|

issue: Tax

Ritz for Forbes: “Three Tax Cuts a Santa Claus Congress Could Deliver in 2019”

Congress must pass a comprehensive funding bill by the end of next week to avoid a repeat of last year’s government shutdown. Such a must-pass bill at the end of the year often becomes a “Christmas tree” decorated with various policy riders and pet projects for members of both parties in Congress. But under this year’s tree, a fiscally irresponsible Santa Claus Congress might leave wealthy Americans three gifts that together could cost up to $1 trillion over the next ten years – all put on the nation’s credit card for young Americans to pay off for generations to come.

PPI’s Ben Ritz Talks Social Security with Ric Edelman

The Director of PPI’s Center for Funding America’s Future, Ben Ritz, joined personal-finance advisor Ric Edelman on his nationally syndicated radio show to discuss the challenges facing Social Security, their role in the 2020 election, and PPI’s proposal to strengthen the program for future generations. Listen to the interview below and read our full plan here.

Ritz for Forbes, “Projected Deficits Grew $872 Billion In Three Months. Here’s How To Rein Them In”

A new report from the Congressional Budget Office projects federal budget deficits between 2019 and 2029 to be $872 billion higher than was projected just three months ago. As a result, Donald Trump will be forced to campaign for re-election next year with his government running a trillion-dollar deficit. Democrats should hold the “king of debt” accountable for his inability to manage the nation’s finances and present voters with a compelling alternative: a new progressivism that invests in our country without burying young Americans under a mountain of debt.

The increase in CBO’s deficit projections is largely due to the bipartisan budget deal signed into law this month and other spending policies enacted over the summer, which CBO says together will cost nearly $2 trillion – making them almost as expensive as the tax-cut bill enacted by Trump and the Republican-controlled Congress in 2017. Projected deficits also increased by almost $280 due to technical changes in CBO’s modeling. Partially offsetting these costs was a reduction in CBO’s forecast for interest rates, which brought projected deficits down by a whopping $1.4 trillion.

That a change of less than one percentage point in interest rates can cost nearly as much as the budget deal or the Trump tax cuts is a testament to the size of our national debt on which that interest is owed. The $16.5 trillion debt (which grows to almost $22.5 trillion if one includes intragovernmental debt such as that owed to the Social Security and Medicare Trust Funds) will only become worse moving forward as the government is projected to spend $1 trillion more than it raises in revenue every single year from 2020 onward if current laws remain unchanged.

Facing the Future Podcast: Ben Ritz on A Progressive Budget for Equitable Growth

During the most recent Facing the Future, Ben Ritz discussed PPI’s latest policy proposal, “A Progressive Budget for Equitable Growth.” The blueprint addresses a variety of issues, such as the national debt, taxes, health care, infrastructure, climate change, and more.

Media Advisory: Building a #BetterBudget, A Forum on Investing in America’s Future and Tackling Our National Debt

WASHINGTON—The Progressive Policy Institute and House Blue Dog Coalition will host a lunchtime discussion today at the Longworth House Office Building about what leaders in Congress can do to invest in equitable growth while reducing our national debt.

America suffers from a shortsighted fiscal policy that promotes consumption today instead of investing in tomorrow. The federal government now spends more to service our growing national debt than it does on public investments in education, infrastructure, and scientific research combined. Meanwhile, a perfect storm of fiscally irresponsible tax cuts and an unwillingness to tackle escalating health and retirement spending are feeding trillion-dollar deficits as far as the eye can see. This is not a fiscal policy for strengthening America’s future – it’s blueprint for American decline.

At the event, PPI will release a comprehensive budget plan with over 50 policy recommendations for the next administration to make room for public investments in education, and infrastructure, and scientific research; modernize federal health and retirement programs to reflect an aging society; and create a progressive, pro-growth tax code that raises the revenue necessary to pay the nation’s bills.

Lunch will be provided. This event is open to the press.

Who:

- Rep Stephanie Murphy (D-FL), Co-Chair of the House Blue Dog Coalition

- Rep. Ed Case (D-HI), Co-Chair of the Blue Dog Task Force on Fiscal Responsibility and Government Reform

- Rep. Ben McAdams (D-UT), Co-Chair of the Blue Dog Task Force on Fiscal Responsibility and Government Reform

- Ben Ritz, Director of PPI’s Center for Funding America’s Future

- Marc Goldwein, Senior Vice President at the Committee for a Responsible Federal Budget

- Emily Holubowich, Executive Director of the Coalition for Health Funding and Co-Founder of NDD United

- Will Marshall, President of PPI, Moderator

When: Thursday, July 25, 2019

12:00 PM – 1:30 PM

Where: Longworth House Office Building, Room 1302

15 Independence Ave, SE

Washington, D.C. 20515

For press inquires, please contact Carter Christensen, media@ppionline.org or 202-525-3931.

Kim for Medium: “How to get more companies to put people over profits”

Corporate profits are soaring. Yet Americans’ paychecks are inching upward by comparison. It’s no wonder many Americans feel anxious despite an economy that, by the numbers, is booming.

This disconnect between shareholders’ prosperity and workers’ precarity has led many on the progressive left to question the very future of capitalism. Some 2020 presidential candidates, such as Sens. Elizabeth Warren and Bernie Sanders, now routinely paint Big Business as the enemy of middle-class mobility and have called for drastic measures to rein in corporate power and mandate better behavior.

It might be too soon, however, to write off U.S. companies as a force for good.

Read the full piece on Medium by clicking here.

Ritz for Forbes, “Keep the White Walkers Out of Our Tax Code”

Millions of Americans watched the 70th episode of HBO’s Game of Thrones last Sunday to see who would win the ultimate battle between the people of Westeros and the undead army of the White Walkers. But there is another undead threat here in America that has gotten far less attention, one that marches not on our lands and castles, but on our tax code: they’re called “tax extenders.”

What exactly are tax extenders, you may be wondering, and how are they at all similar to the mythical antagonists from Westeros? Tax extenders were a package of “temporary” provisions that that gave preferential tax treatment to particular industries or activities. For nearly 30 years, Congress voted to extend the life of these provisions – which primarily benefited niche special interest groups – for just one or two years at a time. The main purpose of this ritual was to hide the true long-term costs of these special-interest handouts from the American people.

Do-Something Congress No. 9: Reserve corporate tax cuts for the companies that deserve it

Americans are fed up seeing corporate profits soaring even as their paychecks inch upward by comparison. Companies need stronger incentives to share their prosperity with workers – something the 2017 GOP tax package should have included.

Though President Donald Trump promised higher wages as one result of his corporate tax cuts, the biggest winners were executives and shareholders, not workers. Nevertheless, a growing number of firms are doing right by their workers, taking the high road as “triple-bottom line” concerns committed to worker welfare, environmental stewardship and responsible corporate governance. Many of these are so-called “benefit corporations,” legally chartered to pursue goals beyond maximizing profits and often “certified” as living up to their multiple missions. Congress should encourage more companies to follow this example. One way is to offer tax breaks only for high-road companies with a proven track record of good corporate citizenship, including better wages and benefits for their workers.

THE CHALLENGE: Good corporate citizenship is punished, not rewarded, in a market that puts profits first.

The pressure to return profits to shareholders – the tyranny of so-called “shareholder primacy” – is one reason companies have been disinvesting in their workers. As Brookings Institution scholars Bill Galston and Elaine Kamarck have noted, many companies are increasingly reverting to “short-termist” behavior to avoid missing the quarterly earnings targets promised to shareholders (1). For instance, one notable survey of more than 400 CFOs found that 80 percent would “decrease discretionary spending on R&D, advertising and maintenance … to meet an earnings target” and 55 percent would “delay starting a new project” even if it meant sacrificing long-term value (2).

Companies also don’t seem to be raising wages or investing in worker training. Even as many firms have been reporting some of their best profits in years during this recovery (3), companies are cutting back on benefits like health insurance and offering less on-the-job training than they once did. And despite their recent uptick, workers’ wages haven’t caught up to where they should be. According to a Brookings Institution analysis, real wages for the middle quintile of workers grew by just 3.41 percent between 1979 and 2016, and actually fell slightly for the bottom fifth.

Corporate short-termism is bad for workers, who don’t get the wages and training they deserve. It’s also bad for companies, which are shortchanging their long-term health to satisfy short-term shareholder demands. But as long as current corporate culture remains fixated on companies’ stock prices, firms will feel tremendous pressure to put short-term profits above all other priorities – and often at workers’ expense.

THE GOAL: ENCOURAGE MORE BUSINESS TO BE “TRIPLE-BOTTOM LINE” CONCERNS THAT PUT PEOPLE ON PAR WITH PROFITS

A small but growing number of firms have begun to reject the hold of “shareholder primacy” and have organized themselves as “triple-bottom line” companies committed equally to social and environmental good as well as profit. Among these is the growing number of “benefit corporations” specially organized under state law with the purpose of “creating general public benefit.” Since 2010, 34 states and the District of Columbia have passed legislation legally recognizing benefit corporations and protecting them from shareholder lawsuits for decisions that don’t maximize profits. Notably these states include Delaware, which is the leading “domicile” – or legal home – for most of America’s major companies. A significant number of benefit corporations have also won third-party certification from the nonprofit B Lab as “Certified B Corps” – essentially a Good Housekeeping seal of approval for benefit companies that have met strict standards for worker treatment, environmental stewardship and social responsibility. Among the many factors considered for certification are the share of workers who get formal training; rates of employee retention and internal promotion; the share of workers receiving tuition reimbursement or similar benefits for training and education; the extent to which “worker voice” plays a role in the company’s governance; pay equity; and company practices to reduce its environmental footprint.

According to the nonprofit B Lab, more than 2,500 businesses globally are certified B Corps. While the vast majority of these businesses are small, certified B Corps include such well-known U.S. and global brands as outdoor clothing maker Patagonia, Cabot Creamery, Ben and Jerry’s Ice Cream, and New Belgium Brewery, the makers of Fat Tire beer. A small but growing number of B Corps are now publicly traded, including cosmetics company Natura; Sundial Brands, a subsidiary of Unilever; and Silver Chef, a company that finances commercial kitchen equipment purchases for restaurateurs. These firms are proof that companies with an avowed social mission can in fact succeed in a cutthroat capital market. If more companies follow suit, the result could be a dramatic and beneficial shift away from the stranglehold of shareholder primacy and toward better corporate practices.

THE SOLUTION: OFFER TAX BREAKS TO “BENEFIT CORPORATIONS” AND HIGH-ROAD FIRMS THAT DEMONSTRATE SOCIAL RESPONSIBILITY

Many companies may feel they can’t “afford” to invest in their workers if it affects the bottom line for their shareholders. Targeted tax cuts to reward high road companies such as certified benefit corporations could, however, change the calculus for some companies and encourage them to change their behavior. These tax benefits could be structured in one of two ways:

- Option One: Preferential tax rate.

As PPI has previously proposed, one option is to modify the new corporate tax rate to establish a preferential “public benefit corporation” rate for businesses that meet “high-road” requirements. Only the most deserving companies should qualify for the new 21 percent corporate tax rate; all others should pay a rate that is two to three percentage points higher.

To be entitled to these benefits, companies would meet one of two requirements: (1) that they be legally organized as “public benefit corporations” in their state and can provide good evidence of how they are fulfilling that mission; or (2) they must meet a minimum set of standards for worker treatment and investment, to be promulgated by a new standards-setting body authorized by Congress (effectively behaving like benefit corporations without the formality of legal status). To set the required standards, Congress could establish an inter-agency “workers’ council,” including representatives from labor and business, to establish guidelines for public benefit corporation rate eligibility (though enforcement would be left to the IRS). Companies would apply for a discounted tax rate in the same way that charities and nonprofits apply to the IRS for tax-exempt status, with the proviso that companies must also report annually on their performance, either in their public filings or in separate submissions to the IRS.

- Option two: Benefit corporation tax credit.

A second option for structuring a high road company tax incentive is to create a tax credit for benefit corporations like the “sustainable business tax credit” offered by the city of Philadelphia. Under this benefit, first launched in 2012, Philadelphia businesses that are either certified B Corps or that can show they meet similar standards of social and environmental responsibility can qualify for a tax credit of up to $8,000 against their revenues. Up to 75 firms can apply for the credit on a first-come, first-served basis.

This structure might be especially beneficial for small and medium-sized benefit corporations structured as “pass-through” entities not subject to the corporate tax rate. As Jenn Nicholas, co-founder of the Philadelphia-based graphic design firm Pixel Parlor told Governing magazine, the credit has helped her afford higher wages and other benefits for her 10 workers. “It’s a challenge to be profitable and provide benefits to our employees,” Nicholas said. “Every tiny bit helps, and it feels like somebody is looking out for us when the general climate [for small businesses] is the opposite” (10).

While some policymakers have proposed requiring companies to treat their workers more fairly, tax incentives for high-road businesses are a better approach. Top-down mandates tend to invite resistance or evasion and will not succeed in changing the overall spirit of corporate culture in favor of shareholders over workers. Encouraging companies to reform themselves will ultimately prove the more enduring tactic. As more businesses see that they can indeed “do good and do well,” the grip of shareholder primacy will weaken, and workers will benefit.

Sources:

1) Galston, William A., and Elaine C. Kamarck. More builders and fewer traders: a growth strategy for the American economy. Washington, DC: Brookings Institution, 2015.

2) Graham, John R., Campbell R. Harvey, and Shiva Rajgopa. The Economic Implications of Corporate Financial Reporting. N.p., 2005.

3) Bureau of Economic Analysis. “Gross Domestic Product, Third Quarter 2018 (Second Estimate); Corporate Profits, Third Quarter 2018 (Preliminary Estimate).” News release. November 28, 2018. Accessed March 28, 2019. https://www.bea.gov/news/2018/gross-domestic-product-third-quarter-2018-second-estimate-corporate-profits-third-quarter.

4) Kim, Anne. Tax Cuts for the Companies That Deserve It. Washington, DC: Progressive Policy Institute, 2018.

5) Shambaugh, Jay, Ryan Nunn, Patrick Liu, and Greg Nantz. Thirteen Facts About Wage Growith. Washington, DC: Brookings Institution, 2017.

6) B Lab. “State by State Status of Legislation.” benefitcorp.net. Accessed March 28, 2019. https://benefitcorp.net/policymakers/state-by-state-status.

7) Title 8: Corporations, Delaware Code §§ CHAPTER 1. GENERAL CORPORATION LAW; Subchapter XV. Public Benefit Corporations-361-386 (2017).

8) B Lab. “Certified B Corporation: About B Corps.” Benefitcorp.net. Accessed March 28, 2019. https://bcorporation.net/about-b-corps

9) Id.

10) Kim, Anne. “The Rise of Do-Gooder Corporations.” Governing, Jan 2019.

TAX DAY: Why the tax time moment matters

By former United States Senator Bob Kerrey.

In the movie series “Nightmare on Elm Street” the words “He’s back” indicated that the antagonist – Freddy Krueger – was not dead after all. The tax reform equivalent to Freddy Krueger is the so-called “return-free tax system” that would make the IRS the nation’s tax preparer. As Tax Day came around, Freddy’s ‘Return-Free’ slashed its way back onto the airwaves once again.

When this proposal is described by academics and political figures, it all sounds too good to be true – and it is. Supporters point to examples in California and Great Britain as successful, and yet the truth is quite different.

In California, where millions of taxpayers were sent pre-populated government returns each year, an average of little better than 2-3% of the state’s taxpayers ever accepted it. Eventually, the experiment fell of its own weight and California quietly abandoned it.

Some proponents have also claimed the idea originated with the 1998 IRS Restructuring and Reform Commission, which I co-chaired, and to the subsequent statute enacted that year that implemented the commission reforms. This is simply not true. The 1998 act did instruct the Treasury Department to study the proposal. Their conclusion was that Congress would have to enact radical changes in our tax laws before it could conceivably be feasible. Question asked and answered.

The much-praised “simpler’ system in Great Britain was examined in a recent study by the British Parliament which reports that the efforts by government to implement an EITC-type tax credit in their return-free tax system were initially a disaster. The reason was because the blue collar taxpayer in the UK is not involved in determining their own taxation, and government did not have the information needed to accurately qualify taxpayer eligibility for the credit. After the initial failed effort at an EITC-like welfare-to-work credit, the British no-return tax system moved to Plan B.

Now British workers are required to prepare a pre-return tax submission, reporting extensive personal and family information to the government, in order to claim tax credit eligibility. This lengthy pre-return filing – which looks like an American 1040 tax return – then enables the government to determine the citizen’s tax liability, so the taxpayer doesn’t have to prepare and file a tax return. This circular logic, and layered complexity, is what passes for a “return-free” tax system in practice in the real world.

The UK Parliament’s post-mortem analysis summed up the true myth-buster reality:

“The Right Honourable Alan Milburn, a former Labour Chief Secretary to the Treasury during Prime Minister Blair’s Premiership, described the reason for the inaccurate and significant overpayments as a result of the state not having enough information about people’s lives to accurately determine tax credit eligibility….”

This is the return-free tax system that is most frequently held up as the one we should adopt to replace American voluntary compliance. And yet the conclusion of the UK study states the obvious:

“The only party that has all the relevant information about an individual’s economic and family circumstances pertinent to his taxation is the individual himself, not the government and not the individual’s employer….”

The alternative to taxpayers preparing and filing pre-returns would of course be for the IRS to just independently collect extensive additional personal information about the private, personal lives of our taxpayers and their families, in order to make the false assertion true that the Government has all the information it needs to prepare people’s tax returns for them. However, in American culture, such an expansion of the role of government in our society would trigger a host of civil liberty and individual privacy questions. Some might describe this as a chilling prospect.

The fact is the American system of income taxation has become, over many decades, a central instrument of national economic policy. A significant proportion of the complexity we all rail about in our income tax system emanates from the public policy objectives we have asked the tax system to carry, from Welfare-to-Work (EITC) to Retirement (IRA’s) to Energy Conservation to Education. The implementing regulations alone have added enormous complexity, and require voluminous information.

One more problem with Freddy Krueger’s return-free system: the implications for national security. I have not heard a single expert in cyber security say that we should not worry about the risk of replacing a highly decentralized, diversified tax system with one characterized instead by over-concentration and centralization of systems and data, and the associated risks of attack by cyber criminals and determined nation-state adversaries. We should shiver when Freddy tells us there’s nothing to worry about.

Another basic question would seem a rather straightforward one: What do the people want? The suggestion that the American public is clamoring for Congress to enlarge the role the tax collector plays in their personal lives is nonsensical. And that simple truth has been consistently and overwhelmingly demonstrated in national polling over many years. The idea that the American public would welcome the tax collector as their new best friend is seriously disconnected from reality. And that is compounded by another reality — that the IRS is already understaffed, technologically struggling, and under-funded for its core mission.

It is time for a reality check. True tax reform and simplification is very much needed, and it will be hard work. But it does not begin with getting the taxpayer out of the room where their tax liability is being determined. In fact, the direct involvement of our citizens in their own tax system is much too valuable to lose. Rather than curtailing the role of the taxpayer, we should leverage the annual engagement of our people by helping them develop basic financial literacy, including learning how to save, and the importance of doing so, for their own financial well-being.

The tax refund, for many families, is the largest paycheck they see all year. The reality is that the “tax time moment”, as many economists call it, is an invaluable national economic policy asset, far too valuable to kick to the curb, regardless of whether the theoretical objective is tax administration expediency, or a strategy to increase revenue collections to pay for public spending.

And so, my sincere advice for what to do as the Freddy Krueger return-free advocates try to slash their way back into our lives this Spring like clockwork: Just wake yourself up, look outside

at the real world, and apply common sense. There is no good reason for this nightmare to ever become a reality.

(To read the full text of Senator Kerrey’s tax policy analysis, click here.)

Ritz for Forbes, “Donald Trump’s Budget For A Declining America”

After the president’s budget was released on Monday, House Budget Committee Chairman John Yarmuth (D-KY) called it “A Budget for a Declining America.” Unfortunately, that might be an understatement.

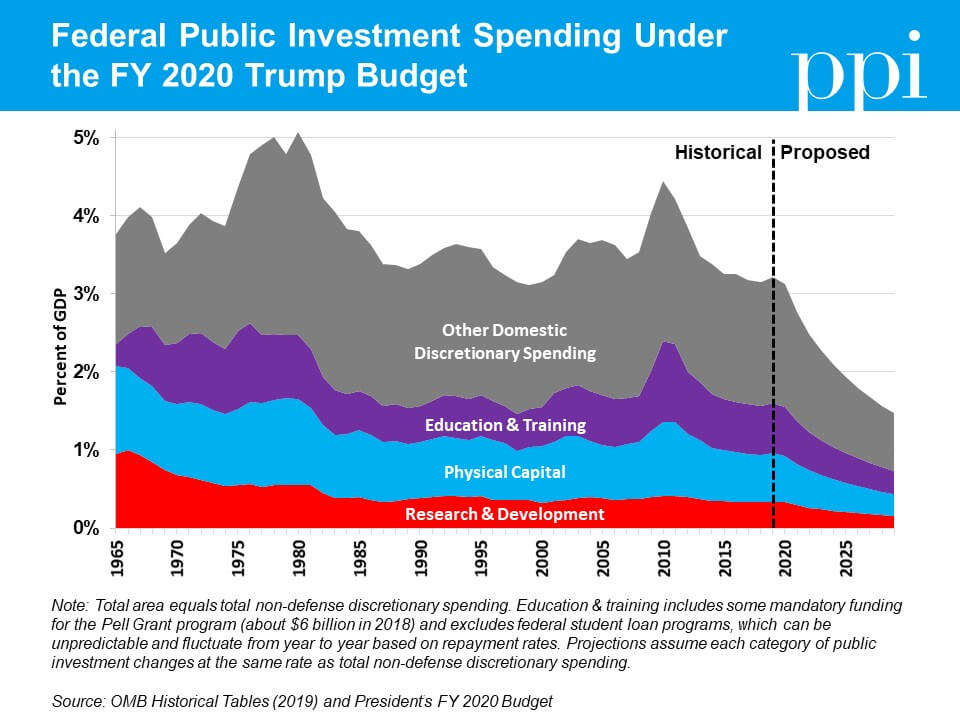

The Trump administration’s Fiscal Year 2020 budget proposal is a compilation of the worst ideas to come out of the Republican Party over the last decade. It would dismantle public investments that lay the foundation for economic growth, resulting in less innovation. It would shred the social safety net, resulting in more poverty. It would rip away access to affordable health care, resulting in more disease. It would cut taxes for the rich, resulting in more income inequality. It would bloat the defense budget, resulting in more wasteful spending. And all this would add up to a higher national debt than the policies in President Obama’s final budget proposal.

The most harmful aspect of Trump’s fiscal blueprint is its scheme for gutting investments in public goods that are core responsibilities of government. The administration proposes to reduce the share of gross domestic product devoted to non-defense (domestic) discretionary spending – the category of the budget that is annually appropriated by Congress and includes most federal spending on infrastructure, education, and scientific research – by more than half over the next decade. The result is deep cuts to all three of these important investments that provide the foundation for long-term economic growth.

New Ideas for a Do-Something Congress No. 5: Make Rural America’s Higher Education Deserts Bloom

As many as 41 million Americans live in “higher education deserts” – at least half an hour’s drive from the nearest college or university and with limited access to community college. Many of these deserts are in rural America, which is one reason so much of rural America is less prosperous than it deserves to be.

The lack of higher education access means fewer opportunities for going back to school or improving skills. A less educated workforce in turn means communities have a tougher time attracting businesses and creating new jobs.

Congress should work to eradicate higher education deserts. In particular, it can encourage new models of higher education – such as “higher education centers” and virtual colleges – that can fill this gap and bring more opportunity to workers and their communities. Rural higher education innovation grants are one potential way to help states pilot new approaches.

THE CHALLENGE: HIGHER EDUCATION “DESERTS” ARE HANDICAPPING RURAL AMERICA

For millions of Americans, distance is as big or bigger a barrier to higher education access as finances. According to the Urban Institute, nearly one in five American adults—as many as 41 million people—lives twenty-five miles or more from the nearest college or university, or in areas where a single community college is the only source of broad-access public higher education within that distance. Three million of the Americans in these so-called “higher education deserts” also lack broadband internet, which means they are cut off from online education opportunities as well (1).

Rural students have lower rates of college-going and completion.

More than four in five people in higher education deserts – 82 percent – live in rural areas. This could be one reason why fewer rural Americans attend or finish college.

In 2016, 61 percent of rural public school seniors went on to college the following year, according to the National Student Clearinghouse, compared to 67 percent for suburban students (2). Only 20 percent of rural young adults between 25 and 34 have four-year degrees, says the USDA’s Economic Research Service, compared to 37 percent of young adults in urban areas (3). Moreover, the urban-rural gap in college degree attainment is growing. From 2000 to 2015, the share of college-educated adults rose by 7-points in urban locales compared to 4-points in rural areas.

Less-educated rural areas are falling behind while better educated cities leap ahead.

With more and more jobs demanding ever higher levels of skill, disparities in access to higher education are translating to vast disparities in the distribution of jobs and opportunity throughout the United States, including a widening urban-rural divide. Wealthy urban areas are getting richer, while rural areas are increasingly lagging.

The Economic Innovation Group (EIG), for instance, reports that of the 6.8 million net new jobs created between 2000 and 2015, 6.5 million were created in the top 20 percent of zip codes, which were predominantly urban (4). These prosperous, job-creating zip codes are also the best-educated. EIG further finds that 43 percent of residents in the top 10 percent of zip codes has a bachelor’s degree or better, compared to just 11 percent in the bottom 10 percent. While a four-year degree is of course not a prerequisite for a good living, the heavy concentration of highly-educated workers is indicative of the imbalance in economic opportunities between rural and urban areas.

Most of the nation’s least educated and most impoverished counties are rural.

If education and prosperity are linked, so conversely are poverty and the lack of educational attainment.

Out of 467 U.S. counties identified by the USDA as “low education” counties – places where 20 percent or more of the population has less than a high school diploma – 79 percent are rural (5). These counties tend to be clustered in the rural South, Appalachia, along the Texas border and in Native American reservations and also suffer from higher rates of poverty, child poverty and unemployment.

THE GOAL: ERADICATE HIGHER EDUCATION DESERTS AND ENSURE EVERY RURAL AMERICAN HAS HIGHER EDUCATION ACCESS

Better access to higher education in rural areas, especially for the many millions of “nontraditional” students who are now increasingly the norm (6), can help close the gulf in opportunity between urban and rural areas. Greater opportunities for convenient, affordable higher education would allow more rural Americans to finish their degrees or pursue occupational credentials, qualifying them for higher-skilled, better-paid jobs. Rural students would also benefit by not being forced to leave home for school – not only lowering costs for students but potentially slowing or even reversing the population declines plaguing rural areas. Institutions of higher education can also serve as engines of economic development in the communities they serve. They can work with businesses to turn out the skilled talent they need and provide research or other support.

THE PLAN: CREATE RURAL HIGHER EDUCATION INNOVATION GRANTS TO ENCOURAGE NEW MODELS OF HIGHER EDUCATION REACHING RURAL AMERICA

While it’s unrealistic to establish a new college, community college or university in every rural area that needs one, emerging models for delivering higher education potentially offer a creative, cost-effective and effective alternative. These new models can also expand the ability of workers to obtain high-quality occupational credentials, which in many instances are likely to be more practical, affordable and desirable than pursuing a two-year or four-year degree.

Some states, such as Pennsylvania, Virginia and Maryland, are pioneering new approaches, such as “higher education centers” and virtual colleges, that use technology to broaden students’ options for both traditional college education and occupational training (7). The Northern Pennsylvania Regional College, for instance, operates six different “hubs” scattered throughout the 7,000 square miles it serves, plus numerous “classrooms” using borrowed space from local high schools, public libraries and other community buildings. In addition to conferring its own degrees, it provides the infrastructure for other accredited institutions to extend their reach through “blended” offerings combining virtual and in-person teaching.

Similarly, Virginia’s five higher education centers provide physical infrastructure for colleges and community colleges offering classes as well as occupational training in fields such as welding, mechatronics and IT certification. In Maryland, the Southern Maryland Higher Education Center offers specific courses from ten different institutions, including Johns Hopkins and the University of Maryland. Though relatively new, these institutions are already establishing a track record of success. In South Boston, Virginia, for instance, the Southern Virginia Higher Education Center worked with more than 30 area industries and entrepreneurs in 2017, developed customized training for nearly 150 workers in local companies and placed 173 students into new jobs (8).

Congress should encourage all states to make rural higher education a priority and help more states experiment with new models for accessing higher education in remote areas. One way to do this is to provide seed money in the form of Rural Higher Education Innovation Grants so that states can stand up pilots, evaluate the effectiveness of new models and scale up promising approaches. These grants moreover do not need to be large – the Pennsylvania legislature initially appropriated just $1.2 million to launch what is now NPRC.

As a start, Congress should set aside $10 million in competitive grant funding for states. Funding for these grants could come from an earmark of the money collected from the 1.4 percent excise tax on large university endowments included in the 2017 tax legislation (9).

Mandel and Blaustein for InsideSources, “Entrepreneurs Need to Escape The Start up Trap”

For many, becoming a small business owner has always been a part of the American Dream and for entrepreneurs launching a successful startup today is, in many ways, the 21st-century version of this ambition. But even if the business gets off the ground, it is becoming more and more challenging for company owners to scale up.

To put it in perspective, “young” businesses — 6 to 10 years — were half as likely to employ 1,000 workers or more in 2014 compared to 20 years ago. That’s based on an analysis of Census Bureau data in research released this month from the Progressive Policy Institute and Allied for Startups.

Large companies have been blamed for acquiring small companies before they can grow. However, there’s another explanation for the scaling-up trap that deserves more attention: the unintentional tax and regulatory cliff created by decades of policies favoring small businesses.

In the United States, small businesses are often exempt from obligations to provide certain employee benefits and comply with certain regulatory rules if the company is small enough. While these “carve-outs” are beneficial for companies who stay below the relevant thresholds, the threat of losing these exemptions can make entrepreneurs think twice before expanding. In fact, sometimes, selling small businesses to larger rivals is more lucrative for owners than scaling their own businesses.

PPI Launches Series of New Ideas for a ‘Do-Something’ Congress

Dear Democratic Class of 2018,

Congratulations on your election to the U.S. House of Representatives! In addition to winning your own race, you are part of something larger – the first wave of a progressive resurgence in U.S. politics.

The midterm elections gave U.S. voters their first opportunity to react to the way Donald Trump has conducted himself in America’s highest office. Their verdict was an emphatic thumbs down. That’s an encouraging sign that our democracy’s antibodies are working to suppress the populist virus of demagoguery and extremism.

Now that Democrats have reclaimed the people’s House, what should they do with it? Some are tempted to use it mainly as a platform for resisting Trump and airing “unapologetically progressive” ideas that have no chance of advancing before the 2020 elections. We here at the Progressive Policy Institute think that would be huge missed opportunity.

If the voters increasingly are disgusted with their dissembling and divisive president, they seem even more fed up with Washington’s tribalism and broken politics. For pragmatic progressives, the urgent matter at hand is not to impeach Trump or to embroil the House in multiple and endless investigations. It’s to show Democrats are determined to put the federal government back in the business of helping Americans solve their problems.

We think the House Democratic Class of 2018 should adopt this simple mantra: “Get things done.” Tackle the backlog of big national problems that Washington has ignored: exploding deficits and debt; run-down, second-rate infrastructure; soaring health and retirement costs; climate change and more. And yes, getting things done should include slamming the brakes on Trump’s reckless trade wars, blocking GOP efforts to strip Americans of health care, as well as repealing tax cuts for the wealthiest Americans.

PPI, a leading center for policy analysis and innovation, stands ready to help. We’re developing an extensive “Do Something” Agenda. Today, we are releasing the first in a series of concrete, actionable ideas designed expressly for Democrats who come to Washington to solve problems, not just to raise money and smite political enemies.

As you get settled into your new office, we’ll look for opportunities to acquaint you and your staff with these pragmatic, common-sense initiatives, and to discuss other ways we might be of service to you. That’s what we’re here for.

Regards,

Will Marshall

President

Progressive Policy Institute

New Ideas for a Do-Something Congress No. 1: “A Check on Trump’s Reckless Tariffs”

New Ideas for a Do-Something Congress No. 1: “A Check on Trump’s Reckless Tariffs”

First and foremost, it’s time for Congress to start doing its job on trade. A key step is enacting the Trade Authority Protection (TAP) Act. This balanced legislation would rein in Trump’s abuse of delegated trade powers, require greater presidential accountability, and enable Congress to nullify irresponsible tariffs and trade restrictions.

A Radically Pragmatic Idea for the 116th Congress: Take “Yes” for an Answer on Net Neutrality

For the last two decades, different versions of net neutrality have bounced between Congress, the Federal Communications Commission, the courts – and most recently the states – but the issue remains unresolved.

It is time for Congress to solve this problem for good by enacting a strong, pro-consumer net neutrality law – an outcome that is politically possible even in this era of maximalist gridlock and deeply divided government, given the broad consensus that has formed around the vital issue of ensuring an open internet.

The number of large U.S. manufacturing facilities has dropped by more than a third since 2000, devastating many communities where factories were the lifeblood of the local economy.

One promising way to revive America’s manufacturing might is not by going big but by going small – and going local. Digitally-assisted manufacturing technologies, such as 3D printing, have the potential to launch a new generation of manufacturing startups producing customized, locally-designed goods in a way overseas mega-factories can’t match. To jumpstart this revolution, we need to provide local manufacturing entrepreneurs with access to the latest technologies to test out their ideas. The Grassroots Manufacturing Act would create federally-supported centers offering budding entrepreneurs and small and medium-sized firms access to the latest 3D printing and robotics equipment.

New Ideas for a Do-Something Congress No. 3: “End The Federal Bias Against Career Education”

As many as 4.4 million U.S. jobs are going unfilled due to shortages of workers with the right skills. Many of these opportunities are in so-called “middle-skill” occupations, such as IT or advanced manufacturing, where workers need some sort of post-secondary credential but not a four-year degree.

Expanding access to high-quality career education and training is one way to help close this “skills gap.” Under current law, however, many students pursuing short-term career programs are ineligible for federal financial aid that could help them afford their education. Pell grants, for instance, are geared primarily toward traditional college, which means older and displaced workers – for whom college is neither practicable nor desirable – lose out. Broadening the scope of the Pell grant program to shorter-term, high-quality career education would help more Americans afford the chance to upgrade their skills and grow the number of highly trained workers U.S. businesses need.

Expanding access to high-quality career education and training is one way to help close this “skills gap.” Under current law, however, many students pursuing short-term career programs are ineligible for federal financial aid that could help them afford their education. Pell grants, for instance, are geared primarily toward traditional college, which means older and displaced workers – for whom college is neither practicable nor desirable – lose out. Broadening the scope of the Pell grant program to shorter-term, high-quality career education would help more Americans afford the chance to upgrade their skills and grow the number of highly trained workers U.S. businesses need.

New Ideas for a Do-Something Congress No. 4: “Expand Access to Telehealth Services in Medicare”

America’s massive health care industry faces three major challenges: how to cover everyone, reduce costs, and increase productivity. Telehealth – the use of technology to help treat patients remotely – may help address all three. Telehealth reduces the need for expensive real estate and enables providers to better leverage their current medical personnel to provide improved care to more people.

Despite its enormous potential, however, telehealth has hit legal snags over basic questions: who can practice it, what services can be delivered, and how it should be reimbursed. As is the case with any innovation, policymakers are looking to find the right balance between encouraging new technologies and  protecting consumers – or, in this case, the health of patients.

protecting consumers – or, in this case, the health of patients.

Telehealth policy has come a long way in recent years, with major advances in the kinds of services that are delivered. Yet a simple change in Medicare policy could take the next step to increase access and encourage adoption of telehealth services. Currently, there are strict rules around where the patient and provider must be located at the time of service – these are known as “originating site” requirements – and patients are not allowed to be treated in their homes except in very special circumstances. To expand access to Telehealth, Congress could add the patient’s home as an originating site and allow Medicare beneficiaries in both urban and rural settings to access telehealth services in their homes.

New Ideas for a Do-Something Congress No. 5: Make Rural America’s “Higher Education Deserts” Bloom

As many as 41 million Americans live in “higher education deserts” – at least half an hour’s drive from the nearest college or university and with limited access to community college. Many of these deserts are in rural America, which is one reason so much of rural America is less prosperous than it deserves to be.

As many as 41 million Americans live in “higher education deserts” – at least half an hour’s drive from the nearest college or university and with limited access to community college. Many of these deserts are in rural America, which is one reason so much of rural America is less prosperous than it deserves to be.

The lack of higher education access means fewer opportunities for going back to school or improving skills. A less educated workforce in turn means communities have a tougher time attracting businesses and creating new jobs. Congress should work to eradicate higher education deserts. In particular, it can encourage new models of higher education – such as “higher education centers” and virtual colleges – that can fill this gap and bring more opportunity to workers and their communities. Rural higher education innovation grants are one potential way to help states pilot new approaches.

New Ideas for a Do-Something Congress No. 6: Break America’s Regulatory Log-jam

Regulation plays a critical role in refereeing competition in a free market economy. But there’s a problem: Each year, Congress piles new rules upon old, creating a thick sludge of regulations – some obsolete, repetitive, and even contradictory – that weighs down citizens and businesses. In 2017, the Code of Federal Regulations swelled to a record 186,374 pages, up 19 percent from just a decade before. PPI proposes a Regulatory Improvement Commission (RIC), modeled on the highly successful Defense Base Realignment and Closure (BRAC) process for closing obsolete military installations. Like the BRAC process, the proposed RIC would examine old rules and present Congress with a package of recommendations for an up-or-down vote to eliminate or modify outdated rules.

New Ideas for a Do-Something Congress No. 7: Winning the Global Race on Electric Cars

Jumpstarting U.S. production and purchase of Electric Vehicles (EVs) would produce an unprecedented set of benefits, including cleaner air and a reduction in greenhouse gas emissions; a resurgence of the U.S. auto industry and American manufacturing; the creation of millions of new, good, middle class manufacturing jobs; lower consumer costs for owning and operating vehicles; and the elimination of U.S. dependence on foreign oil. U.S. automakers are already moving toward EVs, but the pace of this transition is lagging behind our foreign competitors. A dramatic expansion of tax credits for EV purchases could go a long way toward boosting the U.S. EV industry as part of a broader agenda to promote the evolution of the transportation industry away from carbon-intensive fuels.

Jumpstarting U.S. production and purchase of Electric Vehicles (EVs) would produce an unprecedented set of benefits, including cleaner air and a reduction in greenhouse gas emissions; a resurgence of the U.S. auto industry and American manufacturing; the creation of millions of new, good, middle class manufacturing jobs; lower consumer costs for owning and operating vehicles; and the elimination of U.S. dependence on foreign oil. U.S. automakers are already moving toward EVs, but the pace of this transition is lagging behind our foreign competitors. A dramatic expansion of tax credits for EV purchases could go a long way toward boosting the U.S. EV industry as part of a broader agenda to promote the evolution of the transportation industry away from carbon-intensive fuels.

New Ideas for a Do-Something Congress No. 8: Enable More Workers to Become Owners through Employee Stock Ownership

More American workers would benefit directly from economic growth if they had an ownership in the companies where they work. To help achieve this goal, Congress should encourage more companies to adopt employee stock ownership plans (ESOPs), which provide opportunities for workers to participate in a company’s profits and share in its growth. Firms with ESOPs enjoy higher productivity growth and stronger resilience during downturns, and employees enjoy a direct stake in that growth. ESOP firms also generate higher levels of retirement savings for workers, thereby addressing another crucial priority for American workers.

New Ideas for a Do-Something Congress No. 9: Reserve corporate tax cuts for the companies that deserve it

New Ideas for a Do-Something Congress No. 9: Reserve corporate tax cuts for the companies that deserve it

Americans are fed up seeing corporate profits soaring even as their paychecks inch upward by comparison. Companies need stronger incentives to share their prosperity with workers – something the 2017 GOP tax package should have included.

Though President Donald Trump promised higher wages as one result of his corporate tax cuts, the biggest winners were executives and shareholders, not workers. Nevertheless, a growing number of firms are doing right by their workers, taking the high road as “triple-bottom line” concerns committed to worker welfare, environmental stewardship and responsible corporate governance. Many of these are so-called “benefit corporations,” legally chartered to pursue goals beyond maximizing profits and often “certified” as living up to their multiple missions. Congress should encourage more companies to follow this example. One way is to offer tax breaks only for high-road companies with a proven track record of good corporate citizenship, including better wages and benefits for their workers.

Kim for Governing, “The Rise of Do-Gooder Corporations”

Doing good pays dividends for both corporations and governments. Just ask Philadelphia.

Azavea is a 65-person software development company based in Philadelphia. Its business is helping governments and nonprofits use geospatial data to achieve various public goals, such as improving traffic flow or reducing pollution. Many would call Azavea a dream employer. It shares its profits with its workers, buys locally, pays generously for training and allows employees to spend 10 percent of their time on personal projects. “We’re very much a people-first, employees-first company,” says CEO Robert Cheetham.

A growing number of firms are, like Azavea, on the leading edge of corporate reforms to make American businesses better stewards of the environment and worker well-being. They are so-called benefit corporations, whose charter explicitly allows them to pursue purposes other than sheer profit. Many are also certified, meaning they’ve met strict standards set by the nonprofit B Lab. More than 2,600 certified “B Corps” operate globally, according to the group, including such well-known brands as ice cream maker Ben and Jerry’s, women’s clothier Eileen Fisher and crowdfunding platform Kickstarter.

Now, an increasing number of governments are facilitating the growth of benefit companies. At least 34 states and the District of Columbia have passed laws — most of them within the past six years — that allow companies to organize as legally recognized benefit corporations. Legal status confers a potentially significant advantage for a company: protection from shareholder liability if executives fail to maximize profit in pursuit of other goals.

A Strong First Year for PPI’s Center for Funding America’s Future

As the Progressive Policy Institute’s Center for Funding America’s Future wraps up its first year, we want to thank everyone who followed and supported our work. Below you’ll find a compilation of our contributions to the public discourse in 2018.

Through op-eds, blog posts, media interviews, research reports, engagement with elected officials, and public forums organized in key battleground states, the Center drew much-needed attention to America’s interconnected problems of deteriorating public investment and soaring federal budget deficits. We fought back against Republican efforts to make these problems worse and challenged Democrats to counter them by offering a new progressivism that invests in our country without leaving the bill for future generations.

We concluded the year with a public forum in Iowa to kick off the 2020 presidential debate over fiscal issues in the nation’s first caucus state – and this is only the beginning. Now that we’ve made the case for a fiscally responsible public investment agenda that fosters robust and inclusive economic growth, we’re ready to offer concrete proposals for making it a reality.

In 2019, PPI will publish a series of specific policy recommendations to renew public investments in the foundation of our economy, modernize federal health and retirement programs to reflect an aging society, and enact pro-growth tax reform that raises the revenue necessary to support both of these critical government functions. We’re excited for the year ahead and hope you’ll continue to follow our work in 2019 and beyond.

Read Our Major Reports

Ending America’s Public Investment Drought

Ben Ritz and Brendan McDermott (12/19)

Defunding America’s Future: The Squeeze on Public Investment in the United States

Ben Ritz (10/15)

Watch Our Public Forums

Ending America’s Public Investment Drought – Des Moines, IA (12/19)

Former U.S. Secretary of Agriculture and Iowa Governor Tom Vilsack

Former Iowa Lieutenant Governor Patty Judge

Iowa Rep. Chris Hall, Ranking Member on the House Appropriations Committee

Ben Ritz, Director of PPI’s Center for Funding America’s Future

Moderated by PPI President Will Marshall

Defunding America’s Future – Philadelphia, PA (11/19)

U.S. Rep. Madeline Dean (D-PA)

Dr. Robert Inman, Professor of Finance at the Wharton School

Ben Ritz, Director of PPI’s Center for Funding America’s Future

Moderated by David Thornburgh, CEO of Committee of Seventy

Check Out Our Op-Eds and Media Coverage

DC Think Tank Urging Iowans to Ask Presidential Candidates About Infrastructure

O. Kay Henderson, Radio Iowa (12/22)

A Fitting End for Disgraceful House Republicans

Ben Ritz, Forbes (12/22)

Social Security, Public Projects and Rural America with Tom Vilsack (Radio)

Michael Libbie, Insight on the Business Hour on News/Talk 1540 KXEL (12/20)

American Children are Getting a Raw Deal Under GOP Leadership

Brodi Fontenot, The Hill (12/20)

Top Democrats Host Policy Roundtable (TV)

ABC 5, Des Moines (12/19)

Trump Once Again Shows Contempt for Young Americans

Ben Ritz, Forbes (12/6)

Welcome to Post-Thrift America

Andrew Yarrow, RealClearPolicy (12/04)

Victorious Democrats Should Thank Young Voters by Funding America’s Future

Ben Ritz, Forbes (11/8)

Reality Check 10.17.18 (Radio)

Charles Ellison, WURD Radio Philadelphia (10/17)

Defend or Defund Our Future? (Radio)

Chase Hagaman, Facing the Future on NH News Radio WKXL (10/16)

Time to Get DC’s Finances Under Control

Paul Weinstein, RealClearPolicy (10/17)

The Deficit Is Heading to $1 Trillion. How Worried Should We Be?

Michael Rainey, The Fiscal Times (9/24)

Democrats Must Bridge the Generational Divide to Prevent Climate and Budget Crises

Paul Bledsoe and Ben Ritz, The Hill (7/18)

How Trump and Republicans are Damning Social Security and Medicare

Ben Ritz, NY Daily News (6/14)

Making Social Security’s Retirement Age Work for Workers

Andy Rotherham, The Hill (6/8)

Medicare is Running Out of Money. Democrats Want to Expand It

W. James Antle III, Washington Examiner (6/7)

The Deficit Debate

David Leonhardt, The New York Times (4/20)

The Parallel Universe of Trump’s Budget, Explained

Sam Petulla and Gregory Krieg, CNN (2/13)

Welcome to a New Era of Federal Spending

Sam Petulla, CNN (2/10)

12 of the Most Important Things in Congress’s Massive Spending Deal

Heather Long and Jeff Stein, The Washington Post (2/8)

Find More Analysis on the PPI Blog

Republicans Double Down on Deepening Deficits (9/13)

CBO Report Shows That We Really Can’t Afford All These Tax Cuts (8/9)

New Projections Make Clear We Can’t Afford the Trump Agenda (6/27)

Before Expanding Medicare, We Have to Pay for Current Beneficiaries (6/7)

Trustees Reports Highlight Challenges Facing Medicare and Social Security (6/6)

CBO Analysis Exposes Trump’s Faulty Fiscal Policy (5/30)

Are Democrats Really the Party of Fiscal Responsibility? Part 2 (4/19)

A Tax Day Review of Trump’s “Tax Cuts” (4/17)

Are Democrats Really the Party of Fiscal Responsibility? Yes, But… (4/16)

PPI Analysis of CBO’s 2018 Budget and Economic Outlook (4/10)

House GOP’s Balanced Budget Amendment is a Sham (4/10)

Even After Budget Deal, Discretionary Spending Remains Low (3/14)

New Analysis Highlights Dire Fiscal Situation (3/5)

Six Charts That Reveal the Absurdity of the Trump Budget (2/14)

See Our Press Releases

PPI Kicks Off 2020 Economic Debate with Iowa Fiscal Forum (12/19)

New Report: Washington is Crippling America’s Economic Future (10/15)

New CBO Report Highlights the Cost of Trump’s First Year (4/9)

Statement on the Passing of Peter G. Peterson (3/20)