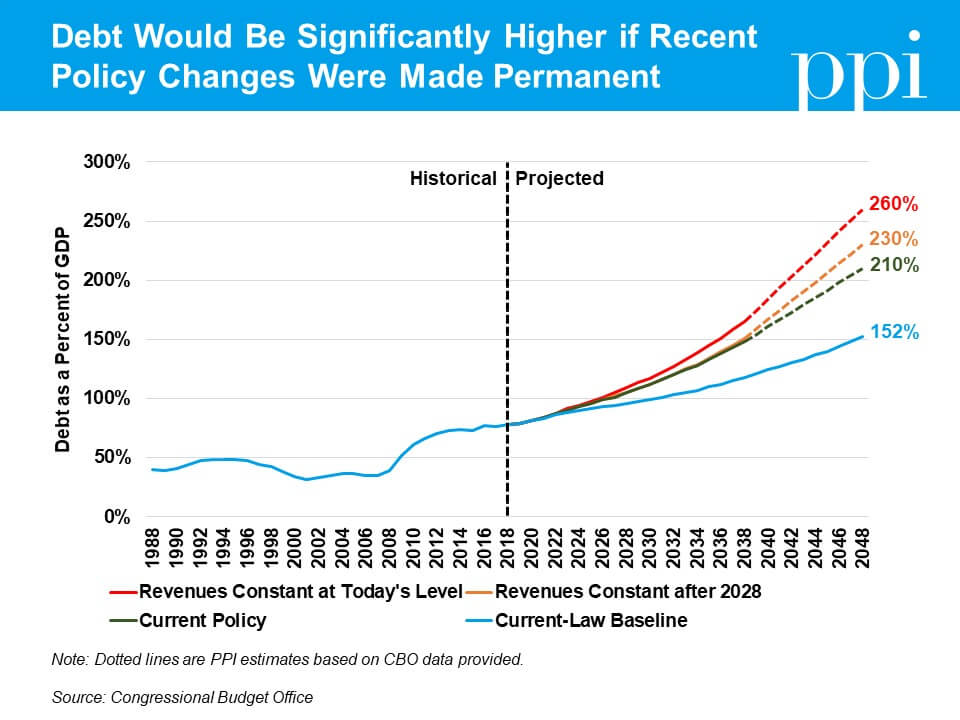

When the non-partisan Congressional Budget Office published its Long-term Budget Outlook in June, it estimated that the national debt relative to the size of the economy would nearly double over the next 30 years – from 78 percent of gross domestic product today to 152 percent of GDP in 2048. Yesterday, a new report from CBO warned that legislation passed within the past year by Donald Trump and the Republican-controlled Congress has the potential to make the problem far worse.

When Washington Republicans enacted a nearly $2 trillion tax cut last year, they included arbitrary expiration dates that minimized the projected cost after 2025. Congress took a similar approach in February, when it passed a bipartisan budget agreement that increased spending by almost $300 billion over just two years. Because CBO is required to make budget projections based on the laws as they are written (the “current-law baseline”), neither of these ostensibly temporary policies had a material impact on the long-term budget picture.

But what if policymakers extended or made these changes permanent? CBO’s models show debt would hit 210 percent of GDP by 2048 under this scenario – 58 percentage points higher than the baseline projection and nearly triple today’s level. CBO also scored two other scenarios: one in which policymakers prevent tax revenue from rising as a percent of GDP after 2028 and one in which policymakers keep taxes at 2018 levels in perpetuity. In these scenarios, CBO projects debt would rise to 230 percent and 260 percent of GDP respectively. However, these projections come with an important caveat. The report states:

“Assessing the economic effects of such large and rising debt would probably require reevaluating the economic relationships in CBO’s current models. In particular, in CBO’s models, the responses of private saving, capital inflows, and interest rates to fiscal policy are based on the nation’s historical experience with federal borrowing. But in these alternative scenarios, debt as a percentage of GDP grows to levels well outside that experience.

Nevertheless, to provide some sense of the possible outcomes, CBO employed its usual models to produce longer-term projections of deficits and debt under the three scenarios—but the actual outcomes would probably be worse than the range of estimates that those models indicate.”

Essentially, these policy scenarios would drive the national debt to unprecedented levels so high that CBO can’t be confident in the precision of its models at that point. These estimates, grim as they are, are thus likely to be overly optimistic.

Yet even under those “optimistic” projections, CBO estimates that the added debt burden from each of the measured scenarios would significantly hurt our economy. By 2038, CBO projects annual national income would be reduced by upwards of $1,000 per person relative to what it would be under current law – and the damage would only get worse as time goes on.

Despite the harm it would cause, Washington Republicans appear committed to pursuing even more unaffordable tax cuts if they retain control of Congress after the midterm elections. House Ways and Means Chairman Kevin Brady (R-TX) has been preparing a “Tax Cuts 2.0” package that would make permanent most expiring provisions of the 2017 tax law. At the direction of President Trump, the Treasury Department also recently explored a move to unilaterally cut capital gains taxes by $100 billion, with 97 percent of the benefit going to the richest tenth of Americans.

Yesterday’s CBO report should be a warning to both them and the American people that we cannot afford to keep piling these irresponsible tax cuts onto our large-and-growing national debt. If Republicans insist on continuing down this reckless fiscal path, Democrats should hold them accountable and offer an alternative approach that pairs responsible fiscal policy with public investments to promote long-term economic growth.