Today, the Labor Department released a new batch of inflation data for the year ending in June. The headline number for the consumer price index has sparked panic in some quarters, as year-over-year inflation is now at 5.4%, the highest annual rate since 2008.

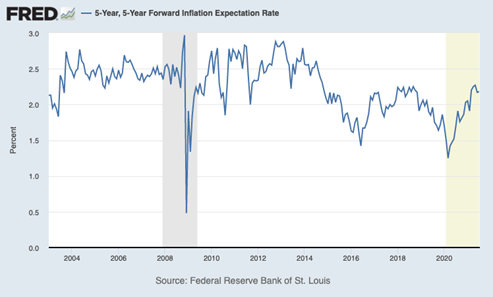

While this backward-looking measure is currently above its recent historical average, there is little cause for concern based on market forecasts of future inflation. Medium-term inflation expectations remain well-anchored, as bond prices show an expected average rate of inflation of 2.2% between 5 and 10 years from today.

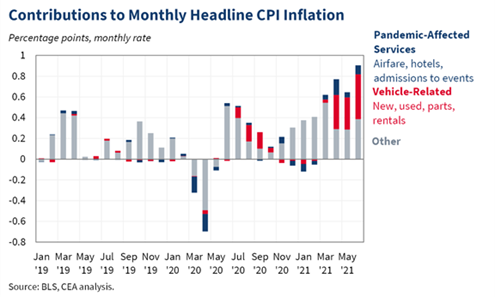

This is a very clear market signal that inflation pressures are transitory and will abate as supply chain issues caused by the pandemic work themselves out. Notably, motor vehicles represented 60% of the month-over-month inflation increase in June. As the global semiconductor shortage ebbs, we can expect motor vehicle inflation to return to its historical average.

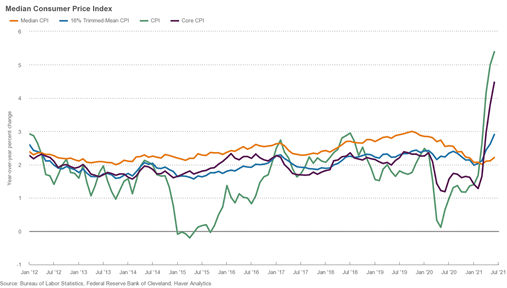

Another way to strip out the most volatile sectors of the economy and get a clearer picture of where inflation is heading is to look at median CPI, which includes only the middle changing item in the CPI’s basket of goods and services. In contrast to headline CPI, median CPI remains stable at 2.2% year-over-year. In the chart below you can see that CPI is more volatile than median CPI, and historically it has reverted toward median CPI after short deviations.

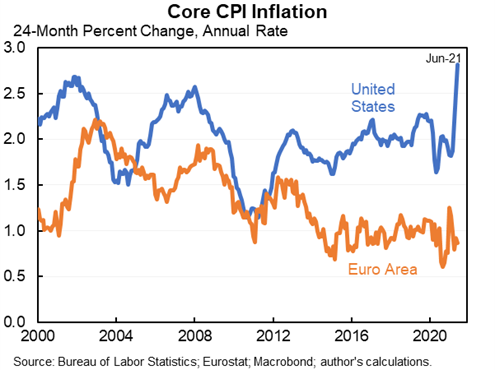

Lastly, year-over-year inflation numbers remain plagued by base effects, as the economy was depressed in June 2020 due to the poor handling of the pandemic by the Trump administration. Looking at two-year core inflation numbers shows that inflation is still within its historical range at 2.8%. This number is entirely consistent with the Federal Reserve’s average inflation targeting framework, which targets 2% average inflation over the business cycle with short periods of above average inflation making up for periods of below average inflation.

While there is not yet much reason to panic about long-run inflation, there are still things policymakers can do today to decrease the risk of inflation expectations becoming unmoored. For the first time in decades, we have sufficient demand in the economy to support rapid growth. Now we just need supply side investments and reforms to make sure that demand turns into real growth rather than increased inflation. Three items immediately spring to mind for policymakers to work on.

First, Congress should double down on its efforts to pass a bipartisan infrastructure package. While it may seem odd to spend more money to tamp down inflation, infrastructure spending is a special kind of spending. It’s an investment in the future productivity of our economy.

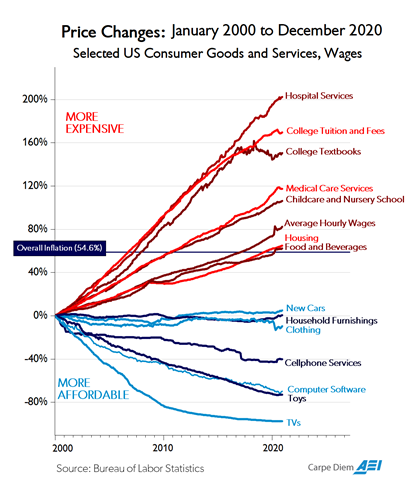

Second, the administration needs to follow through on many of the commitments it made last week in its executive order on promoting competition. Sectors like health care have been driving a disproportionate share of inflation in recent years. Encouraging more competition in that sector and others will have a disinflationary effect. Similarly, policymakers should avoid an unforced error by inadvertently harming sectors like tech and e-commerce, which have been holding down inflation in recent years.

Third, the Biden administration should begin to roll back tariffs implemented during the Trump presidency. These are taxes ultimately borne by American consumers and they raise the input costs for American manufacturers, making them less competitive in global markets.