We’re grateful to have our new report mentioned in Neil Irwin’s piece today in the New York Times about tech employment. The report, An Analysis of Job and Wage Growth in the Tech/Telecom Sector, to be presented at the TPRC conference later this week, directly compares employment at today’s leading tech/telecom firms with employment at the industrial leaders of the past. Here’s what we found:

• Today’s 10 most valuable tech/telecom companies employ roughly 1.5 million people, up 63 percent over the past 10 years.

• In 1979, at the peak of US manufacturing employment, the 10 most valuable industrial companies employed 2.2 million workers, 48 percent more than employment at 2017 tech/telecom leaders.

• The average employment of the vintage-2017 tech/telecom leaders is 149,000, compared to a 222,000 average for the vintage-1979 industrial leaders. However, the industrial average is heavily influenced by General Motors, which is an outlier. If we omit General Motors, the employment average of the other industrial companies is 152,000, very close to today’s tech/telecom average.

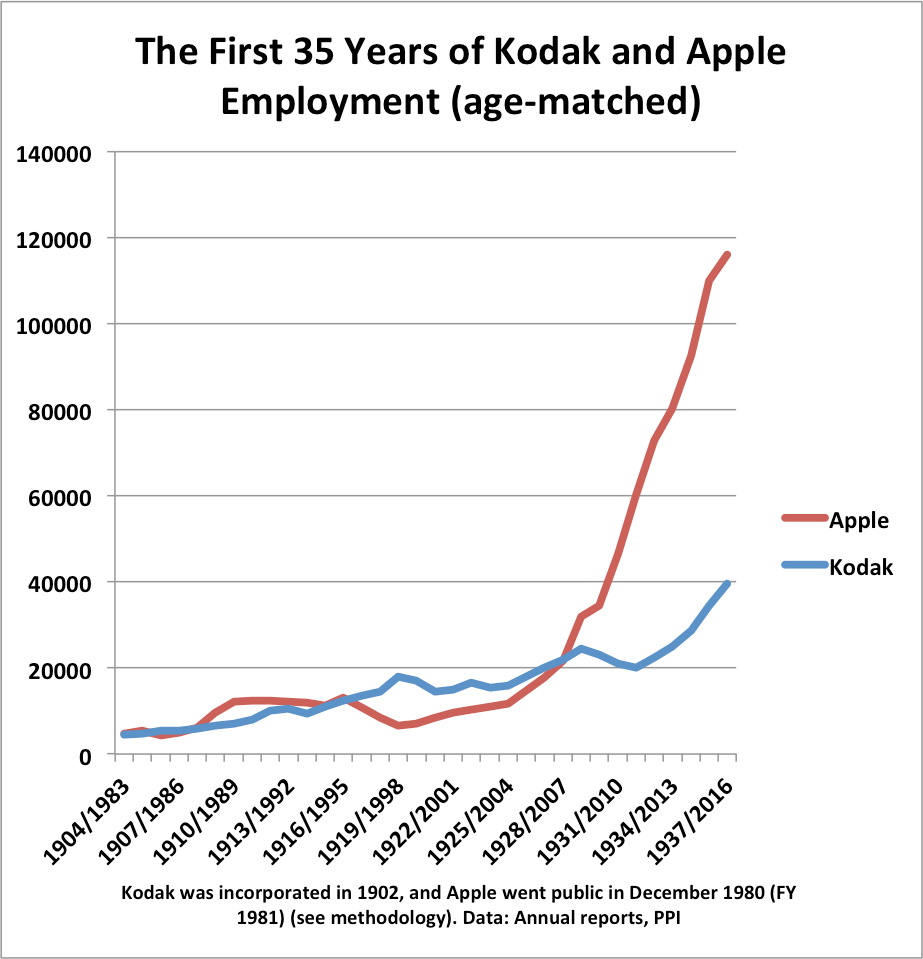

• For example, Apple (mentioned in Irwin’s story) reported 116,000 fulltime equivalent employees as of its last annual report. Kodak in 1979 had 126,300 employees worldwide, and 80,800 in the United States. That makes them roughly the same size in terms of employment.

• Kodak employed 24,500 workers in 1929. So Kodak needed 50 years to add roughly 100,000 workers. Apple employed 17,787 workers in 2006, so Apple needed 10 years to add roughly 100,000 workers.

• The revenue of the top 10 tech/telecom companies in 2016 was 5.5 percent of U.S. GDP, compared to 5.7 percent of GDP for the top 10 industrial companies in 1979.

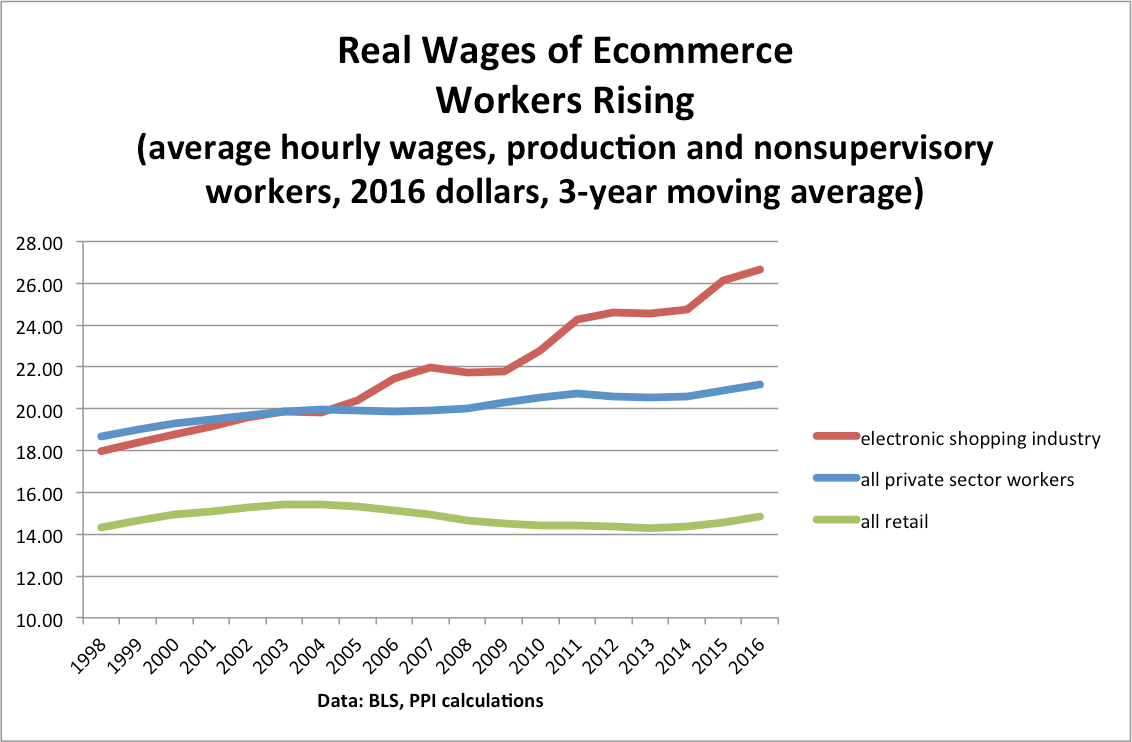

• Real wages for production and nonsupervisory workers in tech/telecom, digital nontech, and health have been steadily rising since 1990. By comparison, real wages for production and nonsupervisory workers in the physical nonhealth sector have been flat since 1990.

• Workers in mid-skill occupations such as office and administrative support; sales; and installation, maintenance, and repair get paid significantly more in the tech/telecom sector.

Read the paper.