For too long, U.S. policymakers have focused narrowly on boosting consumers’ buying power, assuming that the productive end of the economy will take care of itself. Yet the last decade of slow growth shows that debt-driven consumption is not a sustainable strategy for expanding economic opportunity or lifting U.S. living standards. In contrast, a high-growth strategy requires strong investment—private and public—in our nation’s productive and knowledge capacities.

It’s time for progressives to rebalance the consumption-investment equation. Total domestic investment fell drastically during the recession and has yet to fully recover. A big part of the problem is the public sector. With gridlock in Washington and financial troubles at the state and local level, government real spending on productive assets from highways and bridges to computer equipment, net of depreciation, is down by half compared to the average level of the 2000s.

Investment by the private sector is doing better, but taken as a whole still falls way short of what the country needs to generate jobs and growth. As shown in Figure 1, business investment, outside of housing, is still 20 percent below its long-term trend. There are several reasons why private business investment is failing to reach its potential. Globalization, weak demand, deleveraging and a shortage of workers with technical skills all contributed to the investment fall-out and subsequent investment gap. And as PPI has documented elsewhere, the sheer accumulation of regulations over time can discourage capital investment and innovation.

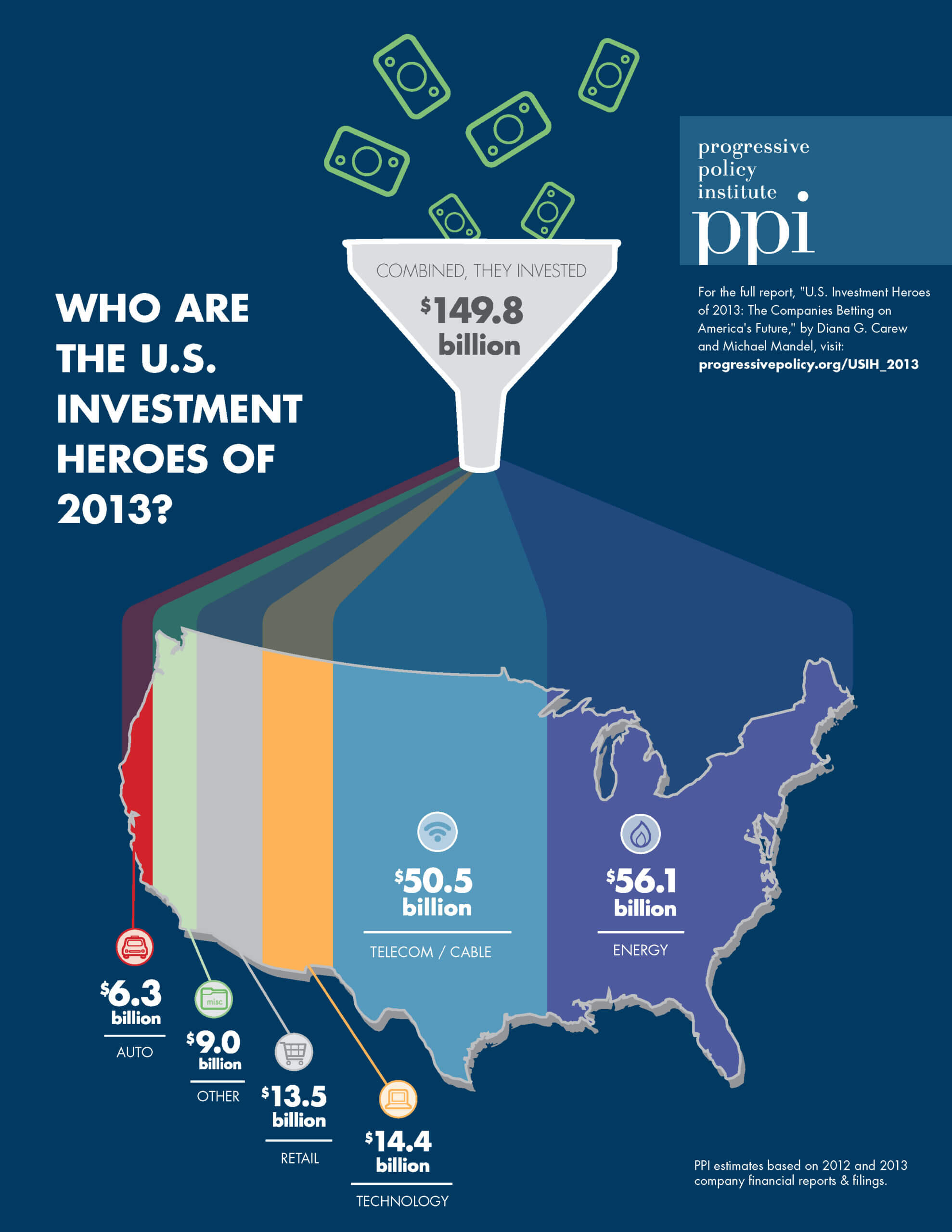

Within this gloomy picture, however, are some bright spots—companies that continue to place big bets on America’s future, creating jobs and raising productivity in the process. Surprisingly, in a world of information overload, identifying these major contributors to the U.S. economy is not an easy task, since most companies do not break out their domestic capital spending. That’s why we undertook our second annual report on “U.S. Investment Heroes,” making a systematic analysis of publicly available information to rank nonfinancial companies by their capital spending in the U.S.

PPI’s ranking of U.S. Investment Heroes for 2013 is once again led by AT&T, which invested almost $20 billion in the U.S. in 2012. The list then follows with Verizon, Exxon, Chevron, Intel and Walmart. Together, we estimate these companies invested almost $75 billion in the U.S. in 2012, an astonishing total almost twice the GDP of Wyoming. Over the last year, these companies have poured capital investment into the deployment of high-speed broadband, oil and natural gas production, and new corporate and retail facilities.

As a general principle such spending provides both direct and indirect benefits to Americans. For example, a variety of studies suggest that investment in fixed and mobile broadband creates jobs. In fact, PPI Chief Economic Strategist Michael Mandel estimates that since Apple introduced the iPhone in 2007, the economy has created over 750,000 jobs related to mobile apps.

Indeed, telecommunications and cable companies are a major driver of U.S. investment today, sparking the rise of what we call “the data-driven economy.” The digital transformation of the U.S. economy would not be possible if high-speed fixed and mobile broadband networks were not in place. That’s why encouraging private investment in our nation’s broadband infrastructure is rightly a major priority for the Obama administration. Beyond that, robust private investment in smart devices, sensors, and “big data” analytics is sparking the emergence of the “Internet of Everything,” which could boost productivity and job creation in ‘physical’ industries such as manufacturing and transportation.

Our ranking of U.S. companies investing in America also shows the tremendous role energy—oil and natural gas production and power generation—has on U.S. economic growth. The shale oil and gas boom has turned old assumptions about energy scarcity on their head. It is lowering input costs for U.S. chemical companies and helping to revive U.S. manufacturing. It may also turn the United States into a major energy exporter, while creating jobs at home.

This report is the third in PPI’s “Investment Heroes: Who’s Betting on America’s Future” research series. That so many companies are choosing to invest elsewhere—or not at all—makes it all the more important to recognize those that are placing their bets on America’s future.