Summary: The new “median employee pay” statistics tell us very little about pay. However, they do illuminate the future of economic statistics.

The median center of the United States population, as calculated by the Census Bureau, is Pike County, Indiana, in the rural southwest corner of the state. A visit with a resident of Pike County, with a density of 38 people per square mile, might tell you something important about the rural Midwest, but it wouldn’t give you any insight into Silicon Valley or New York City.

That, in a nutshell, is the problem with the new “median employee pay” figures that companies are now required to publish. These figures provide us with some useful pieces of information that were hidden before. It’s interesting to know that the median employee at GE, for example, earns $57,211 per year, while Ford’s median employee receives $87,783.

But we’re learning that “median employee pay” for a company has a lot more to do with geographic scope and the nature of the corporate business model than with the actual level of pay in the company. For example, median employee pay at megabank Citigroup is $48,249, while median employee pay at Bank of America is $87,115. Does that mean that comparable workers get paid twice as much at Bank of America? No, it merely reflects that two-thirds of Citigroup employees are outside the United States, many in lower-wage countries. By contrast, Bank of America’s business is mostly focused in the US.

Another odd set of numbers comes out of the utility industry. Median employee pay at The Southern Company, a gas and electric utility employing 31,000 workers in 34 states, was reported at an eye-popping $138,000. Meanwhile, the AES Corporation, with three-quarters of its operations outside the US, reported median employee pay of $49,229. These two numbers tell us nothing, however, about pay for comparable workers.

A different set of issues arises in retailing. The need to staff weekend and evening hours means that many retailers employ a large number of part-time workers to cover off-hours. Similarly, the annual surge in holiday shopping requires hiring an enormous number of seasonal workers. Moreover, there’s a large amount of turnover in the retail industry, which means that many workers hired for a permanent position may not have been working for that employer for a full year at the time when the count is made.

As a result, the reported median employee pay for most retailers is not directly comparable to other sectors of the economy. For example, Macy’s reports median employee pay of $13810, as of October 29, 2017. That number reflects the reality that 54% of its workers are part-time or seasonal. Similarly, Walmart is reporting median pay of $19177, and Loew’s is at $23905. Amazon reported a median employee pay of $28446, and Nordstrom’s median pay is at $30105.

Meanwhile, Connecticut-based tech manufacturer Amphenol, a major global designer and manufacturer of electronic products such as fiber optic connectors, reported median pay of only $12179. But as the company points out in its proxy, that’s because the majority of its employees are in low-wage countries. However, its US employees have a median pay of $54532.

Indeed, in the bigger picture, the data on employee median pay is telling us something important about the ongoing changes in economic statistics. Today, economic and labor statistics mainly come from government statistical agencies. These agencies mainly do expensive surveys which cover the whole country. These surveys are carefully curated and standardized, and systematically designed to be comparable over time and across the economy. The national unemployment rate and inflation rate come from surveys such as these, which were originally designed in the middle of the 20th century.

However, these surveys are increasingly expensive and often lag changes in the economy. Moreover, it’s getting hard to justify sending out teams of interviewers when companies have so much business data on their servers already.

As a result, going forward, economic statistics will be based much more heavily on “organic” data, generated in the normal process of doing business. That’s good news and bad news. The good news is that information technology allows companies to generate new types of economic data that weren’t possible before. Median employee pay, for example, would have been prohibitively expensive to require as recently as ten years go. Most companies just didn’t have the global pay databases that would allow them to do these kind of calculations.

The bad news is that these new types of data—such as median employee pay—may not be comparable across companies, either because they use different calculation methodologies or because different companies have objectively different business models. The median employee in a global company with large operations around the world is very different than the median employee of a company whose operations are based solely in one region of the United States.

The danger is that journalists and politicians treat these new types of organic data as if they were the old type of government-curated statistics. They are not. Comparisons of median employee pay across companies tell us more about how the companies are organized and about their industry than they do about the level of pay.

To put it a different way: If you had a magic wand and could ask corporations to produce one new statistic about their operations, you likely would not have asked for “median employee pay.”

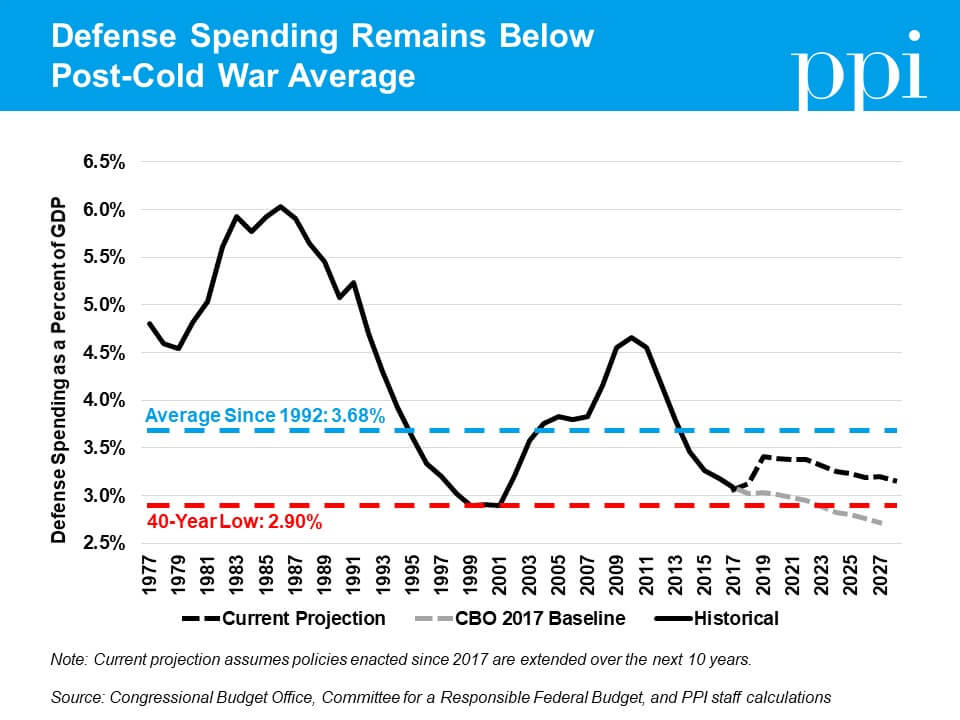

The story is similar for defense spending. Thanks to the pressure put on by the sequester, defense discretionary spending fell to just under 3.1 percent of GDP in FY2017. Under the BBA, defense spending would increase to 3.4 percent of GDP in FY2019 before falling again. Unlike domestic discretionary spending, however, defense would remain above the all-time low it reached before the 2001 terrorist attacks throughout the next decade.

The story is similar for defense spending. Thanks to the pressure put on by the sequester, defense discretionary spending fell to just under 3.1 percent of GDP in FY2017. Under the BBA, defense spending would increase to 3.4 percent of GDP in FY2019 before falling again. Unlike domestic discretionary spending, however, defense would remain above the all-time low it reached before the 2001 terrorist attacks throughout the next decade.