The presidential election is over, but for progressives, the process of winning back the working class has just begun.

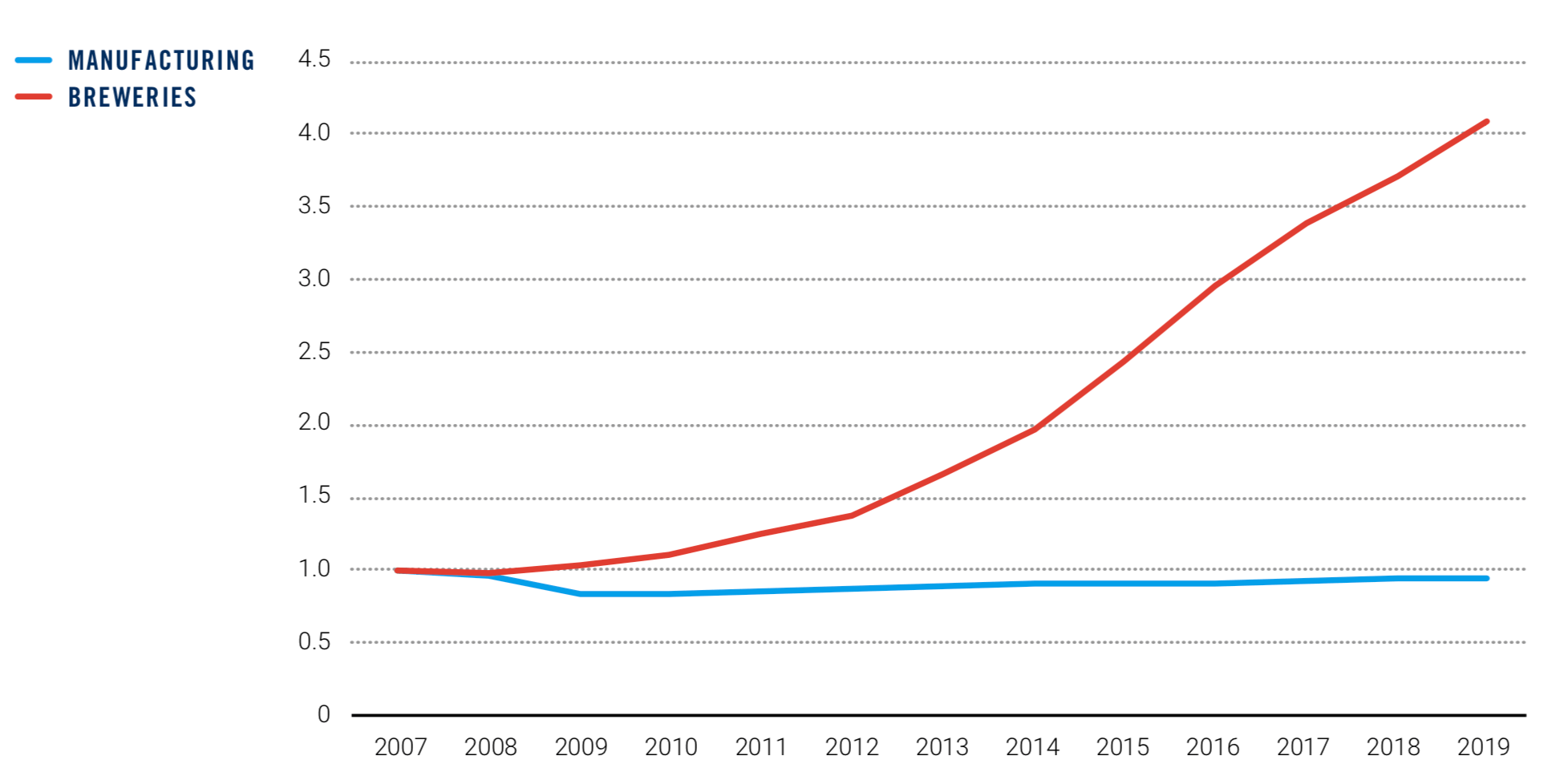

In this note we’re going to focus on beer. Why beer? First, brewery employment is one of the great success stories in manufacturing in recent years. The number of jobs in the brewery industry increased a stunning 230% from 2007 to the pre-pandemic peak of 2019, making breweries the fastest growing manufacturing industry. With many communities—including the “Blue Wall” states—still traumatized by the long-term collapse in manufacturing jobs, the symbolic and actual importance of the health of the brewery industry, especially craft brewers, cannot be underestimated.

Second, beer exemplifies the complicatedpolitical calculation that progressives must make about tax policy. The Tax Cut and Jobs Act of 2017 (TCJA) gashed a huge hole in federal revenues that eventually needs to be plugged. Yet some provisions of the TCJA, such as the excise tax cuts for brewers, have been successful in generating job growth, and deserve to be made permanent.

Third, progressives need to face the regressive and almost punitive nature of excise taxes ingeneral. It’s difficult to build political supportwhen ordinary people feel like they are being nickeled and dimed by taxes and fees that they cannot get away from, whether it’s on beer, telephone service or some other essential product.

Let’s start with manufacturing. The demise of many manufacturing jobs left painful scars in many state economies, wounds that were never fully healed under the Trump administration. As of 2019, before the pandemic hit, manufacturing employment in 40 out of 50 states was still below their 2007 level. In particular, the Blue Wall states—Minnesota, Michigan, Wisconsin, and Pennsylvania—were still down 114,000 manufacturing jobs in 2019 compared to 2007.

Against this dismal backdrop, the brewery industry has been a remarkably positive story. As noted, nationally brewer employment has shown the fastest growth of any manufacturing industry between the business cycle peaks of 2007 and 2019. In the Blue Wall states, brewery jobs quadrupled over this stretch, going from 3,000 in 2007 to more than 12,000 in 2019 (Figure 1).

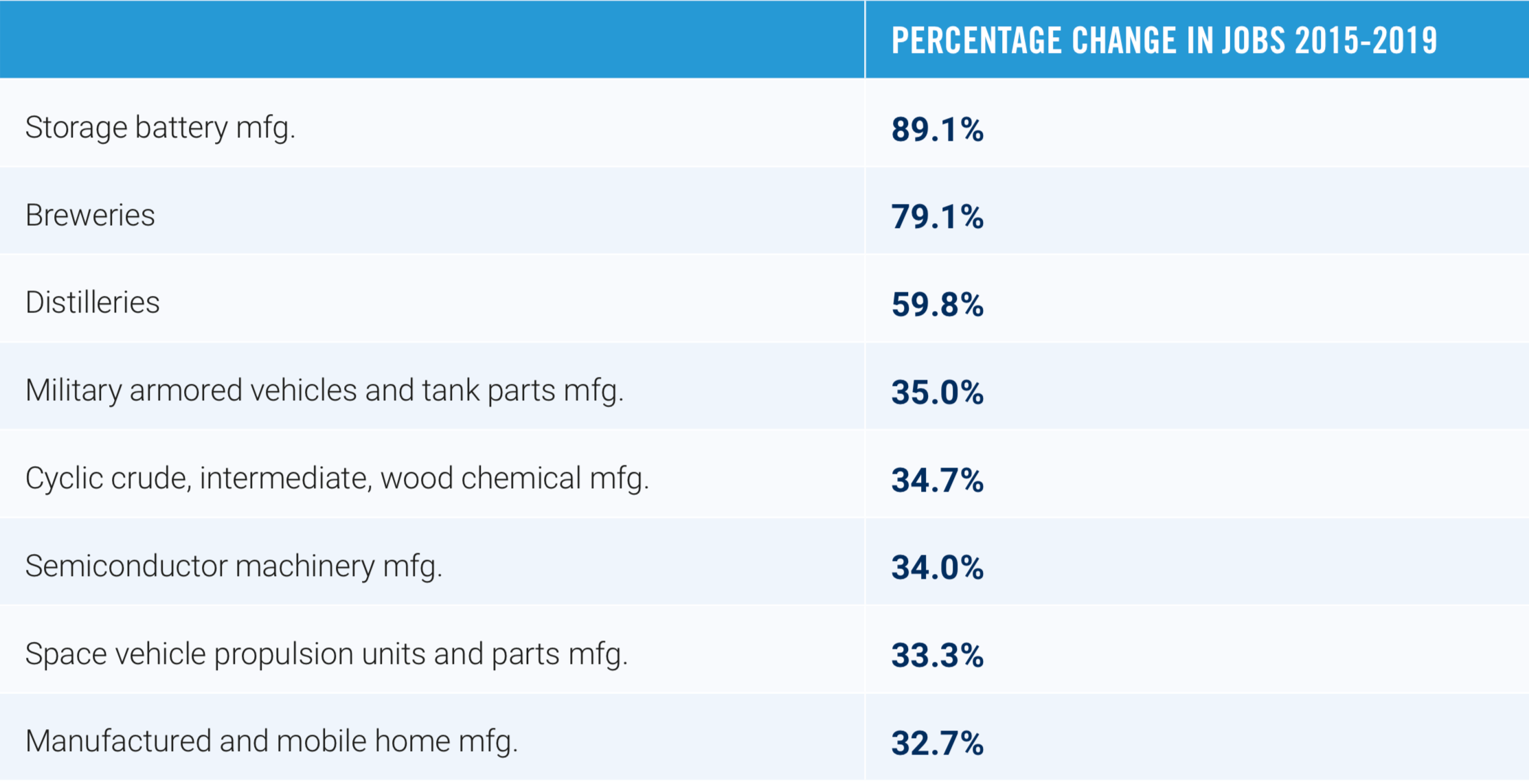

The importance of brewery jobs stands out when we look at the most recent years. From 2015 to 2019, brewery industry jobs rose by an astonishing 79 percent. As Table 1 shows, that makes brewing the second-fastest growing manufacturing industry by jobs over that stretch, second only to storage battery manufacturing (think Tesla and Elon Musk’s huge Gigafactory in Sparks, Nevada, which employs thousands of workers making lithium-ion batteries).

It’s worth noting that the brewery industry is in good company. Other top manufacturing industries in terms of job growth include military armored vehicles, semiconductor machinery and space vehicle propulsion units (another industry related to Musk).

Brewery employment was boosted, in part, by the “Craft Beverage Modernization and Tax Reform” provisions of the TCJA. These provisions, due to expire on December 31, 2020, reduce federal excise taxes on both large and small domestic breweries. The excise tax rate is reduced on the first six million barrels brewed by any brewer.Small brewers, with less than two million barrels, get a deeper reduction on their first60,000 barrels.

Economic research suggests that these excise tax cuts are mostly passed onto the final consumer. Indeed, the price of beer rose

at only a 1.7 percent rate between 2016 and 2019, slower than the 2.1 percent rate of overallconsumer inflation during the same period. Inother words, beer has been getting relatively cheaper compared to other goods and services.

Should the excise tax reduction be extended? On the one hand, the federal government entered the post-election period with a $3.1 trillion federalbudget deficit for FY 2020, and the public holdingfederal debt equal to 100 percent of GDP. Under normal circumstances that would be seen as an opportunity to raise revenues by allowing the provisions to expire, immediately sending excise taxes on small brewers soaring.

Yet, with the pandemic on the upswing across the country and unemployment still high, the notion of raising taxes on an extremely successful job-creating industry seems misguided, at best. That’s the equivalent of removing a tire from your fastest, most reliable car in the biggest race of the year.

One political hurdle is that the excise tax reduction was originally enacted as part of the TCJA, which has a bad association among many progressives for its top-heavy individual rate cuts and large reductions in corporate income tax rates. Nevertheless, the TCJA contained some important progressive provisions, such as improvements in the U.S. international tax code that make it harder for multinationals to shift income to low-tax countries (the so-called BEAT, or “base erosion and anti-abuse tax”) and set a kind of minimum tax on multinationals (the so-called GILTI or tax on “global intangible low- taxed income”). Within this context, the lower excise tax on beer translates directly into lower prices for consumers and more manufacturing jobs for workers, a general plus. Indeed, the Craft Beverage Modernization and Tax Reform Act had strong bipartisan support when it was first introduced in 2017 and extending the current provisions has strong bipartisan support today.

The next question: Should the excise tax reduction on beer not only be extended, but made permanent? To answer that question requires a discussion of the role of excise taxes in fiscal policy. It’s a general principle ofeconomics that broad-based taxes are moreefficient and less distortionary than a narrowexcise tax on a single good. So, a broad sales tax or value-added tax is better for the economy and economic growth than a narrow excise tax which raises the same amount of money. Similarly, a broad carbon tax is better, in a theoretical sense, than a narrow tax on gasoline.

Nevertheless, excise taxes persist. Generally, excise taxes have been justified on two grounds.First, they serve the purpose of use fees, as in the case of the gas tax, which is used to pay for highway maintenance. But in an era of electric vehicles and oversize trucks, there no longer is a direct link between gas taxes paid and damage to the roads.

Excise taxes have been also justified on social grounds, both negative and positive. The tobacco excise tax, of course, is intended to discourage smoking. Telephone companies pay a contribution to the federal government—effectively an excise tax—to support universal service initiatives. And of course, the excise tax on alcohol has been tied to the social costs of alcohol abuse.

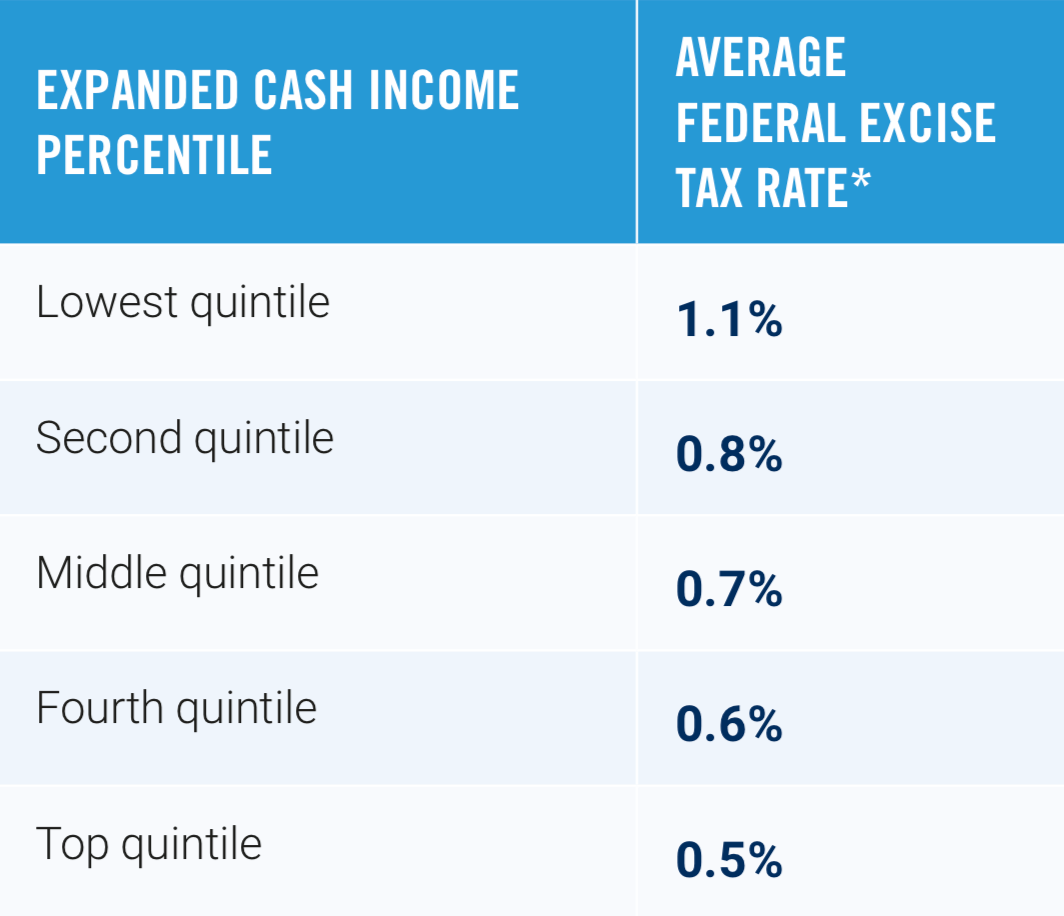

However, there are downsides to the use of excise taxes for any of these purposes. First, excise taxes tend to be regressive. A 2019 analysis by the Tax Policy Center showed that low-income households pay 1.1 percent of their income in federal excise taxes, compared to 0.5 percent for high income households (Table 2).

In terms of alcohol, a 2015 study from the Congressional Research Service noted that excise taxes are generally regressive, alcohol included. Lower income households tend to spend a higher share of their pre- tax income on alcoholic beverages, but this distribution is not as uneven as spending on non-alcoholic beverages or food. In particular, economic studies have shown that beer is much less responsive to price changes than either wine or distilled spirits. This means that excise taxes on beer are much more likely to be transmitted to consumers, which puts more of a burden on low-income consumers. That makes the beer tax regressive.

And then there’s one more issue that’s especially important politically at this moment. A narrowly focused excise tax is perceived by many Americans as direct government interference in their choices. From the progressive perspective, that power should be used judiciously and notwith profligate abandon. That suggests as ageneral principle, we should move away from excise taxes towards broader-based taxes.

That principle obviously has wide applications. But getting back to beer, which is where we started: It’s time to get rid of the temptation to “tax sin” and let the excise tax reductions on beer be permanent. The U.S. needs more tax revenue, but it has to come from broader based taxes.