It’s no secret that the American health care system is far from perfect. The United States spends a higher percentage of our gross domestic product on health care than any other country despite having comparable outcomes. And although the Affordable Care Act successfully reduced the percentage of uninsured Americans by almost half between 2010 and 2016, 8.8 percent still had no coverage according to the most recent Census estimate – one of the highest rates of any OECD country. Moreover, Republican sabotage of the ACA has threatened to dramatically increase costs and reverse much of these coverage gains.

Many Democrats have embraced “Medicare for All” as their preferred mechanism for addressing these problems. Medicare is already one of the largest health insurers in the United States, covering about one sixth of the population, including most Americans over the age of 65, as well as a select few other groups, such as individuals with disabilities. Expanding Medicare to cover the rest of the population has a natural appeal given the program’s overwhelming popularity with both beneficiaries and the general public. But this week’s report from the program’s trustees warns of serious financial challenges that threaten Medicare’s ability to meet its obligations to current beneficiaries. The program cannot be expanded unless these problems are resolved and benefits can be sustainably financed.

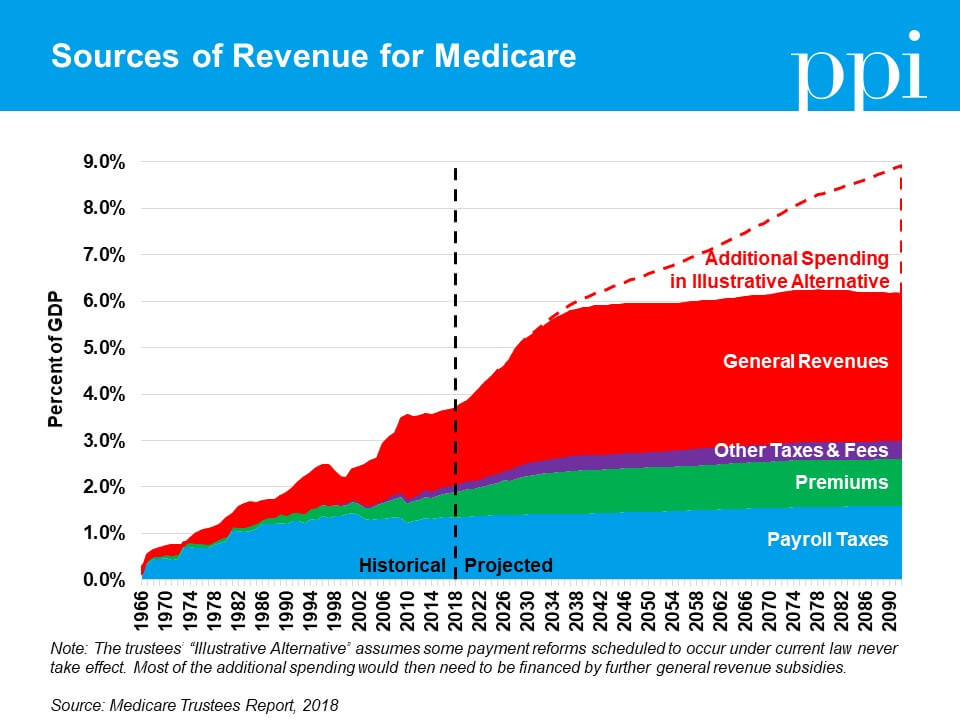

Medicare consists of two financing mechanisms: Hospital Insurance (HI) and Supplemental Medical Insurance (SMI) trust funds. The HI trust fund pays for Medicare Part A, which covers hospital services, nursing facilities, home health assistance, and hospice care. HI is primarily funded by premiums and a payroll tax of 1.45 percent paid by both workers and their employers (or 2.9 percent in the case of self-employed workers who are required to pay both taxes). In years when these revenue sources exceed spending, the Treasury Department credits the HI trust fund for the balance. In subsequent years when spending exceeds revenue, Medicare can then draw upon these surpluses to make up the shortfall.

Although HI used to have regular annual budget surpluses up until 2004, it is now running chronic cash deficits. The trustees report projects that the trust fund will be exhausted by 2026, at which point Medicare would only have enough revenue to meet 91 percent of its Part A obligations. The HI trust fund’s exhaustion date is typically the metric most commonly cited in the media when discussing Medicare’s financial health, but in reality it’s only the tip of the iceberg: the challenges facing HI pale in comparison to those facing SMI.

Unlike HI, SMI – which covers both Medicare Part B (outpatient services and medical equipment) and Part D (prescription drugs) – only receives about one quarter of its revenues from dedicated sources. The remainder is automatically funded by general revenues, which ensures that SMI can never become insolvent but also obscures the true cost to both voters and policymakers. This structure is particularly problematic because Medicare is the fastest growing program in the federal budget: as the total size of SMI grows, it threatens to crowd out other public priorities that compete for the same pool of resources even if the proportion of the program funded by general revenues remains the same.

When taken together, Medicare’s dedicated revenue sources only cover about half of its spending. In that context, it makes sense that many voters would feel they get a better deal out of Medicare than other forms of insurance – they’re only seeing half the cost. Additionally, there are far more workers paying taxes into Medicare than there are beneficiaries. The Medicare model works for providing subsidized care to targeted subsets of the population, but if it were extended to cover the whole population, suddenly there would be fewer taxpayers than beneficiaries and no way to defray the cost.

One alternative that several moderate Democrats have suggested is to offer consumers an option to buy into Medicare voluntarily instead of automatically enrolling the entire population. This “public option” approach would preserve the private health insurance market but allow a public plan to compete. If the public plan is able to deliver more efficient health services or achieve lower prices through the use of Medicare’s rate-setting system, it could eventually grow to dominate the market through consumer choice and develop into a de facto single-payer system.

Before policymakers go this route, however, they need to ensure that any public option is self-financed through premiums (as many of the current proposals recommend). To the extent coverage is subsidized by the government, it must be limited to the same subsidies consumers receive from programs such as those in the Affordable Care Act to purchase private insurance. Should the public option be subsidized by general revenues the same way as SMI, it would become increasingly unsustainable as market share grows – an outcome would be bad for taxpayers and beneficiaries alike.