EXECUTIVE SUMMARY

The U.S. MFN tariff system is a regressive element of the U.S. tax system, with disproportionate effects on low-income families (in particular, single-parent families), and also on African American and Hispanic families relative to families of other races and ethnicities. This emerges from four points:

(1) U.S. MFN tariffs raise revenue principally from home necessities such as clothes, shoes, and a few other consumer goods. These make up only a small share of imports but provide more than half of MFN tariff revenue.

(2) This fact makes the MFN tariff system a regressive form of taxation, since low-income families, single-parent families, and African American and Hispanic families spend more of their family budgets on these products than the U.S. average.

(3) U.S. MFN tariffs on these and several other categories of consumer goods are systematically skewed, taxing cheap goods heavily and luxury goods lightly, making the MFN tariff system discriminatory as well as regressive.

(4) Tariffs on consumer goods appear ineffective as protectors of employment or production.

These four points create a logical path toward pro-poor reform. By “sunsetting” or otherwise eliminating many tariff lines which support no U.S. employment, Congress can make U.S. trade policy and taxation fairer. This would ease financial burdens in a small but real way for American low-income and minority workers and their families, helping to raise their living standards without intensifying competitive pressure.

* * * * *

Ambassador Katherine Tai and the Office of the U.S. Trade Representative deserve great credit for seeking greater insight on the “distributional effects of goods and services trade and trade policy on U.S. workers by skill, wage and salary level, gender, race/ethnicity, age, and income level, especially as they affect underrepresented and underserved communities.” This is an important topic, deserving in-depth and regular examination. The Commission’s investigation of the matter, I hope, will cover several different dimensions of policy:

All these phenomena are likely to have complex and often cross-cutting effects. Sometimes they will reinforce one another. For example, tariff reductions and the growth of the global shipping container fleet both make trade cheaper. At other times they may contradict one another. Analysis of their effects on underserved and unrepresented Americans on the job and in management of family budges is therefore likely to require great sophistication and may often lead to equivocal results.

For example, the Trump administration’s imposition of tariffs on metals under Section 232 of U.S. trade law should provide some advantages to steel and aluminum producers within the United States as they compete with foreign suppliers. Potentially, therefore, this step could provide support to communities in which metals producers are important to the local economy. On the other hand, the same “232” tariffs should simultaneously disadvantage metals users, such as automakers, machinery manufacturers, and food manufacturers, as they strive to export or to compete against imported goods, and consequently disadvantage their communities. Retaliations against U.S. exporters provoked by these tariffs, often targeting agricultural exporters and thus the rural communities dependent on farming, adds another layer of intellectual and ethical complexity to these questions.

Likewise, the long-term effects of change in the logistics and communications industries — a growing container-ship fleet, larger and more efficient air cargo networks, deployment of more capable transcontinental fiber-optic cables and communications satellites, and U.S. investment in physical and telecommunications infrastructure — may often be as powerful as policy decisions by government. These lower the cost of both goods and services trade, and also make international sourcing more attractive by speeding up the movement of physical goods and information. Over time this is likely to make tariffs and some other trade barriers generally less effective. It may also reduce the real-world impact of changing these systems, whether through trade liberalizing agreements or presidentially imposed tariffs.

But some trade policies have less complicated effects. I argue in this paper that the MFN tariff system is such a case. On one hand, though this system is a small part of American tax policy, it is a uniquely regressive part since it raises most of its revenue from taxation of low-priced home necessities — in particular, clothes, shoes, luggage and handbags, home linens and carpets, tableware, and silverware. On the other hand, tariffs on these products offer few offsetting benefits in terms of protecting employment and production, and in many cases appear to offer no such benefits at all. Thus, the MFN tariff system is likely to be harming American workers and families in underrepresented and underserved communities by raising prices on home necessities, without creating an offsetting benefit in job opportunities.

To explain this, the paper makes four points, as follows:

(1) The MFN tariff system is mainly a way to tax home necessities;

(2) U.S. consumer goods tariffs are systematically skewed to tax cheap goods heavily and luxury goods lightly;

(3) Low-income families, single-parent families, and African American and Hispanic families spend more of their family budgets on these products than the U.S. average; and

(4) Tariffs on consumer goods do not appear to be effective at protecting employment or production.

I. MFN TARIFF REVENUE COMES MAINLY FROM HOME NECESSITIES

First, the MFN tariff system — meaning the “Column 1” tariffs listed in the Harmonized Tariff Schedule (HTS), and excluding tariffs imposed through the Trump Administration’s “232” and “301” actions, or through anti-dumping and other trade remedy laws — is mainly a way to tax home necessities.

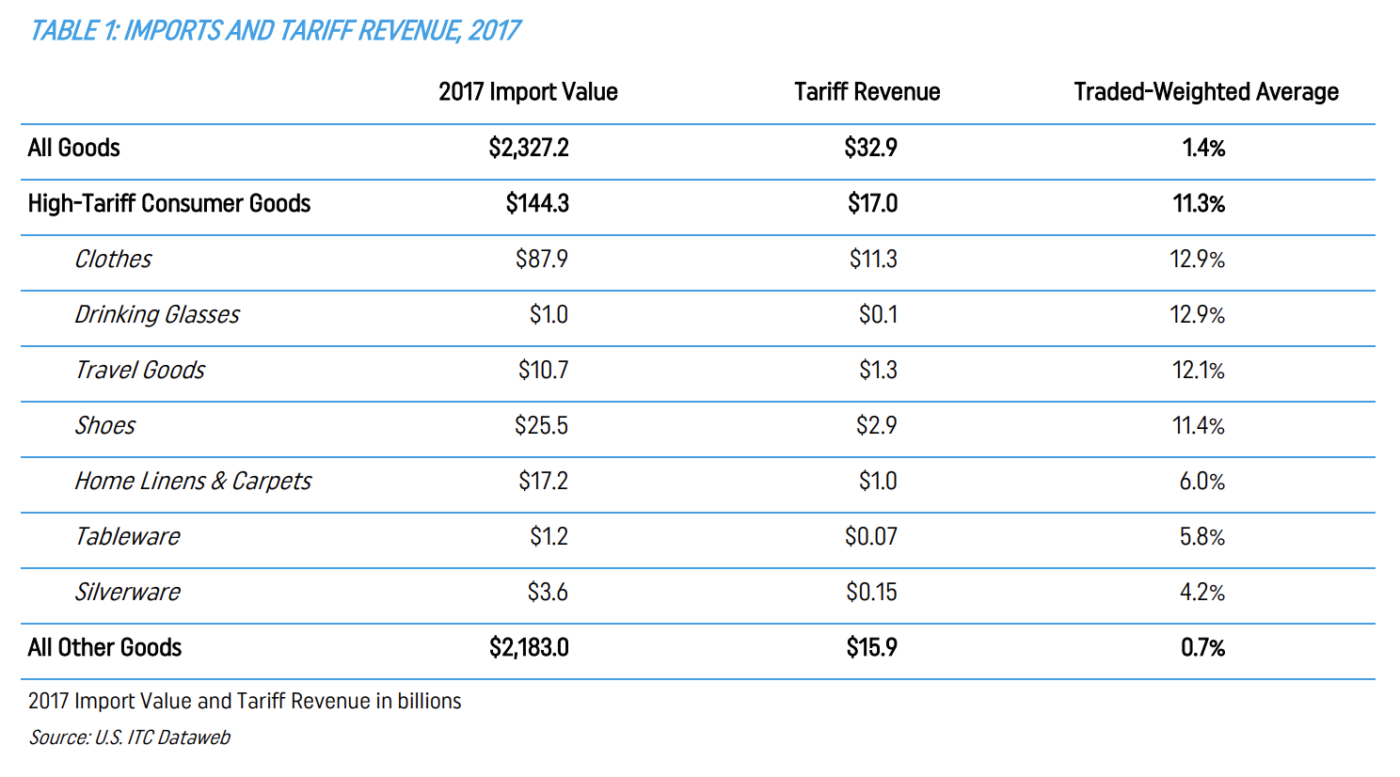

The “calculated duties” published by the ITC through its on-line “Dataweb” service (dataweb.usitc.gov) show this clearly. As Table 1 below shows, in 2017 — the last full year before imposition of the Trump administration’s “232” and “301” tariffs — about half of the $32.9 billion in U.S. tariff revenue came from a small collection of home goods. Specifically, these are clothes, shoes, home linens and carpets, travel goods, silverware, plates and drinking glasses. These products were about 6% of imports, but raised about 55% of all tariff revenue.

These products raise such a disproportionate amount of tariff revenue because (a) they receive unusually high MFN tariff rates; and (b) despite the intense scrutiny U.S. Free Trade Agreements and preference programs receive in public trade policy debate, most are imported under MFN tariffs.

The Trump administration’s “232” and “301” tariffs are a useful way to put these facts in perspective. The “232” actions in 2018 imposed tariffs of 25% on worldwide imports of many steel products and 10% on many aluminum products. The “301” actions in 2018 and 2019 imposed tariffs of 25%, 10%, and 7.5% on many Chinese goods. Observers in the United States and abroad viewed these as very large increases in tariffs — rightly so, since they fell mainly on industrial inputs bought by manufacturers, construction firms, and so on, on which tariffs are normally quite low. For example, the MFN tariff on auto parts (HTS heading 8708) is 2.5%. The MFN tariff on aluminum plates and sheets (HTS heading 7605) are usually 3%; that on pressure-reducing valves (HTS 8481) is 2%; and that on computer accessories (HTS 8471) is zero. Thus the “232” and “301” tariffs appeared to be a draconian step, and can reasonably considered as such.

In the home consumer goods world, however, MFN tariffs of 7%, 10%, 25%, and higher would not be a draconian exception; rather they are the norm. On average, as Table 1 illustrates, they have (trade-weighted) tariff rates of about 11.3% — a figure 15 times than the pre-232/301 rate on all other goods.

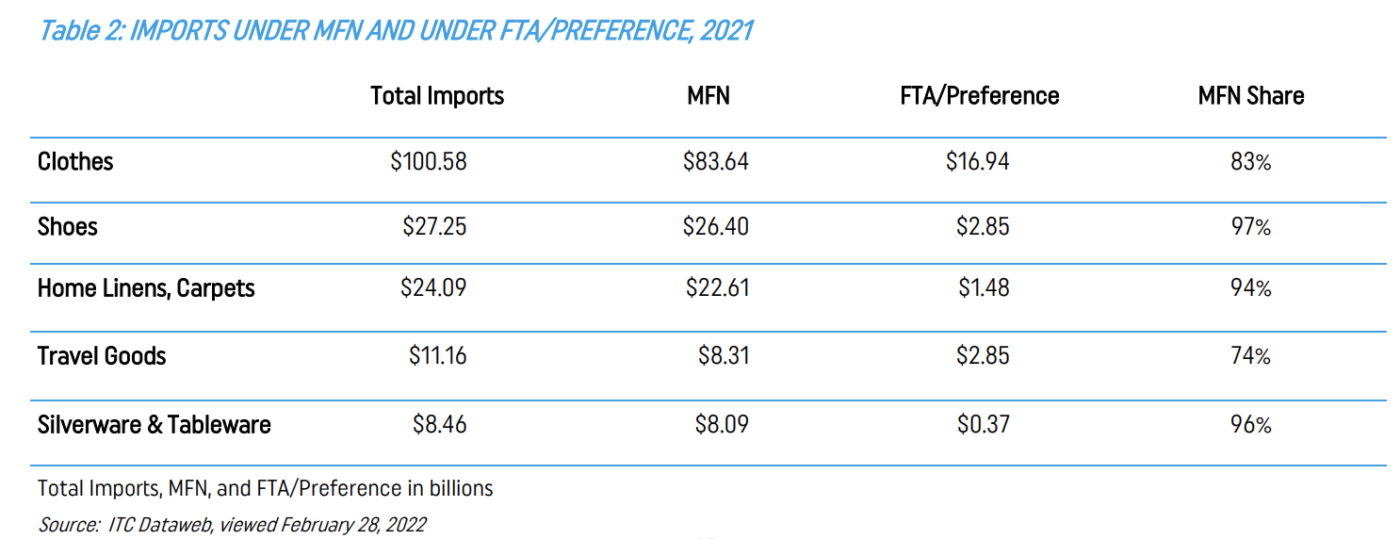

It may be asserted that the MFN tariff rates are headlines that are less important than they seem, given the large role Free Trade Agreements and developing-country trade preference systems play in U.S. trade debates. In practice, it is true that FTAs and preferences diverted some home goods imports away from high-tariff MFN producers. The main examples are diversions of some clothing to Western Hemisphere and (to a lesser extent) African producers, and of “travel goods” to several Southeast Asian GSP beneficiary countries. But as Table 2 points out, these effects are only modest in clothing and travel goods, and negligible in other home goods. In all these product categories, the large majority of imports arrive under MFN tariffs, with buyers paying MFN tariff rates and passing on the costs to customers.

Thus, as of 2017 a small set of home consumer goods made up $144 billion of the U.S.’ $2.33 trillion in imports — 6% of the total, in other words — but raised well over half of all U.S. tariff revenue.

II. SINGLE-PARENT FAMILIES, AND AFRICAN AMERICAN AND HISPANIC FAMILIES, SPEND MORE OF THEIR INCOME ON HOME NECESSITIES

Second, the fact that U.S. MFN tariffs are mainly on home necessities makes the MFN tariff system a regressive element of the tax system.

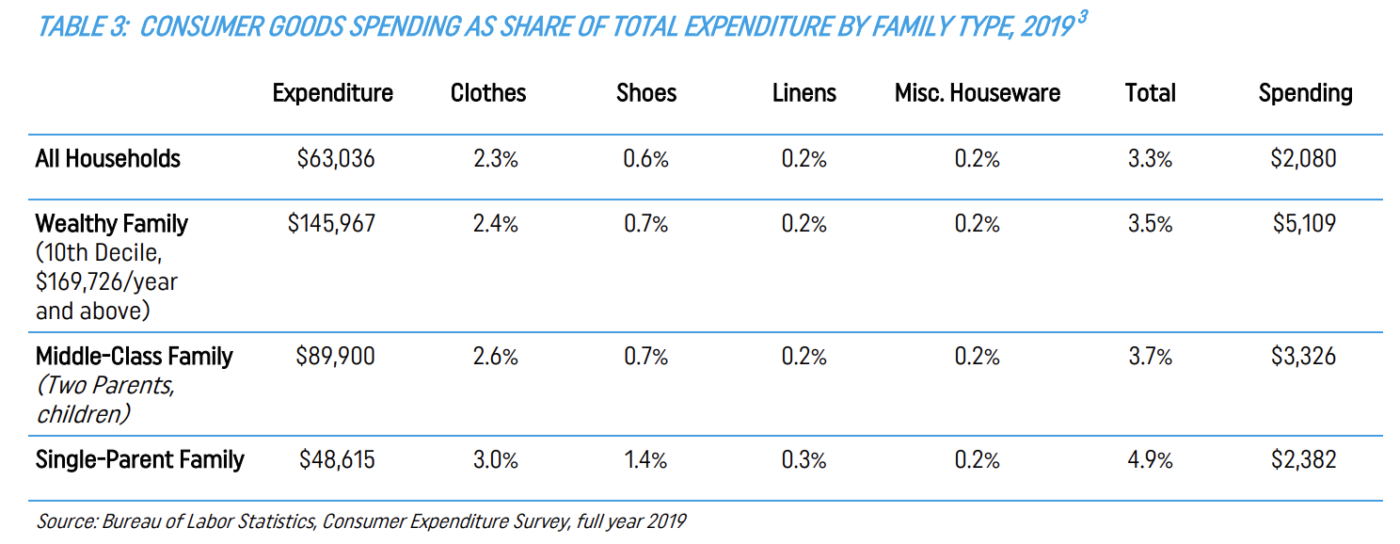

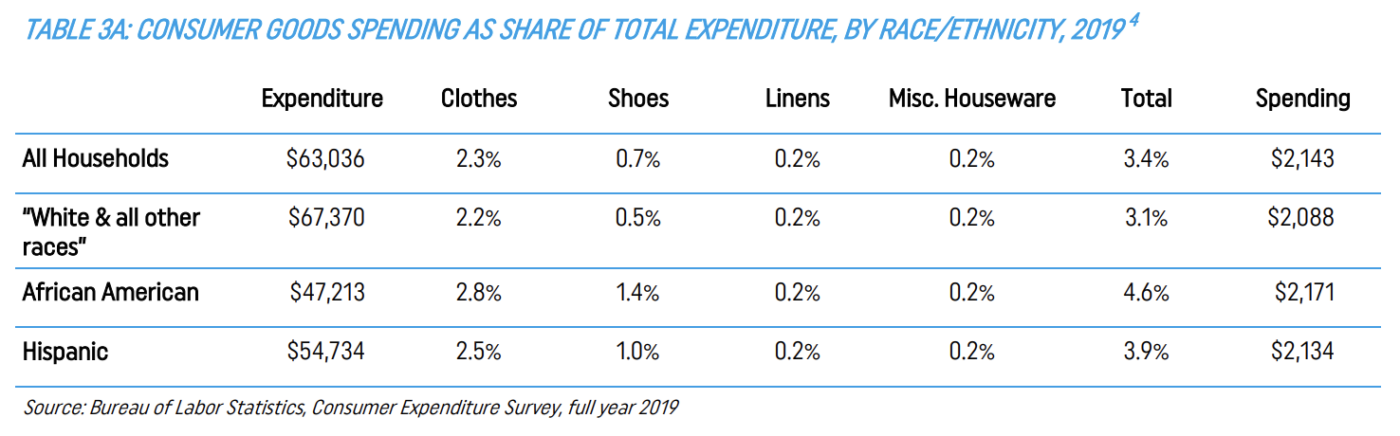

Data from the Bureau of Labor Statistics’ Consumer Expenditure Survey (CEX) show that poor families spend more of their income on home necessities — counting clothes, shoes, home linens and floor coverings, along with “small appliances and other household goods” — than middle-class families or wealthy families. Likewise, African American and Hispanic families spend more of their income on these goods than the national average.

The CEX “Composition of Consumer Unit” expenditure table includes spending patterns for all households, two-parent families with and without children, and single-parent families with and without children. CEX’s “Deciles of Income” table allows us to compare these family types’ expenditures with those of wealthy families with incomes of $175,000 per year and higher. The predictable pattern is that single-parent families have the lowest incomes among the CEX family types and spend the largest share of their incomes on home necessities. Table 3 below illustrates this with CEX’ household expenditure data for 2019.

Likewise, as Table 3a shows, spending on necessities requires more of the family budget for African American and Hispanic families than for the national average, or for BLS’ “White and All Other Races” category.

These tables’ implication is clear. Low-income families, and African American and Hispanic families, devote more of their budgets to home necessities, and the MFN tariff system raises most of its revenue from these products. Therefore, the tariff system is bound to be “regressive” in taxing poor families more heavily than middle-class families, and wealthy families lightest of all. Likewise, it will have disproportionate effects (even if not huge ones) by race and ethnicity. These principles are widely recognized in debates over state sales taxes and federal excise taxes, though in modern history the opacity of the tariff system, and the rarity of investigation into its nature by Congress or economists, has obscured this system’s regressive nature.

III. U.S. MFN TARIFFS ON HOME NECESSITIES ARE LOW ON LUXURIES BUT HIGH ON MASS-MARKET GOODS

However, comparing average MFN rates and families’ spending patterns is insufficient. This is because the MFN tariffs on home goods are not uniform rates applied to all varieties of (say) shoes, clothes, or spoons as is often the rule in Europe, Japan, and other major trading partners. In the U.S. MFN system, by contrast, MFN tariffs on home goods are systematically and rather radically skewed against poorer people, since cheap mass-market products receive especially high rates on cheap mass-market products and analogous luxury goods very low ones.

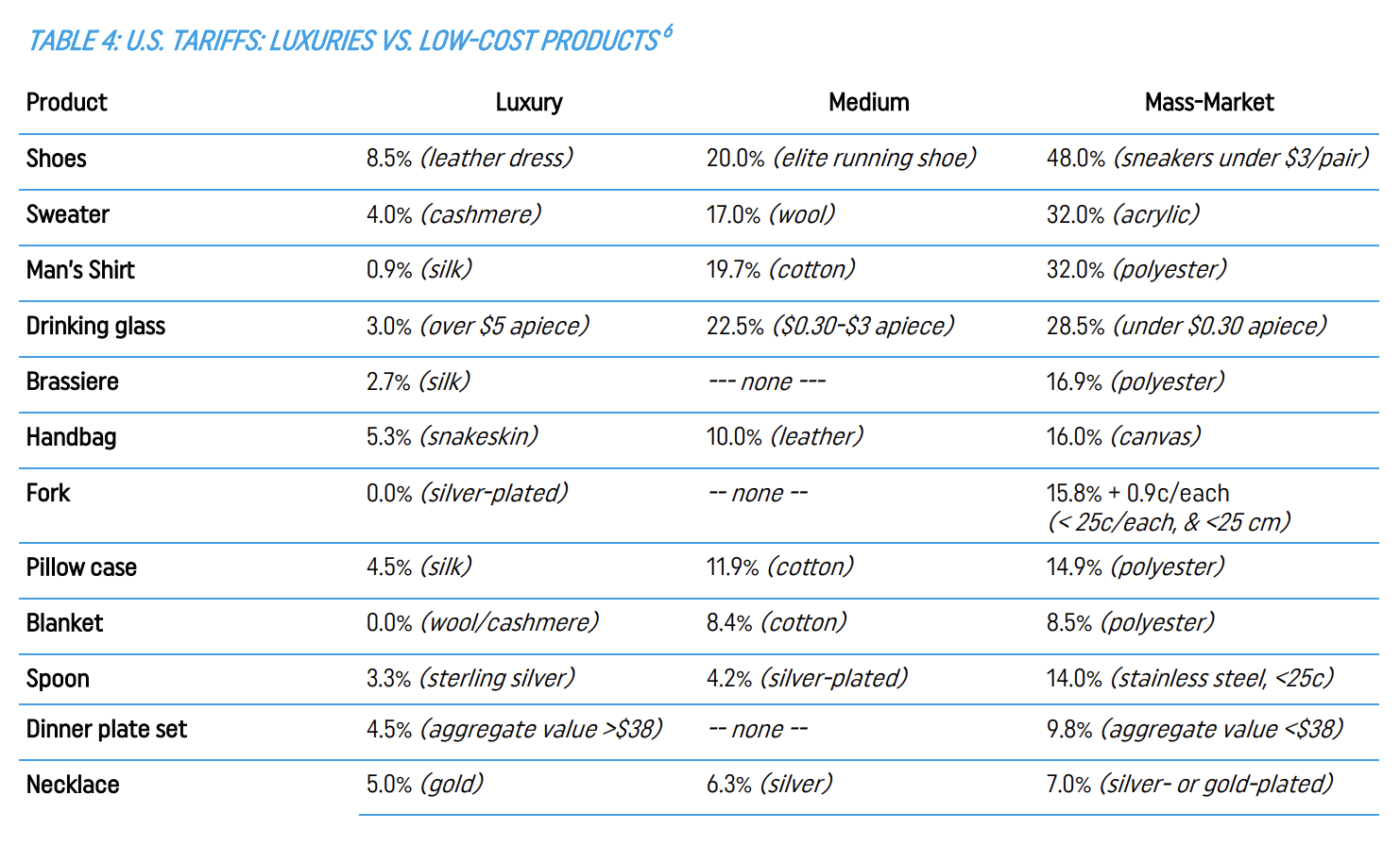

The Harmonized Tariff Schedule (HTS) devotes about 1,000 tariff lines to these products. These lines span a remarkably broad spectrum of rates, many far from the 11.3% trade-weighted average. Table 4 below is an illustrative list of 31 actual MFN tariff rates applied to twelve types of products, grouped in “luxury,” “medium,” and “mass-market” categories. At the luxury end, we find rates of 0.0% on silver-plated forks, 0.9% on men’s silk shirts, 4.0% for cashmere sweaters, and 8.5% on leather dress shoes. At the other end are rates of 14% on stainless steel spoons, 32% on men’s polyester shirts, and 48% (the highest U.S. tariff imposed on any manufactured good) on low-priced sneakers.

These examples illustrate the fact that virtually everywhere in the consumer goods chapters and headings of the Harmonized Tariff Schedule, tariff rates are systematically higher for products mainly bought by poorer people, and systematically lower for analogous luxury products mainly bought by rich people. For example, buyers of cheap stainless steel spoons are (without knowing it) taxed heavily and buyers of sterling silver spoons lightly — in this case, with the tariff rate specifying that low-priced steel spoons specifically receive the highest rates. A hotel maid in polyester underwear must (without knowing it) pays an 16.9% tax, while a wealthy vacationer occupying the balcony she cleans pays 2.7%. This skew makes it reasonable to view the MFN tariff system on home goods not only as regressive, but actually discriminatory against the poor.

IV. TARIFFS ON HOME NECESSITIES APPEAR INEFFECTIVE IN SUPPORTING EMPLOYMENT AND PRODUCTION

Fourth and finally, few tariffs on home necessities appear to be effective protectors of production and employment.

MFN tariff rates for these goods have remained stable for decades. Shoe tariffs, for example, were exempted from Uruguay Round tariff cuts. Most clothing tariffs likewise remained the same, though clothing trade more broadly was substantially liberalized by elimination of the quota systems in effect from the 1970s through 2004. But as these policies remained in place, formerly poor agricultural countries became large producers of consumer goods; European and Asian (and American) port efficiency improved; the global container shipping fleet expanded from about 1 million TEU to 25 million TEU; and innovation in maritime logistics, air cargo, and telecommunications steadily drove down transactional costs. This meant that the power of a stable consumer goods tariff to affect trade flows lessened each year.

Thus, while the MFN tariffs on consumer goods have always been regressive, over time many of them have lost their power to “protect” jobs and production. In such cases, tariffs lose their dual role as trade policy and tax policy, and become essentially excise taxes.

In shoes and clothes, for example, the “import shares” of the U.S. market are exceptionally high at 98% and 97% respectively, despite the high tariffs on these products. Actual shoe employment has fallen by a likely 95% since the mid-1970s to about 6,900 as of 2022. In clothing the same phenomenon appears, as employment has dropped from roughly 1 million in the 1970s to 95,000 in March 2022. In “jewelry and silverware,” a category that obviously goes well beyond tableware, employment has dropped from 70,000 in 1990 to 21,500 in 2022, and a New York company making expensive high-end silverware is advertising itself as the only American firm currently making these goods. On the other hand, employment trends in “textile furnishings” are less dramatic, with job totals clearly down — 130,000 in 1990, 46,000 at the end of 2021 — but the decline much less sharp than in clothes, shoes, silverware, or travel goods. This suggests either the U.S. industry remains competitive and employment declines mainly reflect productivity gains, that tariffs have been more effective in home linens than in other industries, or both at the same time.

This evolution appears to have gone especially far, and in fact to have been completed, in some of the products carrying the very highest tariffs. For example, it appears that none of the cheap sneakers with 48% MFN tariffs or sometimes even higher complex tariffs have been made in the U.S. for decades. Likewise, if the New York silverware company’s presentation is up to date, no U.S. firm is making the cheap spoons with 14.0% tariffs or the “15.8% + 0.9c/apiece” forks.

V. OBSERVATIONS AND CONCLUSIONS

What, if anything, should be done about this? As a starting point, Ambassador Tai and the Office of the U.S. Trade Representative deserve applause for asking a core question about the purposes and effects of trade policy in requesting this International Trade Commission to conduct this study.

One purpose should be to support the living standards of vulnerable Americans, both in their lives as workers and in their lives as managers of especially limited family budgets. Others should include promoting U.S. growth and economic efficiency, providing opportunity for exporting farmers, manufacturers, and services providers, and ensuring that American workers and business operators are treated fairly in global markets.

These goals will not always complement one another. A particular trade policy choice may be good for the nation, but in some degree bad for vulnerable communities, and/or good for some vulnerable communities but harmful to others. In such cases, Congress and administration officials would be making intellectually and ethically complex decisions about defining national interest, and finding complementary ways to support those workers who might be disadvantaged.

On the other hand, sometimes policy choices are relatively simple and easy. If long-established policies are (a) generally regressive and often actually discriminatory against the poor, and (b) have lost their original purpose of protecting employment and production, then they should be scrapped.

One way to approach this would be a “sunset” provision, in which all HTS tariff lines would receive periodic review to see whether they relate to U.S. employment and production. Tariff lines which protect no U.S. employment or production appears would be abolished, unless their advocates could show an important indirect support for U.S. industry and workers via FTAs or some other avenue. Such an approach would not affect employment or production, and would have disproportionate — though obviously not enormous — benefits for single parent families, African American and Hispanic families, and the poor generally.

Policy choices, however, are never likely to materialize without the research and data that illuminate a problem and point the way to solutions. The ITC’s study, accompanied by its hearings and symposium, are a unique opportunity to provide that research and data, and bring it to the attention of Congress, executive branch officials, academics, and the public.

ABOUT THE AUTHOR

Edward Gresser is Vice President and Director for Trade and Global Markets of the Progressive Policy Institute, a 501(c)(3) nonprofit headquartered in Washington, D.C. Before joining PPI in October 2021, he served as Assistant U.S. Trade Representative for Trade and Global Markets, and concurrently as Chair of the U.S. government’s interagency Trade Policy Staff Committee.