When we look back on this period, a big inflation story will be the dog that didn’t bark. While prices for traditional goods like energy, food, and autos have skyrocketed, digital economy inflation has remained almost non-existent.

This relative lack of inflation in the tech, broadband and ecommerce worlds — including ecommerce margins — is a stunning phenomenon that deserves a lot more attention than it is getting. Why are these companies holding the line on inflation when old-line industries are bingeing on double-digit price increases?

One real possibility is that innovation and investment in the digital sector may have a dampening effect on inflation. Basic economics tells us that when tech and telecom companies spend tens of billions of dollars to create new capacity and deploy new technology, it’s going to be hard for anyone to raise prices, including themselves. PPI’s Investment Heroes report from last year showed that eight out of the top 10 companies in terms of domestic capital spending — Amazon, Verizon, AT&T, Alphabet, Intel, Facebook, Microsoft and Comcast — were in the tech, ecommerce, and broadband sectors. PPI has not yet done the most recent Investment Heroes report, but it’s clear that massive spending on information technology, 5G networks, and ecommerce fulfillment centers is holding down digital prices.

Let’s take a look at the data from the January 2022 Producer Price report, released February 15. Overall, this report show relatively high inflation, with final demand prices up 9.7% over the past year, and the prices of final demand less food and energy up 8.3% (the last line of the table below).

But in the middle of this price surge, tech and telecom prices showed relative small increases or even decreases. The table below compares pre-pandemic inflation (January 2019 to January 2020) with the most recent year (January 2021 to January 2022).

We see that in the latest year, the producer price of cable and other subscription programming, internet access services, and data processing and related services are all falling. The producer price of wireless communications is basically flat (we note that the consumer price of wireless is down by -0.5% over the past year, consistent with the picture painted by the producer price data).

Margins for electronic and mail order shopping services are rising at only a 1.1% rate (we’ll discuss these further below). Prices for advertising sales by internet publishers and web search portals are rising at a 3.5% pace, only slightly faster than the pre-pandemic inflation rate of 3.4%. Relative to January 2015, prices for advertising sales by internet publishers and web search portals are down by 16.9%.*

The one major exception to the low inflation story is the producer price of computer and electronic product manufacturing, which did take a substantial jump, probably in part because of supply chain disruptions.

Tech and Telecom Producer Prices Show Very Little Inflation |

||

| (change in producer prices) | ||

| Jan19-Jan20 | Jan21-Jan22 | |

| Cable and other subscription programming | 2.8% | -1.8% |

| Internet access services | 0.5% | -1.3% |

| Data processing and related services | 3.0% | -0.3% |

| Wireless telecommunications carriers | 0.2% | 0.1% |

| Information technology (IT) technical support and consulting services (partial) | 1.4% | 0.9% |

| Electronic and mail-order shopping services | 1.4% | 1.1% |

| Software publishers | -0.9% | 1.1% |

| Wired telecommunications carriers | 2.4% | 2.6% |

| Internet publishing and web search portals – advertising sales | 3.4% | 3.5% |

| Computer & electronic product mfg | 1.3% | 4.1% |

| Comparison: Final demand for goods and services less foods and energy | 1.6% | 8.3% |

For retail industries, the BLS collects “margin” prices, which is the selling price of a good minus the acquisition price of the good. A bigger margin indicates that the retailer is either getting a higher profit, or having to cover increased costs for labor, energy, and other inputs.

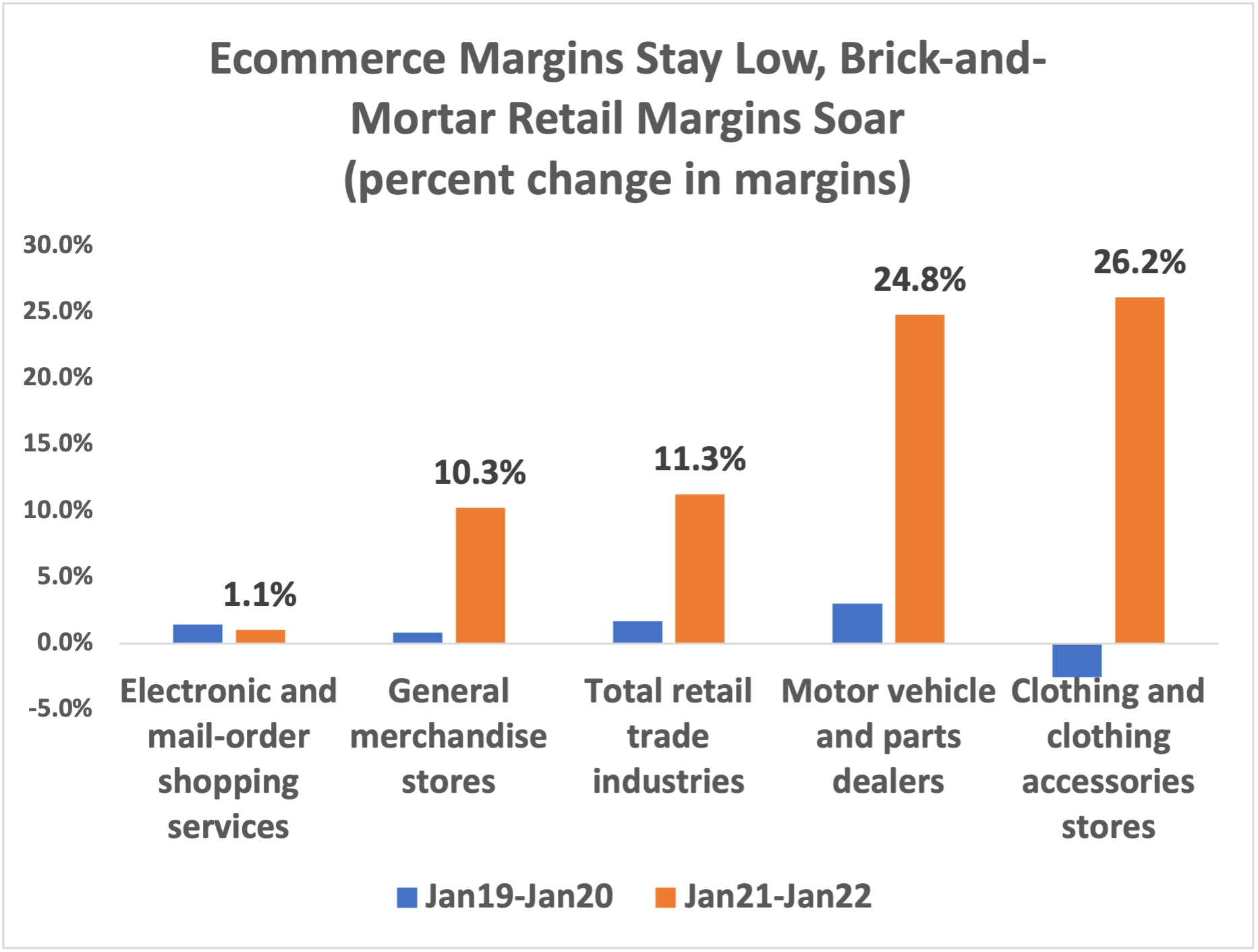

The chart below shows that in the year ending January 2022, overall retail margins rose by 11.3%, a big jump over their pre-pandemic rate of 1.7%. General merchandise store margins rose by 10.3%, while the margins of motor vehicle and parts dealers rose by almost 25%.

Note that this increases could reflect the higher cost of running brick-and-mortar establishments during a pandemic, or they could reflect higher profits. But what is clear is that ecommerce margins have barely rose in the year ending January 2022.

*I looked at long-term trends in internet and print advertising prices in a 2019 paper, “The Declining Cost of Advertising: Policy Implications.”