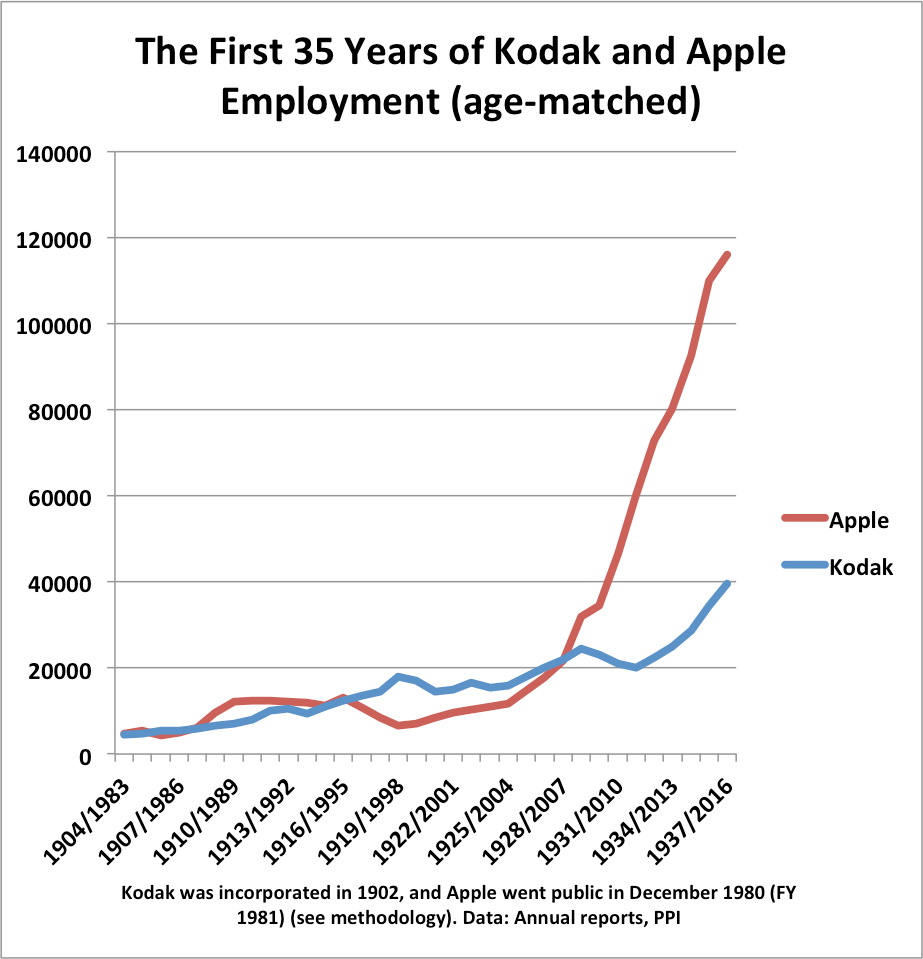

There is a huge debate about whether automation leads to an aggregate loss of jobs. On the one side are those who believe that robots are about to unleash a massive wave of job destruction, rendering most of us superfluous. On the other side are those who are skeptical about the value of new technologies, and believe that the US and other developed countries are stuck in permanent stagnation.

A key case in point is ecommerce. The “robots are here” believers see the impending end of brick and mortar retail and shopping malls, to be replaced by soulless and totally automated warehouses. From their perspective, the latest employment report, which showed a sharp decline in general merchandise stores since October, was only the first sign of the retail workforce circling the drain.

Meanwhile, the stagnationists argue that ecommerce is no big deal, just another way of distributing the same products.

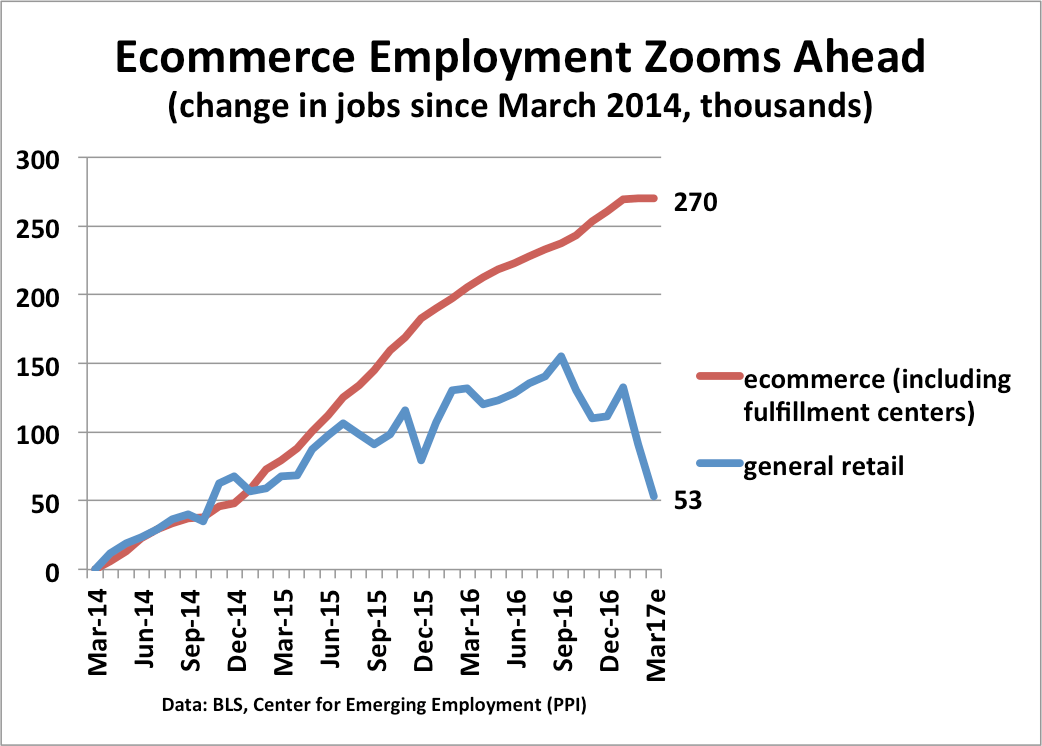

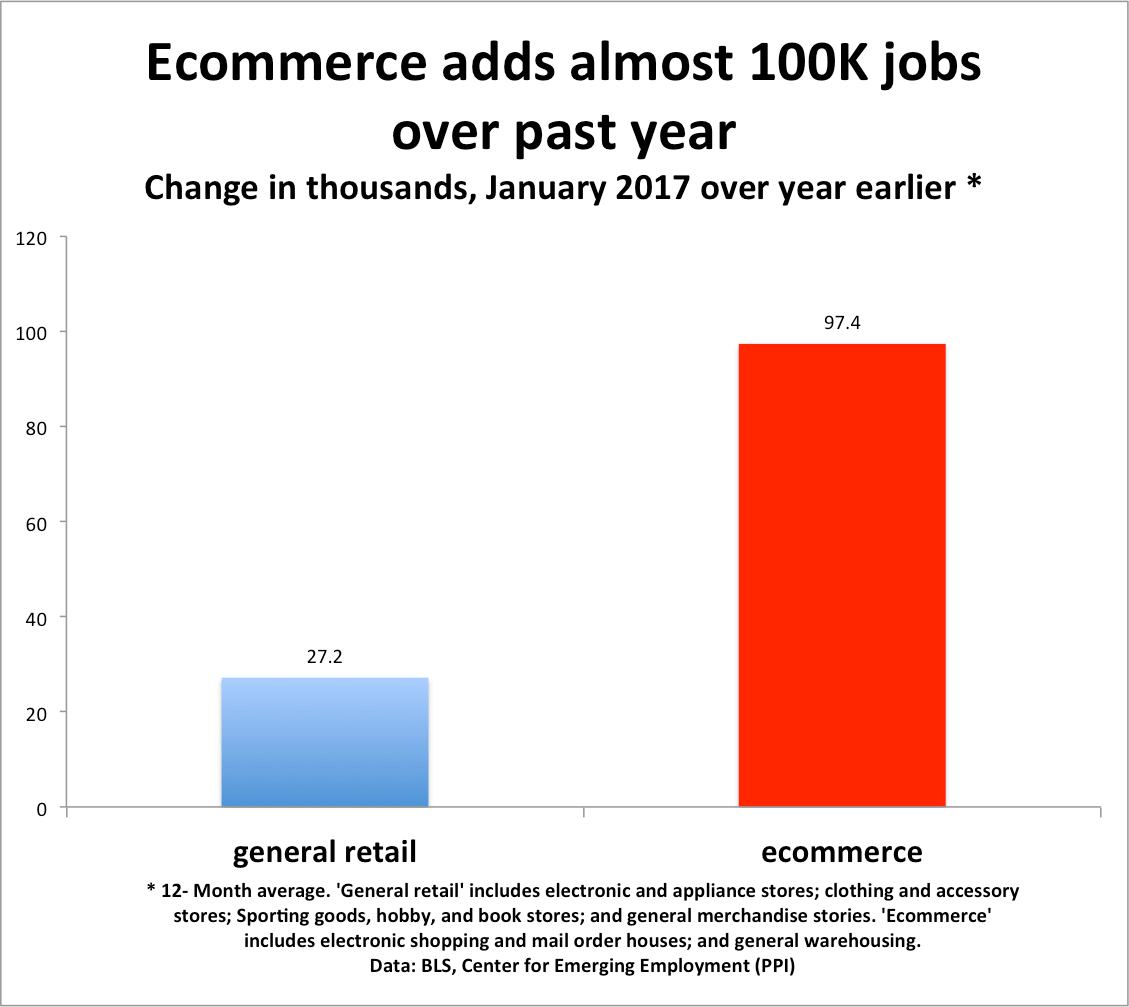

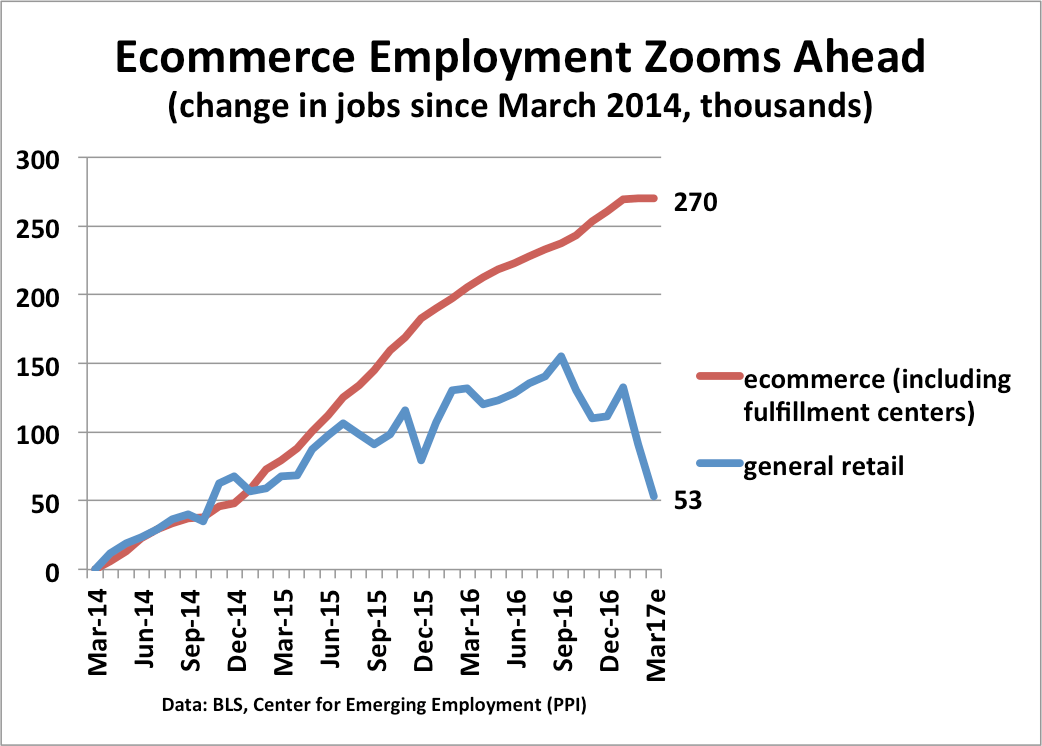

But here is an interesting fact. First, by PPI’s calculations, the ecommerce industry including fulfillment centers has added 270,000 jobs since March 2014. Over the same three year period, general retail stores have actually added 53,000 jobs, including the latest declines reported by the BLS (by our definition, ‘general retail’ includes those stores which compete most closely with ecommerce–see definition below).

So in fact, the number of ecommerce jobs has increased sharply in recent years. And as we have shown in a recent paper, these jobs pay considerably more than the low-weekly-earning jobs that comprise most of the retail sector.

How could this be? The reality is that ecommerce has evolved. The old ecommerce provided the same physical product, but required a long wait compared to going to a store. The new ecommerce, with next day delivery, provides the same physical product as going to a store, with a much shorter wait and much less hassle.

The new ecommerce places much more emphasis on the speed of moving physical objects and quickly getting them to the right place, rather than simply the ease of ordering. It is the cutting edge of the digitization of the physical industries that has the potential to greatly accelerate overall productivity, as Bret Swanson and I wrote in a recent paper.

In fact, I’d like to propose that we stop using the 1990s term ‘ecommerce’, and start calling the new industry “advanced distribution.” Advanced distribution includes the “electronic shopping and mail order industry,” but it also includes the new fulfillment centers that are currently counted in the warehouse industry.

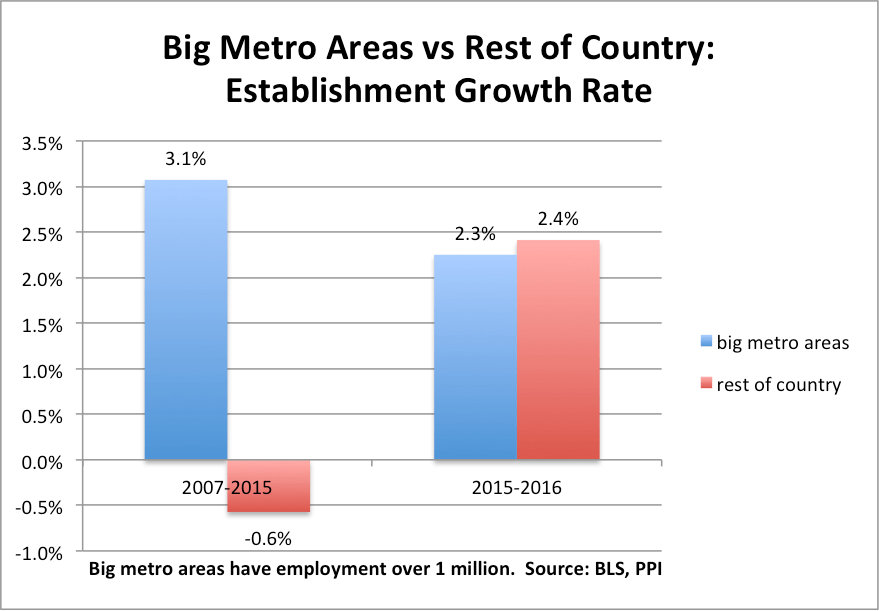

We suggest that advanced distribution–the ability to ensure an order-delivery lag of one day or less–represents a genuinely new advance that has the potential to generate spin-offs of its own. For example, custom manufacturing may become a viable business model if a customer can order a made-to-order shirt or chair and get it in one day. That would require the custom manufacturers to be located near the fulfillment centers, giving them a durable competitive advantage that overseas rivals would not be able to match.

In that way advanced distribution could become an essential complement to advanced manufacturing, potentially exacting a significant time penalty for offshoring. Rather building distribution centers around factories, we’ll start building advanced manufacturing or custom manufacturing hubs around fulfillment centers.

The rise of custom manufacturing is speculative at this point, but the advanced distribution jobs are not. As history shows, productivity gains, when used to offer genuinely new products or services, can create good jobs.

Added (4/10/17): Over the week the WSJ wrote a piece entitled “Online Retailers’ New Warehouses Heat Up Local Job Markets” which talked about the rise in wages at fulfillment centers. By our calculations, total payroll for ecommerce workers has risen by $19 billion (in 2016 dollars) since 2007, while payroll for general retail has fallen by $5 billion. On net, advanced distribution is a plus for workers.

Note: By our definition, ecommerce or advanced distribution includes the electronic shopping and mail order industry, and the warehouse industry. General retail includes furniture and home furnishings stores; electronics and appliance stores; clothing and clothing accessory stores;sporting goods, hobby, book, and music stores; and general merchandise stores. This is a slightly broader definition than we used in the recent paper.