Economists from Adam Smith onward have understood that free markets don’t exist or thrive in a state of nature. They are nestled within a framework of governance that defends societies against outside threats, writes and enforces common laws, and provides public goods – those that all people need but that private actors would have little incentive or ability to develop on their own.

Unlike private investments, investments in public goods generate benefits that accrue not to individual investors but rather society as a whole. Thus, the responsibility for investing in public goods falls on government: the one institution that represents all citizens and therefore has an obligation to act in the common interest. Public investments such as education, infrastructure, and scientific research lay the foundation for long-term economic growth and shared prosperity. Only by making these investments can governments facilitate the success of private enterprise and free markets.

For over three decades following the end of World War II, policymakers in the United States dutifully fulfilled this obligation and invested in America’s future. The post-WWII G.I. Bill provided unprecedented access to higher education for returning veterans and their families regardless of their financial situation, giving them an opportunity to pursue a lucrative and fulfilling career while providing businesses access to a skilled workforce.3 The Interstate Highway System connected people from across the country to exchange goods and services – and still supports one quarter of all vehicle traffic over 60 years later.4,5 And the “Space Race” of the 1960s resulted in the development of new technologies from LEDs to water purifiers that continue to benefit our society today.

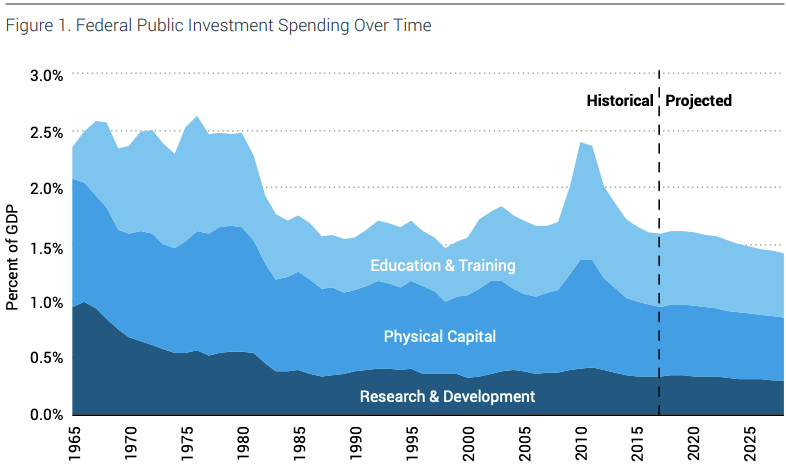

But in recent years, policymakers have defaulted on their fundamental responsibility to maintain sufficient public investment. Between 1965 and 1980, federal spending on education, infrastructure, and scientific research averaged about 2.5 percent of gross domestic product (the total value of all goods and services produced by the United States in a given year). Investment spending at that level would have been equal to roughly $470 billion in 2017. Yet in reality, the federal government spent just $300 billion on public investment in 2017 – less than 1.5 percent of GDP.7 If current trends continue, such investment is projected to reach its lowest level in modern history by 2026 (Fig. 1).8

If the current generation of policymakers fails to “pay it forward” by maintaining and building upon the investments made by their predecessors, young Americans and future generations will not have the kind of opportunities for economic and social advancement that their parents and grandparents enjoyed. Instead, they would face a future of diminished economic dynamism and growth, lower productivity and wages, and greater social inequality and class conflict. Simply put, the de-facto policy of disinvestment is a formula for national decline.

Rather than address this looming threat, current policymakers have been making America’s public investment drought worse. Donald Trump and the Republican-controlled Congress abandoned any pretense of fiscal responsibility and enacted a package of partisan tax cuts in 2017 that the official scorekeepers at the non-partisan Congressional Budget Office estimate will cost more than $2 trillion over the next decade.16 These policies provided tax relief to those who needed it least while draining much-needed revenue from public investments that could benefit everyone.

But the federal government’s fiscal challenges extend beyond insufficient revenue. America’s aging population and rising health care costs are causing spending on expensive federal health and retirement programs such as Medicare, Medicaid, and Social Security to grow significantly faster than the rest of our economy – a trend that members of both parties, but particularly Democrats, have largely refused to tackle. The result is that many people who consider themselves progressives have become complicit in a profoundly unprogressive policy of throttling public investment. These forces together are producing ballooning public debts while leaving less and less room in the federal budget for investments in a better future.

Meanwhile, state and local governments are also cutting back their public investment spending due to similar demographic and political challenges. The bills for unfunded pension liabilities are coming due as a massive number of public employees move into retirement. The cost of state commitments to health programs such as Medicaid are also swelling due to the same rising health care costs that pressure Medicare at the federal level. And while policymakers in some states are working to tackle these problems, others have made matters worse by enacting their own reckless tax cuts based on the same flawed ideology as Republicans in Washington. The result is cuts to public investment at all levels of government.

Fortunately, there are signs that the American people appreciate the stakes: large majorities of voters in both parties have expressed strong support for government spending on public investments in several independent polls.17,18,19 Additionally, a poll conducted by PPI on the eve of the 2018 midterm elections found that more respondents were worried about the growing federal budget deficit than any other issue polled – including almost 9 out of 10 independent voters.20

These findings suggest that Democrats serving in the 116th Congress (or running for higher office in 2020) have a unique opportunity to draw a stark contrast between themselves and fiscally irresponsible Republicans by offering the electorate an agenda that pairs robust public investment in progressive priorities with the fiscal discipline necessary to secure those investments for generations to come.

The goal of this report is to highlight for American policymakers and their constituents the role that public investment plays in providing the foundation for a prosperous economy, as well as the steps that must be taken to end America’s current public investment drought.

The first three sections provide an overview and analysis of the three main categories of public investment in the United States: research and development (intellectual capital), infrastructure (physical capital), and education (human capital). Next, the report demonstrates how these public investments both create long-term economic growth and ensure its benefits are shared by all. Finally, the report explores the external forces that have resulted in recent cuts to public investment, with one section on the pressures facing the federal budget and another on the parallel challenges facing state and local governments.

In 2019, PPI’s Center for Funding America’s Future will offer concrete proposals for a fiscally responsible public investment agenda that fosters robust and inclusive economic growth.

• Federal R&D spending has contributed to countless technological innovations that enrich our society. To take just one example, a study of NIH’s Human Genome Project estimated that the project generated nearly $1 trillion of economic growth – yielding a massive return of $178 for every dollar spent.

• Back in the 1960s, the federal government spent as much as 1 percent of GDP on nondefense R&D as it sought to win the space race and put a man on the moon. But today, this spending has fallen by more than half. That disinvestment threatens basic scientific research that lays the foundation for new industries and technological innovations.

• This year, for the first time in modern history, China – not the United States – will be the global leader in R&D spending. If policymakers don’t boost public investment in R&D, they risk forfeiting America’s position as the global leader in innovation.

• Several independent estimates suggest the United States will need to spend roughly $1.4 trillion more on infrastructure than it is currently projected to spend over the next decade. Failure to reverse America’s disinvestment in infrastructure could reduce GDP by nearly $4 trillion over that time period, costing the average family about $3,400 per year.

• Investments in infrastructure also boost economic growth in the short term by creating well-paying jobs today. Roughly 1 in 10 workers are employed in either developing or maintaining infrastructure, and wages at the bottom of the earnings distribution are approximately 30 percent higher than what other jobs requiring a comparable level of education would offer.

• Education is a valuable investment for both individuals and governments. Investing in a child’s pre-kindergarten education generates 7 to 10 percent annual returns for the child and society at-large, while the average annual return on investment for postsecondary education is double or triple what it would be if a similar amount of money was invested in the stock market. Disinvesting from education not only hurts students but also hurts the public by foregoing increased worker productivity and higher tax revenue for the government.

• Per-pupil funding for K-12 education has stagnated or fallen in most states since the 2008 financial crisis. This disinvestment will likely be costly: every dollar spent educating a child results in an average of $3 in economic activity down the road. It can also reduce the number of students who graduate, potentially imposing long-term costs on them and taxpayers. High-school dropouts are about twice as likely to be unemployed as graduates, and those who are employed earn an average of $8,000 less per year than graduates do.

• “New-collar” jobs that require some postsecondary education but not a four-year degree now account for 53 percent of jobs in the United States. A worker who obtains the necessary credentials can see their incomes rise by as much as $11,000 within the first two years alone. But only 43 percent of U.S. workers have the appropriate credentials for these positions, resulting is a “skills gap” that is in part due to underinvestment by the government.

• Sustained public investment can unleash robust economic growth. The OECD estimates that increasing public investment by 1 percent would increase potential GDP by an average of 5 percent in the long run.

• Public investment also ensures the benefits of economic growth are widely shared. Technological innovations such as the internet improve the lives of people of all income levels. Better transportation infrastructure is correlated with higher social mobility. And investments in public education level the playing field for lower-income students who have access to fewer resources than their wealthier peers.

• But the ability of a state or local community to make public investments is heavily dependent on its existing wealth and fiscal capacities. Poorer communities require federal investments to attract private capital and talented workers. Such investments are vital for promoting economic mobility and keeping the American Dream alive for all.

• Washington Republicans abandoned any pretense of fiscal responsibility by adding $2 trillion of reckless tax cut to the national debt over the past year. These cuts both starved public investments of much-needed revenue and likely contributed to the GOP losing control of the U.S. House of Representatives in the 2018 midterm elections.

• Public investment is also being squeezed by the inexorable growth of Medicare, Medicaid, and Social Security. Due to the aging of the population and rising health care costs, ENDING AMERICA’S PUBLIC INVESTMENT DROUGHT P7 spending on these programs are projected to grow from about 10 percent of GDP today to nearly 16 percent of GDP in 2048. The refusal of both parties to modernize these programs has left fewer resources available for federal public investment.

• As a result of these decisions, public investment spending by the federal government in GDP-adjusted dollars has plummeted by nearly 40 percent since 1968 – and is projected to hit record-low levels by 2026 if current policies remain in place. Meanwhile, the share of federal spending committed to public investment will fall from 7.9 percent today to 4.4 percent in 2048.

• State and local governments are also major contributors to public investment, but they are suffering from problems similar to those that afflict Washington.

• Republican governors and legislators in states such as Kansas and Oklahoma enacted unaffordable tax cuts that resulted in dramatic cuts to public investment. These tax cuts proved to be both bad policy and bad politics: Democrats won huge victories in both states in the 2018 midterm elections (despite their strong Republican lean) by campaigning for fairer and more responsible tax policies.

• State and local budgets are also strained by demographic changes. As a share of GDP, state spending on Medicaid has increased nearly 40 percent since 2000 due to rising health costs, while the costs of unfunded pension liabilities have doubled during the same period as the bill for retiring baby boomers comes due. The result: a perfect storm of fiscal mismanagement has drained public investment spending at all levels of government.