This week, Sen. Elizabeth Warren (D-MA) unveiled new legislation aimed at turning American’s largest companies into better corporate citizens.

Under Warren’s “Accountable Capitalism Act,” companies earning more than $1 billion a year in revenues would be required to obtain a new federal corporate charter her legislation would create. Among other things, this charter would mandate directors to “consider the interests of all major corporate stakeholders—not only shareholders—in company decisions,” as Warren wrote in a companion Wall Street Journal op-ed.

There is much to like about Sen. Warren’s approach.

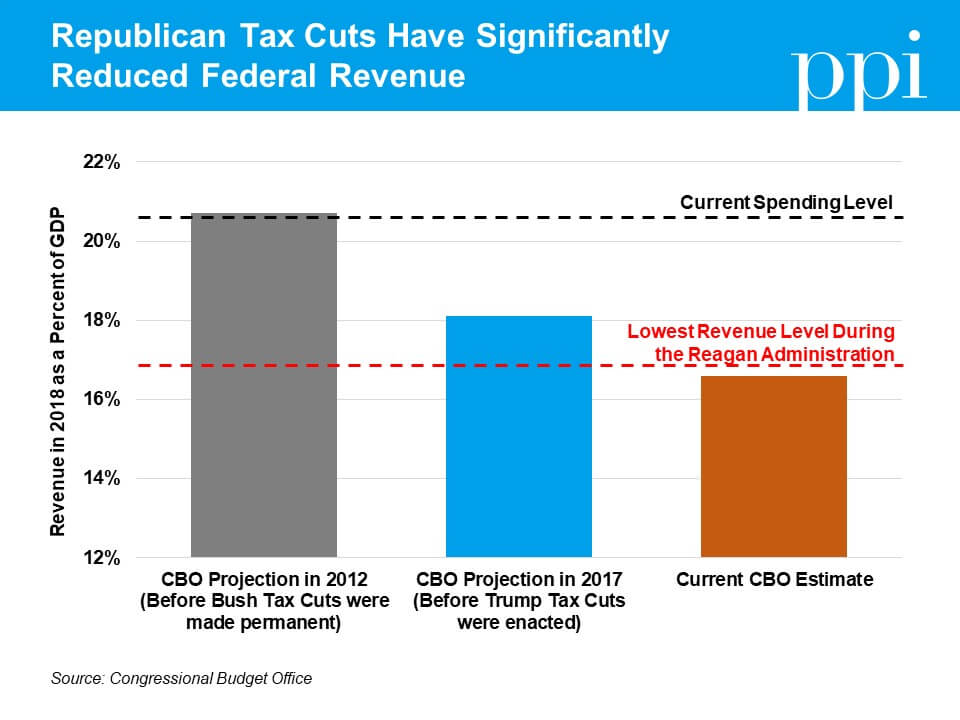

For one thing, she rightly attacks the culture of “shareholder primacy” that has dictated corporate behavior in recent decades. As Warren points out, companies once spent a much greater share of their earnings on workers’ wages and long-term investment. “But between 2007 and 2016,” she writes, “large American companies dedicated 93% of their earnings to shareholders.” Recent evidence of this shift has been the spate of disgracefully large share buybacks in the wake of last year’s corporate tax cuts, which one analysis estimates could exceed $800 billion in 2018. Meanwhile, the modest gains in wages workers have seen have already been wiped out by inflation. Workers would likely indeed be better off if their employers spent more money on wages and less on fattening shareholders’ wallets.

A second appealing aspect of Warren’s approach is her adoption of the “benefit corporation” as a model for corporate reform. As I explain in this PPI policy brief, companies that choose to charter themselves as “benefit corporations” legally commit themselves to corporate purposes other than the sheer pursuit of profit.

Since 2010, 32 states and the District of Columbia have passed benefit corporation statutes, including the corporate powerhouse state of Delaware. Thousands of “double bottom line” companies are chartered as benefit corporations, including such well-known brands as Etsy and Warby Parker. Many further choose to become “certified B Corps,” adhering to the strict standards for corporate responsibility promoted by the nonprofit B Lab.

By organizing as benefit corporations, these companies are directly refusing to kowtow to the tyranny of shareholder primacy. In return, they are legally shielded from shareholder liability for decisions that don’t maximize profit. They also send a signal to consumers and investors looking for socially responsible firms.

Benefit corporations are a relatively new invention, but the already significant growth in these firms and the ready adoption by states of benefit corporation statutes shows the enormous potential of this model as well as the interest and capacity of companies to reform themselves.

It would be a pity if Sen. Warren’s legislation were to wreck this potential.

Set aside what the creation of a federal corporate charter would mean to the states, which have traditionally been the arbiters of corporate governance. From a sheer practical standpoint, corporate culture is not something that can be easily dictated by fiat, and Warren’s legislation will be difficult to enforce. Companies seeking to evade their new obligations will no doubt litigate what the new federal charter means, as will stakeholders – not necessarily workers – who see an opening to claim a stake in corporate spoils. Meanwhile, the workers intended as the legislation’s beneficiaries will still end up holding the bag.

Second, by requiring all companies of a certain size to become benefit corporations, Warren goes too far in dictating how companies should govern themselves. One of the most important principles in corporate law is the so-called “business judgment rule,” under which courts restrain themselves from second-guessing the business decisions a company makes, so long as the board of directors can show it acted in good faith on an informed basis and in the honest belief it was acting in the best interests of the company.

Companies that choose to become benefit corporations are exercising a business judgment that this is the right corporate status for them. Warren’s legislation essentially substitutes the federal government’s business judgment for that of individual companies in deciding how to run themselves. Government has traditionally had a poor track of interfering in the markets this way. Among the unintended potential results are that companies either keep themselves small enough not to trigger the $1 billion threshold (not a good thing when we want companies to grow) or that they leave the country once they reach a certain size.

There are, however, potentially effective ways to tip companies’ business judgment in favor of behaving like benefit corporations, which is the approach we propose in this brief. Rather than mandating companies to behave as we’d like them to see, government should offer an incentive attractive enough that they’ll do so on their own. In particular, we propose a preferred corporate tax rate for benefit corporations, provided they also supply sufficient evidence of their commitment to other aims besides shareholder profit.

A voluntary embrace of corporate responsibility is more likely to be an authentic one. This approach also builds on and accelerates a reform that is already happening, which means more room for innovation and less likelihood of litigation.

Sen. Warren deserves applause for beginning an important conversation about the rights and responsibilities of the nation’s most powerful “citizens.” The introduction of this bill could also serve as welcome wake-up call to the nation’s CEOs – if they do not work soon to reform themselves, reforms will be thrust upon them, and perhaps in ways they will not like.