Senate Democrats yesterday unveiled an ambitious $1 trillion infrastructure proposal that would invest in everything from roads and railways to hospitals and high-speed broadband. And in sharp contrast to recent proposals by the Trump administration, this new Democratic proposal includes a plan to fully pay for itself.

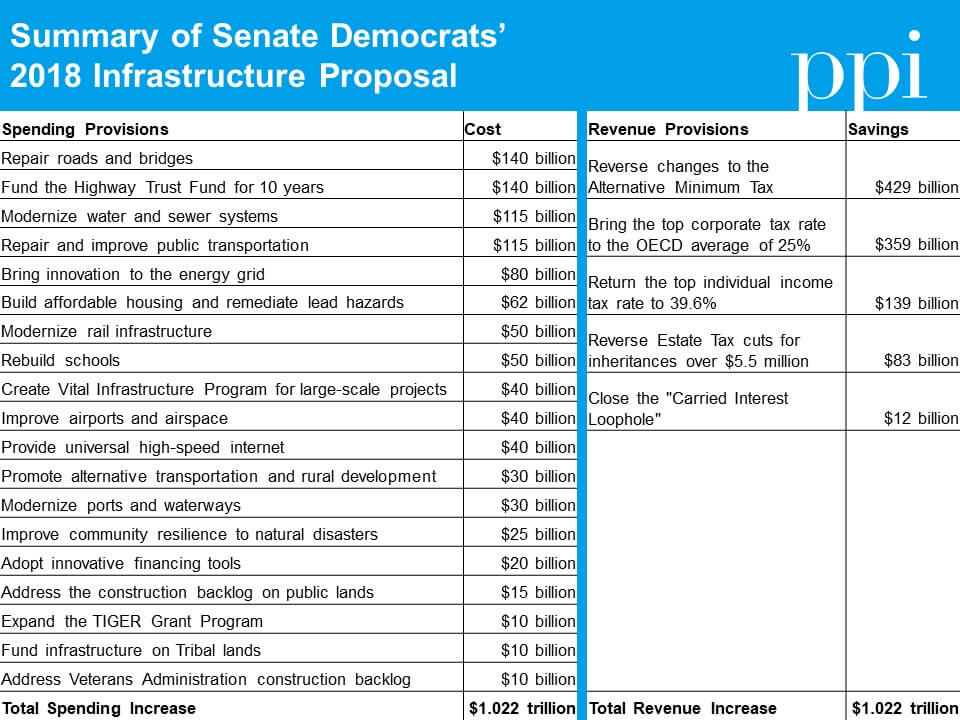

The proposal calls for repealing three elements of the recently-enacted Republican tax bill that almost exclusively benefit the wealthiest taxpayers, as well as closing the “carried interest loophole” that allows certain earnings on Wall Street to be taxed at a lower rate than other compensation. It would also raise the top corporate tax rate from 21 percent to 25 percent – the average rate among OECD countries and the level originally proposed by House Ways and Means Chairman David Camp (R-MI) back in 2014.

Spending in the new proposal is broken down into 19 different categories, each with its own budget and parameters for implementation. The package as a whole includes additional guidelines, such as encouraging the adoption of innovative technologies and long-term financing mechanisms, to accompany proposed spending. If fully implemented, the proposal’s authors believe it would create 15 million good-paying jobs.

Compare that to the proposal offered last month by the Trump administration, which claims to increase infrastructure investment by $1.5 trillion even though the administration’s budget provided no additional funding for it. The Trump proposal would also privatize a wide variety of physical assets, such as waterways and interstate highways, that the Democratic proposal would retain for public use.

Another advantage of the Democratic proposal is that it makes clear to voters the true cost of the Republican tax cut enacted last year – something PPI has been urging Democrats to do since before passage of the bill. For less than half the cost of this terrible tax cut, voters could have gotten a robust 21st century infrastructure that would benefit our economy for generations to come. That message could be a powerful one heading into the midterm elections, especially if paired with a credible and comprehensive Democratic framework for “repealing and replacing” the GOP tax bill.

Senate Democrats should be commended for including suggested funding mechanisms in their proposal. Whereas Republicans added over $2 trillion of tax cuts to the national debt, the Democrats’ infrastructure proposal would be fully funded and deficit-neutral. If implemented in a timely and cost-effective way, their proposal might even reduce budget deficits because of the high economic returns on well-targeted infrastructure investment. The stark contrast between these two approaches to fiscal policy is just further evidence that only one of the two political parties in Washington is making any attempt to pay for its proposed policies.

But when they find themselves in a position to implement these policies, Democrats should keep in mind that simply paying for their new proposals isn’t sufficient.

The federal government is now spending $1 trillion more than it raises in revenue every year – a gap that is projected to more than double over the next decade. It will be impossible to sustain social programs as they’re currently structured, let alone fund new ones, without major reforms to both existing spending and the tax code. The government cannot afford to commit every dollar of additional revenue to new promises until it finds a way to pay for the ones we’ve already made.

For these reasons, Democrats would be wise to use yesterday’s proposal as merely the starting point for crafting a complete fiscal policy: one that sustainably finances both public investments and a strong social safety net without placing an undue burden on young Americans. A fiscally responsible public agenda along these lines is what the Democratic Party needs, and it’s what our country deserves.