If you think your credit report is accurate, there is a good chance you are wrong. According to the Federal Trade Commission (FTC), one in five Americans has a potentially material error in their credit file, and one of the biggest contributors is medical bills—with half of all medical bills containing an error.

In fact, mistakes on credit reports have become so pervasive that around a third of all complaints filed annually to the Consumer Financial Protection Bureau (CFPB) resulted from problems with consumer credit reports.

Credit report errors are a serious threat to the financial well-being of American families. As Senator Elizabeth Warren has noted, “credit reports regularly contain errors that can make it harder for families to access credit, find jobs, and get housing.” And as many consumers know all too well, it’s very difficult to get those errors corrected.” (1)

Under the Fair Credit Reporting Act, the company that furnished the information to the credit bureau must conduct an investigation to verify the information and correct a mistake, if they find one. Unfortunately, consumers who want to try to fix mistakes on their credit report face three daunting obstacles.

First, the system put into place by the credit reporting agencies heavily favors creditors and other data furnishers. Credit bureaus almost exclusively depend on lenders (such as banks, credit unions, credit card providers, and mortgage underwriters).

Consumers contacted the credit reporting agencies approximately eight million times in 2011 to initiate a credit dispute. But only a small fraction of those disputes was resolved internally by credit bureau staff. According to the CFPB, 85 percent of credit report disputes are passed on to data furnishers (the lenders) to investigate and resolve. (2) Unfortunately, in most cases the disputes are then shelved unless the consumer perseveres.

Second, the credit report agencies earn their profits by providing services such as credit checks to the very entities that provide the data used to create the credit reports – banks, mortgage lenders, credit card companies, retailers, and other businesses that provide credit. This creates a serious conflict of interest.

Third, despite several notable efforts to try to empower consumers, trying to correct errors on your credit report is still tedious, confusing, and time consuming.

CREDIT REPAIR ORGANIZATIONS AND COMPANIES

Because the system is rigged against them, many consumers turn to credit counseling agencies or credit repair companies. The dispute system designed to help consumers fix the problem favors the position of the debt collector over the consumer. Specifically, the credit bureau is only legally required to check with the creditor or debt collector and ask them whether they stand by their claim. As long as the creditor says you owe money, the dispute is resolved in their favor. As the National Consumer Law Center concludes: “Credit bureaus have little economic incentive to conduct proper disputes or improve their investigations.” (3)

Credit counseling agencies are typically a free resource from nonprofit financial education organizations that review your finances, debt and credit reports with the goal of teaching you to improve and manage your financial situation.

A credit repair company is a firm that offers to improve your credit in exchange for a fee. Unfortunately, the quality of these firms varies greatly. Some credit repair firms are highly reputable and follow best practices. Unfortunately, a significant cohort of credit repair firms are not good actors and, in some cases, have committed outright fraud. In 2016 the Consumer Financial Protection Bureau (CFPB) stated that “more than half of people who submitted complaints with the CFPB about credit repair chose the issue ‘fraud or scam’ to describe their complaints.”

There are some telltale signs for consumers trying to separate the bad actors from legitimate credit repair firms. Companies should be avoided that:

- Demand an upfront payment.

- Don’t provide a written agreement that includes cancellation rights for consumers.

- Guarantee they’ll raise your credit score or fix an error.

- Have multiple complaints against them with the Consumer Financial Protection Bureau or the attorney general’s office in the state where they operate.

- Suggest they can remove legitimate negative information.

- Offer to create a new credit profile based on a new employer identification number, rather than your Social Security number.

In contrast, responsible credit repair companies not only follow federal and state law but also:

- Offer a free consultation

- Have a track record and consistently solid reviews from past clients.

- Have an attorney on staff.

- Are licensed, bonded and insured.

WHAT NEEDS TO CHANGE?

To protect consumers, some policymakers have suggested new regulations to further police the credit repair industry. They note that credit repair firms don’t do anything someone with a bad credit report couldn’t do on their own. Anyone can dispute credit errors on their own behalf. But the Do-It-Yourself approach can be dauntingly complicated and time-consuming for harried families.

In essense, paying for credit repair assistance is really no different than paying an accountant or purchasing software to do your taxes – something 90 percent of Americans do according to the Internal Revenue Service.

It is important to note that there is already existing legislation to regulate the credit repair system. The Credit Repair Organizations Act (CROA) was signed into law in 1996 to protect consumers from the unscrupulous practices commonly used by several credit scammers.

Because of CROA, credit repair organizations are not permitted to misrepresent the services they provide, including guaranteeing the removal of negative credit listings. Credit repair organizations are also not permitted to attempt to create a “new” credit file or advise you to lie about your credit history. The Act also bars companies offering credit repair services from demanding advance payment, gives consumers certain contract cancellation rights as well as the right to sue a credit repair organization that violates CROA. (4)

CROA is a sensible law, and despite criticisms that it does not go far enough in regulating the credit repair industry, the law does provide consumers with protections against bad actors in the credit repair sector without eliminating legitimate credit repair firms. CROA needs strengthening, not in the form of new regulations but rather more effective enforcement.

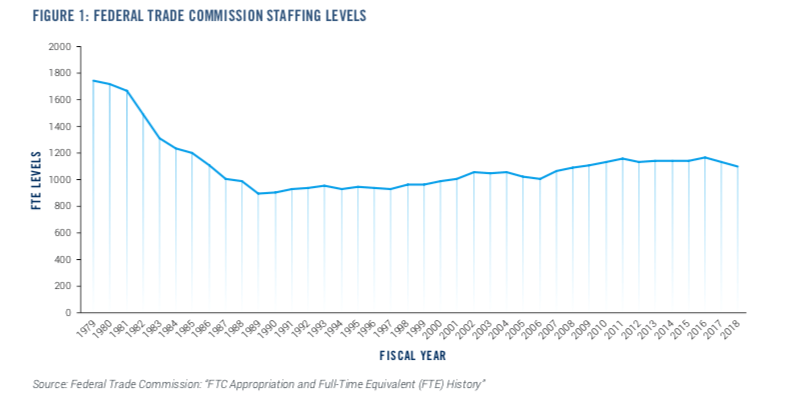

Under CROA, the Federal Trade Commission (FTC) is the primary enforcement body at the federal level. The problem is the FTC is severely underfunded and understaffed. In a Senate hearing last year Commissioner Rebecca Slaughter said the FTC’s staff level is 50 percent below its level at the beginning of the Reagan administration in 1981. Senators Jerry Moran (R-Kan.) and Catherine Cortez Masto (D-Nev.) agreed the FTC needs more resources and is “understaffed.” (5)

As Table 1 confirms, FTC staffing levels dropped dramatically during the 1980s and have never really recovered. Yet, over the same time, the responsibilities of the agency have dramatically changed and expanded. Today the FTC has to address some 2.7 million complaints a year in areas from debt collection, to identify theft, to imposter scams. (6)

Better enforcement of CROA would obviate the need to pile on new rules. Unfortunately, in fact, Congress has added to the FTC’s workload even as its workforce has shrunk. The simplest solution is to provide the FTC with additional resources dedicated to enforcing CROA and protecting consumers from those credit repair companies that have acted fraudulently or in bad faith.

To pay for this increase in supervisors, a small annual fee could be placed on the credit reporting agencies (Equifax, TransUnion, and Experian). To create an incentive for these agencies to be more responsive to consumer complaints about credit reporting agencies, the fee could be lowered or raised in synchronization with the number of consumer complaints about their credit reports.

OTHER REMEDIES

Another approach to fixing the current system is to go to the source of the problem, eliminating some of the causes for the extraordinary amount of errors made by the credit reporting industry. As Aaron Klein of the Brookings Institution has noted, there are three major reasons why credit scores are so inaccurate: “size, speed, and economic incentives of the system.”

One way to change the incentive structure would be to create some consequences for credit rating companies that frequently give lenders inaccurate data about borrowers. Lawmakers could consider legislation that would penalize credit reporting agency error rates above a certain level. Klein’s approach would use a random sample method (5 to 10 percent of complaints) to review credit rating firms’ performance. Another approach would be to grade the credit bureaus on their error and response rates.

CONCLUSION

While it is tempting to lump all credit repair firms into the same basket, many of these firms act in good faith and follow CROA to the letter of the law. Yet there is no doubt that a significant number of these companies are misleading consumers and sometimes acting fraudulently. If lawmakers really want to crack down on these bad actors, however, the first step should be strengthening enforcement of existing law.

Otherwise, spawning new laws and regulations would likely enmesh all credit repair firms in new layers of regulatory complexity and compliance burdens, making it even harder for consumers to detect and correct errors on their credit reports. In CROA we have the consumer protection law we need, now it’s time to focus on oversight and enforcement.

[gview file=”https://www.progressivepolicy.org/wp-content/uploads/2019/05/CreditFinal.pdf”]

(1) Brian Schatz Press Release: “Following Equifax Breach, Schatz, Warren, McCaskill, Colleagues Reintroduce Legislation to Help Consumers Catch And Correct Credit Report Errors,” September 11, 2017

(2) Kelly Dilworth, “Consumer watchdog report details credit bureaus’ work,” Creditcard.com, December 13, 2013

(3) Aaron Klein, “The Real Problem with Credit Reports is the Astounding Number of Errors,” Brookings Institution, September 28, 2017

(4) 15 USC Chapter 41, Subchapter II-A: Credit Repair Organizations

(5) Kate Patrick, “FTC Asks for More Control Over Big Tech, Privacy Issues,” Insidesources.com, November 30, 2018

(6) Federal Trade Commission, “FTC Releases Annual Summary of Complaints Reported by Consumers,” March 1, 2018

(7) Aaron Klein, “The Real Problem with Credit Reports is the Astounding Number of Errors,” Brookings Institution, September 28, 2017

(8) Ibid

It would be one thing if this budget deal merely repealed the sequester, which was never meant to take effect and has hamstrung important investments in both defense and domestic initiatives. The Senate budget deal, however, would raise spending above the original levels agreed to by both parties in the Budget Control Act of 2011. It would also cut taxes for corporations by an additional $17 billion and repeal important cost-control measures imposed by the Affordable Care Act – all without paying for them.

It would be one thing if this budget deal merely repealed the sequester, which was never meant to take effect and has hamstrung important investments in both defense and domestic initiatives. The Senate budget deal, however, would raise spending above the original levels agreed to by both parties in the Budget Control Act of 2011. It would also cut taxes for corporations by an additional $17 billion and repeal important cost-control measures imposed by the Affordable Care Act – all without paying for them.