One important focus in the current Google antitrust trial is the question of competition and prices in the digital advertising market. In a 2019 paper titled “The Declining Cost of Advertising: Policy Implications,” we examined long-term trends in the price of digital and print advertising, using data from the Bureau of Labor Statistics.

The paper showed that print media such as newspapers and periodicals had long boosted ad prices faster than the overall rate of inflation. For example, from 1982 to 2010, the price of newspaper advertising quadrupled, while the GDP price deflator only doubled. In other words, the real price of newspaper advertising actually doubled over those three decades. Published prices for classified ads confirmed these observations.

The paper then showed that this trend shifted with the increased competition from digital advertising. The price of digital advertising, excluding ads sold by print publishers, fell sharply from 2010 through the beginning of the pandemic. Moreover, the share of GDP going to advertising was lower, suggesting gains for advertisers and consumers.

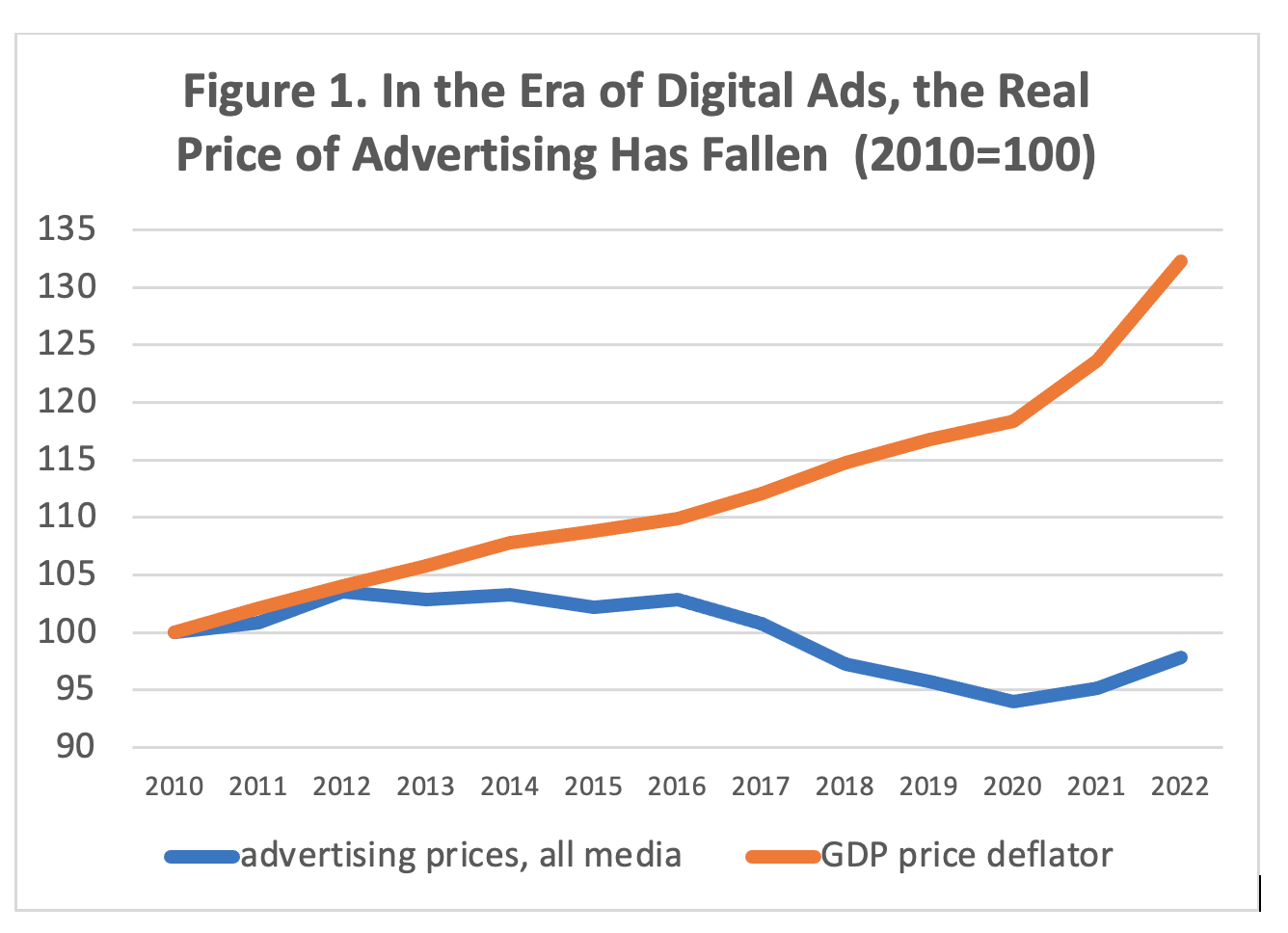

We now extend the analysis through 2022. Figure 1 compares the price of all advertising from 2010 to 2022 with the GDP price deflator over that period. We see that in this period of great expansion of digital advertising, the real price of advertising compared to other goods and services fell by 26%, as the nominal price of advertising fell by 2% while the GDP price deflator rose by 32%. Over the pandemic period 2019 to 2022, the overall price of advertising rose by 2%, while the GDP deflator rose by 13%, suggesting that the real price of advertising was still falling.

Table 1 looks at prices for individual components of advertising. We see that the price of Internet advertising sales, excluding Internet advertising sold by print publishers, fell by 27% from 2010 to 2022. Meanwhile the price of television advertising, for example, only fell by 1%.

Our conclusion from this data is that the shift to digital advertising has generally been associated with a period of falling real prices for advertising, especially compared to the pre-digital period of rising real prices for newspaper advertising.

Two important caveats here. First, we do not know how well the BLS price indices reflect the full set of prices charged in the market. Second, this analysis does not speak directly to the question of anti-competitive behavior in digital advertising. However, it does set the broader context.

| Table 1. Advertising Prices, 2010-2022 | |

| Percentage price change, 2010-2022 | |

| Internet advertising sales, excluding Internet advertising sold by print publishers | -27.3% |

| Advertising space sales in newspapers | -8.4% |

| Advertising space and time sales | -2.2% |

| Radio advertising time sales | -1.3% |

| Television advertising time sales | -1.2% |

| Advertising space sales in periodicals | 14.1% |

Data: BLS