For the firms that adopt them, artificial intelligence (AI) systems can offer revolutionary new products, increase productivity, raise wages, and expand consumer convenience.[1] But there are open questions about how well the ecosystem of small and medium-sized enterprises (SMEs) across the United States is prepared to adopt these new technologies. While AI systems offer some hope of narrowing the recent productivity gap between small and large firms, that can only happen if the technologies actually diffuse throughout the economy.

While some large firms in the U.S. are on the cutting edge of global AI adoption, the challenge for policymakers now is to help these technologies diffuse across the rest of the economy. To realize the full productivity potential of the U.S., AI tools need to be available to 89% of U.S. firms that have fewer than 20 employees and the 98% that have fewer than 100.[2] An AI-enabled productivity boost would be particularly timely as SMEs are recovering from the effects of the ongoing COVID-19 crisis.

The report discusses the promise for AI systems to increase productivity among U.S. SMEs, the current barriers to AI uptake, and policy tools that may be useful in managing the risks of AI while maximizing the benefits. In short: there is a wide range of policy levers that the U.S. can use to proactively provide the underlying digital and data infrastructure that will make it easier for SMEs to take the leap in adopting AI tools. Much of this infrastructure operates as a type of public good that will likely be underprovided by the market without public support.

The central case for AI adoption is that human cognition is limited in a variety of ways, most notably in time and processing power. Software tools can improve decision-making by increasing the speed and consistency with which decisions can be made, while also allowing more decisions to be planned out ahead of time in the event of various contingencies. Under this broad framework, we can think about “AI” as being a broad suite of technologies that are designed to automate or augment aspects of human decision-making.

AI tools are already being used across a wide range of domains to decrease power costs, improve logistics and sourcing systems, predict cash flows, steamline legal analysis, aid in drug discovery, improve factory safety conditions, and identify logistics efficiencies. This is in addition to opening up entirely new fields like autonomous vehicles, drone delivery systems, and instantaneous language translation.

While many of AI’s most eye-catching use cases will likely remain the preserve of large platforms, the technology also holds tremendous promise for SMEs. The adoption of third-party AI systems will notably enable SMEs to streamline mundane (but often costly) tasks such as marketing, customer relationship management, pre- and post-sales discussions with consumers, and Search Engine Optimization (SEO). These systems can provide a lifeline for SMEs who are overwhelmed by the many challenges of running a business, and they can expand the number of businesses that are eligible for certain financial supports. For example, AI tools can be used to improve the accuracy of credit risk underwriting models and using alternative data sources and a streamlined process, they can make it easier for SMEs to take out loans they otherwise might not qualify for under traditional methods. Along similar lines, research shows that AI-driven robotics have (and will continue) to boost the productivity of SMEs in the manufacturing industry.

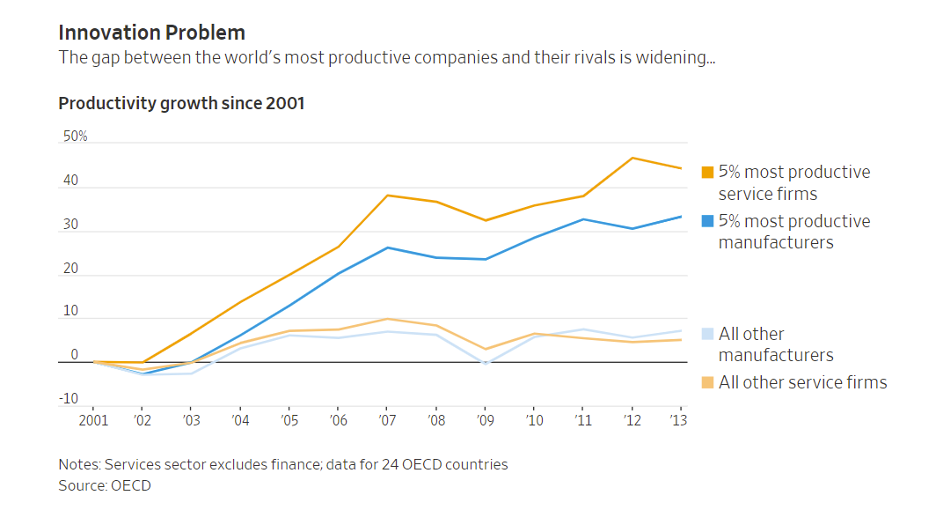

Importantly, this upcoming wave of AI technology can help SMEs catch up with larger, international firms because it can democratize the benefits of large information technology (IT) investments that superstar firms have been seeing over the last decade.

The economist James Bessen has argued that the top 5% of firms in many industries have been increasingly pulling away from the rest of the field because they’ve made large investments in proprietary IT systems. Their smaller rivals struggle to develop their own systems because they lack the necessary scale to hire a large stable of in-house technical talent. Amazon, for example, has a team of 10,000 employees working to improve their Alexa and Echo systems.

While AI tools can’t fully reverse this trend, they can help shrink the gap when embedded into Software as a Service (SaaS) platforms that smaller firms can make use of without the same level of investment. Essentially, through general-purpose AI tools, SMEs can have access to a host of productivity enhancements that these proprietary IT systems offer, but at a price point that is economical for SMEs. By shrinking this productivity gap, smaller firms can begin to compete in earnest while differentiating from large firms through improved customer service and greater product diversity. This will give a large leg up to SMEs who adopt these AI systems and help them better compete with large global incumbent firms.

Consider a firm like Keelvar Systems, which uses advanced sourcing automation to help businesses rapidly shift supply chains around the globe in the event of disruptions or delays. Essentially, it replaces or augments the work that a large supply chain and sourcing office would do within a firm. By using their service, or others like it, SMEs have the ability to benefit from similar levels of sophistication in their supply chain management without having employees spend hundreds of hours on tedious tasks or maintaining expensive proprietary IT systems.

There are firms like Legal Robot that have created a series of tools to help small businesses access legal services that would otherwise require a small army of in-house lawyers. With their service, SMEs can use smart contract templates based on their industry, receive instant contract analysis to make sure they are receiving fair terms and can automate certain aspects of compliance with laws like the GDPR.

Likewise, companies like Bold360 have helped SMEs improve their customer service experiences by offering a variety of AI-powered-chatbots and tools. Many basic customer concerns about products or delivery can be handled by these basic chatbots, freeing up human customer representatives to focus their time on the hard or advanced cases. Again, the pattern here is there is a service that large, multinational companies have been investing billions of dollars to create proprietary versions of, and now the customizability of AI is helping this service become more accessible to SMEs.

What are the barriers to AI adoption for SMEs in the U.S. and what can policymakers do to help create a welcoming environment?

Depending on the context, data can often have the same traits as other public goods. First, it is non-rival—the marginal cost of producing a new copy of a piece of data is zero. Stated differently, multiple individuals can use the same dataset at almost no additional cost. The second important trait is that data is hard to exclude. Consider this report. Once it has been posted online, it is difficult to prevent people from accessing and sharing it as they see fit. This is one of the reasons why copyright infringement is so hard to stamp out.

Oversimplifying, these two features can lead to two opposite problems. On the one hand, economic agents might underinvest in public goods, absent government-created appropriability mechanisms (such as patent and copyright protection). Conversely, public goods tend to be underutilized (at least from a static point of view). Any price that enables economic agents to recoup their investments in a public good will be above the good’s “socially optimal” marginal cost of zero. Public good policies thus involve a tradeoff between incentives to create and incentives to disseminate. For example, patents give inventors the exclusive right to make, use and sell their invention; but inventors must disclose their inventions, and these fall into the public domain after twenty years.

What does this mean for data and artificial intelligence? If policymakers think that data is an essential input for cutting-edge AI, then they should question whether obstacles currently prevent firms from investing in data generation or disseminating their data.

While policies in this space involve significant tradeoffs, some offer much higher returns to social welfare. For instance, to the extent policymakers believe existing datasets are being underutilized, purchasing private entities’ data (through voluntary exchanges) and placing it in public data trusts would be a better policy than imposing data sharing obligations (which could undermine firms incentive to produce data in the first place). This is akin to the idea of government patent buyouts.

Of particular interest for policymakers, however, is the fact that some SMEs are sitting on top of data flows that are not being fully utilized because it is expensive to make data usable and these datasets may not be very valuable in isolation. As an example, industry-level manufacturing data might be quite valuable to all firms in a sector, but the dataflows from one SME are much less valuable. The U.S. could align incentives by providing investment funds to quantify various aspects of business flows and then submit them to public data trusts, which could be accessible for use by all firms in the industry. This would essentially be treating valuable dataflows as a type of public infrastructure that needs government investment to be fully realized.

This kind of public investment can happen not only through incentives for private firms but through the public sector as well. Governments at all levels (state, local, and national) have valuable dataflows regarding infrastructure development, the organization of public transportation, and general macro-level economic data that can be turned into open datasets for public and commercial use. Particularly on the national level, the U.S. should consider investment in IT infrastructure that can coordinate the submission of open datasets on the state and local level.

Indeed, if key scientific or commercial datasets do not yet exist, the public sector may be best positioned to create them in the first place as a type of digital infrastructure provision. One notable structure that may help in this regard is the idea of a Focused Research Organization, which would provide a team of researchers with an ambitious budget and a nimble organizational structure with the specific goal of creating new public datasets or toolkits over a set time period.

For SMEs deciding whether to invest in adopting AI tools, regulatory and compliance costs can be a significant deterrent. Policymakers should recognize that regulation is often more burdensome for small firms that generally have less ability to shoulder compliance costs. Especially in industries with low marginal costs, such as the tech sector, larger firms can spread fixed compliance costs across more consumers, giving them a competitive edge over smaller rivals. Regulation can thus act as a powerful barrier to entry. For instance, a study found that the European experiment with GDPR led to a 17% increase in industry concentration among technology vendors that provide support services to websites.

This is not to say that additional regulation is, or is not, necessary in the first place. Indeed, there are a host of malicious or unintentional harms that can occur from improperly calibrated AI systems. Regulation can be a powerful tool to prevent these harms and, when well-balanced, can promote greater trust in the overall ecosystem. But potential regulation should follow sound policymaking principles that reduce the regulatory burden imposed on firms, notably by making regulation easy to understand, risk based, and low-cost to comply with.

In the U.S. there is to date no overriding national AI regulation. Instead, each sectoral regulator (i.e. Federal Aviation Administration, Security and Exchange Commission, Federal Trade Commission, etc.) has been steadily increasing their oversight over the use of algorithms and software in their specific area. This is likely an appropriate approach, as the kinds of risks and tradeoffs at play are going to be very different in healthcare or financial decision-making when compared to consumer applications. As this approach develops, it would be prudent to develop a risk-based framework that allows for more scrutiny of algorithmic decision-making in sensitive areas while giving SMEs confidence to invest in low-risk areas with the knowledge they will not later take on large compliance costs.

However, regulation over data protection has been far more segmented and piecemeal. And the state-by-state patchwork of rules that has developed can be a significant deterrent for SMEs when considering whether to invest in the use of certain AI tools. Policymakers should consider an overriding national privacy law that would be able to set standard rules of the road over the protection of data in all 50 states so that U.S. SMEs can invest with confidence.

Finally, U.S. policymakers should consider aggregating all this information through the creation of a dedicated AI regulatory website that provides a toolkit of resources for SMEs about the benefits of AI adoption for their business, the potential obligations and roadblocks that they need to be aware of, and best practices for cybersecurity hygiene and data sharing.

A lack of skilled talent is one of the biggest barriers to AI adoption as the technical skills required to build or adapt AI models are in short supply. In the U.S., especially, smaller companies struggle to compete with the high salaries paid out by large tech firms for top-end machine learning engineers and data scientists.

In broad strokes, this skills shortage can be alleviated in two ways: through upskilling the domestic population and by improving immigration pathways for global talent.

To upskill the domestic population, one relatively simple lever would be to pay some portion of the costs of individuals and businesses who wish to upskill. In the U.S., a portion of a worker’s retraining costs may be written off as a business expense so long as the worker is having their productivity improved in a role they currently occupy. But this expense is not tax deductible if the proposed training would enable them to take on a new role or trade.

For example, if a small manufacturing firm has technically competent IT staff who wish to attend a specialized training course on using machine vision systems in a warehouse environment, this expense would not currently be deductible as it would enable them to take on a new role within the company. This inadvertently creates an incentive to spend more on capital productivity investments than labor productivity investments. Addressing this imbalance would incentivize more firms to invest in worker retraining and help speed the creation of an AI workforce in the U.S.

Secondly, the U.S. needs to urgently address the shortcomings in the U.S. immigration system which make it more difficult for startups to compete with large incumbents on the basis of talent. Approximately 79% of the graduate students in computer science (and related subfields) studying in the U.S. are international students, which means a large majority of potential AI workers U.S. firms may look to recruit must operate through the immigration system. The cost, complexity, and length of this process inevitably favors large, incumbent firms who can afford to navigate the regulatory maze of procuring an H-1B or related work visa.

A recent NBER paper showed in detail the myriad ways in which access to international talent is important for startup success. Utilizing the random nature of the H-1B lottery system, the paper compared startups that randomly received a higher percentage of their visa applications approved to those who did not. The random nature of the H-1B lottery makes an ideal policy experiment because it allows for a clean test in which other potentially confounding variables are controlled for. The study found that a one standard deviation increase in the likelihood of successfully sponsoring an H-1B visa correlated with a 10% increase in the likelihood of receiving external funding, a 20% increase in the likelihood of a successful exit, a 23% increase in successful Initial Public Offering, and a 4.8% increase in the number of patents filed by the startup.

Policymakers could begin to counter this effect by waiving immigration fees for firms of a certain size and by streamlining the application process.

Further, policymakers should look to create a statutory startup visa so that international entrepreneurs have a viable pathway into the U.S. to launch firms of their own. According to research by Michael Roacha and John Skrentny, international STEM PhD students are just as likely to report wanting to work for or launch their own firm as native-born students, but the difficulty of our immigration system pushes them towards working at large incumbent firms.

Using these two levers of upskilling and immigration reform, the U.S. should increase the supply of AI talent available to SMEs or to launch SMEs themselves and thereby spur the adoption of AI adoption.

Artificial intelligence systems hold great potential to streamline the costs of doing business in a modern economy, particularly for SMEs. The last 20 years of the information technology revolution have helped large, established firms reach the cutting edge of productivity while smaller firms have been left behind. But general-purpose AI tools now provide an opportunity for SMEs to take advantage of many of these IT advancements at a cost and a scale that is feasible for them. Policymakers should attempt to proactively build out the digital infrastructure that will make it easier for SMEs to take the leap in adapting AI tools.

Summary of policy recommendations:

Data investment as a public good:

Provide regulatory certainty:

Expand the AI talent pool

[1] This report is an adaptation of an earlier paper coauthored with Dirk Auer titled “Encouraging AI Adoption in the EU”.

[2] Annual Survey of Entrepreneurs – Characteristics of Businesses: 2016 Tables, United States Census Bureau