Clearly Americans are concerned about inflation. Prices for most food and energy products are soaring, which hits them right in the wallet. The Biden Administration finds itself on the political defensive, as prices increases are outstripping wage increases for most workers.

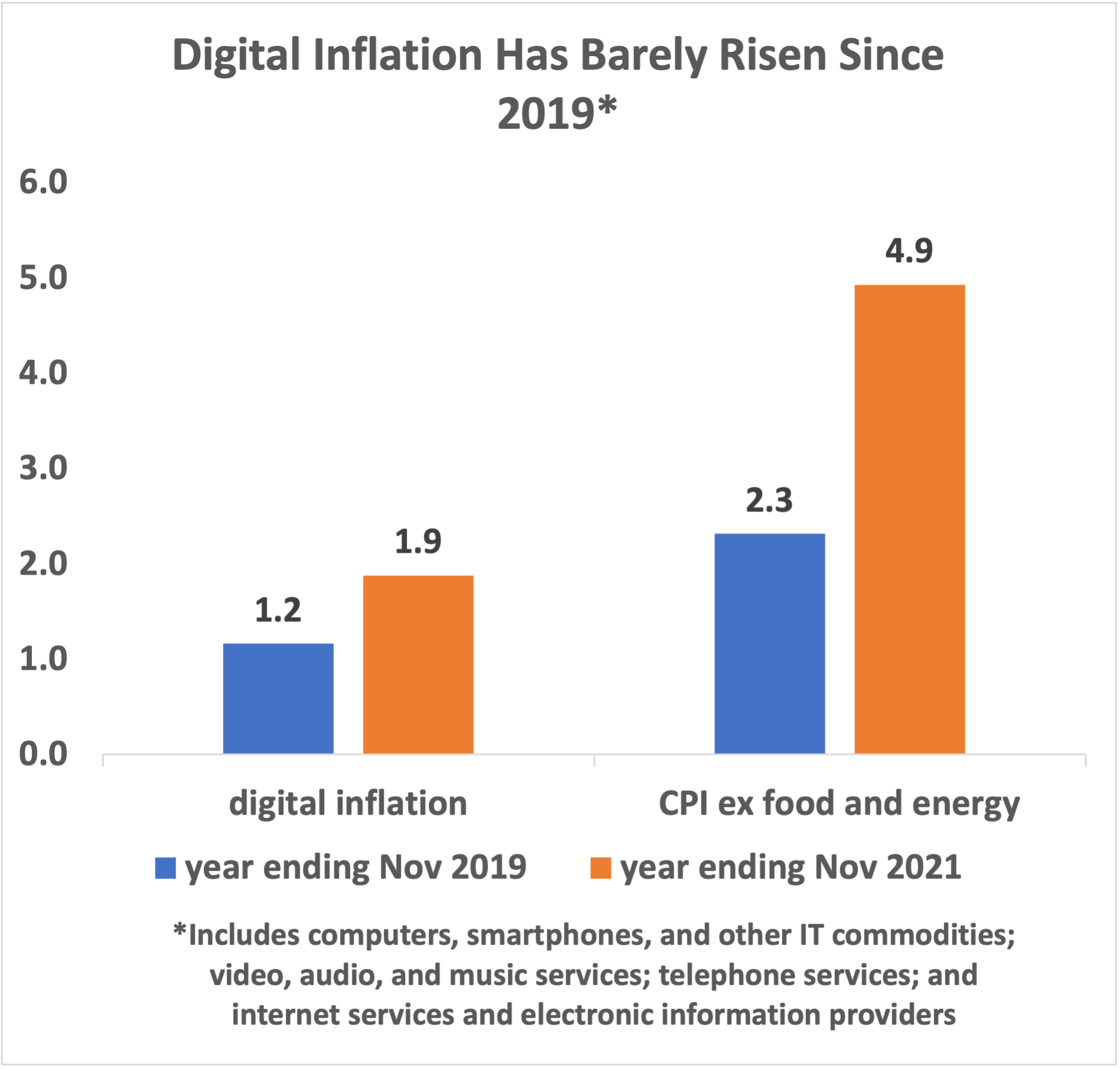

But here’s an important piece of good news that is not getting enough attention. Inflation remains low in the digital sector, even as it accelerates across much of the economy. Start with consumer inflation (as measured by the CPI). Over the past year, prices for digital consumer goods and services tracked by BLS (see graphic) have risen by only 1.9% overall, compared to 4.9% for CPI ex food/energy and 6.8% for total CPI.

Digital consumer goods and services include computers, smartphones and other IT commodities; video, audio, and music services; wired and wireless phone services; and internet services and electronic information providers.

The chart shows that digital consumer inflation has risen only 0.7 percentage points (PP) compared to November 2019, while consumer inflation ex food/energy has risen 2.6 PP. For example, the inflation rate for “internet services and electronic information providers” has only risen by 0.7 PP (from 1.5% to 2.3%).

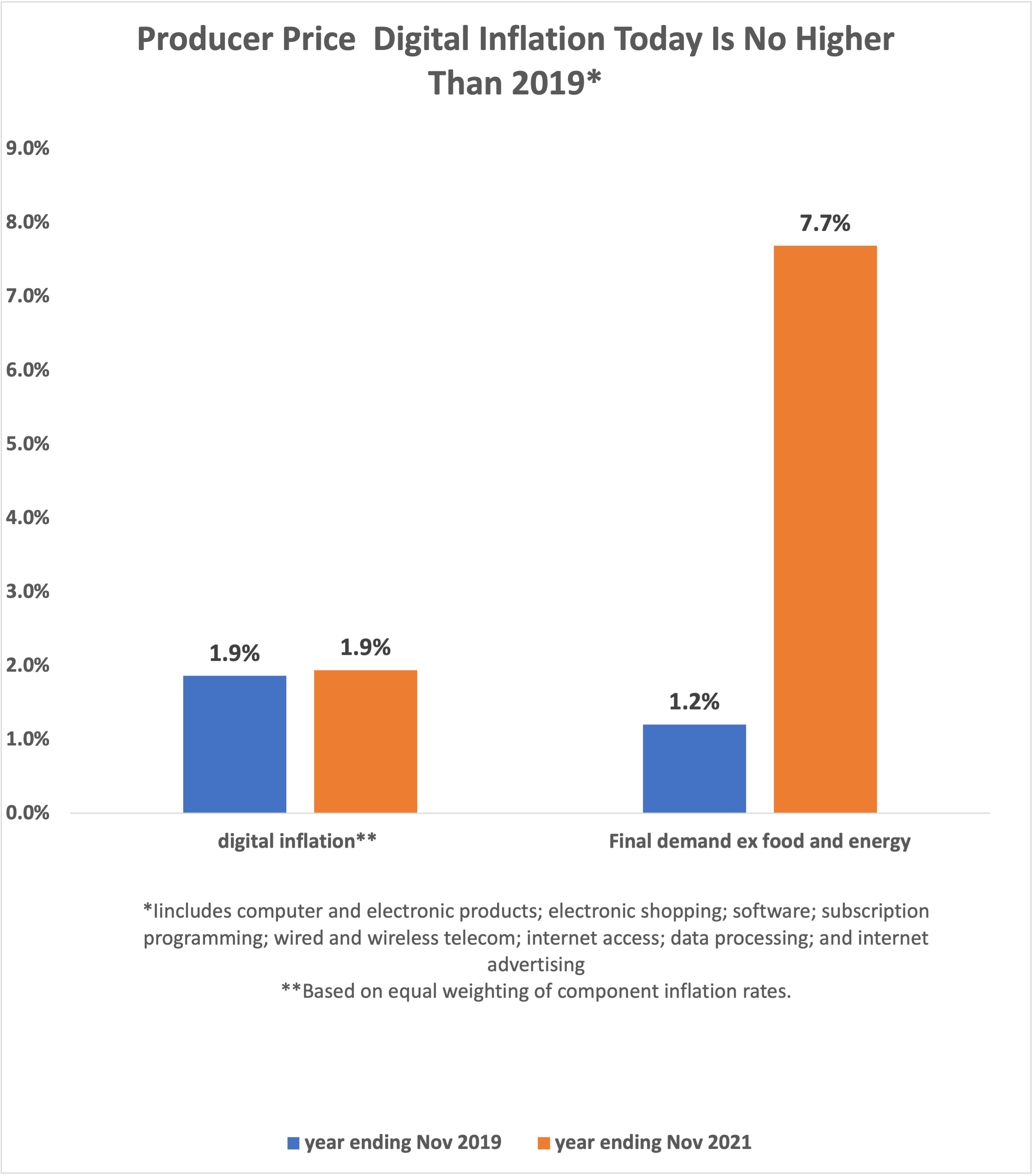

When we look at producer prices, we see a very similar phenomenon:Producer price inflation in the digital sector is no higher today than it was before the pandemic. Over the past year, producer prices for digital goods and services tracked by BLS (see graphic) have risen by only 1.9%, compared to 7.7% for final demand ex food and energy.

Final demand inflation (ex food and energy) accelerated from 1.2% in the year ending Nov 2019 to 7.7% in the year ending Nov 2021. But digital producer price inflation was roughly constant at 1.9% in both periods (this calculation was done giving equal weights to each component).

Digital producer prices include computer and electronic manufacturing; electronic and mail order shopping services; software publishers; cable and other subscription programming; wired and wireless telecom; internet access; data processing; and internet publishing and web search advertising.

Some examples: The producer price of internet access services rose by only 0.3% over the past year, up only slightly from the -0.3% rate in November 2019. The producer price charged by software publishers fell by 0.3%, a slightly bigger decline compared to two years ago. The producer price index for telecommunications, both business and residential, is running at a 1.1% rate, slightly down from the 1.2% rate in November 2019.

The digital sector is exerting a dampening effect on both consumer and producer price inflation, reflecting large productivity-enhancing capital investments by digital companies. Meanwhile productivity has lagged in sectors such as food processing, where prices are skyrocketing.

However, the digital sector is not getting enough “credit” in the overall numbers for holding down inflation. For example, there’s no doubt that the digital sector is much more important to Americans today than it was in pre-pandemic 2019. Yet the digital sector gets a smaller weight in the CPI today than it did in 2019, because spending on digital goods and services is a smaller share of the consumer basket. That’s good news, but it has a perverse effect on the calculation of the overall inflation rate.

We may have to move towards a time-weighted versus expenditure-weighted CPI. Certain tasks, like dealing with the DMV or health insurers, are more “costly” in time than money. Conversely, digital services save you time that doesn’t show up in the official stats.

Time-weighted CPI would take into account that digitizing tasks, including shopping, generally reduces time spent by consumers, while adding more regulations generally increases time spent.

A time-weighted approach to CPI would likely show higher inflation for rural and poorer Americans. It would allow us to think about how cutting government bureaucracy and saving the time of Americans actually reduces inflation.

From the political perspective, the Biden Administration can make a strong case that the digital goods and services that are so important to Americans these days are barely rising in price. And America’s digital leadership will continue to hold down price increases once the temporary supply chain issues abate.