American voters are finding it hard to get excited about this year’s presidential election. Job growth is slow. Economic growth is slow. Real wages have been essentially stagnant since 2009. It’s the same old story as when the recovery began three years ago. We are in an atmosphere of economic uncertainty. Voters—swing voters especially—are looking for news that will boost their confidence from all the economic doom and gloom going around. We are a country that needs to hear more (if not have more) economic successes.

Such successes begin at home with investment—business investment, government investment, and household investment. Government has to invest in infrastructure, education, and research. Households have to invest in their own human capital. And businesses have to invest in buildings, equipment, and software. All are essential—but in this report we will focus on business investment. Domestic business investment generates growth, raises productivity, increases wages and creates jobs for Americans. It can span the gamut from new office buildings to improved production lines to faster communications equipment to deeper natural gas wells.

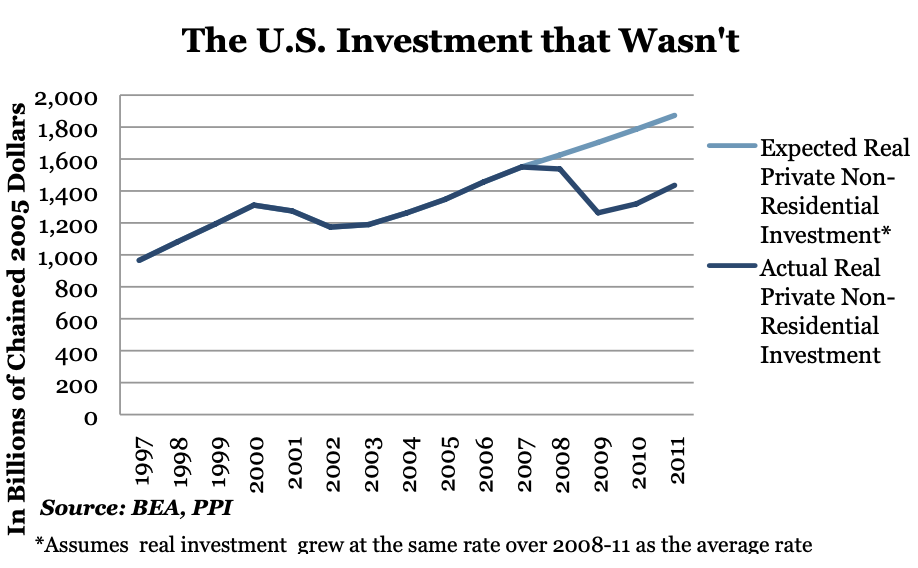

Unfortunately, U.S. business investment tanked during the Great Recession, and has yet to recover. The graph below shows the extent of the drop-off—in 2011, non-residential investment remained more than 7% below 2007 levels, adjusting for prices. By comparison, personal consumption in real terms was higher in 2011 compared to 2007. We find ourselves in an investment drought, not a consumption drought.

Equally as important, before the recession companies were expanding their domestic investment at a rapid pace. In fact, we estimate there would have been a total of $1.4 trillion more in non-residential business investment over 2008-2011, in 2005 dollars, had business investment continued to grow at the same average annual rate in the ten years before the recession (4.8% over 1997-2007). That extra investment could have gone a long way creating jobs, boosting productivity, and enhancing U.S. competitiveness.

The decline and lackluster recovery in business investment has a wide range of causes, including globalization, regulatory barriers, and weak demand. Many companies are investing overseas rather than in the United States. Multiple layers of regulation, even if well-intentioned, have the impact of discouraging capital investment and innovation. And the continued weakness in demand at home makes it difficult to justify building new factories. But no matter what the reason, this weakness is having an adverse effect on economic growth and is one of the main reasons behind the job drought.

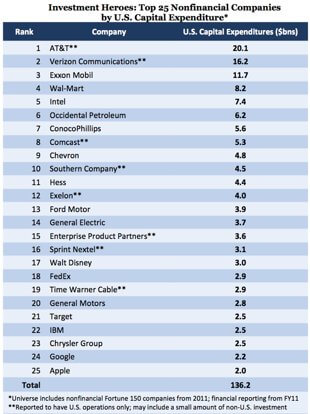

That’s why PPI wants to highlight those companies that are still investing domestically in buildings, equipment, and software. Using publicly available financial reports, PPI constructed a list of the top 25 nonfinancial U.S.-based companies ranked by their U.S. capital spending in 2011. In many cases this required detailed calculations and assumptions, since companies often report global capital spending without breaking it down by country. Financial companies were excluded because they do not publicly report their capital expenditures. (A more detailed explanation of our methodology can be found later in this memo.)

PPI calls these companies “Investment Heroes” to make a key point: the U.S. economy is at its best—in terms of growth and job creation—when companies and workers are partners with the same objectives. Half of the leading companies are telecom and energy, but the list also includes tech, retail, automotive, and entertainment companies.