Warning! Wonky post ahead.

At PPI, we are focused on understanding where the new jobs of the future are coming from, and how policymakers can help foster their growth. That sometimes requires identifying underlying trends that may not be obvious.

The growth of multiple networks of ecommerce fulfillment centers–built by retailers such as Amazon, Walmart, Nordstrom and many others–is effectively a transition from “circuit-switched” physical distribution networks to “packet-switched” physical distribution networks. Analogous to the shift from circuit-switched telephone networks to the packet-switched networks that make up the Internet, the new ecommerce distribution networks are capable of much greater flexibility and lower costs than the dumb warehouses which preceded them.

And just like the Internet helped create a wave of new industries in tech hubs, this new “Internet of Goods” is going to enable a new wave of business and job creation in domestic manufacturing and food production. With the right policy, this growth in domestic manufacturing and food production jobs will benefit states across the country.

Background

The old telephone networks were “circuit-switched”–that means the telephone company would set up a separate circuit for each call, and the callers would “own” the circuit until the call was over. The connections were solid, but they were not flexible, and they wasted network resources (since so much of a voice conversation is dead air). By contrast, the multiple networks that make up the Internet break down data (including voice) into packets, which are then routed to their destinations and reassembled. Packet switching requires a lot more intelligence in the system, but it’s much more flexible and lower cost than circuit switching.

As we’ve seen over the past two decades, the widespread introduction of packet switching in telecom opens up all sorts of possibility for entrepreneurs and existing companies to create new digital products and services. The Internet revolution transformed digital industries, creating millions of jobs in the process. In particular, since December 2007, the tech-ecommerce sector has generated 1.7 million jobs. That’s around half of private sector job growth, outside of health and education.

The old warehouse-retail distribution system was analogous to circuit switching. Big trucks would bring boxes of identical goods from manufacturers or importers. The warehouses would break down the incoming goods into predictable patterns. All the boxes of identical lamps, for example, would be stored together for easy retrieval when it was time to put together the shipments to individual retail stores. The shipments were regular and straightforward, and didn’t require much “intelligence” in the networks.

Ecommerce fulfillment centers are much more like the “routing nodes” of the Internet. They take in goods from a wide variety of sources, at irregular interviews, including returns from consumers. They store the goods according to their own internal schema. For example, Amazon uses a “random stow” method that distributes incoming products across the fulfillment center in a way that maximizes the odds of products in the same order being close together. Since most consumers don’t order multiples of the same item, the Amazon random stow method might distribute the most popular items across the whole fulfillment center, rather than clumping them all together. Then the ecommerce fulfillment center puts together consumer orders and ships them out.

The Internet of Goods

In effect, these multiple networks of fulfillment centers are creating a new packet-switched “Internet of Goods.” The first economic consequence, as we have described, is the creation of hundreds of thousands of jobs in electronic shopping companies and fulfillment centers. This is analogous to the first wave of Internet growth in the 1990s.

The next step, we believe, will be the creation of new businesses in domestic manufacturing and food production that make use of the flexibility and low cost of the Internet of Goods. For example, we can visualize custom manufacturing operations that are located near fulfillment centers. They take production orders from customers, and then ship out the product on the same day via the fulfillment center. The cost of distribution would go way down compared to today’s situation, giving domestic custom manufacturers a sustainable competitive advantage against foreign rivals.

To get an idea of magnitudes, consider that as of 2015, 57% of the retail price of furniture was the cost of distribution (transportation, wholesale, and retail). For women’s clothing, 59% of the retail price was the cost of distribution, and for food, 40% of the retail price was the cost of distribution. Reducing the cost of local distribution while shortening the distribution time could open up new sustainable business models for domestic manufacturers and food producers.

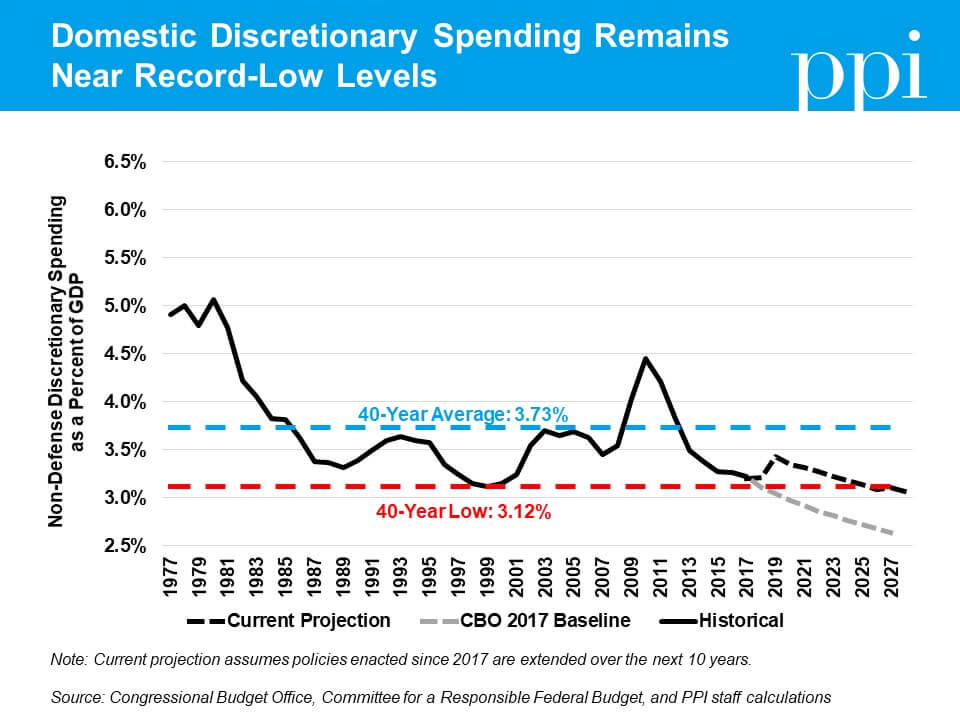

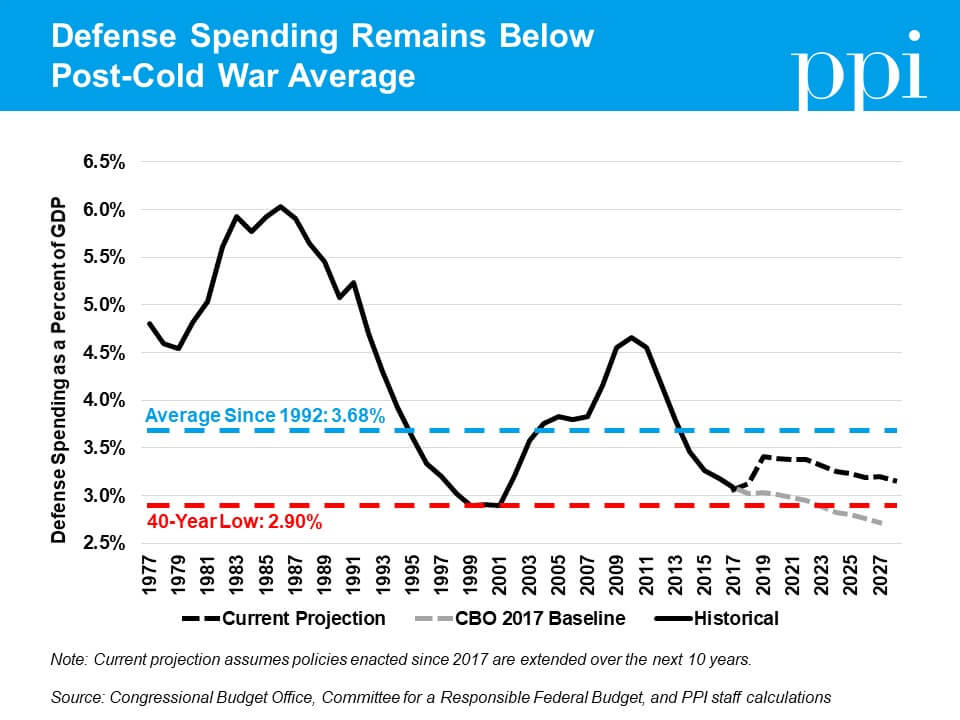

The story is similar for defense spending. Thanks to the pressure put on by the sequester, defense discretionary spending fell to just under 3.1 percent of GDP in FY2017. Under the BBA, defense spending would increase to 3.4 percent of GDP in FY2019 before falling again. Unlike domestic discretionary spending, however, defense would remain above the all-time low it reached before the 2001 terrorist attacks throughout the next decade.

The story is similar for defense spending. Thanks to the pressure put on by the sequester, defense discretionary spending fell to just under 3.1 percent of GDP in FY2017. Under the BBA, defense spending would increase to 3.4 percent of GDP in FY2019 before falling again. Unlike domestic discretionary spending, however, defense would remain above the all-time low it reached before the 2001 terrorist attacks throughout the next decade.