It’s official: House Republicans are campaigning on a pledge to increase the federal budget deficit. It was just 10 months ago that they enacted a package of ostensibly temporary tax cuts that is projected to increase deficits by roughly $2 trillion over the next decade. This week, they offered a series of proposals dubbed “Tax Reform 2.0” to expand upon and make permanent the first tax cut’s expiring provisions. Although the package is unlikely to become law in this Congress, this legislation sends a clear message to voters about the GOP’s main objective if they retain control after the midterm elections: more deficit-financed tax cuts.

The Joint Committee on Taxation estimates that the new tax cut package will add another $657 billion to budget deficits between 2019-2028. This score, however, understates the true cost of the legislation because of the time period analyzed. The original tax cuts are largely in place through 2025, so most of the new package’s costs don’t begin to materialize until 2026. The upshot is that although the $657 billion is technically a 10-year cost estimate, 96 percent of that cost is concentrated in just the last three years.

What would the true cost of “Tax Reform 2.0” be? The Tax Policy Center estimates it could cost nearly $4 trillion over the next 20 years – and that’s on top of the $2 trillion cost of the original tax-cut law. Over half of these additional tax cuts would go to benefit the richest tenth of Americans. The tax cut isn’t just larger for wealthy Americans in dollars – they would also see their after-tax incomes rise by over two percent, while Americans in the bottom half of the income distribution would only see their incomes rise by less than one percent.

And how does the GOP plan to pay for the enormous costs of their regressive tax proposals? They don’t. It was recently reported that when former National Economic Council Director Gary Cohn asked President Trump how he would finance the administration’s budget deficits, Trump proposed to “just run the presses — print money.” Congressional Republicans haven’t offered a serious alternative.

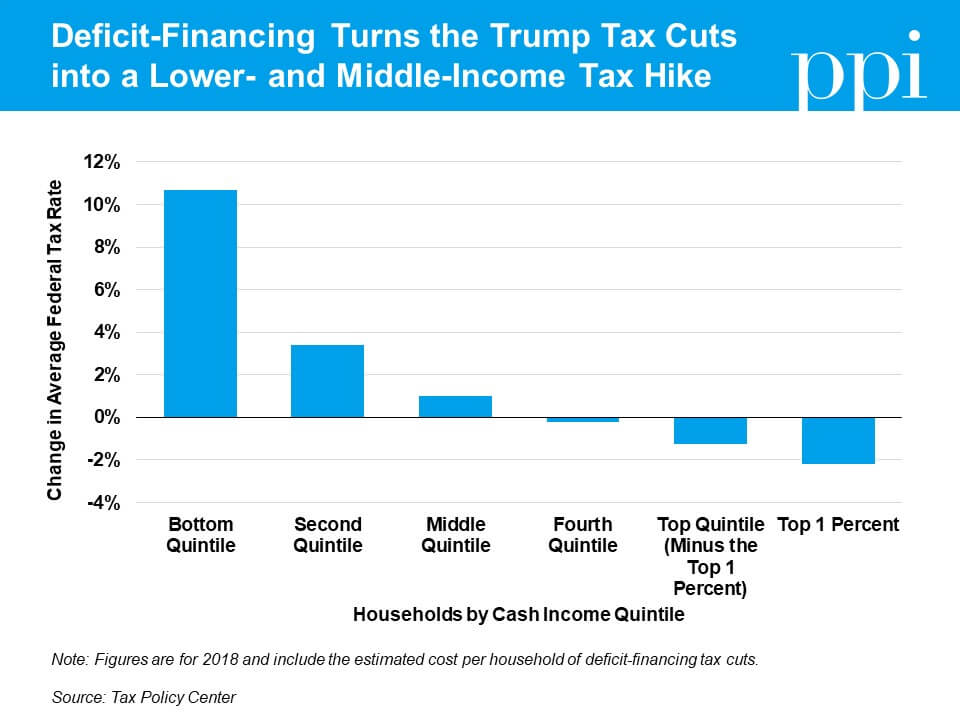

As PPI noted earlier this year, a deficit-financed tax cut is really no tax cut at all. Households that received a tax cut of less than $1,610 in 2018 are likely to lose more in the long-run than they will gain from those tax cuts, including most lower- and middle-income households. Perhaps it should be no surprise that these tax cuts are incredibly unpopular among non-Republicans.

When Republicans won their House majority in 2010, they campaigned against deficits and the implicit tax it imposes on future generations. Eight years later, as those same Republicans prepare to lose their majority, they’ve cravenly embraced the very things they were supposedly elected to oppose.

Alisha Gurani contributed to this post.