In the United States, it is critically important to understand how this fundamental shift in technology will impact the broader economy, especially at a moment when COVID-19 has caused significant economic disruption and massive job losses nearing Great Depression levels. Key questions include:

How many jobs will be created by the 5G Economy? Will they be focused around traditional technology centers like San Francisco, New York, and Boston, or create new opportunities across the nation? What kinds of jobs will be created?

And for policymakers, what does the U.S. need to do to support efficient allocation of radio spectrum to support this technology development? And should we provide job training to ensure that workers in America can meet the opportunity?

Already the 5G job revolution has begun. Large mobile providers such as AT&T and Verizon are building out new networks across the country. Network companies such as Cisco, CommScope, Mavenir, and L3Harris are hiring 5G system architects, Radio Access Network (RAN) engineers, 5G solution architects, and technical managers in the 5G space.

Technicians and tower climbers are putting up 5G small cells at a rapid pace. This is not the first time that fundamental shifts in networking technologies have created sudden shifts in the economy and job opportunities.

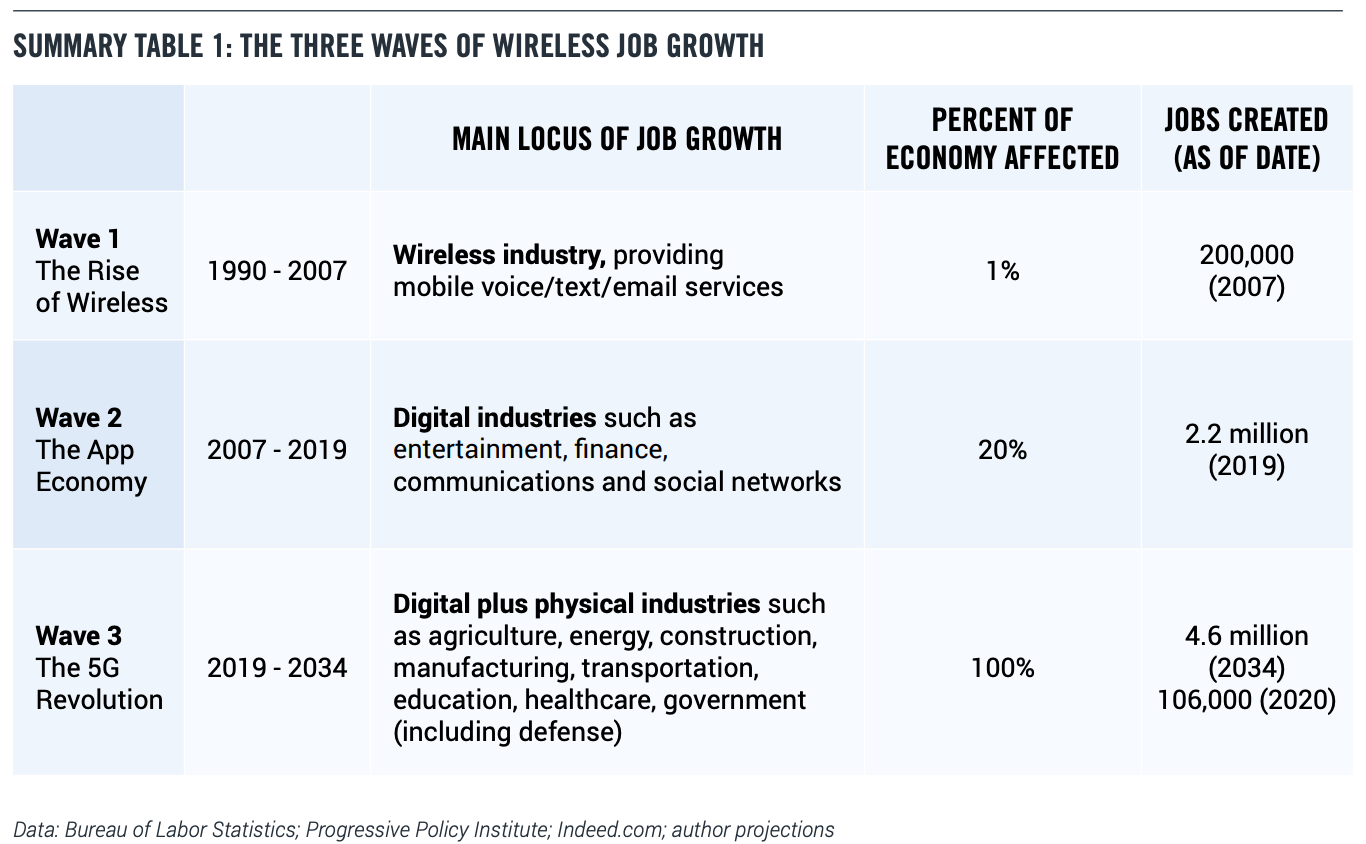

This paper identifies and outlines three waves of wireless-driven job growth (Summary Table 1) in the U.S., and answers major questions about how many jobs will be created, which industries will be affected, where they will be located, and what we can do as a nation to accelerate efforts to meet this challenge.

Wave 1, The Rise of Wireless, covers the period from 1990-2007, as mobile carriers were building out the original wireless networks and cell phones went from a rarity to a necessity. Wave 1 generated roughly 200,000 jobs in the wireless industry.

Wave 2, “The App Economy,” covers the period from 2007 to 2019, which was rooted in the application of wireless to mobile apps via smartphones, rather than in the wireless industry.

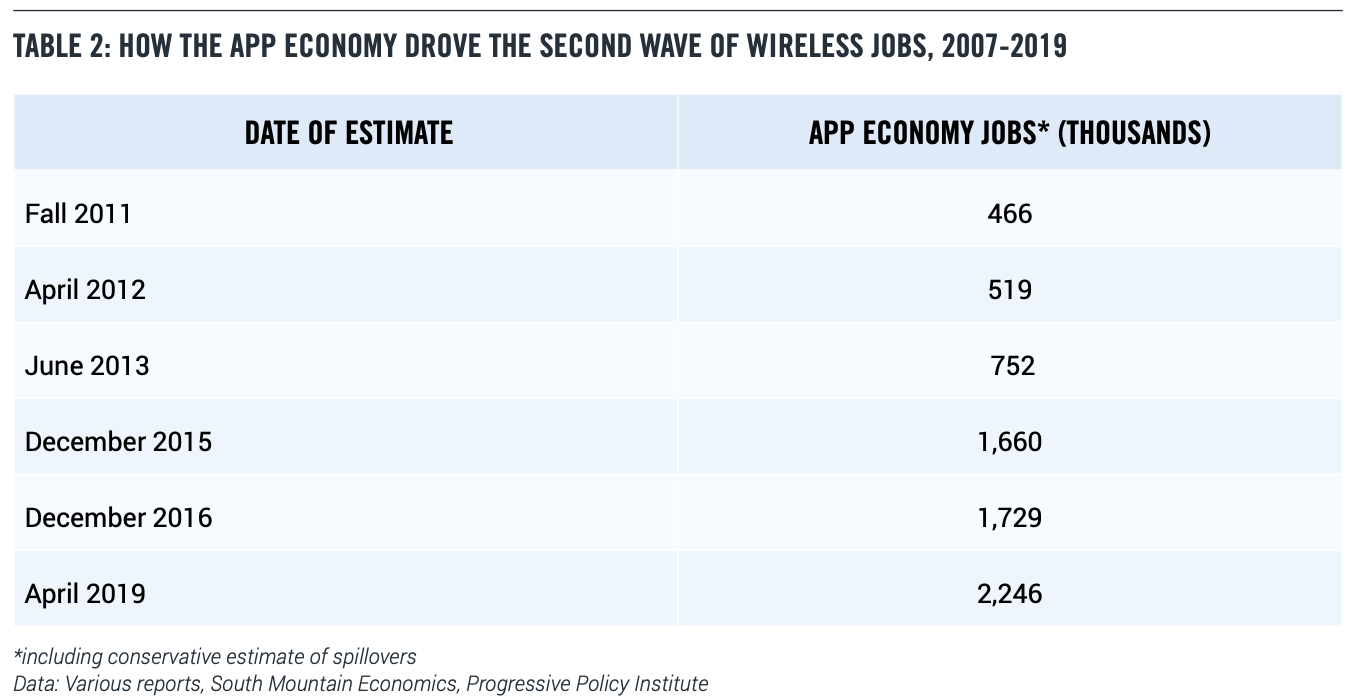

Conventional BLS statistics contained no categories for app developers. But a widely cited study by this report’s author, released in early 2012, analyzed detailed data on job postings and estimated that the U.S. App Economy included 466,000 jobs, including workers developing and maintaining mobile apps and the workers supporting them. (1) Follow-up studies showed continued growth in the U.S. App Economy, with the latest figures from September 2019 reporting more than 2.2 million App Economy jobs. (2) This reflects an average growth rate of more than 20 percent annually. The main locus of Wave 2 job growth has been in industries such as entertainment, finance, communications and social networks, whose output can be easily delivered in a digital form (hence “digital industries”).

Wave 3, “The 5G Revolution,” began in 2019 as mobile carriers expanded their initial 5G networks. Wave 3 is generated by the applications of wireless to challenges in physical industries, such as agriculture, energy, construction, manufacturing, transportation, education, healthcare, and government including defense.

In recent years, most of these physical industries have experienced low or negative productivity growth, as well as low spending on telecommunications services.

5G is reversing both of these trends. Faster, more versatile wireless communications are an essential factor in driving productivity gains and creating jobs. Research shows that industries like manufacturing, construction, and healthcare have lagged in digitization, helping explain why productivity growth has been so slow. To increase productivity, physical industries need the ability to gather information from widely dispersed sensors and to use that data to control activities in real time. That’s not possible without faster and more versatile wireless commnications supplied by 5G. And the COVID-19 pandemic is accelerating the shift to many of these use cases.

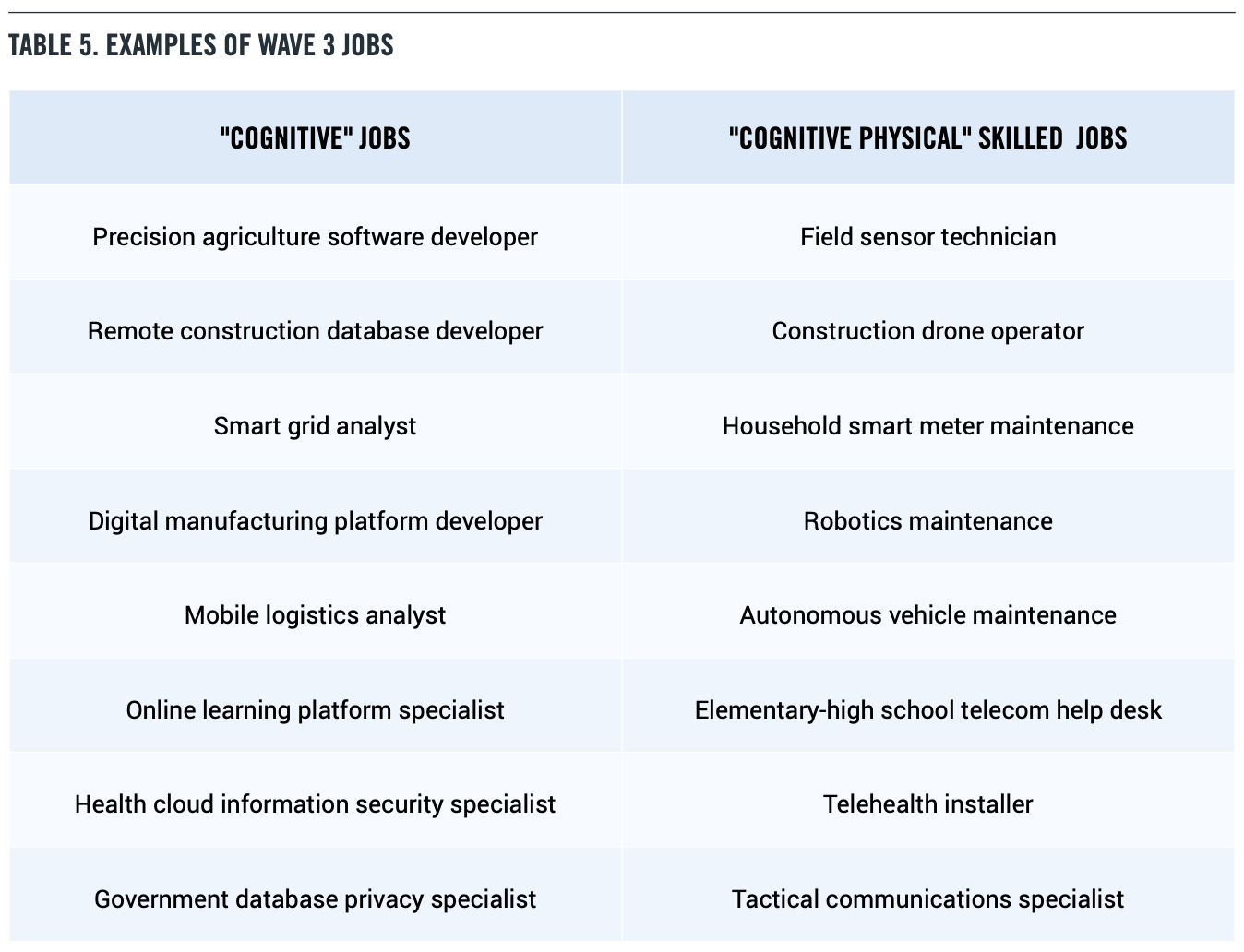

Unlike Wave 2, which mostly generated “cognitive” tech jobs which required a college education, Wave 3 is rooted in the physical world.

As a result, Wave 3 will also create mixed ‘cognitive-physical” skilled jobs, many of which fall into the category of installers and maintainers. So while App Economy jobs were focused on software development, Wave 3 jobs will drive job growth in dozens of sectors, across the economy in what we would traditionally consider both white collar and blue collar positions. Simply put, the third wave will benefit a wider set of Americans and regions than the second wave did.

For example, healthcare providers already monitor medical equipment like pacemakers remotely. But with 5G, the set of possible athome diagnostics or even interventions will expand greatly, and telehealth installers and maintainers will be a highly valued occupation. Similarly, precision agriculture will require “field sensor technicians,” autonomous vehicles will need a cadre of mechanics, and ecommerce will need people skilled in robotics maintenance.

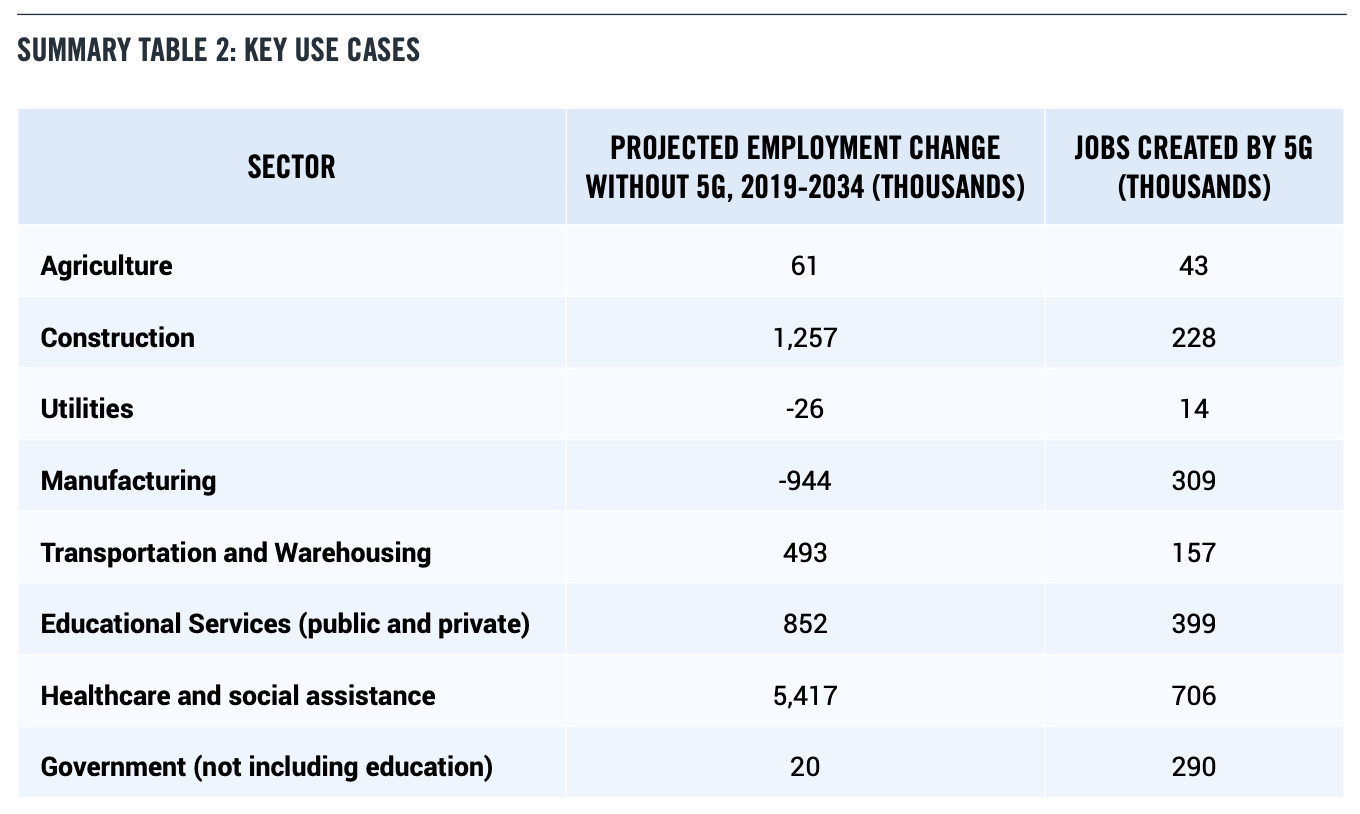

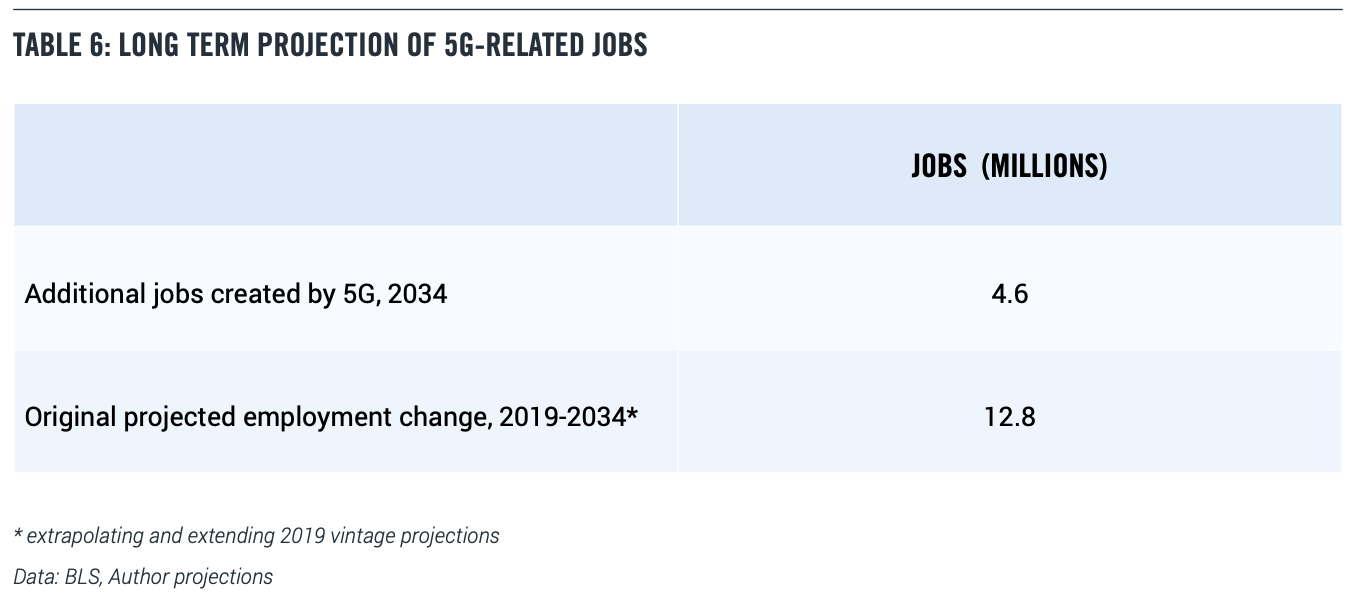

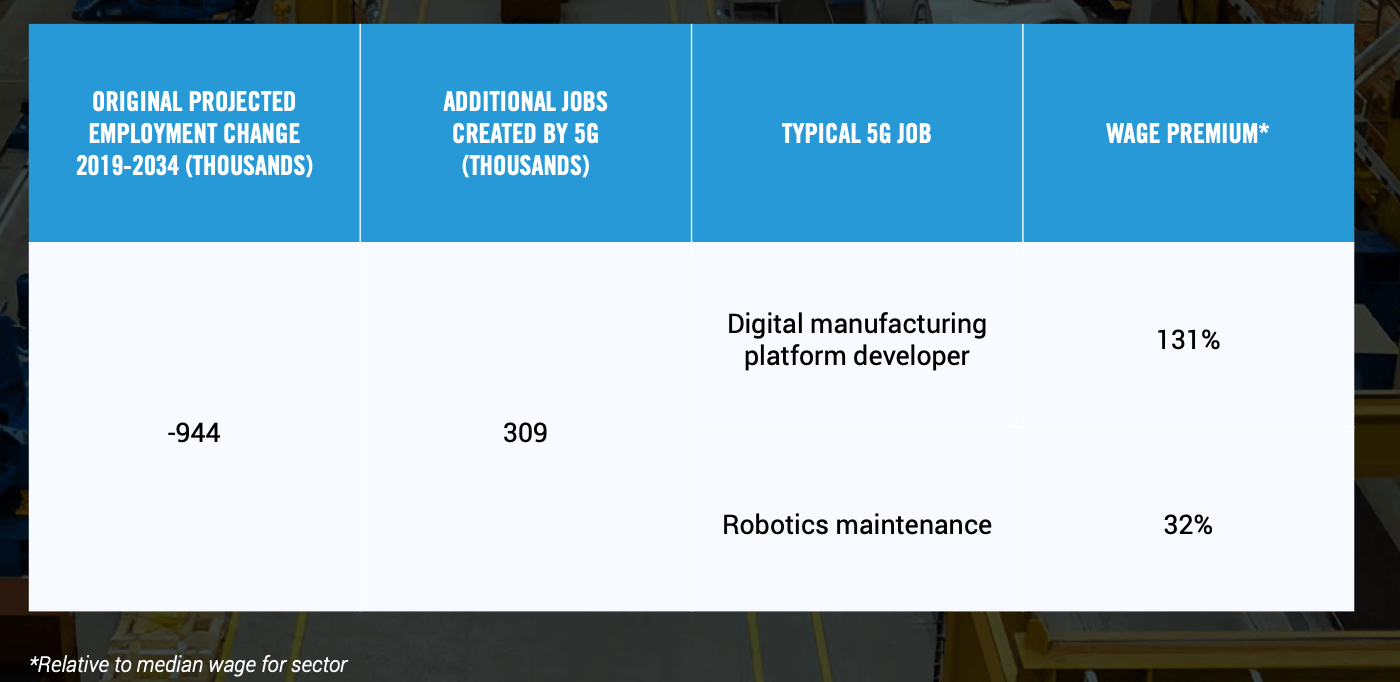

Using the latest BLS projections as a baseline jumping off point, we estimate that 5G and related technologies will create 4.6 million jobs relative to the baseline in 2034, 15 years after the introduction of 5G in 2019 (which is also, not coincidentally, the peak of the most recent business cycle). These are higher paying jobs that will replace jobs that are lost in a wide range of industries and use cases (Summary Table 2).

In an important sense, 5G job creation is a countervailing force to job destruction from automation and globalization, and critically important in the post-COVID world.

During these tough economic times, we also need to be concerned about the short-term job impact and opportunities that 5G is creating as well. This paper also shows that current 5G build-out and engineering activities are creating 106,000 jobs as of April/May 2020. We estimate the location of these jobs by state. To get this estimate, we use a combination of data from real-time job postings and BLS figures.

Finally, this paper identifies four areas where policymakers should focus to harness the full potential of 5G.

First, more spectrum – mmWave, sub-6, and unlicensed – will be needed for broadband and related applications. The U.S. would benefit greatly from a long-range spectrum plan. While the Trump Administration has directed the Department of Commerce to create a National Spectrum Strategy, it has not yet been released.

A long-range spectrum plan would ensure the resource is allocated wisely, provide certainty to 5G stakeholders, and encourage long-term investment in networks for 5G and beyond.

In addition to spectrum, the U.S. also needs a plan for the adoption of 5G across the government, both defense and civilian. The public sector should be a leader, not a follower.

Third, Congress should be willing to invest heavily in the development of 5G and successor technologies. That’s essential if the U.S. is to keep up with global competition.

And finally, the U.S. should make a significant investment in job training. The U.S. needs to double down on traditional STEM fields and encourage more people in America to go into engineering and math. Beyond that, we need a national skills initiative and mentoring programs to ensure that this new generation of workers will have the training needed to support the cognitive-physical jobs that the 5G Revolution is already beginning to create.

Wireless technologies are generally divided into generations, each one corresponding to higher speed and increased capabilities. 5G is the current technology being rolled out, with 6G on the horizon, promising even faster speeds and satellite-terrestrial integration.

However, for the purposes of this paper we use a different taxonomy, based on the labor market impact of wireless technologies.

Commercial mobile radio telephony—what is sometimes called “0G”—was available as a niche service since the late 1940s. (3) It had very little economic impact. The first true commercial portable cellphone, the Motorola DynaTAC 8000X, was introduced in 1983, but there were only 5 million cellphone subscribers as of 1990.

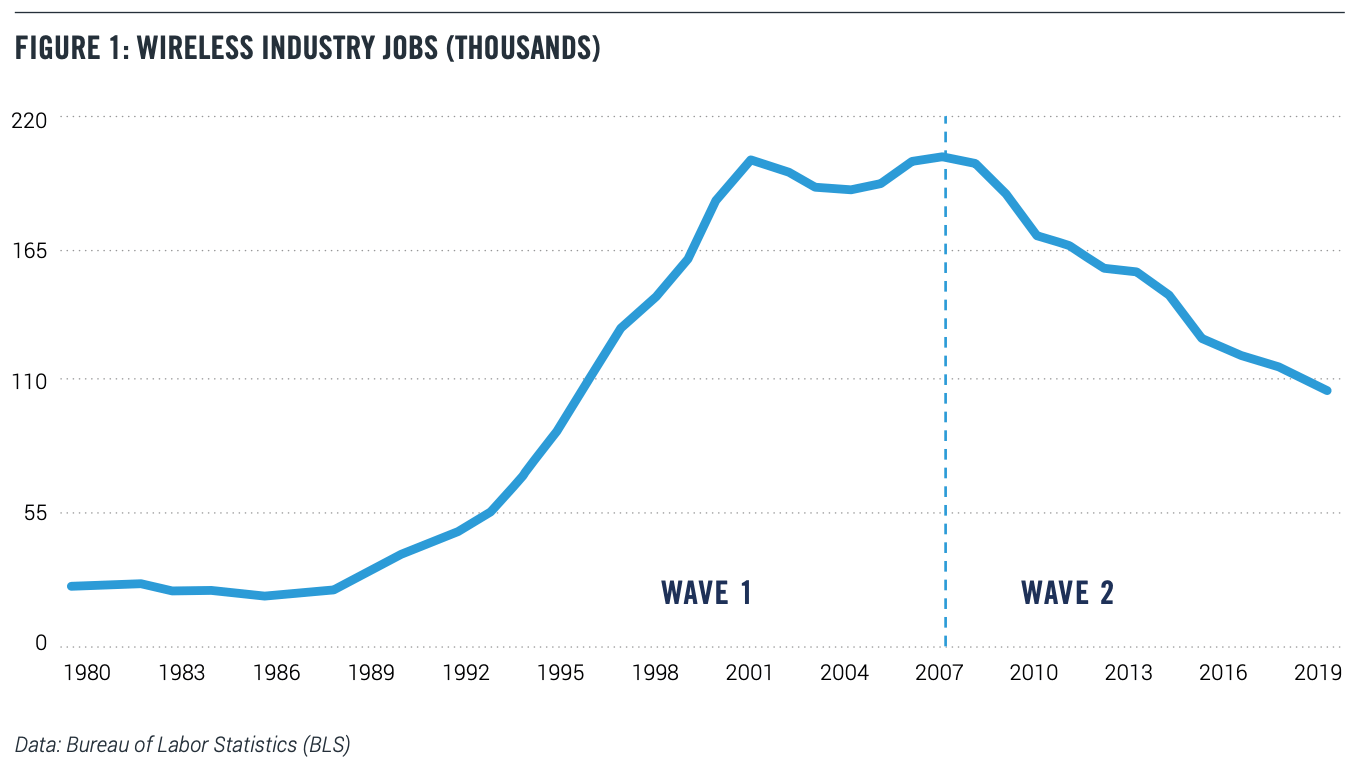

But the use of cellular wireless technology rapidly gathered speed after 1990, giving rise to 109 million subscribers as of 2000 and 233 million subscribers as of 2006. Not surprisingly, the need to build out networks, and handle a soaring customer base generated a large number of jobs. The number of people working in the wireless industry went from 36,000 in 1990 to 200,000 in 2000. (4) Wireless employment remained at roughly that level until 2007 (Fig 1).

The first wave of wireless job growth encompasses 2G in the 1990s and 3G and 3G+ in the first half of the 2000s. With 2G data speeds measured in the kilobits, only low-bandwidth applications such as voice, text messages, and email were viable. Running other applications on top of a slow network was almost impossible.

Mobile internet became possible with 3G and 3G+, but it was still not fast enough to make a significant difference.

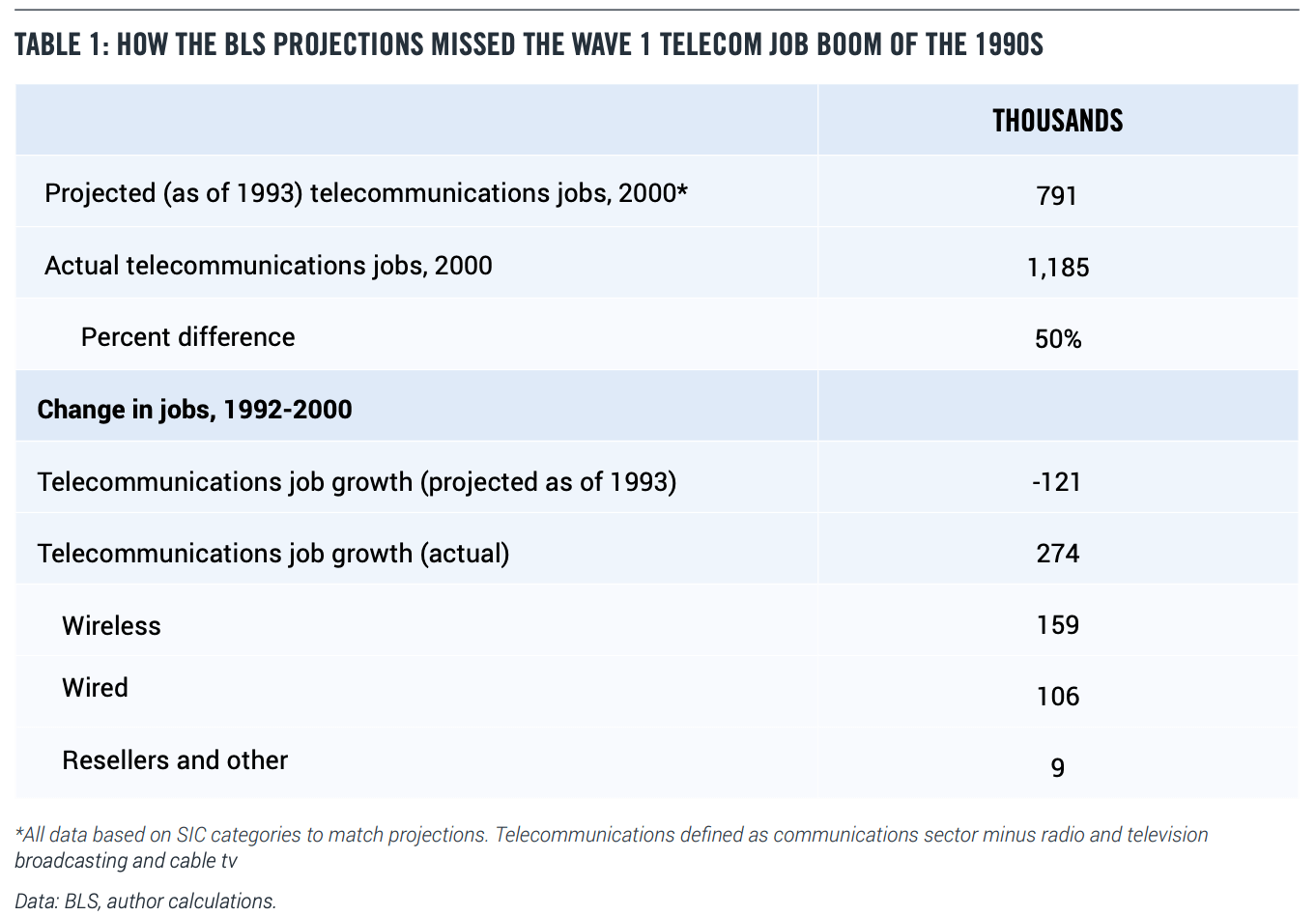

Wave 1, The Rise of Wireless, was not anticipated in any of the long-run employment projections issued by the BLS in the late 1980s and early 1990s. That’s important, because the BLS projections, issued regularly since the 1960s, are the most widely quoted comprehensive long-run occupational and industry forecasts available. The BLS also maintains the most detailed occupation industry matrix available for the United States.

Yet, the BLS projection methodology typically misses the impact of new technologies. For example, the employment projections issued in 1993 anticipated that telecommunications employment would drop from 912,000 in 1992 to 791,000 in 2000. (5) In reality, telecommunications jobs rose to 1,185,000 in 2000, 50 percent above the projected value (Table 1). (6)

The second wave of wireless jobs, The App Economy, began in 2007 with Apple’s introduction of the iPhone, coupled tightly with the opening of the App Store and Android Market (later renamed Google Play) in 2008. Suddenly mobile phone users had a powerful computer in their pockets that could handle a myriad of applications. The demand for mobile broadband soared. Mobile wireless networks moved from faster versions of 3G to 4G and LTE, as the number of broadband subscriptions soared.

But the second wave of wireless jobs also started with a paradox. Despite the central role of mobile, employment in the wireless industry peaked in 2007 and fell by half by 2019. In 2011, the Wall Street Journal ran a piece with the stark title: “Wireless Jobs Vanish.” (7)

In fact, wireless was creating jobs, but not in the wireless industry. (8) More and more IT professionals were involved in either developing mobile apps, maintaining them after they were on the market, or supporting them with users. For banks and other financial institutions, mobile apps became an important way of supplying their services without having expensive real estate or branch workers. Moreover, mobile apps could use the camera on smartphones to provide services like depositing checks at homes.

Beyond utilitarian tasks like banking, shopping, and travel reservations, apps became the major way that people interacted with their smartphones. We watched videos, listened to music or podcasts, messaged friends, played games, and spent time on social networks. One survey found that adult Americans spent almost three hours per day on their smartphones, and 90 percent of that time was spent on apps. (9)

Conventional BLS statistics contained no categories for app developers. But a widely cited study by this report’s author, released in early 2012, analyzed detailed data on job postings and estimated that the U.S. App Economy included 466,000 jobs, including workers developing and maintaining mobile apps and the workers supporting them. (10) Follow-up studies confirmed continued growth in the U.S. App Economy, with the figures from April 2019 reporting more than 2.2 million App Economy jobs. (11) This reflects an average growth rate of more than 20 percent annually (Table 2).

Other studies have found similar or even higher estimates. For example, a 2018 study from Deloitte estimated 5.7 million App Economy jobs in the U.S., using a different methodology and a much bigger assumption of spillover effects. (12)

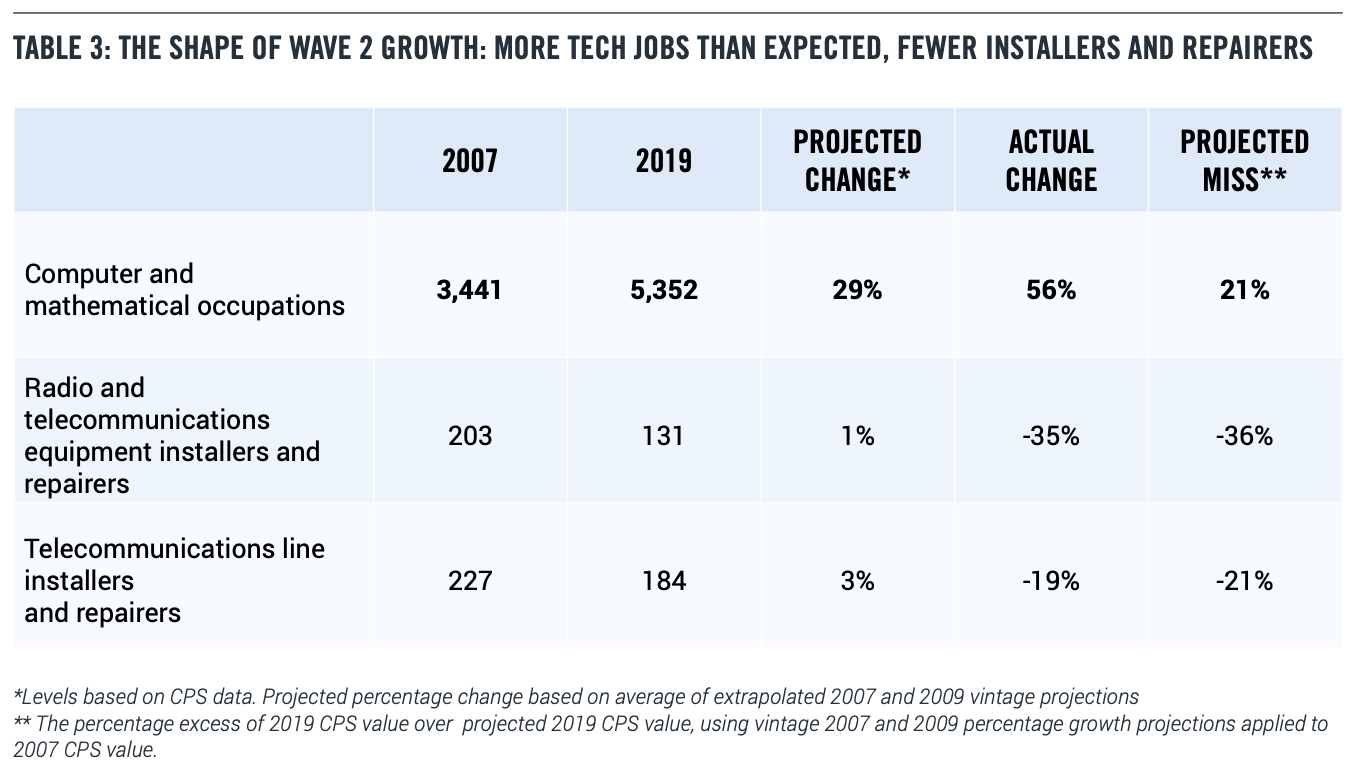

The job impact of mobile broadband and the App Economy did show up in the official numbers in a different way: the unexpectedly rapid growth of people working in “computer and mathematical occupations.” “Computer and mathematical occupations” is a broad category that includes data scientists, software developers and engineers, information security specialists, computer support specialists, and database and network administrators.

By contrast, skilled workers who maintain the telecom networks—the people who lay and fix the fiber-optic lines and put up the cellphone towers—are in the “installation, maintenance, and repair” occupations.

The BLS projections in 2007 and 2009 underestimated the expected size of the computer and mathematical workforce in 2019 by roughly 20 percent, or over 1 million workers. But the relevant categories of skilled installers and maintainers were overestimated in the projections. This tilt towards tech jobs is very important for understanding the third wave (Table 3).

Wave 3 of wireless-driven job growth, The 5G Revolution, began in 2019 as mobile carriers expanded their initial 5G networks, and then continued into 2020. All major carriers in the U.S. — AT&T, Verizon, and T-Mobile — are heading towards nationwide 5G networks by the end of 2020, according to analysts. (13) The pandemic has made the case for 5G more compelling as many of the use cases for 5G services have been pulled into the present.

Telehealth has become not just optional but a requirement in many medical situations.

Students from kindergarten to graduate school have been forcibly introduced to distance learning. Businesses and governments have been learning how to use virtual meetings, at a much lower cost than flying around the world. Companies have started using robots to help disinfect their stores. (14)

The U.S. military faces its own challenges, as the virus has forced changes in routines to minimize infectiousness and to protect its suppliers. “We believe the COVID-19 pandemic has accelerated society’s transition to broadband and digitization by at least a decade,” said one market analyst in March 2020. (15)

Indeed, in the early days of the pandemic, Verizon announced that it was expecting to allocate $17.5- $18.5 billion on capital expenses in 2020, up from its previous guidance of $17-$18 billion. “This effort will accelerate Verizon’s transition to 5G and help support the economy during this period of disruption,” Verizon said in a press release. So far, the pandemic has caused spectrum auctions in Europe to be pushed back. (16) Meanwhile the FCC has not changed its spectrum auction plans for 2020. (17)

Spending on 5G networks is what is known by economists as “autonomous investment”—that is, investment that is not linked to the immediate ups and downs of GDP. (18)

Wave 2 was focused on “digital industries,” where the output can be reduced to bits and bytes. This includes games, music, communications, social networks, news, advertising, financial services, and ecommerce purchases of digital goods such as hotel and plane reservations. These digital industries, while important, make up less than 20 percent of the economy. (19) (Formally defined, the digital sector includes computer and electronics manufacturing; ecommerce; software and other publishing; video and audio content; broadcasting; telecommunications; data processing; internet publishing and search; and computer systems design and programming. Slight changes to the boundary of the digital sector does not affect the analysis here).

Wave 3, by contrast, is based on the applications of wireless to the challenges and opportunities in physical industries, such as agriculture, energy, construction, manufacturing, transportation, education, healthcare, and government (including defense).

Physical industry use cases include low-power wireless sensors that must operate for long periods in a field, say, without a battery replacement, or a low-latency connection to a drone or autonomous vehicle.

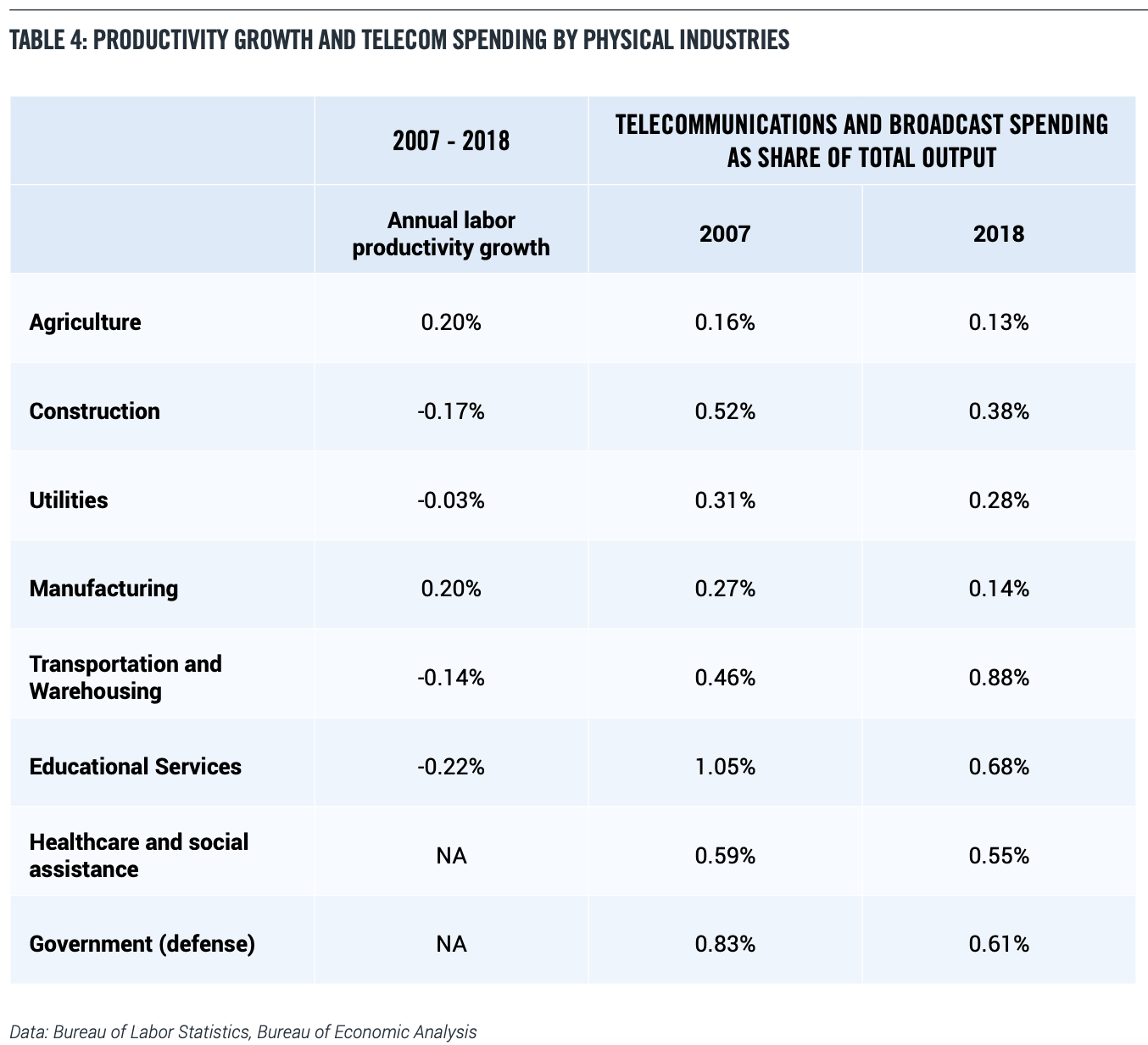

Table 4 shows the key physical sectors had slow or negative productivity growth during the second wave (in general 1 percent annual productivity growth is adequate and 2 percent is good, so none of these industries made the grade). Slow or negative productivity growth means less competitive industries, weaker wage gains, and lesser quality jobs.

Surprisingly, most of these industries had low and falling spending on telecommunications services, as a share of total output (for most industries, total output can be interpreted as revenues. For defense, total output can be interpreted as spending including accounting for depreciation). (20) For example, in agriculture, the amount spent on telecom services went from a very low 0.16 percent in 2007 to an even lower 0.13 percent. (To provide some context, in 2018 the average telecom share for digital industries was 3.5 percent, and the average telecom share for physical industries was 0.7 percent).

5G is likely to reverse both of these trends. Faster, more versatile wireless communications are an essential factor in driving productivity gains. Research shows that industries like manufacturing, construction, and healthcare have lagged in digitization, helping explain why productivity growth has been so slow. To increase productivity, physical industries need the ability to gather information from widely dispersed sensors and to use that data to control activities in real-time. That’s not possible without faster and more versatile wireless communications supplied by 5G.

The ability to rapidly communicate data and information using 5G will increase productivity gains in both the public and private sectors. And these productivity gains, in turn, will lead to higher revenue, faster wage gains, advances in job quality, and increased international competitiveness.

In 2017, a study from the Technology CEO Council examined the impact 5G will have on productivity growth in the “physical industries” and tax revenues over the next 15 years.21 The report estimated that the physical industries will boost annual economic growth by 0.7 percentage points over the next 15 years, generating an additional $2.7 trillion in annual economic output, $8.6 trillion in wage and salary payments, and $3.9 trillion in federal tax revenue.

The impact of 5G on jobs can be summarized as “network meets the cloud.” That means we can push more capabilities out to the edge, including real-time and near-real-time applications of machine learning and artificial intelligence to the physical world. In many cases, new technologies create new tasks and markets that didn’t exist before. (22) For example, healthcare providers already monitor medical equipment like pacemakers remotely. But with 5G, the set of possible at-home diagnostics or interventions will expand greatly, and telehealth installers and maintainers will be a highly valued occupation.

5G will greatly expand the capabilities of drones in a range of applications from agriculture to military to logistics, especially in conjunction with artificial intelligence. That will expand the market for skilled drone operators, sometimes called “remote-pilots-in-command,” earning as much as $100,000 per year.

The other alternative is that productivity gains will lower costs enough to expand the market, which ends up creating new jobs. (23) That’s what happened in ecommerce. The use of robots in ecommerce fulfillment centers, combined with effective use of data, helped drive down costs low enough to offer consumers fast delivery and easy returns. And the combination of fast delivery and easy returns, in turn, made the ecommerce proposition irresistible to many consumers, because now they could avoid the time and trouble of going to the store, getting the product quickly and simply returning it for free if it didn’t work. The result was a massive shift from unpaid household shopping hours to paid ecommerce fulfillment and delivery hours. (24)

Or consider manufacturing. The pandemic has called into question the wisdom of depending on global supply chains for important medical supplies, and by extension, any parts that one might need in a crisis.

The low-latency high-bandwidth services delivered by 5G can help spur the digitization of the factory floor, boosting productivity and increasing flexibility. (25, 26) The result could be a shift to distributed local manufacturing in the U.S. in the post-COVID era, creating jobs and shortening supply chains.

Table 5 identifies examples of Wave 3 jobs. Unlike Wave 2, which mostly generated “cognitive” tech jobs which required a college education, Wave 3 is rooted in the physical world. As a result, Wave 3 will also create mixed ‘cognitive-physical” skilled jobs, many of which fall into the category of installers and maintainers. In addition, people will continue to play an essential role in the supervision loop of advanced robots.

The types of cognitive jobs listed in Table 5 mainly fall into the broad occupational class of “computer and mathematical occupations.” Relative to the median wage for all occupations, these jobs pay a wage premium of 122 percent.

But Wave 3 will also generate blue-collar jobs that use a combination of manual and problem-solving skills—what we call “cognitive-physical” jobs— which are likely to pay a wage premium as well.

Today, the median wage for telecommunications equipment installers and repairers is 45 percent higher than the overall median wage, according to figures from the BLS. As 5G becomes an integral part of business operations, we would expect such jobs to become more valuable rather than less.

Estimates of job growth spurred by a new technology have to be measured against some baseline. As we noted earlier, the BLS projection methodology typically looks backward, not forward, and has a difficult time dealing with ongoing technological changes. BLS projections have consistently understated the job impact of wireless innovation. In the first wireless wave, jobs in the wireless industry came in 50 percent above projections. In the second wireless wave, the rise of the App Economy drove up demand for computer and mathematical jobs 21 percent above BLS projections as of 2019.

Our fundamental assumption is that unlike the second wave—which was mostly focused on digital industries—the third wave will drive demand for both cognitive and cognitivephysical jobs across the whole range of physical and digital industries. The third wave will therefore benefit a wider set of Americans and regions than the second wave did. We therefore adopt a simple and straightforward approach to estimating the impact of 5G on jobs. We start with the latest BLS industry and occupation projections, issued in September 2019, for the 2018-2028 period. We rebase them to 2019 and extend them to 2034 to get a 15-year projection.

Then we assume that the additional jobs produced by 5G in the third wave, relative to the baseline, are the same magnitude as the additional jobs produced by wireless innovation in the second wave. We then allocate these jobs across industries according to their size, rather than focused on only tech. Finally, we then apply a conservative job multiplier.

Based on these assumptions, we estimate that 5G and related technologies will produce an additional 4.6 million jobs in 2034 relative to the baseline original projected growth of 12.8 million.

When we say ‘additional’ we mean that 5G-driven job growth is an additional factor that the conventional projections do not take into account. In an important sense, 5G job creation is a countervailing force to job destruction from automation and globalization. These are higher paying jobs that will replace jobs that are lost.

In 2017, Accenture released a report estimating wireless operators will directly invest $275 billion between 2017 and 2024 in 5G infrastructure, creating up to 3 million jobs and boosting GDP by $500 billion.27 Of the $275 billion investment, $93 billion was estimated to be spent on construction, with the remainder being allocated to network equipment, engineering, and planning. Importantly, the report recognized this growth will be spread across communities of all sizes. “Small to medium-sized cities with a population of 30,000 to 100,000 could see 300 to 1,000 jobs created. In larger cities like Chicago, we could see as many as 90,000 jobs created,” the authors wrote.

More recently, a report on the global economic impact of 5G was released in November 2019 by IHS Markit, updating a 2017 study. (28) This report looked at several measures of 5G impact. First, the report forecast that between 2020 and 2035, global real GDP would grow at an average annual rate of 2.5 percent, with 5G contributing almost 0.2 percent of that growth. Second, the report looked at the seven leading countries for 5G—the United States, China, Japan, Germany, South Korea, the United Kingdom, and France—and found that the collective investment in R&D and capital expenditures by firms that are part of the 5G “value chain” within these countries will average over $235 billion annually, measured in 2016 dollars. The U.S. and China each accounted for about one-quarter of global spending on 5G R&D and capital expenditures. Third, the IHS Markit report estimated that 22 million jobs would be supported by the 5G value chain globally in 2035, with 2.8 million of those jobs in the United States.

Most recently, two economists at NERA Economic Consulting, Jeffrey A. Eisenach and Robert Kulick, estimated the potential job impact of 5G. (29) They found that if 5G adoption followed the path of 4G adoption, then, “at its peak, 5G will contribute approximately 3 million jobs and $635 billion in GDP to the U.S. economy in the fifth year following its introduction.” This employment effect is smaller but faster than the one reported here.

As previously noted, The 5G Revolution will create job opportunities across many sectors and regions in the U.S. In this next section, we identify eight of the most likely use cases that have significant potential for job growth.

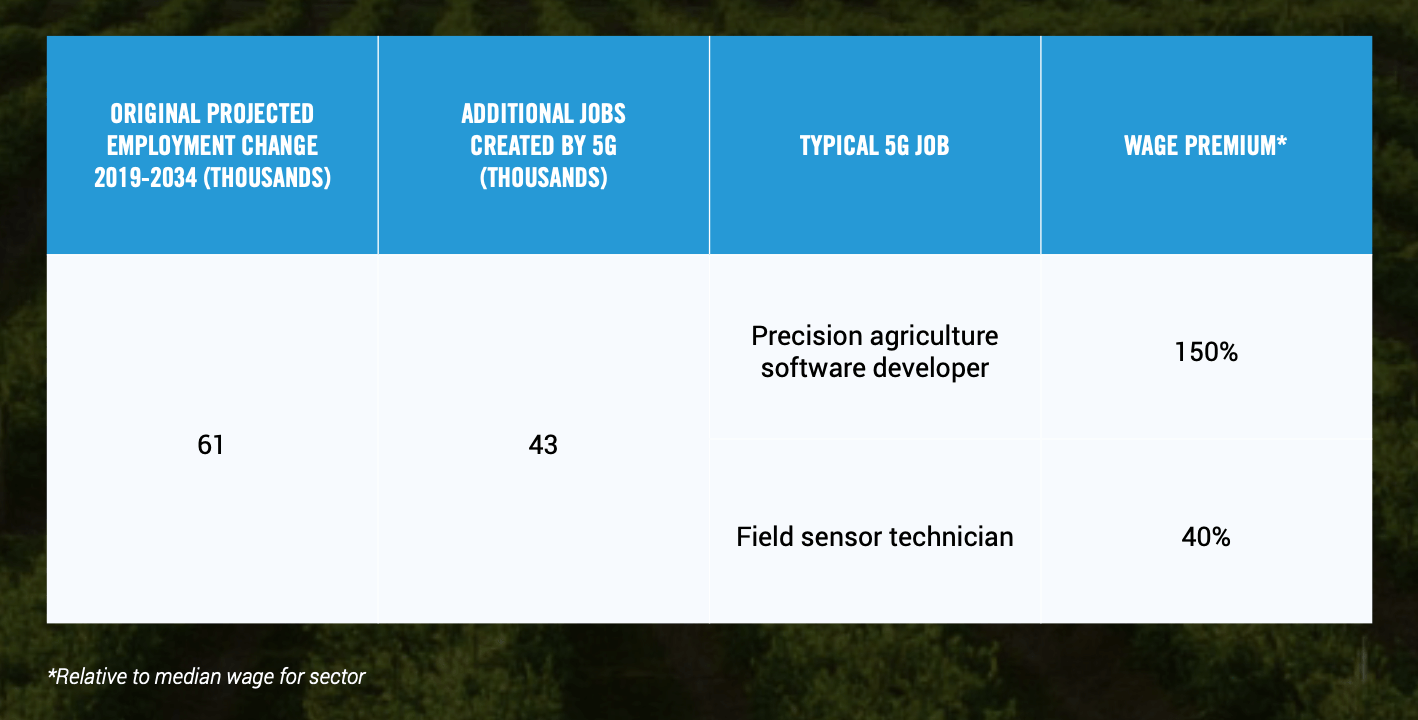

Agriculture is an industry ripe for transformation. In many areas of the country, it is still heavily dependent on low-cost labor, which may be discouraged because of the pandemic. And as of 2018, only 0.1 percent of agriculture revenues were being spent on telecommunications, a percentage that had dropped slightly since 2007.

Faced with an evolving environment with increasing temperatures and diverging precipitation levels in wet and dry areas, precision agriculture will rely on an interconnected system of low power sensors, integrated equipment, and data—all powered by 5G—to monitor field conditions and maximize yields while efficiently allocating scarce resources such as water. (30)

To best utilize the new technologies, agriculture will have to build and maintain a new tech and telecom infrastructure and the workforce is only now starting to come into existence. This requires both software developers and people to install and maintain the equipment.

For example, as of March 2020, agriculture technology company Farmers Edge was looking for a precision technology specialist to install equipment and software at its growers’ farms in Madison, Wisconsin.

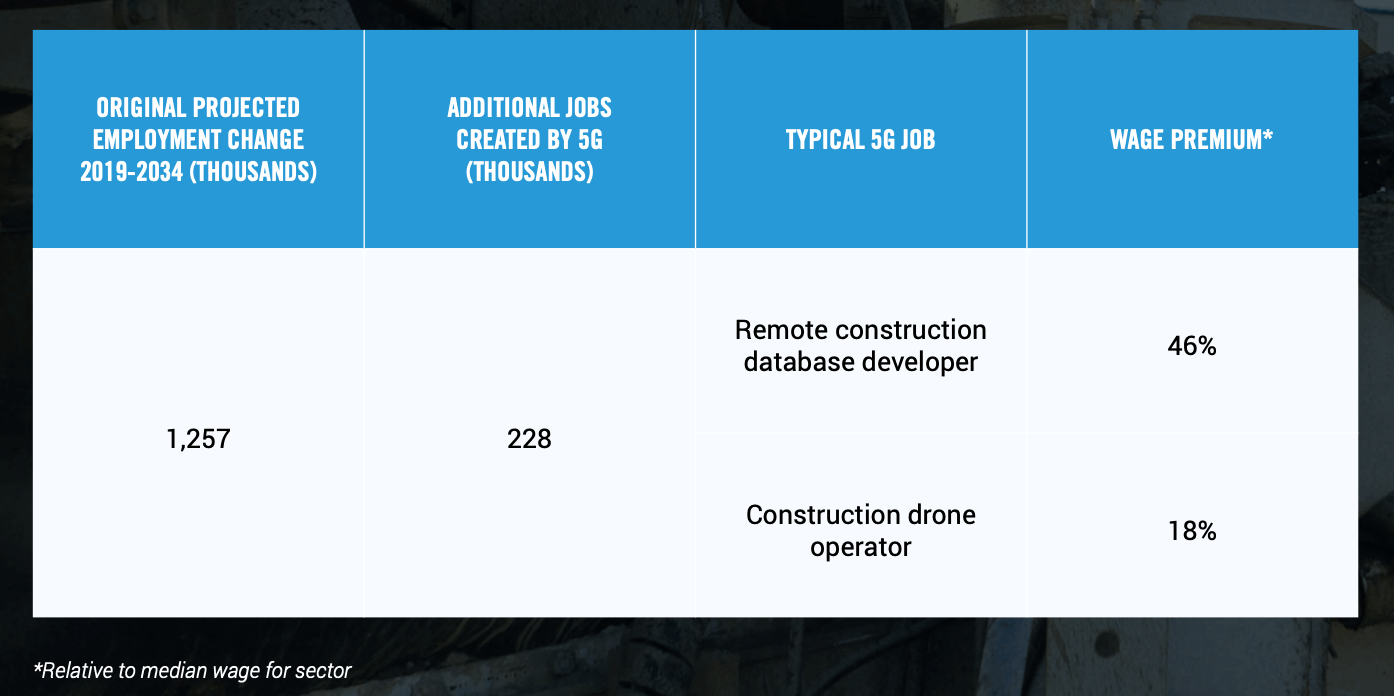

5G plays an essential role in digitizing construction, a key sector which has been plagued by high costs and low productivity in recent decades, especially in public infrastructure. (31) Perhaps not coincidentally, construction is one of the least digitized sectors of the economy. (32)

Since 2000, the cost of construction has risen 118 percent according to the Bureau of Economic Analysis. (33) Highways and streets have become 126 percent more expensive for state and local governments to invest in. (34) By comparison, overall prices in the economy have only risen 41 percent over the same time span. (35)

This increase in the relative price of construction helps explain why U.S. infrastructure seems shoddier and worn-out these days.

A 5G communication grid will allow the seamless and flexible integration of automated equipment and skilled workers on a construction site. Structures will go up faster with fewer dangerous errors, and worksites will be safer. Meanwhile, as 5G helps bring down the cost of construction, demand will rise. Both renovation and new building will be cheaper and faster.

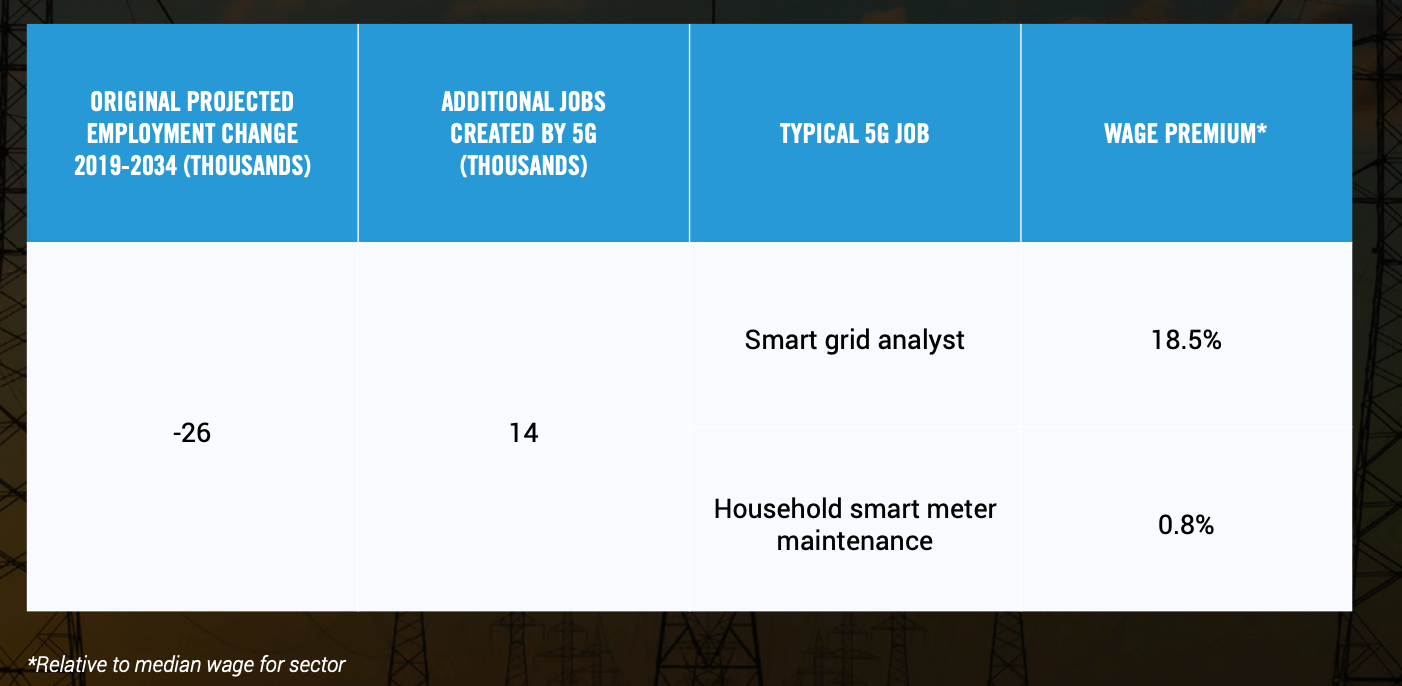

Energy use management is an essential use case for 5G. Utilities are already extensive users of information technology within their own operations to monitor power production and distribution. But 5G makes it much easier to connect up smart meters to the grid to give people and businesses better incentives to control their electric use.

This is one sector where our projection methodology may underestimate the number of new 5G-related jobs. If the energy infrastructure shifts over the next 15 years from fossil fuels to low-carbon energy sources, the opportunities for 5G-enabled workers may be very strong.

In manufacturing, 5G and digitization will help reduce costs, making domestic manufacturing more competitive. Many manufacturing industries have weak or even negative multifactor productivity growth over the past 20 years. (36) Multifactor productivity growth takes into account the usage of purchased services, energy, capital, and intermediate inputs and is a key measurement of competitiveness. Investment in information technology such as 5G, which manufacturing has lagged in since the early 1990s, will enable new business models that expand markets and enhance domestic competitiveness.

New markets and reinvigorated domestic competitiveness means more jobs in the U.S. Through a combination of digitized distribution, digitized production, and new manufacturing platforms – coined by PPI as the Internet of Goods – a new network of smallbatch and custom goods factories will likely arise. Importantly, these industrial startups will fuel job creation in low-density areas and former industrial hubs like the Midwest and upstate New York, as physical industries like manufacturing dominate these economies. That means more domestic production and less imports. (37)

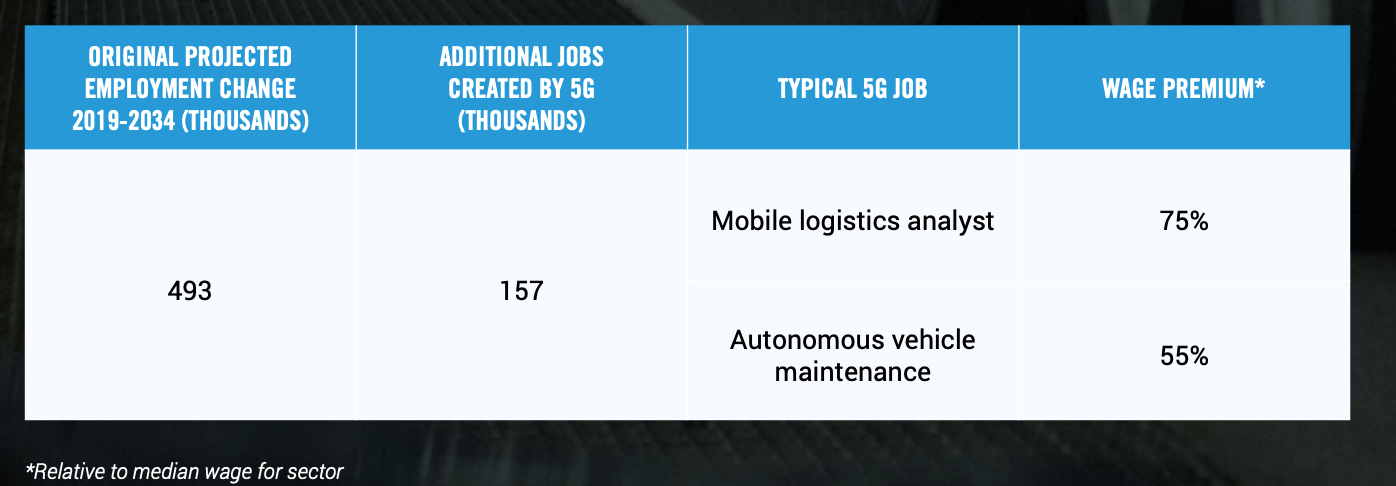

5G will transform how people and goods move from point to point and how cities manage traffic. This has major implications for industries ranging from defense and transportation to logistics and delivery.

Low-latency 5G connections will accelerate the roll-out of fully autonomous trucks and cars. But the flip side is that these vehicles will have to be maintained to a very high standard to keep them safe, creating more jobs for skilled technicians, and compensating for the loss of truck driver jobs.

These capabilities depend on the speed of 5G to rapidly relay data. In trucking, a report by McKinsey recognizes, “sixty-five percent of the nation’s consumable goods are trucked to market. With full autonomy, operating costs would decline by about 45 percent, saving the US for-hire trucking industry between $85 billion and $125 billion.” (38) This savings from automated trucking could be passed onto consumers in the form of lower prices. Delivery drones stand to further disrupt how goods are delivered.

And in traffic management, traffic signals will be based on real-time traffic flow rather than timed stoplights. Pittsburgh recently introduced smart traffic lights and saw travel times cut by 25 percent. (39) These innovations reduce the need for drivers and increase the need for maintenance and road workers as driving and delivery become less physically intensive and goods can be moved around the clock.

The creation of new types of jobs is already starting. As of March 2020, transportation services company Transdev Services was hiring a self-driving vehicle operator in San Francisco, California. Technology platform Argo AI was seeking an autonomous vehicle system test specialist responsible for operating its autonomous test platforms in Miami, Florida. And transportation services firm MV Transportation was searching for an autonomous vehicle attendant tasked with ensuring the safe operation of the Autonomous Vehicle in Corpus Christi, Texas.

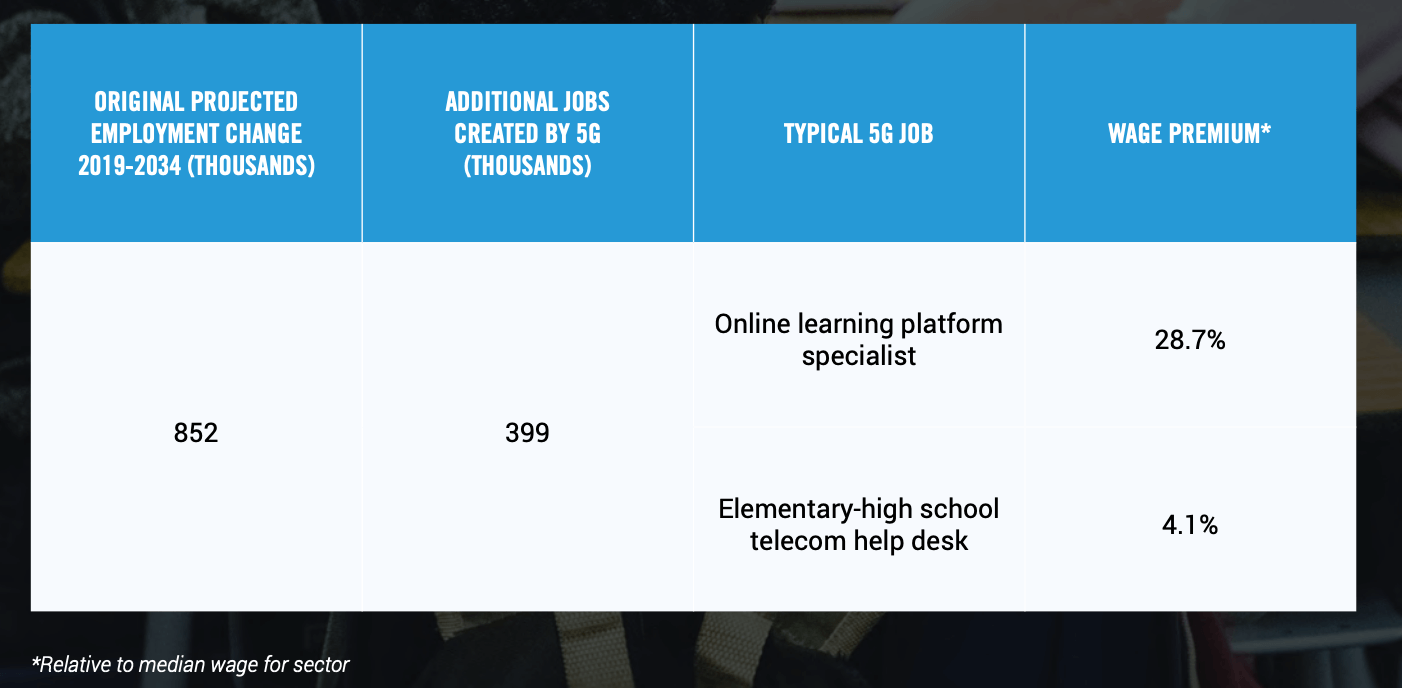

Students and teachers at all levels were forced to adopt virtual learning in 2020 because of the pandemic. Reports from the field have been mixed. The technology in many cases was not up to the task, and many students, especially in low-income neighborhoods, were caught on the wrong side of the digital divide. If schools want to engage in virtual learning, they will need a technology like 5G with the bandwidth for students and teachers to fully engage.

A related issue is training of workers on new equipment and processes. As 5G moves into the workplace, it will transform the way that physical industries such as manufacturing and healthcare do business. In order for workers to stay relevant, the training technology has to become 5G-enabled as well.

As with education, the pandemic forced healthcare providers to adopt ad hoc telehealth practices without the proper technology. 5G will provide the framework in which providers can truly practice healthcare at a distance. Moreover, 5G is essential to unlocking quality healthcare for rural, low-density areas because of its ability to support real-time high-quality video, transmit large medical images, and enable real-time remote monitoring.

Maintaining the telehealth infrastructure will be a core function at hospitals, which will employ skilled telehealth technicians, just like they have lab technicians and nurses. Clinical information will flow wirelessly into electronic health records, requiring specialized database specialists who are trained in the medical and privacy requirements of these types of data. As of late April, Beth Israel Lahey Health of Beverly, Massachusetts was looking for a “telehealth installer.”

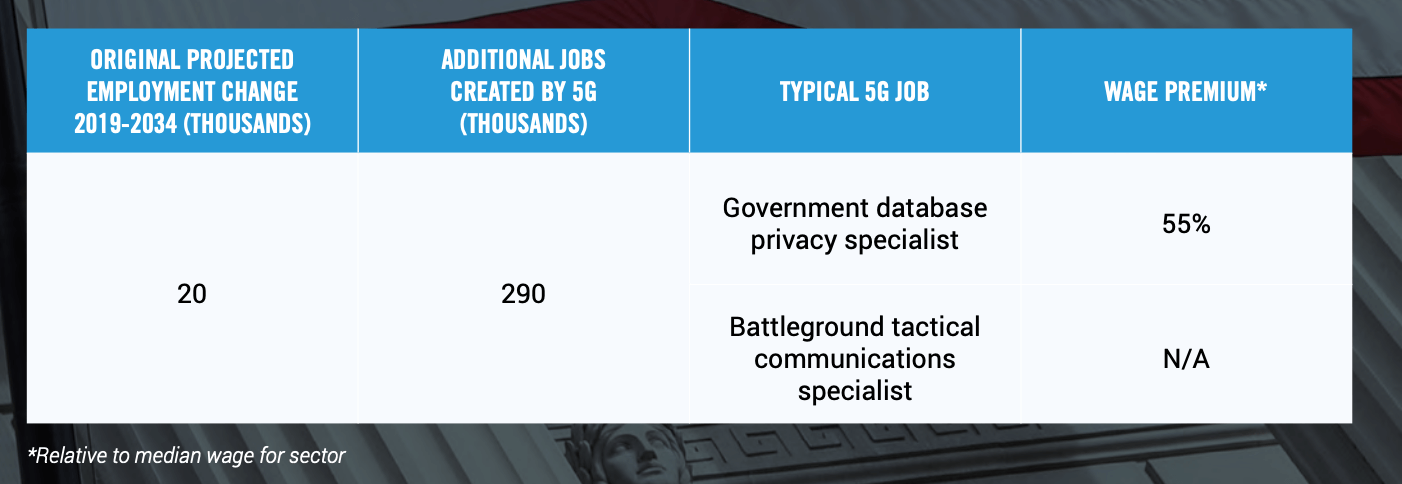

We can divide the impact of 5G on government into military and civilian uses. On the military side, a March 2020 report from the Congressional Research Service noted: “5G technologies could have a number of potential military applications, particularly for autonomous vehicles, command and control (C2), logistics, maintenance, augmented and virtual reality, and intelligence, surveillance, and reconnaissance (ISR) systems—all of which would benefit from improved data rates and lower latency (time delay).” (40)

In fact, the USDOD has already released several Requests for Prototype Proposals for test beds focusing on AR/VR for training, smart warehouses and dynamic spectrum sharing. All of these potential applications generate new human resource demands as well. As the capabilities of 5G evolve, it becomes more important than ever to best make use of resources, both in terms of equipment and people. For example, as of summer 2020, The Aerospace Corporation was looking for a “5G and Internet of Space Things Wireless Network Engineer” with the ability to obtain a U.S. security clearance.

On the civilian side, “smart cities” development will mean that state and local governments will have to transform all of their services to 5G, from waste collection to police to property tax assessment. And that will, in turn, mean a workforce much more heavily oriented towards maintaining and repairing the necessary telecom equipment.

Both the first and second wave of wireless jobs were concentrated in dense digital cities like San Francisco, New York and Boston.

Table 7 shows examples of top “digital” areas, as ranked by the share of local GDP coming from the information sector, the financial services sector, and the professional services sector (which includes law, engineering, and accounting, as well as computer programming).

Not surprisingly, the list of the top digital metro areas is headed by New York and San Francisco. There’s one important caveat: for confidentiality reasons, the Bureau of Economic Analysis suppresses some data, so we can’t calculate the digital share for all metro areas.

1. Boston-Cambridge-Newton, MA-NH

2. Boulder, CO

3. New York-Newark-Jersey City, NY-NJ-PA

4. San Francisco-Oakland-Berkeley, CA

5. Seattle-Tacoma-Bellevue, WA

By contrast, Wave 3 will benefit those areas which are more balanced in terms of digital and physical industries. Table 9 shows some examples of such areas. These areas are not tech deserts, for sure, but they are well-positioned to take advantage of the opportunities offered by 5G.

1. Albany-Schenectady-Troy, NY

2. Ann Arbor, MI

3. Baltimore-Columbia-Towson, MD

4. Buffalo-Cheektowaga, NY

5. Cleveland-Elyria, OH

6. Colorado Springs, CO

7. Detroit-Warren-Dearborn, MI

8. Harrisburg-Carlisle, PA

9. Huntsville, AL

10. Jacksonville, FL

11. Kansas City, MO-KS

12. Lincoln, NE

13. Pittsburgh, PA

14. San Antonio-New Braunfels, TX

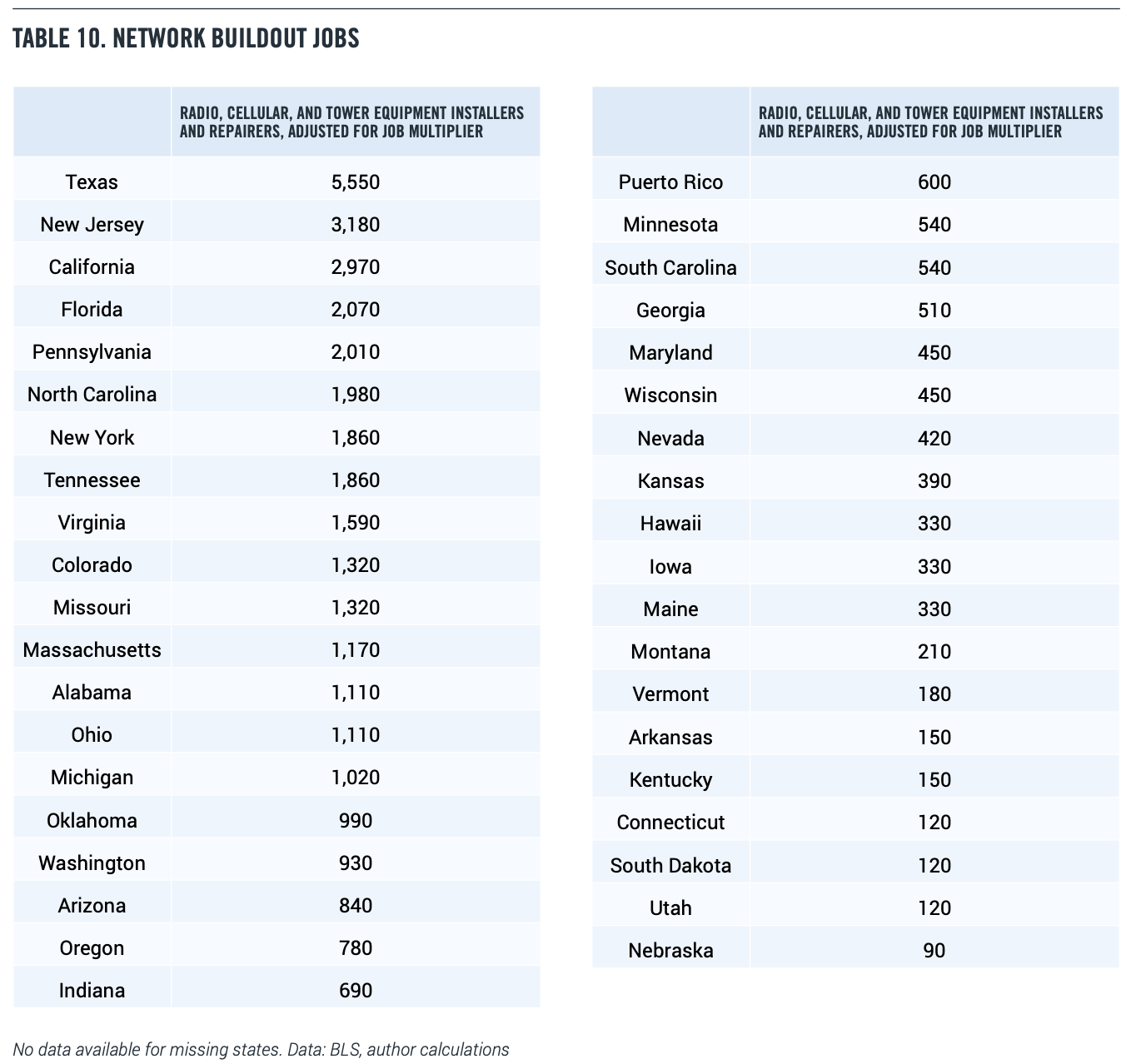

So far, we have been discussing the longterm job impact of 5G. But in the wake of the COVID-19 pandemic, we need to be concerned about the short-term job impact as well. In this section, we show that current 5G build-out and engineering activities has already created 106,000 jobs as of April/May 2020 (Table 9).

Network build-out activities, of course, consist of installing 5G small cells around the country, including their backhaul connections. In some cases, the technicians and installers are employed directly by the carriers, while in other cases they are contractors. These are cognitive physical jobs, in the sense that we discussed earlier in the rep

ort. We get data on this employment from two different sources. First, the BLS track

ort. We get data on this employment from two different sources. First, the BLS track

s the number of “Radio, Cellular, and Tower Equipment Installers and Repairers” in its Occupational Employment Statistics (OES). (41) As the name suggests, this category includes the workers who install 5G access points. As of May 2019, the last data available, there were 14,370 workers in this occupational category, with a relative standard error of 5.8 percent. Factoring in a conservative job multiplier, that gives us a net job impact of 43,000.

How are those jobs distributed? The top state according to the BLS data is Texas, followed by New Jersey, California, and Florida. These figures were as of May 2019 and based on several years of rolling surveys (Table 9).

Of course, the location of build-out activity changes over time as providers finish with one area for now and shift their construction activities to other area. To understand current 5G construction activity, we turn to another data source: publicly available job postings. These job postings contain information on the location of jobs and also the skills needed. For example, one company is advertising for a “Tower Top Hand” with 5G experience in the Baltimore area.

The database of job postings that we use comes from Indeed.com, which identifies itself as “the #1 job site in the world.”(42) Indeed’s real-time database of job postings is full-text Booleansearchable, including by title, location and by age of job posting.

We searched for job postings with the terms “tower” or “technician” in the title, and 5G in the body of the posting. This allowed us to identify “hot spots”—metro areas where there was current hiring activity for workers installing 5G networks (Table 11).

As of early May, companies are hiring for tower technicians in areas such as Allentown, Pennsylvania and the Baltimore metro area, as telecom providers extend their 5G networks outside of the densest high-income urban areas. Indeed, local news publications in these areas show evidence of discussions about ongoing deployments. (43)

Current 5G Engineering and Software Jobs

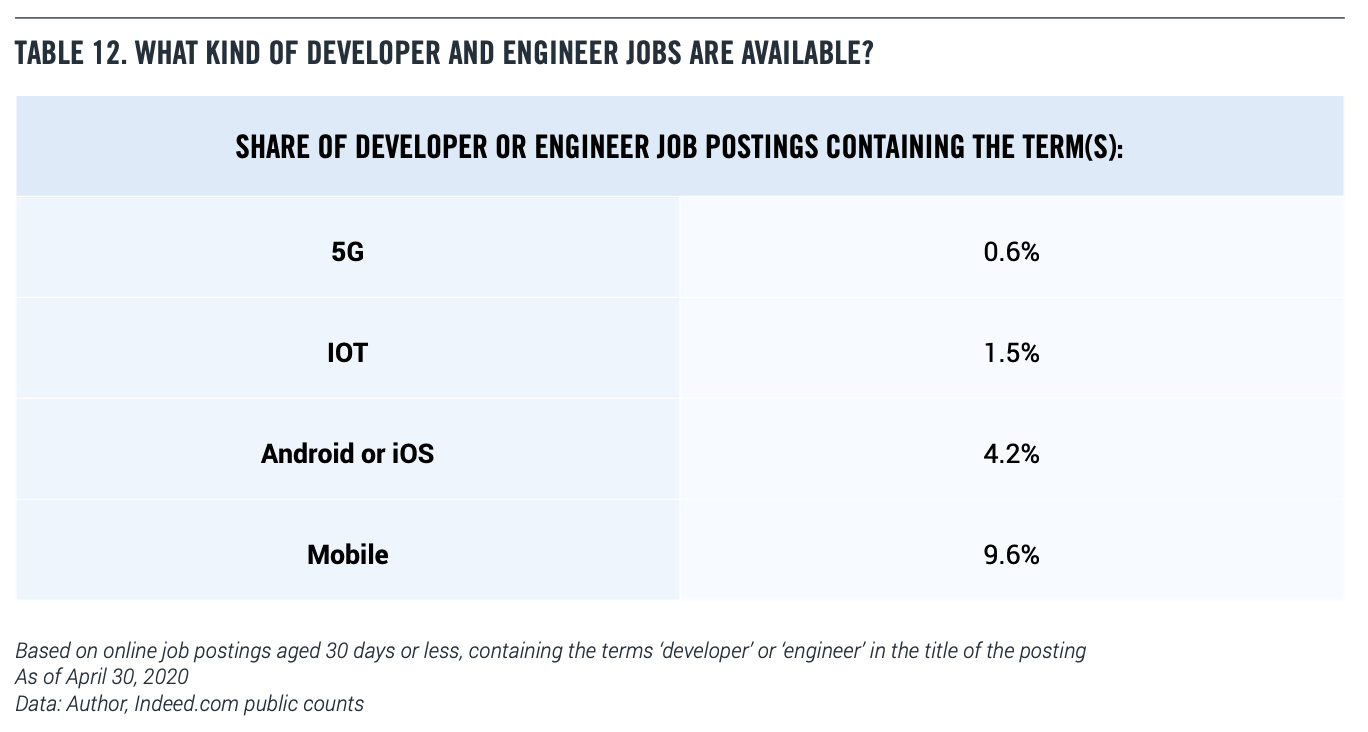

Current 5G Engineering and Software JobsMaking 5G a reality will also require hiring in engineering and software development. But unlike cell and tower installers and repairers, there is no obvious BLS occupational category that matches up well to 5G engineers and software developers.

To understand the prevalence and location of 5G engineers and developers, we further analyze the universe of online job postings, using a methodology that was developed to estimate the number and distribution of App Economy jobs.

These job postings contain information on the location of jobs and also the skills needed. For example, in late April and early May 2020, Commscope was advertising for an “Engineer, Principal 5G Systems” in Richardson, Texas. Epsilon Solutions was advertising for a contract “Wireless Core Engineer” to “test, deploy and debug DISH’S standalone 5G network” in Denver, Colorado. And KaRDS Cyber Solutions in Annapolis Junction, Maryland was advertising for a “5G Wireless SME / Senior Systems Engineer Level 6.” This position required a “TS/ SCI clearance with polygraph.

We started by searching for job postings with the words “engineer” or “developer” in the title, with postings aged 30 days or less. This gave us our initial pool of roughly 50,000 postings nationally as of the end of April. Generally speaking, our past research has suggested that searches with no age limit work better, but because of the pandemic-related shutdowns, we decided to focus on the more recent job posts.

Within that pool, roughly 0.6 percent contain the term 5G. By contrast, job postings containing the terms IoT, Android or iOS, or mobile are far more common (Table 12). We then use this share of job postings to estimate the share of jobs (see Appendix). There are roughly 1.75 million engineers, and an equal number of software developers, according to BLS. Taking 0.6 percent of that total comes to roughly 21,000 jobs, and then accounting for the multiplier gives us 63,000 5G-related engineering related jobs.

We gain some insights into the Chinese 5G labor market through analysis of online job postings in both English and Chinese, as collected by Indeed.com. This approach is limited because of the lack of visibility into hiring by key 5G companies such as Huawei, China Telecom, and Tencent, so we cannot arrive at an overall number. Nevertheless, even a preliminary analysis may be useful.

We consider job postings which include ‘5G’ in the title and were released 30 or fewer days ago. For example, in the U.S., CommScope posted an opening for a 5G Systems Architect. As of August 17, 2020, the U.S. had 85 such new postings, compared with 125 for China. As noted, the China sample is significantly incomplete.

To put these numbers into some context, over the same period, the U.S. had 14370 new postings with ‘software’ in the title, while China had 4137 new postings with ‘software’ in the title (in either Chinese or English). That suggests the intensity of Chinese hiring of 5G personnel, relative to hiring of software personnel overall, is higher than in the U.S.

These jobs are very heavily concentrated in a relatively small number of states. California and Texas by themselves account for almost 50 percent of 5G engineering job postings. This makes sense given the location of the leading companies in the 5G space.

5G is a capital-intensive investment by its nature. To realize its benefits, wireless operators must invest in R&D and capital expenditures in engineering and network buildout. In a 2017 study, Accenture estimated wireless operators will invest $275 billion from 2017 to 2024, $93 billion of which will be spent on construction. (44) Indeed, via its Investment Heroes series, PPI estimates the major wireless operators have invested more than $150 billion in the United States since 2016, much of which has gone towards 5G R&D and deployment. (45, 46)

The portion of spectrum to be most used for 5G is divided into two categories: millimeter wave (above 24 GHz) and sub-6 (6 GHz and below). (47, 48) Each of these spectrum ranges will play a vital role in bringing 5G products and services online. While mmWave has the fastest speeds, it has limited range and is not able to tolerate much interference like walls or rain. (49) In the sub-6 spectrum, the range is better than that of the mmWave, but speeds are reduced. While mmWave will be utilized in dense population areas such as downtown areas and stadiums to transmit data, sub-6 will be critical to providing access to IoT products in suburban and rural areas.

Spectrum for commercial use is controlled by the Federal Communications Commission (FCC). One of the ways the FCC distributes spectrum is by auctioning licenses, with the proceeds going to the Treasury Department. Since 1994, the U.S. government has raised over $100 billion in revenue from wireless companies participating in FCC spectrum auctions. (50) The FCC’s first 5G spectrum auction, the mmWave of 28 GHz, was conducted in November 2018.51 The FCC followed by auctioning the 24 GHz band in March 2019, and the 37, 39, and 47 GHz bands in December 2019. (52, 53)

Much of the spectrum used by mobile networks to date have been concentrated in the sub-6 bands of 600 MHz to 2.6 GHz. These mid- to low-bands are likely to be used for 5G as well to achieve wider geographical coverage. As of April 2019, the FCC had awarded 716 MHz of spectrum below 3 GHz. (54) Additionally, the FCC has designated the 2.5 GHz band to “be available for commercial use via competitive bidding”. (55) The FCC ran an auction the 3.5 GHz band in July and August 2020. (56) And in February, the FCC ordered satellite operators in the 3.7- 4 GHz range to relocate, freeing the space for reallocation by December 2023. (57)

The other mechanism by which the FCC distributes spectrum is by allowing unlicensed use of certain spectrum – for purposes such as Wi-Fi. Under this regime, operators can use designated airwaves to transmit data without getting permission from the FCC. (58) However, the lack of exclusivity in unlicensed bands means an increased risk of interference. In March 2019, the FCC freed up the 116-123 GHz, 174.8-182 GHz, 185-190 GHz, and the 244-246 GHz bands for unlicensed use. (59) And in April 2020, the FCC proposed rules to make the entire 6 GHz band available for unlicensed use. (60)

In April 2019, Analyses Mason released a report summarizing certain countries’ spectrum allocations. (61) The countries had comparable amounts of spectrum below 3 GHz awarded, with the U.S. coming in first at 716 MHz, Australia in second at 690 MHz, Germany at third with 689 MHz, Canada fourth with 648 MHz, and the United Kingdom rounding out the top five with 647 MHz. Asian countries have allocated similar amounts of spectrum below 3 GHz, with Japan at 601 MHz, Hong Kong at 583 MHz, China at 582 MHz, and South Korea at 477 MHz.

Awarded spectrum from 3-24 GHz had greater variation among countries. “Whilst many countries have now awarded over 100MHz of (exclusive nationwide) spectrum to mobile, several countries (China, Italy, and Spain) have awarded 300MHz or more,” the authors write. Following those three countries were South Korea, the U.K., Australia, Japan and Qatar – all with 200 MHz or more allocated. Notably, the U.S., Canada, France, Germany, and Hong Kong had not awarded any of this spectrum as of April 2019. As previously mentioned, sub-6 spectrum is a critical component to delivering new 5G products and services outside of high population density areas because of its ability to travel long distances while still providing 5G speed.

In the mmWave range, only the U.S., South Korea, and Italy had awarded spectrum. The U.S. had awarded 2,500 MHz, South Korea 2,400 MHz, and Italy 1,000 MHz as of April 2019. Other countries in the analysis had mmWave allocations planned, ranging from the second half of 2019 to 2021. The U.S. leads in the total amount auctioned or planned to be auctioned at about 7 GHz, followed closely by China at 6 GHz, and Canada at nearly 5 GHz. Australia, France, Germany, Spain, Sweden and the U.K. all planned to assign around 3 GHz.

A broader February 2020 analysis of countries conducted by Global Mobile Suppliers Association found 40 countries have completed allocations of 5G suitable spectrum since 2015. (62) “A total of 54 countries have announced plans and approximate dates for allocating 5G-suitable frequencies with timelines for completion between now and end-2022,” the authors note.

The economic and national security implications of 5G are why the U.S. needs a long-run spectrum plan. In September 2018, the FCC unveiled its ‘5G FAST’ plan, detailing the previously discussed spectrum that it intends to make available for 5G services. (63) In October 2018, the Trump Administration issued a presidential memorandum directing the Department of Commerce to create a National Spectrum Strategy, but the strategy has not yet been released.

There are four important policy issues when it comes to 5G. First, as we have been discussing, is spectrum. As 5G opens up the physical industries to joining the digital economy, it becomes ever more imperative to have a longterm spectrum plan. Unlicensed spectrum, sub-6 spectrum, and mmWave spectrum all serve different purposes in the 5G ecosystem but are critical to realizing the full economic benefits of 5G.

The amount of spectrum suitable for 5G use is limited and thus needs to be allocated efficiently. Policymakers should prioritize a long-term spectrum plan that frees up more licensed and unlicensed spectrum, provides certainty for auctions in terms of cost and scheduling, streamlines government licensing and renewals, and encourages long-term investment in 5G networks.

5G is also critical to national competitiveness and security. As an April 2019 report from the Defense Innovation Board recognizes, leadership in 5G carries economic and national security advantages such as rapid communication systems, enhanced decision-making and strategic capabilities, better technology, standard setting, and job creation. (64) But, as the report notes, the physics of mmWave are challenging. Additionally, the sub-6 band is crowded with incumbent systems and uses, large portions of the spectrum are government owned and commercially limited, and there are concerns the Defense Department could experience reduced capability if it is required to share its sub-6 spectrum. While the Trump Administration has directed the Department of Commerce to create such a National Spectrum Strategy, it has not yet been released. For the U.S. to meet the challenges ahead, a national spectrum plan must carefully balance the government’s needs and what 5G will require in the long-term.

The second policy issue is increased government usage of 5G across both military and civilian activities. The public sector should be a leader in exploring cutting edge uses of 5G in areas like the delivery of government services and battlefield control-and-communications.

Third, Congress should be willing to invest heavily in the development of 5G and successor technologies. That’s essential if the U.S. is to keep up with foreign competitors, who are already focused on the military uses of so called 6G. (65) The federal government must start investing heavily in telecom research and development. The money should be split between nonprofits and for-profit companies, and the goal should be to create a new set of standards that American companies can build on.

And finally, the U.S. should make a significant investment in job training. The U.S. needs to double down on traditional STEM fields and encourage more people in America to go into engineering and math. Beyond that, we need a national skills initiative and mentoring programs to ensure that this new generation of workers will have the training needed to support the cognitive-physical jobs that the 5G Revolution is already beginning to create.

In this paper we estimate both the long-term and short-term job impacts of the 5G Revolution, using different methodologies. Our 15-year estimates build on BLS employment projections, and assume a scenario where the employment impact of 5G is of the same percentage magnitude as the employment impact of Wave 2. The short run current job impact of the 5G build-out is estimated by a combination of BLS data and real-time job postings.

Context There are three main approaches for modeling the occupational impact of new technologies:

1. Consensus-based extrapolation of existing occupation-industry matrix, subject to industry employment constraints

2. Analysis of substitution effects of new technology on existing occupations

3. Modelling of new job creation by new technologies based on analysis of job impact of existing technologies. We call this the “bootstrap” approach.

Occupation-industry matrix In the United States (Bureau of Labor Statistics 2019), Canada (Canada Employment and Social Development Canada,2020), and other OECD countries, the main approach to modeling future occupational growth uses a detailed occupationindustry matrix. Industry growth is projected based on a macroeconomic model and an assumption of full employment, and “small changes” are made in the future coefficients of the occupation-industry matrix.

Because of their size and comprehensiveness, these models tend to be unique for their country. The BLS notes that “there are no comparable projections which are not in some way derived from BLS projections.”

However, such models in practice are not designed to pick up the occupational impact of disruptive technologies or the creation of new occupations. Indeed, the BLS explicitly benchmarks its model against what it calls the “occupational–share naïve model,” where the occupational share doesn’t change over time (BLS 2020).

Frey and Osborne (2017) is the best-known example of projecting the potential substitution effects of new technology. By examining the tasks associated with particular occupations, they estimated that about 47 percent of total US employment is at risk of computerization.

However, the authors stress that their models only focus on the substitution effect of new technology, and provide no information at all about the job creation aspects of technology.

However, we make no attempt to forecast future changes in the occupational composition of the labour market. While the 2010-2020 BLS occupational employment projections predict US net employment growth across major occupations, based on historical staffing patterns, we speculate about technology that is in only the early stages of development. This means that historical data on the impact of the technological developments we observe is unavailable. We therefore focus on the impact of computerisation on the mix of jobs that existed in 2010. Our analysis is thus limited to the substitution effect of future computerisation.

For this reason, the substitution effect approach is inappropriate for this project.

What we call the “bootstrap approach” uses the employment effects of previous technological advances to project the impact of future technologies. Shapiro and Hassett (2012) estimated the employment impact of 3G, and used that to project the impact of 4G. Accenture (2017) used the Shapiro-Hassett results for 3G to project the impact of 5G. Eisenbach and Kulik (2020) estimated the employment impact of 4G, and used that to project the impact of 5G.

In this project, we use the bootstrap approach, taking into account the new characteristics of 5G compared to 4G. We model the employment impact of 5G as a deviation from the BLS baseline forecast, based on the observed magnitude of the 4G deviation.

But whereas the employment impact of 4G was completely concentrated in white collar jobs and digital industries, we model the employment impact of 5G as extending to blue-collar jobs that use a combination of manual and problem-solving skills—what we call “cognitivephysical” jobs. Moreover, we model the industry impact of 5G as extending over the entire economy, including physical industries such as manufacturing, agriculture, and defense.

Here’s where the genuinely disruptive nature of 5G comes into play. We expect 5G to enormously increase telecom usage by physical industries, as 5G becomes an integral part of operations. However, as of the 2018 input-output data from the Bureau of Economic Analysis, telecom usage is still an extremely low share of intermediate inputs for many industries (see Table 4). As a result, current telecom usage is not a useful guide as to what industries will add workers with 5G.

In addition, to the degree that 5G usage is integrated into operations in physical industries, we would expect that the number of telecom installers and maintainers would increase. That has not yet happened under 4G. Indeed, the number of telecom installers and maintainers fell in 2019, according to BLS data (346K in 2018, versus 315K in 2019).

When dealing with technological trends that have not yet appeared in the official data, it is preferable to adopt the smallest number possible of conservative assumptions. In this case the model uses the employment category of “telecom installers and maintainers” as a proxy for skilled blue-collar, or “cognitive physical” jobs generated by 5G, as described on page 40 of the report. The model uses the employment category of “computer and mathematical occupations” as a proxy for cognitive jobs generated by 5G. And the model distributes the number of 5G jobs across all industries in proportion to their total employment. The model generates a conservative projection of 5G jobs by industry, based on the employment performance of 4G plus a small number of additional assumptions about the difference between 4G and 5G.

We recognize that totally new occupations generated by 5G might fall outside those categories 15 years from now. But given that 5G is just rolling out right now, we don’t have the data necessary, for example, to produce a credible forecast of the number of precision sensor installers that the agriculture sector will need to hire in 2033.

We also note that both the short term and long term models are completely agnostic about whether the 5G networks are built by the current cellular operators or by private enterprise. In fact, that is a strength of the methodology that we use. Industry-specific data was used to analyze Wave 1. But Wave 2 and Wave 3 are modeled based on occupational data which does not reference the cellular operators at all.

The BLS regularly lists projections of employment trends by occupation and industry. As we showed in Tables 1 and 3, these projections underestimated the employment impact of the Wave 1 telecom boom by 50 percent after 10 years. The employment impact of the Wave 2 telecom boom on tech jobs was underestimated by 21 percent after 12 years.

To calculate this underestimate, we applied the projected growth rate of computer and mathematical occupations, derived from the 2007 and 2009 vintage projections, and applied it to the 2007 figure for computer and mathematical occupations from the Current Population Survey (CPS). Then we compared the result to the 2019 figure for computer and mathematical occupations from the CPS. We use the CPS data as the benchmark for the underestimate calculation because it gives the best available measure of the actual growth of tech jobs over time.

The analysis in this paper is based on the employment projections released in September 2019 for the time period 2018-2028. As in the past, these projections clearly do not have a telecom boom built into them. (A new set of projections were released in September 2020, after the analysis of this paper was completed. The new projections do not significantly change the results).

We will use a scenario for 5G jobs which is similar in one major respect to the Wave 2 boom, and different in two other aspects which reflect the particular characteristics of 5G.

We also use a conservative job multiplier of 3—that is, two additional indirect jobs for each direct job created by 5G (Bartik and Sotherland, 2019). By contrast, tech jobs are often assumed to create as many as five indirect jobs (MIT Sloane Review, 2012).

We derive the number of “Radio, Cellular, and Tower Equipment Installers and Repairers” from the May 2019 Occupational Employment Statistics (OES). (68) As the name suggests, this category includes the workers who install 5G access points. However, by the nature of network build-out, where tower technicians were working last year may not be where they are working today. So we used the real-time database of job postings maintained by Indeed.com, which identifies itself as “the #1 job site in the world.” (69) Job postings are regularly used by economists as a rich data source. (70) Indeed’s real-time database of job postings is full-text Boolean-searchable, including by title, location and by age of job posting. We searched for job postings with the terms “tower” or “technician” in the title, and “5G” in the body of the posting.

For example, as of early July 2020, a staffing firm was looking for a “Tower Climber Technician” to work on maintaining and repairing 5G networks and based in the Detroit area. That gives us an indication of where mobile carriers or their contractors are hiring.

We also used job posting data to estimate the number of engineers nationally working on 5G projects. We started by searching for job postings with the words “engineer” or “developer” in the title, with postings aged 30 days or less. This gave us our initial pool of roughly 50,000 postings nationally as of the end of April.

Within that pool, roughly 0.6 percent contain the term 5G. The key assumption is the percentage of job postings for engineers and developers that include the term “5G” is a reasonable estimate of the percentage of engineers or developers that are involved in 5G development. Past research has supported this assumption.

Accenture. 2017. “Smart Cities: How 5G Can Help Municipalities Become Vibrant Smart Cities.”

Timothy Bartik and Nathan Sotherland. 2019. “Realistic Local Job Multipliers,” WE Upjohn Institute, April 1, 2019.

Bureau of Labor Statistics. 2019. “Projections overview and highlights, 2018–28,” Monthly Labor Review, October 2019.

Bureau of Labor Statistics. 2020a. “Occupational Projections Evaluation: 2008–2018”

Bureau of Labor Statistics. 2020b. “Occupational Employment Statistics,” https://www.bls.gov/oes/

Jeffrey A. Eisenach and Robert Kulick. 2020. “Economic Impacts of Mobile Broadband Innovation: Evidence from the Transition to 4G,” American Enterprise Institute, May 2020.

Employment and Social Development Canada. 2020. “Canadian Occupational Projection System (COPS) – 2019 to 2028 projections.”

Carl B. Frey and Michael A. Osborne. 2017. “The Future Of Employment: How Susceptible Are Jobs To Computerisation?” Technological Forecasting and Social Change, 2017, vol. 114, issue C, 254-280.

Indeed.com. 2020. “About Indeed,” https://www.indeed.com/about

AnnElizabeth Konkel. 2020. “Healthcare and Medical Research Postings Decline,” Indeed, July 9, 2020. https://www.hiringlab. org/2020/07/09/healthcare-postings-decline/

MIT Sloan Review. 2012. “The Multiplier Effect of Innovation Jobs,” MIT Sloan Reiew, June 6, 2012. https://sloanreview.mit.edu/article/themultiplier-effect-of-innovation-jobs/

Robert J. Shapiro and Kevin A. Hassett. 2012. “The Employment Effects of Advances in Internet and Wireless Technology:Evaluating the Transitions from 2G to 3G and from 3G to 4G.”