our population ages, and if nothing is done to address the structural imbalances in both programs’ financing, they face automatic benefit cuts under current law within the next 10 years. Biden’s budget proposal this year mostly just relies on the same budget gimmicks to paper over the problem that it did last year.

Although it is unlikely Biden will walk back his $400K tax pledge during an election campaign, he cannot allow shortsighted campaign promises to prevent him from securing a durable and sustainable legacy in a potential second term. At a time when annual interest payments are already at their highest level in history relative to the size of our economy, we can’t afford to rack up even more debt. Doing so would leave policymakers with few resources to fund future responses to economic emergencies or progressive public investments. Instead, the president should be willing to entertain common-sense spending reforms and broader-based taxes, such as a value-added tax or a carbon tax, which would raise trillions in revenue without harming economic growth.

For a democratic society to be successful, lawmakers must be accountable to voters who can evaluate whether the new services they’re being offered are worth their additional tax dollars. As the lone remaining presidential candidate committed to defending democracy, if re-elected, Biden must be willing to spend his remaining time in office making the argument to voters that his initiatives are worth paying for rather than hiding the costs and leaving the next generation to pick up the pieces.