What explains Wall Street’s remarkable resilience while Main Street endures a punishing pandemic recession?

Although the three economic relief packages Congress has passed since the crises began no doubt have played a supportive role, the answer mainly lies in bold intervention by the Federal Reserve. The Fed played a similar role in staving off a financial collapse following the 2007-08 housing crisis. With a robust toolkit at its disposal, from slashing interest rates, purchasing securities, lending money directly and backstopping unstable markets, the Fed allayed investor fears about the impact of the Covid-19 lockdown on corporate profits and debts.

While Fed action to keep capital markets afloat is essential to prevent a wider economic implosion, it does have the unfortunate consequence of aggravating economic inequality. Only about 55% of Americans own stocks, and the top 1% percent own 50% of all equities. Pushing up stock prices, in other words, helps the rich get richer.

The progressive response to this distributional dilemma is not to let financial markets crash, but to democratize capital ownership in America.

U.S. policymakers therefore should emerge from the Covid-19 crisis resolved to tackle a growing “wealth gap” that is largely defined by race and ethnicity. According to the Urban Institute, the median wealth of white families in 1963 was $45,000 higher than the median wealth of nonwhite families. By 2016, the median wealth of white families had climbed to $171,000, or $132,600 more than the median wealth of black families ($17,400) and of Hispanic families ($21,000).

The strategy for narrowing the nation’s wealth gap has three key parts: Reduce racial and ethnic wage disparities, expand home ownership, and create new opportunities for Americans now locked out of capital markets to build financial assets that allow them to take advantage of the power of compound interest.

Focusing here on the third element, PPI endorses a radically pragmatic idea for democratizing capital ownership: Create lifetime savings accounts for all newborns, tied to voluntary national service. Here’s how these new “America Serves” investment accounts would work:

At birth, the federal government would stake every U.S. child to a $5,000 investment account similar to a government Thrift Savings Plan or a 401k. The money would be invested in a market index or target date fund to ensure the high average returns of investing in equities rather than low-return T-bills. With one stroke, this action would put America on the road toward universal capital ownership.

Families could also contribute post-tax earnings to their children’s accounts. No one could touch the funds in the account until the children turned 18. An “asset waiver” would also protect the account, preventing the income from being counted toward means testing for financial aid, food stamps, Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI) or Medicaid.

Upon turning 18, account owners would face a choice. If they agree to perform a year of national service before they turn 25, they would be deemed 100% vested and could tap their funds after serving for specified purposes at tax advantaged rates. These include: post-secondary tuition, down payment on a first home, or starting a business.

Our goal is to start by engaging one million young adults in qualified domestic and international service programs (including active military), out of the roughly four million who turn 18 every year. Those who choose not to serve would be entitled to only the returns (and principal) on half the original stake — $2,500. The other half of their accounts would revert back to the taxpayers via the U.S. Treasury.

Although the governments’ upfront investment is considerable, over the long-term costs of America Serves accounts will likely decline. We estimate that the first 10 years would cost $230 billion, and a 25-year timeline sees total outlays of just under $700 billion.

It’s even possible that after 25 years, the program could become self-financed, depending on how many people choose to serve. Our projections are based on the assumption that one in four newborns will receive the full government contribution via service.

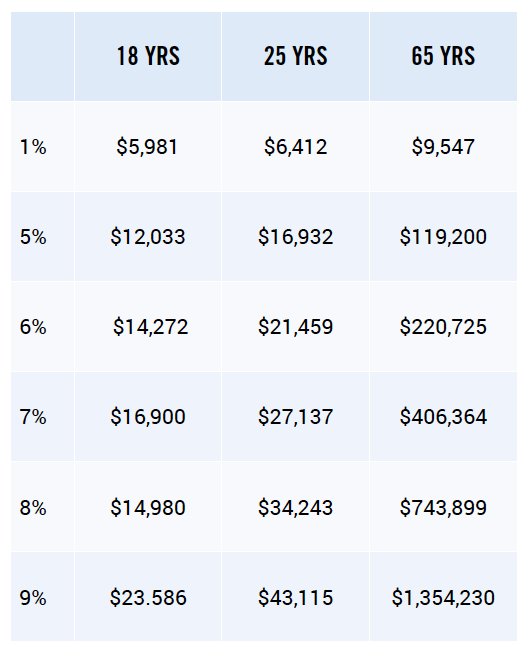

We use a historic average return rate on the S&P 500 of 8% for our assumptions. That means the $5,000 initial taxpayer contribution invested in the market grows to $34,250 after 25 years (See tables below). Assuming that one in four account holders choose to serve, the rest will be required to return to the U.S. Treasury half their savings – $17,125 (half the original government contribution plus market earnings.) That would be enough to stake three newborns with $5,000 contributions.

By creating a strong incentive to serve, this proposal – in the spirit of the World War II G.I. Bill — would link the opportunity to start building significant financial assets to civic responsibility. It would help to scale up voluntary national service and make it a more potent tool for public problem solving. Volunteers, for example, could assist in contact tracing during future pandemics, provide services to the swelling population of older Americans, help tutor low-income children, clean up public spaces, and much more.

A large national service program would also help our divided society bridge its class, racial and cultural divisions by bringing together youths from all backgrounds to engage in a common civic enterprise.

The organizing framework already exists: AmeriCorps and Peace Corps and other volunteer programs that operate under the aegis of the Corporation for National and Community Service (CNCS). The 75,000 yearly volunteers in these civilian service programs are in addition to the approximately 180,000 Americans who join the active duty military each year, and who would also qualify for full “America Serves” investment accounts.

The idea of expanding national service already enjoys bipartisan support in Congress. Senators Chris Coons, (D-DE), Roger Wicker (R-MS) and Cincy Hyde Smith (R-MS) recently introduced the CORPS ACT, which would increase from 75,000 to 150,000 in year 1, and up to 300,000 in years 2 and 3, the number of civilian national service slots.

“As we work to recover from the dual challenge of a public health crisis and an economic crisis, national service presents a unique opportunity for Americans to be part of our response and recovery while earning a stipend and education award and gaining marketable skills,”

Sen. Coons has said. “Expanding these programs to all Americans who wish to serve should be a key part of our recovery effort.” Another sponsor of the bill, Sen. Tammy Duckworth (D-IL), a Purple Heart military veteran gravely wounded in action, notes that “Just as picking up a rifle to defend our country is ‘American Service,’ so is helping out a food pantry for those at risk of hunger, assisting students with remote education and helping patients make critical health care decisions.”

Simply put, stock markets have been the most reliable generator of long-term wealth accumulation in history, and financial capital grows traditionally faster than wages. There have also been a series of innovations that have helped underpin the ability to efficiently and safely invest for the long term.

These include Index based, passive investing in target date ETF’s (Exchange Traded Funds), which essentially invest in a diverse basket of stocks or other assets such as commodities or bonds, and manages risk according to a future “target date” – usually when someone plans to retire. This passive investment approach diversifies the risk of any single stock plunging in value, and uses the ETF structure with minimal fees as opposed to active management models that assess much higher fees. Small investors get access to higher returns with less risk and keep more of their money as it grows.

To illustrate how “America Serves” investment accounts could grow, consider these projections of possible returns over 18, 25, and 65 years from an initial $5,000 contribution:

Let’s look at the standard market benchmark of the S&P 500, which since adopting 500 stocks to the index in 1957 has produced an annual return of 8% (through 2018). Yet, since stocks and bonds fall as well as rise in value, it is worth looking at the largest “drawdown” (market pullback) since that time. According to S&P Dow Jones Indices:

Let’s look at the standard market benchmark of the S&P 500, which since adopting 500 stocks to the index in 1957 has produced an annual return of 8% (through 2018). Yet, since stocks and bonds fall as well as rise in value, it is worth looking at the largest “drawdown” (market pullback) since that time. According to S&P Dow Jones Indices:

“the most significant market downturn occurred in the early 1970s, coinciding with the U.S. economy reeling from double-digit inflation courtesy of a quadrupling in oil prices. During this period, the S&P 500 declined by 45% over a 21-month period and took three and a half years to return to its previous local peak.”

This means that should the market be down in any given year, history shows us the largest pullback only took about 5 years to regain all its lost value. What that means is that by ensuring that every American has an opportunity to build a significant financial asset, this proposal would enhance their economic security and resilience in economic downturns from whatever sources.

The pandemic has thrown a harsh light on America’s economic and racial inequities. The government’s otherwise commendable efforts to keep the comatose U.S. economy from flatlining have had the unintended effect of making these disparities worse. By giving every newborn child a capital stake in America’s future, we will put our economy on a higher growth trajectory while also making it fairer. And by linking the accounts to service, we will create a powerful new incentive for young Americans to give back to their communities and their country.

(Note: The author would like to thank Alan Khazei, a longtime PPI friend and co-founder of Boston’s City Year voluntary service program, who with the late Harris Wofford and other leading national service advocates originally envisioned the link between “service bonds” and service.)