EXECUTIVE SUMMARY

This policy brief highlights recent developments in the federal response to the hunger crisis resulting from the Covid pandemic and recession. It discusses the valuable policies contained in President Biden’s recent executive orders and the proposed American Rescue Plan legislation, and also identifies additional policies to address hunger, including reducing concentration in the food industry, using modern information technologies to help low-income Americans cut through siloed bureaucratic obstacles, and expanding food aid for low-income children.

As the pandemic unfolded across the country last spring, one of the first major disruptions was widespread school closures. When teachers locked up their classrooms last March, few thought that a year later schools would still be shuttered. Among the troubling losses to students, especially for the low-income, have been the social services that schools provide, such as meals. Millions of children around the country rely on school for breakfast, lunch, and daytime snacks. In April 2020, as policymakers scrambled to address spiking food insecurity, 35 percent of households with children under 18 said they didn’t have enough to eat, a dramatic rise from already high rates of hunger pre-pandemic. A recent analysis of food insecurity data found that the number of children not getting enough to eat was ten times higher during the pandemic, comparing December 2019 to December 2020.

Food insecurity doesn’t just affect children; adults and the elderly also don’t have enough to eat. Covid relief has certainly helped, but nearly 1 in 6 adults – or close to 24 million Americans – reported that their households did not have enough to eat sometimes or often in the past seven days, according to the latest Census Household Pulse survey in January. Households experiencing food insecurity include close to 5.3 million senior citizens. America’s ongoing hunger crisis requires a forceful response encompassing several different dimensions of public policy.

The sharp rise of hunger during the pandemic is yet another woeful legacy of the Trump administration’s mishandling of the Covid crisis. Last spring, in response to widespread school closures, Congress launched Pandemic Electronic Benefit Transfer, or P-EBT, a program to replace the free and subsidized meals that children would normally get at school. However, the Trump administration placed unnecessary bureaucratic barriers on states which meant that many households eligible for the P-EBT program never received the benefits, even as Congress re-funded the program in September 2020. The Trump administration went so far as to try to kick nearly 700,000 unemployed people off of food assistance late last year in the midst of this public health crisis, but this move was stopped by a federal judge. The consequence of these actions was that while spending for food assistance went up by nearly 50 percent in 2020, some of that aid never reached families in need.

President Biden’s swift call for legislative and executive action on hunger is a welcome sign that U.S. leaders finally are determined to give this problem the attention it deserves.

During his first week in office, President Biden moved quickly to address the acute hunger crisis afflicting millions of Americans during the Covid pandemic and recession. Unveiling his $1.9 trillion coronavirus relief plan in January, Biden struck an urgent note, decrying a reality in which “…folks are facing eviction or waiting hours in their cars — literally hours in their cars, waiting to be able to feed their children as they drive up to a food bank. It’s the United States of America and they’re waiting to feed their kids… But this is happening today, in America, and this cannot be who we are as a country. These are not the values of our nation. We cannot, will not let people go hungry.”

To meet this emergency, Biden’s American Rescue Plan extends the 15% increase in Supplemental Nutrition Assistance Program (SNAP) benefits and proposes $3 billion in additional funding for the Women, Infant and Children (WIC) program. The plan also includes $350 billion in aid to state and local governments to support their anti-hunger initiatives, including food pantries, senior nutrition, and other nutrition programming.

President Biden is not waiting for Congressional legislation to provide a much-needed increase in food assistance to families. In his first week in office, the President signed an executive order that will alleviate the hunger crisis in three critical ways.

First, Biden’s executive order will increase food benefits for the P-EBT program by 15 percent, which will give a family of three children an additional $100 every two months, according to National Economic Council Director Brian Deese. The P-EBT was created by Congress in 2020 to give benefits to eligible households with children who would have received free and reduced meals under the National School Lunch Act had schools not been closed. Second, the President has directed the USDA to increase the SNAP Emergency Allotments for those at the lowest rung of the income ladder. And lastly, the executive order calls for modernizing the Thrifty Food Plan to better reflect the cost of a market basket of foods upon which SNAP benefits are based. Collectively, these changes should make food assistance more generous and better targeted.

While these are welcome steps, we call on the Administration to go further by addressing the underlying causes and structural barriers to food access and affordability. We focus on three in particular: Growing concentration in the food industry; siloed social service bureaucracies that make it difficult for low-income Americans to get public assistance; and the difficulty in expanding food aid for low-income children in hard-to-reach places. The pandemic has shined a light on the silent nutrition and food insecurity epidemic in our country and our policy brief outlines a comprehensive federal response.

KEY RECOMMENDATIONS:

- Extend the Pandemic EBT program through the pandemic and economic recovery to provide low-income children with free or subsidized meals during weekends, holidays, and summer break. To be better prepared for a future crisis, Congress should also leverage the P-EBT program to create a permanent authorization for states to issue replacement benefits, giving them more flexibility to respond in a crisis.

- Study the success of the P-EBT program with an eye to converting it into a Summer EBT program post-Covid to bridge the gap in nutrition during the summer months and reach more low-income children in rural and underserved communities.

- Pass legislation, such as the Pandemic Child Hunger Prevention Act, in future recovery legislation, to allow all children free access to breakfast, lunch, and after school snack programs either in school or through “grab and go” and delivery options, as well as reduce bureaucratic barriers for schools to deliver meals to kids.

- Focus on stricter antitrust enforcement in the food industry to help consumers facing increasing prices for basic nutrition staples, such as meat and eggs.

- Use information technology to modernize social service delivery and reduce the administrative burden on low-income people. For example, Congress should enact the HOPE Act, which would create online accounts that enable low-income families to apply once for all social programs they qualify for, rather than forcing them to run a bureaucratic gauntlet.

- Pass the bipartisan Healthy Food Access for All Americans (HFAAA) Act, put forth by Sens. Mark R. Warner, Jerry Moran, Bob Casey, Shelley Moore Capito, which provides incentives, including tax credits or grants, to food providers who serve low-access, rural communities. Draft legislation that provides grants to states to fund the establishment and operation of grocery stores in rural and underserved communities.

GO BIG ON HUNGER — FAST

Food insecurity is not just a moral issue, it also has economic and social costs. Adults who go hungry are less productive and are more likely to suffer from chronic illness. The nutrition crisis has been called a “slow epidemic” by Dr. Dariush Mozaffarian, dean of the Freidman School of Nutrition Science and Policy at Tufts University.

The rate of households reporting that they do not have enough to eat is much higher than pre-pandemic levels, especially for families with children. Hungry children are more likely to get sick and fall behind in school. One in five Black and Hispanic households report they are unable to afford food. Poor nutrition and soaring rates of metabolic disease are a drag on the economy and contribute to rising healthcare costs and early deaths in minority and low-income families that are disproportionately more likely to experience poor nutrition and health as a result of food insecurity.

Food assistance spending now can also speed economic recovery. A 2019 report from the U.S. Department of Agriculture quantified the economic impact of SNAP spending during the Great Recession and found that this program can serve as an “automatic stabilizer” during a downturn. The authors analyzed program data and observed that low-income SNAP participants quickly spent the benefits after receiving them and the overall effect was a boost in the economy. Every $1 billion in new SNAP benefits led to “an increase of $1.54 billion in GDP – 54 percent above and beyond the new benefits.” SNAP benefits also generated $32 million in income for the agriculture industry and helped create jobs.

BUILDING RESILIENCE INTO OUR ANTI-HUNGER POLICIES

Despite the pandemic’s many tragic aspects, the disruption of our everyday lives has had some silver linings. Many innovations have been born of necessity, such as pioneering new approaches to feeding children who rely on meals at school despite school closures, and these can inform how we tackle food insecurity going forward.

The U.S. has a patchwork of programs to feed children, and the efficiency of this system has been sorely tested during the pandemic. The School Breakfast Program and the National School Lunch Program feeds over 22 million children per year who rely on meals provided by their schools as a significant source of nutrition. During a normal schoolyear, the lack of access during weekends, holidays, and summer break can leave kids hungry. During the summer, only 1 in 6 of these children still receive meals through the USDA Summer Food Service Program. In 2011, in response to this gap in nutrition, the USDA launched a pilot called the Summer EBT to provide meals to children during the summer months. The program is aimed at reaching low-income families in rural and hard-to-reach communities where the Summer Food Service Program has not been as successful. Results from the demonstration are promising and, so far, more than 250,000 children have gained access to nutrition as a result of the program. Despite the early successes of the Summer EBT demonstration projects, the Trump administration took the controversial step of closing sites in some places, such as Connecticut and Oregon.

Some researchers have called for expanding the Pandemic-EBT program through the rest of the pandemic and recovery to allow states to provide free or subsidized meals for children during these breaks in the school calendar. Once schools reopen, the Biden administration should explore preserving the systems set up by schools during the pandemic to provide meals to low-income children outside of the usual school day and year, including potentially by expanding Summer EBT.

Forced to improvise when schools shut down, many school districts have developed more flexible and varied ways to get meals in the hands of hungry families. School meals now are more widely available to children learning at home through “grab and go” distribution centers or meal delivery. School systems should go further to ensure that other family members in low-income households can take away meals during pickup to eat off-site. For example, Rep. Suzanne Bonamici has co-sponsored a bill that would allow schools to distribute meals to students and other community members in need, and to extend meal service for afterschool meals and snack programs. We applaud this bill as temporary and essential pandemic-relief legislation. This flexibility and the waivers aimed at making it easier to serve meals for low-income families in school districts could end up having unintended consequences, such as impacting funding levels as these waivers are used to determine need across districts. Policymakers should remain aware that funding will need to be determined differently during the pandemic as a result of fast-changing policies.

We do not know when the next pandemic or economic crisis may strike, but we can be better prepared. As we’ve learned from Covid, systems that we take for granted, such as schools, can be shut down overnight. In order to stay ahead of a future crisis, researchers at the Center on Budget and Policy Priorities have suggested that Congress “leverage the P-EBT structure to create a permanent authorization for states to issue replacement benefits (similar to P-EBT, and perhaps renamed “emergency-” or E-EBT) in case of lengthy school or child care closures resulting from a future public health emergency or natural disaster.” This will make it easier for states to act quickly and not rely on Congressional action should schools need to close in the future.

Making our food delivery system more resilient against future pandemics or other emergencies should be a national priority. That will require attacking the structural roots of food scarcity in the world’s richest country.

STRUCTURAL BARRIERS TO FOOD ACCESS AND AFFORDABILITY

Of course, America’s hunger problem did not start with the pandemic. Before Covid, as many as 13.7 million households or 10.5 percent experienced food insecurity. In addition to dealing with the present crisis, the White House should develop new strategies for tackling the structural causes of food access and unaffordability. Three stand out today in particular: a decades-long trend of concentration in the food industry; bureaucratic inertia and dysfunction that discourages enrollment in aid programs; and the stubborn blight of rural hunger.

As PPI economist Alec Stapp has documented, market concentration in the food industry is driving up prices for basic sources of protein, such as chicken and eggs. A recent antitrust conference at Yale Law School noted that “the country’s four largest pork producers, beef producers, soybean processors, and wet corn processors control over 70 percent of their respective markets. Four companies control 90 percent of the global grain trade. Agrochemical, seed, and many consumer product industries are likewise now controlled by just a few mega-sized firms.”

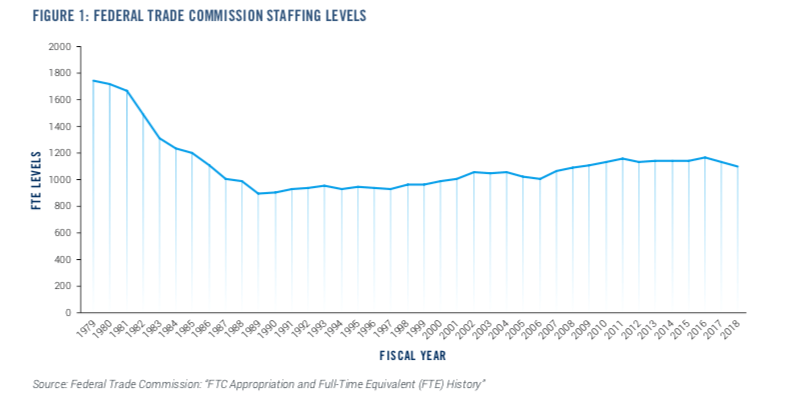

Low-income households spend the bulk of their budgets on housing, transportation, and food and, as a share of their household income, these families spend close to a third on food, with meat and eggs being especially pricey. To make food more affordable for all families, the White House should focus on stricter antitrust enforcement in the food industry by appointing leaders to the USDA, the Antitrust Division of the Department of Justice, and the Federal Trade Commission who will make this issue a priority.

Recent evidence from communities hit especially hard by the pandemic also highlights how formidable bureaucratic barriers deter many eligible households from accessing food aid. Policymakers should use information technology to modernize social service delivery and reduce the administrative burden on people to increase take-up in food assistance programs.

PPI has called for modernizing safety net programs to reduce the high “opportunity costs” of being poor in America. Federal and state governments should adopt modern digital technologies that help low-income families apply once for public benefits without having to run a bureaucratic gauntlet of siloed programs for nutrition, housing, unemployment, job training, mental health services, and more.

“While it’s true that government safety net programs help tens of millions of Americans avoid starvation, homelessness, and other outcomes even more dreadful than everyday poverty, it is also true that, even in ‘normal times,’ government aid for non-wealthy people is generally a major hassle to obtain and to keep,” notes Joel Berg, CEO of Hunger Free America.

“Put yourself in the places of aid applicants for a moment,” Berg added. “You will need to go to one government office or web portal to apply for SNAP, a different government office to apply for housing assistance or UI, a separate WIC clinic to obtain WIC benefits, and a variety of other government offices to apply for other types of help—sometimes traveling long distances by public transportation or on foot to get there—and then once you’ve walked through the door, you are often forced to wait for hours at each office to be served. These administrative burdens fall the greatest on the least wealthy Americans.”

In a 2016 PPI report, Berg proposed the creation of online “HOPE” accounts for families to better manage and access their benefits, and into which they could deposit their public assistance.

This idea is at the heart of the Health, Opportunity, and Personal Empowerment (HOPE Act) introduced by Reps. Joe Morelle (D-NY) and Jim McGovern (D-Mass) and Senator Kirsten Gillibrand (D-NY). The HOPE Act would fund state and local pilot projects setting up online HOPE accounts to make it easier for low-income people to apply for multiple benefits programs with their computer or mobile phone. In addition to saving them time, money, and aggravation, HOPE accounts enable people to manage their benefits – effectively becoming their own “case manager” – and easing their dependence on often inefficient and unresponsive social welfare bureaucracies.

WIC (formally the Special Supplemental Nutrition Program for Women, Infants, and Children) is a concrete example of how bureaucratic barriers can impact program enrollment. Despite increases in funding and strong evidence for its boost in outcomes for mothers and children, the share of eligible household participating in the program has fallen over the past ten years. One significant barrier to uptake is the requirement that families take time off of work to apply in person and bring their children to multiple appointments at clinics. HOPE accounts, if implemented well, could help families by creating an online platform where they can complete an initial application and better manage their benefits.

Policymakers should also make it easier for the elderly and other vulnerable groups to navigate eligibility and participate in SNAP. Researchers recently found that “providing information on eligibility or information plus application assistance” can significantly increase take-up rates among the elderly. Interventions should be designed with the behavioral differences of eligible groups for various social safety net programs, including food assistance.

The third major contributor to food insecurity is geography. According to the USDA, nearly 40 million Americans live in rural communities considered “food deserts” because they lack a nearby grocery store or food pantry or bank. And although rural communities make up 63% of counties in the U.S., they represent 87% of counties with the highest rates of food insecurity. These “food deserts” tend to disproportionately impact the rural poor, Black and Hispanic households, and families with children. To address this disparity, some organizations have launched mobile food pantries and food delivery programs that ship food in bulk to low-income families, but more access is needed to bridge this geographical barrier.

Earlier this month, Senator Mark Warner, along with several senators from both sides of the aisle, introduced the Healthy Food Access for All Americans (HFAAA) Act which provides incentives, including tax credits or grants, to food providers who serve low-access communities and become designated as a “Special Access Food Provider” certification process through the U.S. Treasury Department. This legislation is a crucial way to incentivize food providers to set up shop in rural and hard-to-reach communities.

CONCLUSION

The Trump administration’s feeble response to America’s hunger crisis was a national disgrace, one of the many ways in which it thoroughly bungled the nation’s response to the Covid pandemic. The contrast with the Biden administration’s sharp focus on hunger and decisive moves to alleviate it couldn’t be more dramatic.

Nonetheless, it should be just the beginning of a new national commitment to wiping out hunger and malnutrition in America. It’s time for a vigorous public response to growing concentration in the food industry, as well as a new push to use modern information technologies to help low-income Americans cut through burdensome bureaucratic obstacles and take charge of their economic security. We’ve also learned lessons during the pandemic for how to provide meals to families outside of the traditional systems, and we should preserve these going forward in the effort to be better prepared for a future crisis and to curb hunger in America.