In 2020 U.S. businesses cut back domestic capital investment by seven percent, in response to the Covid-19 pandemic, lockdowns and recession. The decline was broad-based, from transportation equipment to industrial equipment to energy investment.

But amidst this slowdown, Amazon boosted its domestic capital expenditures by 75 percent in 2020, according to new estimates by the Progressive Policy Institute (PPI). The ecommerce giant invested a stunning $33.8 billion in the United States last year, a record for the 10 years that PPI has been doing the Investment Heroes report.

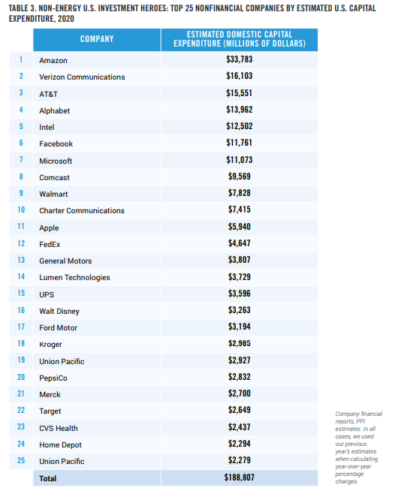

Amazon’s capital investment performance illustrates just how critical the tech-broadband- ecommerce sector has been to keeping people working and propping up the economy. The second company on our list, Verizon, invested $16.1 billion in the U.S. in 2020, AT&T $15.6 billion, Alphabet $14 billion, and Intel $12.5 billion. Eight out of the top 10 companies in our list—Amazon, Verizon, AT&T, Alphabet, Intel, Facebook, Microsoft and Comcast—are in the tech, ecommerce, and broadband sectors.

The willingness of these companies to keep spending essentially made it possible for large chunks of the economy to move forward despite the pandemic.

Capital investment is critical because it enables the creation of high-productivity, well-paying jobs. Collectively the top 10 companies in the Investment Heroes list added 483,000 jobs in 2020, led by Amazon’s dramatic leap from 798,000 workers in 2019 to 1,298,000 workers in 2020. Just looking domestically, the industries represented by the top 10 Investment Heroes added 234,000 jobs between the start of the pandemic in February 2020 and April 2021, while the rest of the private sector lost more than 6 million jobs.1

Capital investment is also essential for creating more production, communications and distribution capacity. This was essential during the pandemic, when investment by broadband and tech companies kept people connected at home during the shock of the lockdown; and the investment by ecommerce firms helped keep essential goods flowing while many Americans could not go out shopping.

As the Broadband Internet Technical Advisory Group wrote in an April 2021 report, “available data suggests that the Internet has performed well during the pandemic…. and is a testament to the importance of continued investment in robust Internet infrastructure in all parts of the ecosystem.”2 The report went on to note that “ISPs reacted to the sudden demand increase by rapidly adding extraordinary amounts of new capacity and pledging to Keep Americans Connected.”

Capital investment also helps hold down prices by creating more supply—and the lack of investment creates the conditions for overall price inflation. Prices in the tech-broadband-ecommerce sector were mostly flat or down in 2020, as investments in new capacity helped meet soaring demand. For example, the surge of new broadband capacity meant that the price of telecommunications services to consumers fell by 2 percent in 2020, and the price of Internet access fell by 1 percent, according to data from the Bureau of Economic Analysis.

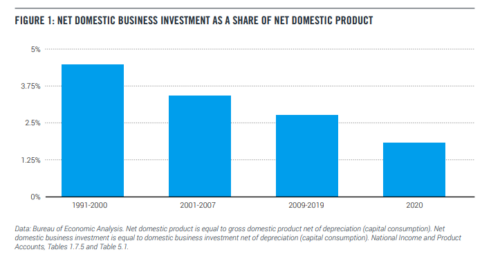

Similarly, one big reason for the recent return of inflation in 2021 has been production and supply bottlenecks caused by a lack of investment during 2020. Net domestic business investment totaled an anemic 1.9 percent of net domestic product in 2020.3 To put this in perspective, that was a sharp fall-off from 2.8 percent, which was net domestic business investment’s average share of net domestic product from 2008 to 2019. And that in turn was down from the business cycles running from 1991 to 2000 and 2001 to 2007, when net domestic business investment’s share of net domestic product averaged 4.5 and 3.5 percent, respectively (Figure 1).

Which companies are fighting this downward trend? Since 2012 PPI has provided unique estimates of domestic capital spending for individual major U.S. companies. Currently, accounting rules do not require companies to report their U.S. capital spending separately. To fill this gap in the data, we created a methodology using publicly-available financial statements from non-financial Fortune 150 companies to identify the top companies that were investing in the United States.

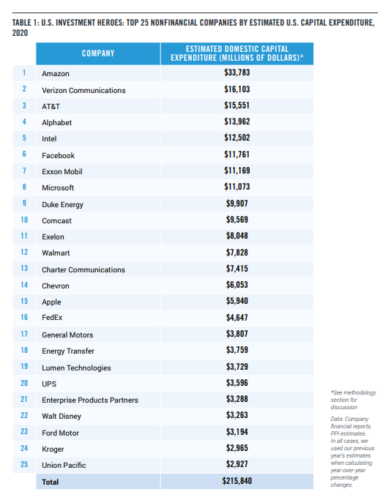

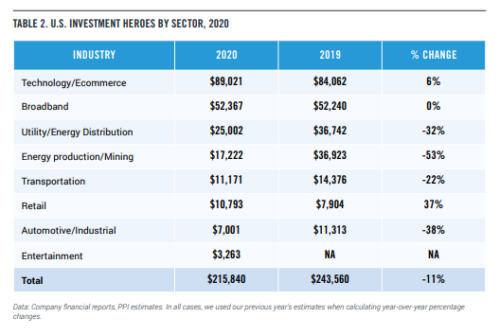

We call these companies “Investment Heroes” because their capital spending is helping create good jobs and boost capacity across the country. In 2020, the 25 companies on our list invested $216 billion in the U.S. This year’s list includes 11 tech, broadband and ecommerce companies; six energy production and distribution companies; three transportation companies; two automotive companies; two retail companies; and one entertainment company.

In terms of government policy, U.S. regulators and policymakers have an ambivalent attitude towards corporate capital investment. On the one hand, companies that don’t invest are decried as suffering from “short-termism,” being more concerned about current profits than long-term growth.4

On the other hand, the tech, broadband, and ecommerce companies that do make long- term investments in American workers and the American economy are often accused of unfair competition and monopolistic business practices, precisely because of their large capital expenditures. It seems odd that Congress seems more interested in sharply questioning companies that are investing heavily in America, rather than those that have reduced investment or actually disinvested in this country.

President Biden’s American Jobs Plan shows the same ambivalence towards business investment leaders. The plan would spend $2 trillion over the next decade on infrastructure, research and development, and manufacturing among other public investments.5 The avowed goal is to stimulate productivity-enhancing investments in the U.S., which is a goal that PPI favors.

On the other hand, the plan would pay for these proposals by raising the federal corporate income tax rate from 21 to 28 percent and imposing a 21 percent minimum tax on overseas corporate profits among other tax changes. While the package would generate $2.1 trillion over a decade, these tax increases could discourage business investment at a time when capital spending is already weak.

Using the methodology described in the appendix, we estimate domestic capital spending for large U.S. non-financial companies based on publicly available data. We then rank the companies to give us the top 25 Investment Heroes.

The top 25 Investment Heroes invested $216 billion in the U.S. in 2020, according to our estimates (which are based on companies’ most recent fiscal year through January 31, 2021). That’s a decrease of 11 percent compared to last year. 18 of our 25 Investment Heroes posted a decrease in U.S. capital expenditures relative to our 2019 estimates, with an average decline of 21 percent.

Amazon by far leads our Investment Heroes this year, spending an estimated $33.8 billion on domestic capital expenditures in 2020. Second is Verizon Communications, investing an estimated $16.1 billion on capital expenditures in the U.S. on the basis of increased broadband spending. AT&T came in third, spending an estimated $15.6 billion on domestic capital expenditures. Alphabet and Intel are fourth and fifth, respectively, investing $14 billion and $12.5 billion.

Four “newcomers” made our list this year. We estimate that Lumen Technologies (formerly CenturyLink) spent $3.7 billion on U.S. capital expenditures in 2020, a three percent increase compared to our estimates for CenturyLink’s 2019 domestic capital spending. Disney returns to the top 25 this year for the first time since our 2013 report. Kroger makes our list this year, investing an estimated $3 billion on domestic capital expenditures in 2020. And Union Pacific cracks the top 25 after making our non-energy list the last two years.

Four companies from our 2019 list didn’t make our 2020 list. Southern Company fell out of the Fortune 150 and thus out of the purview of our analysis. Marathon Petroleum cut its U.S. capital expenditures by more than $2 billion in 2020 compared to 2019 by our estimates. Delta Air Lines decreased its domestic capital expenditures by more than 60 percent according to our estimates as fears of Covid ravaged the travel industry. And ConocoPhillips missed our top 25 list by $8 million.

At the sector-level, our 11 tech, broadband and ecommerce companies invested an estimated $141.4 billion in domestic capital expenditures (Table 2). This category comprises six tech and ecommerce companies (Amazon, Alphabet, Intel, Facebook, Microsoft, and Apple) and five broadband companies (Verizon Communications, AT&T, Comcast, Charter Communications, and “newcomer” Lumen Technologies).

The next category includes six energy production and distribution companies, with total estimated domestic capital expenditures of $42.2 billion. This category is made up of Exxon Mobil, Chevron, Duke Energy, Exelon, Energy Transfer, and Enterprise Product Partners.

Coming in third is transportation, spending a total of $11.2 billion on U.S. capital expenditures by our estimates. This category consists of FedEx, UPS, and “newcomer” Union Pacific.

The retail sector, which included Walmart and “newcomer” Kroger, came in fourth. These retailers invested a combined $10.8 billion by our estimates, a 37 percent increase compared to 2019 as a result of Kroger making our list.

The last two categories were automotive and entertainment. Our automotive category was made up of General Motors and Ford Motor, investing an estimated $3.8 billion and $3.2 billion respectively. The lone entertainment company to make our list was Disney, investing $3.3 billion by our estimates.

Next we delve deeper into each of our Investment Heroes’ capital spending.

Amazon spent an estimated $33.8 billion on U.S. capital expenditures in 2020, a 75 percent increase compared to 2019 as

the ecommerce company sought to meet increased demand from Covid protocols like social distancing and work from home. We note that Amazon turned in a historically high investment performance. The company’s global capital expenditure of $45.7 billion (the sum of purchases of property and equipment, net of proceeds from sales and incentives, plus principal repayments of finance leases) exceeds the peak capital spending by such industrial giants as General Motors, General Electric, and IBM, even after adjusting for inflation.6

Verizon Communications spent an estimated $16.1 billion on U.S. capital expenditures in 2020, up slightly relative to our 2019 estimates. Verizon continued to invest in expanding its 4G LTE network and deploying its 5G and Intelligent Edge networks, despite the pandemic.

Third was AT&T, spending an estimated $15.6 billion in 2020. AT&T continues to invest in expanding its networks.

Alphabet invested $14 billion on U.S. capital expenditures in 2020 by our estimates. “We continue to make significant R&D investments in areas of strategic focus such as advertising, cloud, machine learning, and search, as well as in new products and services. In addition, we expect to continue to invest in land and buildings for data centers and offices, and information technology assets, which includes servers and network equipment, to support the long-term growth of our business,” the company writes in its 10-K.

Coming in fifth was Intel, spending an estimated $12.5 billion on U.S. capital expenditures in 2020, a decrease of 7 percent relative to our 2019 estimates.

Facebook spent an estimated $11.8 billion on U.S. capital expenditures in 2020, a decrease of 6 percent from our 2019 estimates. The social media company continues to invest in data center capacity, servers, network infrastructure, and office facilities.

Seventh was Exxon Mobil, investing $11.2 billion on U.S. capital expenditures in 2020 by our estimates. That’s a decrease of 33 percent compared to our 2019 estimates. The energy company cut its upstream capital investment in the U.S. by nearly $5 billion in 2020 according to its 10-K.

Microsoft spent an estimated $11.1 billion on U.S. capital expenditures during the fiscal year ending June 2020, the mostrecent 10-K available. The software company continues to invest in new facilities, data centers, computer systems for research and development, and its cloud offerings. We note that this estimate has not been updated from our previous Investment Heroes report, because we moved up the timing of the report.

Duke Energy invested $9.9 billion on U.S. capital expenditures in 2020 by our estimates, a decrease of 11 percent compared to 2019. The energy company decreased capital investment in its electric utilities, gas utilities, and commercial renewables segments.

Comcast invested $9.6 billion on U.S. capital expenditures by our estimates. Comcast continued to spend on customer premise equipment, scalable infrastructure, line extensions, and support capital.

Exelon spent an estimated $8 billion on U.S. capital expenditures in 2020, an increase of 11 percent relative to our 2019 estimates. The utility company increased capital investment in every segment except Exelon Generation.

Walmart spent an estimated $7.8 billion on U.S. capital expenditures in 2020. The retailer’s capital investments were relatively flat compared to our 2019 estimates.

Charter Communications invested $7.4 billion in domestic capital expenditures in 2020, a slight increase of 3 percent compared to 2019. The broadband company spent on line extensions and support capital according to its 10-K.

Chevron spent an estimated $6.1 billion on U.S. capital expenditures in 2020. That’s a 40 percent decline compared to 2019. The energy company spent about $3 billion dollars less in its upstream segment and about $800 million less in its downstream segment in 2020 compared to 2019.

Apple invested an estimated $5.9 billion on domestic capital expenditures in 2020. Apple’s figures are based on its latest 10-K for its fiscal year ending September 2020.

FedEx invested $4.6 billion in domestic capital expenditures by our estimates. The shipping company continued to spend on aircraft, equipment, vehicles, information technology, and facilities. We note that this estimate has not been updated from our previous report, as FedEx’s fiscal year ends on May 31st and thus their FY 2021 10-K was not published at the time of this writing.

General Motors spent an estimated $3.8 billion on U.S. capital expenditures in 2020, a 22 percent decline relative to our 2019 estimates.

Energy Transfer spent an estimated $3.8 billion on U.S. capital expenditures in 2020. Energy Transfer continued to invest in natural gas transportation and storage.

Lumen Technologies, formerly known as CenturyLink, invested $3.7 billion on domestic capital expenditures in 2020

by our estimates. That’s an increase of 3 percent compared to our 2019 estimates for CenturyLink. The broadband company continued to spend on enhancing network efficiencies and supporting new service developments.

UPS invested an estimated $3.6 billion on U.S. capital expenditures in 2020. UPS continued to spend on buildings, equipment, aircraft, vehicles, and information technology.

Enterprise Product Partners spent $3.3 billion on domestic capital expenditures in 2020 by our estimates, a 27 percent decline compared to our 2019 estimates. Enterprise Product Partners continued to invest in facilities and projects to gather, transport, and store natural gas and crude oil.

Disney invested an estimated $3.3 billion on U.S. capital expenditures in 2020, a decrease of 19 percent relative to our

2019 estimates. The entertainment company decreased spending in every segment except its direct-to-consumer and corporate segments.

Ford Motor invested $3.2 billion on domestic capital expenditures in 2020 according to our estimates, a decline of 50 percent compared to our 2019 estimates.

Kroger spent an estimated $3 billion on U.S. capital expenditures, a slight decline of 5 percent compared to 2019.

Union Pacific invested an estimated $2.9 billion on U.S. capital expenditures in 2020. Union Pacific continued to invest in new locomotives and freight cars, maintenance, and safety improvements.

President Biden has proposed the American Jobs Plan, which includes $621 billion for transportation infrastructure, $300 billion to bolster manufacturing, $180 billion for research and development, and $100 billion for broadband among other proposals.7 Each of these areas has been an important source of economic growth historically. For example, manufacturing employment peaked in 1979 at nearly 20 million but has been on the decline since, employing about 12 million people

today.8 President Biden’s plan would restore manufacturing supply chains and provide capital to revitalize manufacturing.

Similarly, R&D investment is key to commercializing new technologies and fueling growth of industries. A few key innovations that were made possible by federal R&D funding include the internet, smartphone technologies, global positioning systems, the human genome project, and hydraulic fracturing.9 Unfortunately, federally sponsored R&D has declined from its peak of 1.8 percent of GDP in 1965 to .74 percent in 2020.10, 11 The American Jobs Plan’s $180 billion investment would provide additional funding for the National Science Foundation, the development of technology to address the climate crisis, and R&D that spurs innovation and job creation.

These increases in infrastructure and other public spending are highly desirable for growth. However, the plan would pay for these proposals by raising the federal corporate income tax rate from 21 to 28 percent and imposing a 21 percent minimum tax on overseas corporate profits among other tax changes.12 While the plan would generate $2.1 trillion over a decade, policymakers should be mindful of potentially discouraging business investment, which would prolong the economic recovery. Raising the corporate income tax rate to 28 percent would create a federal-state combined corporate income tax rate of 32.8 percent, returning the U.S. to the highest combined rate in the OECD.13

We also note that policymakers often misunderstand the link between strong corporate investment and creation of good jobs. True, in some cases, companies have invested in automation that reduces employment. But more recently, we have seen that companies making the biggest capital investments, like Amazon, may also be the biggest job creators. In particular, Amazon’s spending on fulfillment center automation has boosted productivity, enabling the company to pay a minimum wage of $15 per hour that is comparable with advertised entry-level manufacturing hourly wages of $15-$17 in many parts of the country.14 Indeed, a recent PPI analysis shows that most Americans live in states where the tech-ecommerce ecosystem, including all positions and skill levels from fulfillment center and delivery workers to website designers, pays better than manufacturing.15

The bottom line: As the U.S. struggles out of recession, and faces the worries of inflation, we should be lauding companies that invest in America during the pandemic, rather than denigrating them.

Our U.S. Investment Heroes ranking for 2020 follows the same methodology as our most recent report in 2019. We started with the top 150 companies of the 2020 Fortune 500 list as our universe of companies. We removed all financial companies and all insurance companies except health insurance companies. We also omitted the financing operations of non- finance companies when possible.

Except as noted, we use the global capital expenditure reported on the most recent 10-K through January 31, 2021, as the starting point for the analysis. In this report, we refer to all estimates as “2020,” even if the fiscal year ended in 2021. Capital expenditures generally cover plant, equipment, and capitalized software costs. For energy production companies, capital expenditures can include exploration as well.

For broadband companies, we did not include their often sizable spending on purchases of wireless spectrum as part of capital expenditures, since that category is not counted as investment spending by the economists at the Bureau of Economic Analysis. Companies purchasing spectrum in 2020 include Verizon ($2.1 billion); AT&T ($1.6 billion); Comcast ($459 million); and Charter ($464 million).

The companies in these rankings are all based in the United States. Non-U.S. based companies were not included in this list because of data comparability issues, although there are many non-U.S. companies that invest in America.

For transportation companies our report estimates the booked location of spending on capital expenditures for the company’s most recent fiscal year, rather than how much of those acquired assets are actually being used within the U.S.

Most multinational companies do not provide a breakdown of capital expenditures by country in their financial reports. However, PPI has developed a methodology for estimating U.S. capital expenditures based on the information provided in the companies’ annual 10-K statements and other financial documents. After developing our internal estimate, we contact the companies on our top 25 list to ask them to point us to any additional public information that might be relevant. Notwithstanding these queries, we acknowledge that the figures in this report are estimates based on limited information.

Our estimation procedure goes as follows:

As a supplement to our complete U.S. Investment Heroes rankings, we also present a non-energy list for 2020 (Table 3). This list ranks the top U.S. companies investing domestically, according to our estimates, that are both non- financial and non-energy. The energy sector is one of the most capital intensive sectors of the economy and thus can heavily influence the top 25 results. The non-energy ranking includes the non-energy companies from our complete ranking but has also made room for other companies. For example, PepsiCo spent $2.8 billion on domestic capital expenditures by our estimates in 2020, a 26 percent increase compared to 2019.

Merck invested an estimated $2.7 billion on U.S. capital expenditures in 2020, a 42 percent increase compared to 2019. The pharmaceutical company spent on new capital projects focused primarily on increasing manufacturing capacity for its products.

Target invested $2.6 billion on domestic capital expenditures in 2020 by our estimates. The retailer increased its investments in information technology and new stores, while decreasing its spending on existing stores.

CVS Health spent an estimated $2.4 billion on U.S. capital expenditures in 2020, a relatively flat amount compared to our 2019 estimates for the company. Technology made up the majority of the health retailer’s capital expenditures, while store and fulfillment expansion and improvements and new store construction made up a minority share.

Home Depot invested $2.3 billion on domestic capital expenditures in 2020 by our estimates, a slight decrease of 5 percent relative to our 2019 estimates for the company.

Rounding out our top 25 non-energy list is Johnson & Johnson, spending an estimated $2.3 billion on U.S. capital expenditures in 2020. Johnson & Johnson continues to invest in its consumer health, pharmaceutical, and medical device segments, and of course vaccine production.