INTRODUCTION:

The Federal Reserve made clear in its December 2021 meeting that it intends to raise interest rates in 2022. Interest rate changes flow through the economy and affect the rates borrowers pay on all types of loans. In particular, the increases in interest rates may place greater pressure on home mortgage rates and the credit scores that are used by financial institutions to determine who qualifies for loans.

In the area of housing finance, how credit scores are used by key market players has received attention for some time. The better the credit score, the more likely a borrower will qualify for a mortgage at the best possible rate, saving the borrower money over the life of the loan. There has been debate, however, over the models used to create those scores — should there be more competition and, more important, can new models lower costs for home buyers and ensure equity of access to loans.

Two of the most important entities in housing finance are the nation’s housing government sponsored enterprises — Fannie Mae and Freddie Mac (Enterprises) — which are now under government conservatorship overseen by Federal Housing Finance Agency (FHFA). As a result, many policymakers and elected officials have encouraged the FHFA to take steps to promote more competition in the credit scoring models used by the Enterprises to help lower costs to consumers and give greater access to credit for previously underserved individuals.

These are important goals and should be pursued. However, some reforms presented would have had a less than optimal effect — decreasing competition and potentially driving up mortgage costs rather than lowering them. The Enterprises have used a valid credit score model for over 20 years. Introducing competitive reforms has merit, but it must be done in a way that does not create unfair advantages. FHFA has a clear mandate to keep the Enterprises solvent and help homeowners, as witnessed by their recent COVID assistance. But FHFA must ensure that any reforms maintain competition and keep prices low for consumers.

This paper reviews how credit scores are presently used by the Enterprises and discusses some of the issues that can be addressed to keep competition in the credit score market. This paper also discusses some of the pitfalls associated with some proposed reforms to credit score markets.

ENTERPRISES HAVE USED PROVEN CREDIT SCORE MODELS FOR OVER TWO DECADES

Fannie Mae and Freddie Mac (Enterprises) are commonly known as housing government sponsored enterprises. Somewhat unique in their structure, they were originally chartered by Congress, but owned by shareholders, to provide liquidity in the mortgage market and promote homeownership.[1] The Enterprises maintained this unique ownership structure until their financial condition worsened during the financial crisis of 2008, when they were placed in government conservatorship under the leadership of the Federal Housing Finance Agency (FHFA).

The Enterprises do not create loans. They purchase loans made by others (such as banks), and then package those loans into securities which are then sold on the secondary market to investors. The loans purchased by the Enterprises can only be of a certain size and home borrowers must have a minimum credit score to qualify. The Enterprises use these and other criteria to minimize the risk that the loans they purchase will not be paid back (default) — an important step because it is this step of buying loans from banks and other lenders, thereby providing them with replenished funding that allows further home lending.

The loans purchased by the Enterprises then are packaged into securities that have specific characteristics which are told to investors — including the credit scores on the loans in the security. According to FHFA, the Enterprises use credit scores to help predict a potential borrowers likeliness to repay and has been using a score developed from a model, FICO Classic,[2] for over 20 years.[3] In discussing FICO Classic, FHFA points out that it “and the Enterprises believe that this score remains a reasonable predictor of default risk.”[4]

While the current system has been in effect for some time, Congress recently asked FHFA and the Enterprises to review their credit scoring model to determine if additional credit scoring models could be used by the Enterprises to increase competition. Specifically, FHFA was to “establish standards and criteria for the validation and approval of third-party credit score models used by Fannie Mae and Freddie Mac.”[5] Advocates of using alternatives to FICO Classic said, at the time, that using other validated credit scoring models would lead to more access.[6] While a worthy goal, incorporating a flawed new model, could have impacts and potentially drive-up costs.

CONFLICT OF INTEREST COULD LEAD TO DECREASED COMPETITION

Beginning in 2017, FHFA proposed a rule which would set the stage for reviewing the Enterprises’ credit score models. The rule FHFA finalized in 2019 directed the Enterprises to review and validate alternative credit models in the coming years.

Section 310 of the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018 (Pub. L. 115–174, section 310) amended the Fannie Mae and Freddie Mac charter acts and the Federal Housing Enterprises Financial Safety and Soundness Act of 1992 (Safety and Soundness Act) to establish requirements for the validation and approval of third-party credit score models by Fannie Mae and Freddie Mac.[7]

At the time of the proposed rule, some thought that alternative credit scores could open access to a larger group of homeowners.[8] [9] While an admirable goal, and in keeping with FHFA’s mission for the Enterprises even now, a major issue was left unresolved. The proposed rule “would have required credit score model developers to demonstrate, upon applying for consideration, that there was no common ownership with a consumer data provider that has control over the data used to construct and test the credit score model.”[10]

The proposed rule would have created a separation between those who create and control the data, from those in charge of the model creating the scores — an important goal. Not surprisingly, the proposed rule received significant comments. Sadly, the final rule did not adopt this important provision which required those submitting models to not have a conflict of interest or “common ownership with a consumer data provider that has control over the data used to construct and test the credit score model.”[11] This lack of clear independence could set the stage for a lack of competition in the future.

While the rule was being proposed, former FHFA director Mel Watt in 2017 said, “how would we ensure that competing credit scores lead to improvements in accuracy and not to a race to the bottom with competitors competing for more and more customers? Also, could the organizational and ownership structure of companies in the credit score market impact competition? We also realized that much more work needed to be done on the cost and operational impacts to the industry. Given the multiple issues we have had to consider, this has certainly been among the most difficult evaluations undertaken during my tenure as Director of FHFA.”[12]

Several at the time of the proposed rule pointed out that having one dominant player possibly replaced by another, would not further competition but could further consolidate it. One commentator stated, “to push for alternative scoring models may simply trade one dominant player (FICO) for another (Vantage),”[13] in referring to legislation which would ultimately be incorporated into the bill where the proposed rule was developed. The Progressive Policy Institute (PPI) held an expert panel discussion at the time which also discussed the problems with adopting VantageScore due to conflict of interest.[14] “The reason? Because the owners of Vantage control the supply of information currently used by FICO to make its determination. And given the history of monopolies, it would not be surprising to see Equifax, Experian, and TransUnion use that leverage to the advantage of Vantage, and eventually force FICO out of business.”[15]

The proposed rule points out that “VantageScore Solutions, LLC is jointly owned by the three nationwide CRAs. The CRAs also own, price, and distribute consumer credit data and credit score. This type of common ownership could in theory negatively impact competition in the marketplace.”[16] Another writer at the time, also acknowledged the potential conflict of interest provision of the proposed rule.[17] While these issues were not resolved in the final rule, they still matter and can affect not only competition but also costs in the residential mortgage marketplace.

Competition is key to innovation and inclusiveness is important to further homeownership. Using alterative data, rent payments, utility payments, bank balances, all could potentially be used help complete the credit picture and increase access to credit.[18] Other research organizations have acknowledged that FICO has improved models and incorporated alternative sources of data that are available,[19] which would not have the conflict of interest that VantageScore would have. FHFA must ensure that competition is maintained, without creating unfair advantages.

LACK OF REAL COMPETITION COULD INCREASE COSTS

Before any changes can happen, however, FHFA must articulate all costs to consumers, lenders, the Enterprises, and investors of any change. COVID-19 proved a real-world laboratory for the Enterprises under stress. FHFA’s recent Performance Report lays out the series of actions the Enterprises took to help borrowers affected by COVID-19, including payment deferrals, forbearance, and evictions suspensions.[20] These actions likely kept many homeowners in their homes during a difficult period, and kept the Enterprises functioning. The relief provided was important and was balanced against the risk to the Enterprises — but it did come at a cost.

FHFA made their first announcement on COVID assistance to homeowners in March 2020.[21] A few months later in August 2020, FHFA announced that the Enterprises would charge a fee of 50-baisis points per refinancing to help make up for any potential losses the Enterprises might experience.[22] An initial estimate put the projected losses at $6 billion. Thankfully the Enterprises saw declining rates of loans in forbearance and the fee was ultimately ended in July 2021.[23]

Changes at the Enterprises have affects across the industry. Just as the potential increases in interest rates by the Federal Reserve this year could raise interest costs to home buyers, at time of the proposed rule, former FHFA Director Watt knew that changes to the credit scoring model could raise costs and even stated “much more work needed to be done on the cost and operational impacts to the industry,”[24] before changes were made. Clearly, the FHFA realizes that any changes to its credit scoring models will also likely have increased costs to the housing finance sector. As an aside, the related issue of changes to issues such as mortgage servicing have led to increased costs in the home purchase ecosystem.[25]

Changes to the credit scoring models could also affect prices in the secondary market for mortgage-backed securities (MBS) and credit risk transfers (CRT). As the FHFA pointed out, investors “in Enterprise MBS and participants in Enterprise CRT transactions would need to evaluate the default and prepayment risks of each of the multiple credit score options.”[26] While the FHFA in the final rule did not address the costs of these evaluations, incorporating multiple credit score options could raise the cost investors demand and ultimately increase the costs to home buyers via the fees the Enterprises would need to pass on.

Others have pointed out that changes to credit scoring models could have cost impacts for banks, investors, pension funds, and others.[27] These issues of cost and operational impacts need to be given serious consideration, because as the recent Enterprise actions related to COVID-19 made clear — they matter. The lending industry was upset when the Enterprises raised a temporary fee to help ensure Enterprises’ soundness through the difficult period.[28] What would the costs be with a wholesale change to the credit score model system? And who would ultimately pay those costs? These are questions the FHFA must address as they review any changes to the credit scoring model.

One of the FHFA’s current core goals is to “Promote Equitable Access to Housing.”[29] To ensure that the Enterprises can undertake their important role in addressing long standing issues of equity, they need to be in the best place possible financially to do that. A question that FHFA needs to address as they review credit scoring models is, would using a model with a conflict of interest hurt their goal of equity? Would changes raise prices or worse, limit access for those FHFA is looking to provide access into the market?

CONCLUSION AND QUESTIONS FOR CONSIDERATION

The crisis of COVID-19 and its effects on the housing market were serious, but thankfully not detrimental due to prudent planning and oversight of the Enterprises and FHFA. The Enterprises have used a current credit scoring model that has produced necessary liquidity in the market in both good and difficult times. As FHFA oversees the next phase of testing alternative credit score models, it should ensure that the models are subjected to the criteria laid out in their final rule — with emphasis placed on the cost and market affects any change would have. The Enterprises were called upon to help homeowners during the recent crisis and could do so with minimal disruption to the consumers and housing finance stakeholders. The Enterprises and FHFA should take seriously how any further changes would impact competition, soundness of the Enterprises, and how those changes could increase the costs for everyone in housing finance.

REFERENCES

[1]“Fannie Mae and Freddie Mac in Conservatorship: Frequently Asked Questions,” Congressional Research Service, July 22, 2020, https://crsreports.congress.gov/product/pdf/R/R44525.

[2] “Selling Guide: B3-5.1-01, General Requirements for Credit Scores,” Fannie Mae, September 2021, https://selling-guide.fanniemae.com/Selling-Guide/Origination-thru-Closing/Subpart-B3-Underwriting-Borrowers/Chapter-B3-5-Credit-Assessment/Section-B3-5-1-Credit-Scores/1032996841/B3-5-1-01-General-Requirements-for-Credit-Scores-08-05-2020.htm.

[3] “There’s More to Mortgages than Credit Scores,” Fannie Mae, February 2020, https://singlefamily.fanniemae.com/media/8511/display.

[4] “Credit Score Request for Input,” FHFA Division of Housing Mission and Goals, December 20, 2017, https://www.fhfa.gov/Media/PublicAffairs/PublicAffairsDocuments/CreditScore_RFI-2017.pdf.

[5] “FHFA Issues Proposed Rule on Validation and Approval of Credit Score Models,” Federal Housing Finance Agency, December 13, 2018, https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Issues-Proposed-Rule-on-Validation-and-Approval-of-Credit-Score-Models.aspx.

[6] “Validation and Approval of Credit Score Models,” Federal Housing Finance Agency, August 13, 2019, https://www.fhfa.gov/SupervisionRegulation/Rules/RuleDocuments/8-7-19%20Validation%20Approval%20Credit%20Score%20Models%20Final%20Rule_to%20Fed%20Reg%20for%20Web.pdf.

[7] “Federal Register/Vol. 84, No. 159/Friday, August 16, 2019/Rules and Regulations,” August 2019, https://www.govinfo.gov/content/pkg/FR-2019-08-16/pdf/2019-17633.pdf

[8] Karan Kaul, “Six Things That Might Surprise You About Alternative Credit Scores,” Urban Institute, April 13, 2015, https://www.urban.org/.

[9] Michael A. Turner et al., “Give Credit Where Credit Is Due,” Brookings Institution, June 2016, https://www.brookings.edu/wp-content/uploads/2016/06/20061218_givecredit.pdf.

[10] “Federal Register.”

[11] “Federal Register.”

[12] Melvin L. Watt, “Prepared Remarks of Melvin L. Watt, Director of FHFA at the National Association of Real Estate Brokers’ 70th Annual Convention,” Federal Housing Finance Agency, August 1, 2017, https://www.fhfa.gov/Media/PublicAffairs/Pages/Prepared-Remarks-of-Melvin-L-Watt-Director-of-FHFA-at-the-NAREB-70th-Annual-Convention.aspx.

[13] Paul Weinstein Jr., “No Company Should Have a Monopoly on Credit Scoring,” The Hill, December 7, 2017, https://thehill.com/opinion/finance/363755-no-company-should-have-a-monopoly-on-credit-scoring.

[14] “Updated Credit Scoring and the Mortgage Market,” Progressive Policy Institute, December 4, 2017, https://www.progressivepolicy.org/event/updated-credit-scoring-mortgage-market/.

[15] “No Company Should Have a Monopoly.”

[16] “Validation and Approval of Credit Score Models: Final Rule,” Federal Register, August 16, 2019, https://www.federalregister.gov/documents/2019/08/16/2019-17633/validation-and-approval-of-credit-score-models.

[17] Karan Kaul and Laurie Goodman, “The FHFA’s Evaluation of Credit Scores Misses the Mark,” Urban Institute, March 2018, https://www.urban.org/sites/default/files/publication/97086/the_fhfas_evaluation_of_credit_scores_misses_the_mark.pdf.

[18] Kelly Thompson Cochran, Michael Stegman, and Colin Foos, “Utility, Telecommunications, and Rental Data in Underwriting Credit,” Urban Institute, December 2021, https://www.urban.org/research/publication/utility-telecommunications-and-rental-data-underwriting-credit/view/full_report.

[19] Laurie Goodman, “In Need of an Update: Credit Scoring in the Mortgage Market,” Urban Institute, July 2017, https://www.urban.org/sites/default/files/publication/92301/in-need-of-an-update-credit-scoring-in-the-mortgage-market_2.pdf.

[20] “Performance & Accountability Report FY2021,” Federal Housing Finance Agency, 2021, https://www.fhfa.gov/AboutUs/Reports/ReportDocuments/FHFA-2021-PAR.pdf.

[21] “Statement from FHFA Director Mark Calabria on Coronavirus,” Federal Housing Finance Agency, March 10, 2020, https://www.fhfa.gov/Media/PublicAffairs/Pages/Statement-from-FHFA-Director-Mark-Calabria-on-Coronavirus.aspx.

[22] “Adverse Market Refinance Fee Implementation Now December 1,” Federal Housing Finance Agency, August 25, 2020, https://www.fhfa.gov/Media/PublicAffairs/Pages/Adverse-Market-Refinance-Fee-Implementation-Now-December-1.aspx.

[23] “FHFA Eliminates Adverse Market Refinance Fee,” Federal Housing Finance Agency, July 16, 2021, https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Eliminates-Adverse-Market-Refinance-Fee.aspx.

[24] Melvin L. Watt, “Prepared Remarks.”

[25] Laurie Goodman et al., “The Mortgage Servicing Collaborative,” Urban Institute, January 2018, https://www.urban.org/sites/default/files/publication/95666/the-mortgage-servicing-collaborative_1.pdf.

[26] “Credit Score Request for Input.”

[27] Pete Sepp and Thomas Aiello, “Risky Road: Assessing the Costs of Alternative Credit Scoring,” National Taxpayers Union, March 22, 2019, https://www.ntu.org/publications/detail/risky-road-assessing-the-costs-of-alternative-credit-scoring.

[28] “FHFA Eliminates Controversial ‘Adverse Market Refinance Fee’.”

[29] “Performance & Accountability Report.”

DOWNLOAD THE PAPER

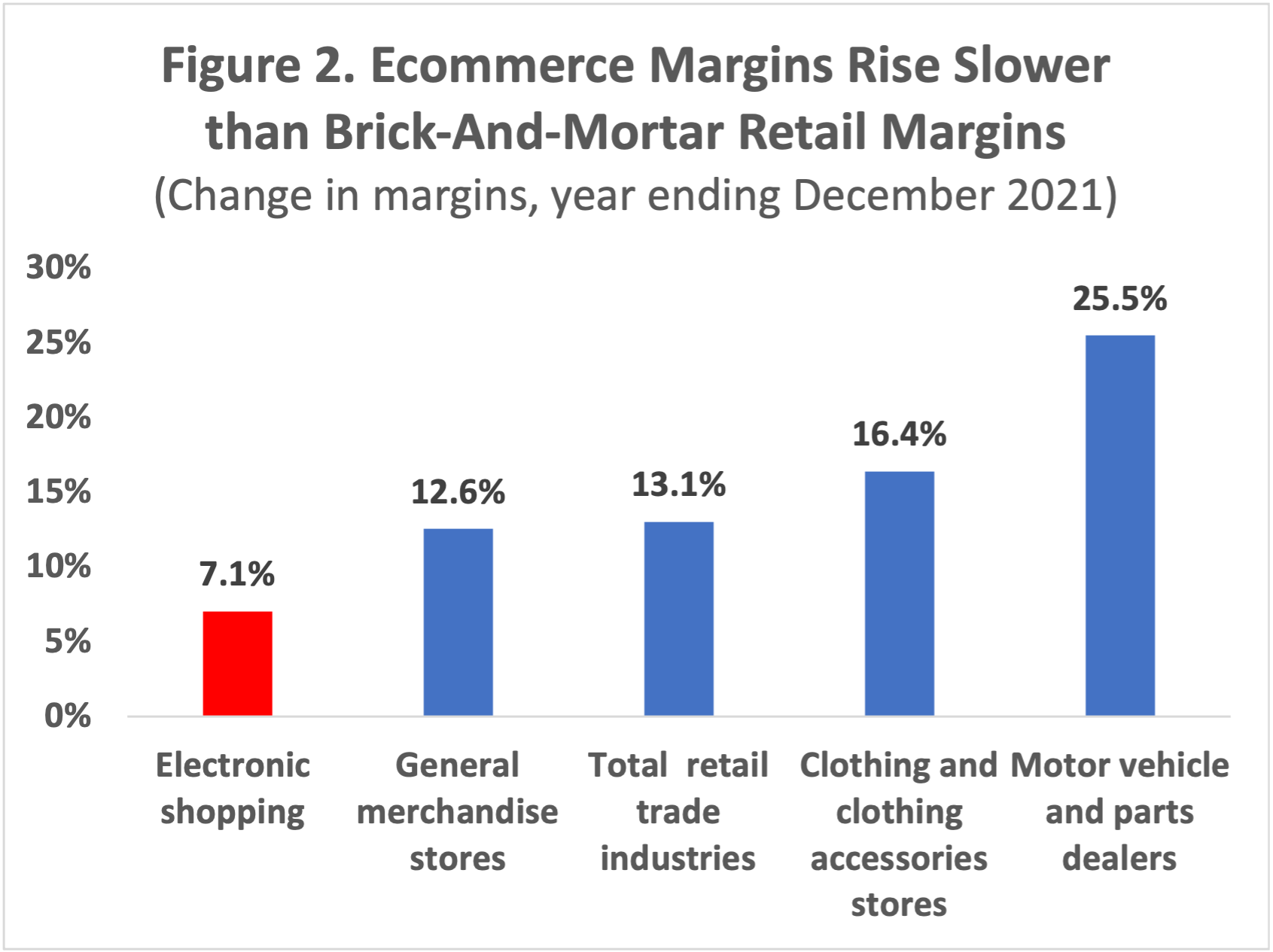

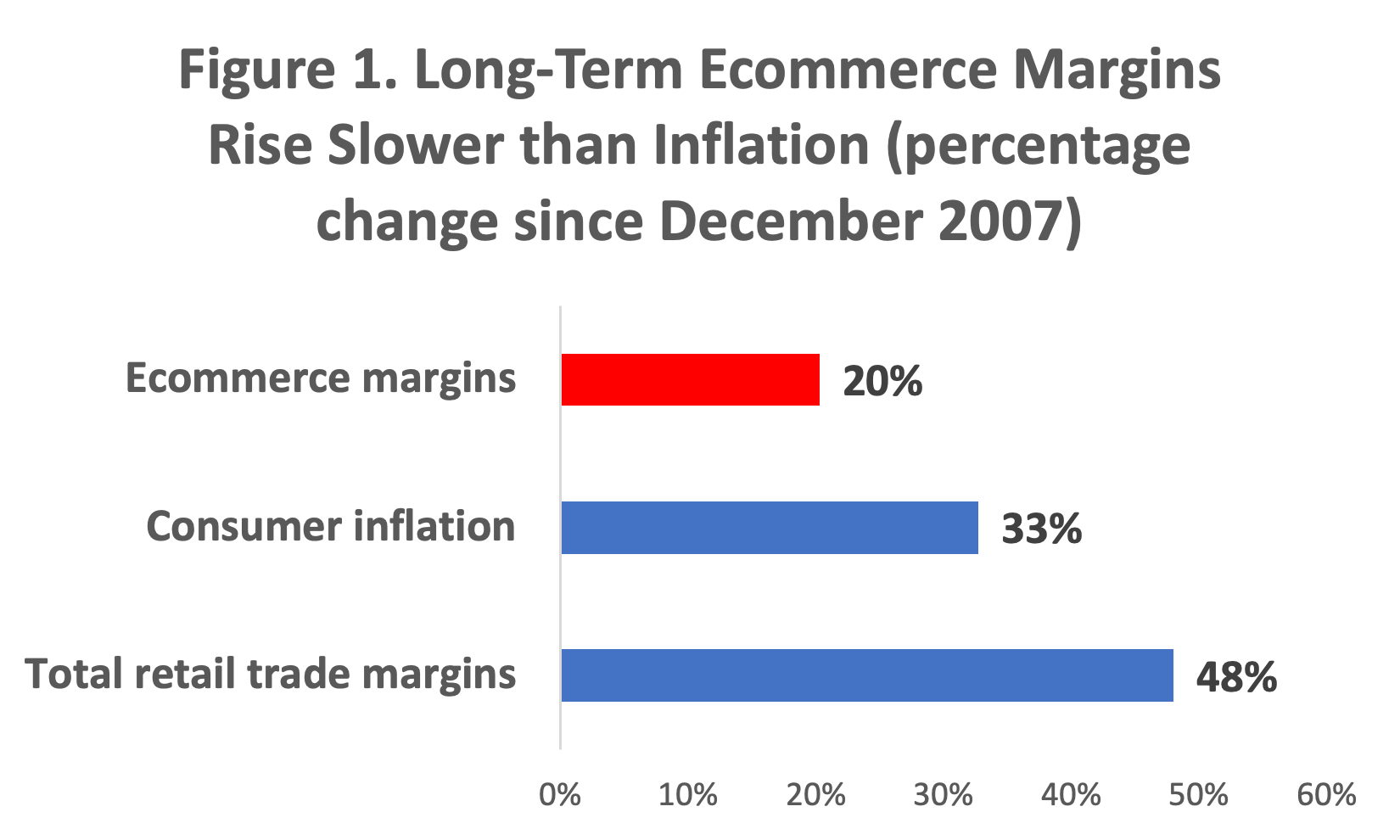

By comparison, the data for the overall retail industry has shown a much worse inflation performance, measured by margins. Margins for the total retail industry rose by 48% since December 2007, much faster than consumer inflation. As a result, real margins for the retail industry as a whole have risen, putting upward pressure on consumer prices.

By comparison, the data for the overall retail industry has shown a much worse inflation performance, measured by margins. Margins for the total retail industry rose by 48% since December 2007, much faster than consumer inflation. As a result, real margins for the retail industry as a whole have risen, putting upward pressure on consumer prices.