In this episode of The Abundance Podcast, Richard Kahlenberg chats about the persistence of economic segregation, the connection between housing and education, and what the federal government in particular could do about it.

issue: Economy

The Oregon Rebate: A Well-Intentioned Policy with Flawed Outcomes

Getting public policy right is never easy. There are almost always unintended consequences and miscalculations that can lead to negative outcomes. However, when it becomes clear that a policy will not work as promised, policymakers have a responsibility to reconsider and withdraw the proposal.

This is the case with Oregon Measure 118, also known as the Oregon Rebate. The ballot measure proposes a 3% tax on a business’s gross sales above $25 million, and would apply to both S corporations and C Corporations. The revenue generated from this tax will be distributed equally among Oregonians of all ages and income levels, providing, according to the measure’s proponents, a $1,600 rebate for each person in the state.

Unfortunately, despite its good intentions, this measure will hurt, not help Oregon families.

It would create a budget shortfall. Several nonpartisan studies indicate that a 3% tax on corporate sales is unlikely to raise enough revenue to sustain a statewide $1,600 per person rebate. To maintain the rebate, the state legislature would have to cut expenses elsewhere, potentially affecting critical services like road maintenance, firefighting, and addiction recovery. Some estimates suggest that if the rebate were to become law, the state could end up with about $400 million less to spend on basic government services in the 2025-27 budget cycle.

The most vulnerable in Oregon would be left worse off. Although the Oregon Rebate was designed to create a basic level of income for all state residents, in reality, the budget shortfall will likely encourage cuts to vital safety net programs.

It would lead to higher prices for goods and services. The sales revenue tax established to fund the rebate would likely lead to higher prices, including for basic goods like food and transportation. The Legislative Revenue Office estimated that the gross receipts tax established in the measure is expected to increase prices by 1.3%. With average annual personal consumption expenditures estimated at $52,200 by the Bureau of Economic Analysis, a 1.3% increase in prices would add $679 in expenses per household. This would effectively diminish the value of the $1600 rebate, making it far less beneficial than it initially appears.

It would create unnecessary job losses. While historically low at 4.1%, the unemployment rate in Oregon has risen since last year, and many predict job creation will slow nationally. Unfortunately, Measure 118 could exacerbate this trend because a tax on gross corporate sales would harm businesses that have low profit margins. Unlike a traditional corporate income tax which is levied on net income or profits, the Oregon Rebate proposes a tax on gross sales, applying the same tax rate regardless of a company’s profitability. This would place a disproportionate burden on businesses with high revenues but low profit margins. In response, companies with marginal profits might choose to move out of Oregon or distort their business decisions by reducing sales to minimize tax exposure, which would negatively impact corporate growth and innovation.

Given the problems with the design of the Oregon Rebate, it is not surprising that the proposal is opposed by leaders from both political parties, including Oregon House Speaker Julie Fahey, Senate President Rob Wagner, House Majority Leader Ben Bowman, Senate Majority Leader Kathleen Taylor, Oregon Governor Tina Kotek, and Senate Republican Leader Daniel Bonham. Ensuring corporations pay their fair share is an important goal and one that should be pursued. But that is not what would be achieved should Measure 118 become law.

Mandel for The Hill: It’s official: America’s real wages are up under Biden-Harris

With inflation easing, the wages of working-class Americans are finally moving into the plus column. Average hourly pay for production and nonsupervisory workers — who make up four-fifths of employees — hit $30.27 in August, according to the latest report from the Bureau of Labor Statistics.

According to my organization’s analysis, working-class Americans’ wages, adjusted for inflation, have just edged higher than they were on Election Day, 2020. The average working-class American can now answer “Yes” to the question, “Are you better off now than you were under Donald Trump?”

That’s obviously important for political symbolism. But the milestone for real wages also explains a lot about why Americans have felt so badly oppressed by inflation up to now. The price of food and housing matters, but they matter more if price increases exceed wage gains.

Keep reading in The Hill.

New PPI Report Highlights Role of Foreign Direct Investment in Revitalizing U.S. Manufacturing Amid Nippon Steel’s Bid for U.S. Steel

WASHINGTON — As the U.S. seeks to bolster its domestic manufacturing, the role of foreign direct investment (FDI) is more critical than ever, particularly from trusted allies. This insight is at the heart of a new report from the Progressive Policy Institute (PPI), titled “The U.S. Wants Manufacturing to Drive Growth. Foreign Friends Can Help.” The report examines the converse of U.S. “friendshoring” in friendly countries: the potential for allied nations like Japan, South Korea, Canada, the UK, and Germany to support U.S. economic growth through investment in sectors ranging from electric vehicles to biopharmaceuticals.

The report, authored by Yuka Hayashi, is the second in a two-part series. The first, “Behind Japan’s U.S. Steel Bid: An Aging, Shrinking Home Market,” provides a fresh perspective on Nippon Steel’s proposed acquisition of U.S. Steel and closely examines the economic realities behind Nippon Steel’s pursuit of the American industrial icon.

The new report highlights how these investments can create high-paying jobs, drive technological innovation, and strengthen America’s position in the global economy. Drawing on examples from states like Ohio, Michigan, and North Carolina, where Japanese companies have built major manufacturing hubs, the study argues that such partnerships are essential to America’s economic future.

“If the U.S. wants to strengthen domestic manufacturing, promoting foreign investment from friendly countries is a smart strategy,” said Hayashi. “Not only does it create good-paying jobs and spur innovation, but it also deepens our economic ties with trusted allies, ensuring that critical industries remain secure.”

The report stresses that the U.S. must be strategic in welcoming investment from allied nations, especially in the context of growing tensions with China. As part of this strategy, the report calls for expanding “friend-shoring” partnerships — moving supply chains to allied nations to ensure resilience and stability.

In light of the Inflation Reduction Act and the CHIPS and Science Act, both passed in 2022, PPI’s report underscores the opportunity for the U.S. to attract even more foreign investment, particularly in green technology and semiconductor manufacturing. It also warns that protectionist policies could deter friendly nations from further investing in the U.S. economy.

Read and download the report here.

The Progressive Policy Institute (PPI) is a catalyst for policy innovation and political reform based in Washington, D.C. Its mission is to create radically pragmatic ideas for moving America beyond ideological and partisan deadlock. Learn more about PPI by visiting progressivepolicy.org. Find an expert at PPI and follow us on Twitter.

###

Media Contact: Ian O’Keefe – iokeefe@ppionline.org

The U.S. Wants Manufacturing to Drive Growth. Foreign Friends Can Help

Introduction

As the world grappled with shortages and soaring prices of energy and food following Russia’s invasion of Ukraine in the spring of 2022, Treasury Secretary Janet Yellen introduced the term “friend-shoring” to describe a new dynamic needed for America’s economic engagement with the world. She called for building and deepening integration among trusted partners to secure supplies of critical raw materials, technologies, and products.

“Let’s do it with countries we know we can count on,” she said in a Washington speech. “Favoring the ‘friend-shoring’ of supply chains to a large number of trusted countries, so we can continue to securely extend market access, will lower the risks to our economy, as well as to our trusted trade partners.”

Yet, when it comes to working with friendly partners seeking to invest in the U.S., Washington’s message has been less than

welcoming. Amid the rise of “America First” economic nationalism, its policies have been inconsistent and muddled, even for companies from the closest allies in Europe and East Asia. Election-year politics have further complicated its stance, casting in doubt the fate of a high-profile pursuit of U.S. Steel by Japan’s top steel maker.

President Biden wants to strengthen American manufacturing. Foreign investors can help speed it up. They have for decades created more jobs, paid higher wages and spent more on factories and equipment than the average U.S. manufacturer. Their spending on research and development has enhanced productivity and accelerated America’s strong innovation.

America’s manufacturing is already starting to benefit as companies from allied nations take up Yellen’s concept and “friend-shore” some of their production to the U.S. Amid growing U.S.-China tensions, South Korea’s LG Energy is building an EV battery plant with Hyundai Motor in Georgia and another with Honda in Ohio, while BMW is adding EV assembly lines to its South Carolina plant. Multi-billion-dollar semiconductor factories are under construction by Samsung in Texas and Taiwan Semiconductor Manufacturing in Arizona.

Yet, after hitting a record $440 billion in 2015, annual flows of foreign direct investment into the U.S. fell sharply — declines economists attribute to technical changes in corporate accounting strategies, as well as a protectionist turn in U.S. trade policy brought by former President Trump.

The pandemic then further lowered inflows. Between 2016 and 2023, the annual value of FDI averaged $256 billion. Investment flows have been helped by Washington’s efforts to bolster green technology and semiconductor manufacturing, but overall fell 28% in 2023 to $145 billion.

With the right set of policies, America can go a long way toward bolstering its domestic economy while strengthening its ties to close allies. To maintain strong alliances, the U.S. must not just talk, but show them it has their back.

Read the full report.

New PPI Report Examines Impact of ‘Buy Now, Pay Later’ on Consumer Credit

WASHINGTON — Amid growing concerns about economic instability and the risk of a wider economic downturn, the Progressive Policy Institute (PPI) has released a new report examining the rapidly expanding “‘Buy Now, Pay Later”’ (BNPL) trend. The report, titled “Buy Now, Pay Later: The New Face of Consumer Credit,” explores the benefits and risks of this emerging form of consumer credit and advocates for targeted regulations to protect consumers while encouraging ongoing innovation in the credit market.

Authored by Andrew Fung, an Economic Policy Analyst at PPI, the report highlights the growing popularity of BNPL services among young and low-income consumers, who are attracted to the flexibility these services provide in accessing goods and services that may otherwise be unaffordable. While BNPL loans can improve financial inclusion, they also carry significant risks, especially for consumers with limited financial literacy or those prone to overextending themselves financially.

“In today’s uncertain economic climate, it’s crucial to understand the patterns of consumer spending,” said Fung. “BNPL loans present a new way for consumers to access credit, but the rapid growth of this market requires careful attention to potential financial risks.”

The report outlines the current state of consumer credit, noting that while overall debt levels remain stable, there are emerging areas of concern that should be closely monitored. BNPL loans, with their smaller, fixed payment structures, are generally less risky than traditional credit cards. However, the report recommends sensible regulations, such as interest rate caps, clear loan term disclosures, and standardized dispute resolution processes, to protect consumers and support the sustainable growth of this credit option.

“As policymakers continue to navigate economic challenges, it’s important to examine the current state of consumer credit closely,” added Fung. “Our report provides a practical approach for ensuring BNPL can benefit consumers while mitigating potential risks to both individuals and the broader economy.”

The report also examines the demographic profile of BNPL users, revealing that these services are especially popular among Black, Hispanic, and female consumers, as well as those with household incomes between $20,000 and $50,000 per year. Although BNPL has grown rapidly, it still represents a relatively small portion of the overall American economy. However, its differences from traditional credit methods and the unique risks it presents are drawing increasing attention from policymakers.

Read and download the report here.

The Progressive Policy Institute (PPI) is a catalyst for policy innovation and political reform based in Washington, D.C. Its mission is to create radically pragmatic ideas for moving America beyond ideological and partisan deadlock. Learn more about PPI by visiting progressivepolicy.org. Find an expert at PPI and follow us on Twitter.

###

Media Contact: Ian O’Keefe – iokeefe@ppionline.org

Buy Now, Pay Later: The New Face of Consumer Credit

Introduction

Consumer credit plays two essential roles in our everyday lives. Instruments like credit cards make it possible for Americans to purchase everything from their daily latte to groceries and furniture with less friction, even if we have enough money in the bank. Beyond these smaller purchases, consumer credit also allows us to borrow to pay for bigger ticket items that may be too expensive to buy with their current resources. The second scenario can lead to a potentially dangerous expansion of household debt, which can trap some households in a debt spiral that’s hard to escape or have larger systemic effects.

This paper will consider the economic and policy ramifications of the current rapid expansion of one form of consumer credit, known as buy now, pay later (BNPL). Buy now, pay later loans serve as an alternative to traditional payment methods like credit cards when shopping online, allowing consumers to break up the cost of their purchase into several installments to be paid over the course of a few weeks or months, often with very low or zero interest. Understanding how this new form of consumer credit fits into the larger American economy is important, and this paper will explain why BNPL falls under the first category of consumer credit but does merit scrutiny and potential regulation as it continues to develop.

Read the full report.

Amazon Tops PPI’s Investment Heroes List for Fifth Consecutive Year

WASHINGTON — The past several years have been marred by turbulent economic times for the United States, with the COVID-19 pandemic, stubborn inflation, and high interest rates threatening Americans’ economic well-being. Despite these headwinds, some companies continue to show their faith in America’s future by making significant capital expenditures. The Progressive Policy Institute (PPI) yesterday released its annual report, titled “Investment Heroes 2024: Faith in the Future,” highlighting the top 25 companies with the highest capital expenditures in the United States for 2023.

For the fifth year in a row, Amazon leads the list, investing an estimated $36.8 billion in the U.S. in 2023. This brings Amazon’s total investment in the U.S. to $183 billion since 2019. Such substantial spending has not only created hundreds of thousands of jobs but has also helped hold down consumer price increases.

“From 2021 until 2023, the first three years of the Biden-Harris administration, PPI’s Investment Heroes invested more than $900 billion in the U.S. economy. That’s nearly 40% more than the comparable total in the first three years of the Trump-Pence administration,” said Michael Mandel, Vice President and Chief Economist at PPI. “This massive surge in capital spending has been a critical driver of job creation and economic growth.”

In second place is Alphabet, with an estimated $24.5 billion in domestic capital spending in 2023. It is followed by Meta, AT&T, Verizon, Walmart, Intel, Microsoft, Comcast, and Duke Energy, rounding out the top ten.

Top Ten Investment Heroes of 2024:

1. Amazon – $36.8 billion

2. Alphabet – $24.5 billion

3. Meta Platforms – $24.2 billion

4. AT&T – $22.9 billion

5. Verizon Communications – $20.1 billion

6. Walmart – $17.7 billion

7. Intel – $16.1 billion

8. Microsoft – $15.4 billion

9. Comcast – $13.5 billion

10. Duke Energy – $12.6 billion

Top 25 Investment Heroes of 2024:

11. Chevron – $11.7 billion

12. Charter Communications – $11.1 billion

13. ExxonMobil – $10.8 billion

14. Dominion Energy – $10.2 billion

15. PG&E – $9.7 billion

16. Apple – $8.9 billion

17. ConocoPhillips – $8.2 billion

18. Oracle – $7.7 billion

19. General Motors – $7.6 billion

20. Tesla – $7.5 billion

21. ExxonMobil – $7.4 billion

22. United Airlines Holdings – $7.2 billion

23. FedEx – $5.7 billion

24. Occidental Petroleum – $5.4 billion

25. Delta Air Lines – $5.3 billion

This year’s top 25 Investment Heroes invested a record $328.3 billion in the United States in 2023, up 1.3% compared to 2022. The growth of domestic capital expenditures by PPI’s Investment Heroes has outpaced the overall growth of U.S. nonresidential investment. Since 2019, domestic capital expenditures by PPI’s Investment Heroes has risen by 34.8%, compared to a 24.2% increase in total nonresidential investment over the same period.

“Our report showcases how leading companies are committing substantial resources to the U.S. economy, driving innovation, job creation, and long-term growth,” said Andrew Fung, co-author of the report. “These investments are vital for maintaining America’s competitive edge and ensuring economic stability.”

PPI’s Investment Heroes report emphasizes the critical role of capital expenditures in powering job creation and economic growth. The U.S. economy continues to outperform its industrialized peers, thanks in significant part to the domestic investments made by the companies on this year’s list. Furthermore, these investments help hold down price increases over the long term, particularly in sectors like e-commerce, broadband, data processing and wireless, where high investment correlates with lower long-term inflation.

Read and download the report here.

The Progressive Policy Institute (PPI) is a catalyst for policy innovation and political reform based in Washington, D.C. Its mission is to create radically pragmatic ideas for moving America beyond ideological and partisan deadlock. Learn more about PPI by visiting progressivepolicy.org. Find an expert at PPI and follow us on Twitter.

###

Media Contact: Ian O’Keefe – iokeefe@ppionline.org

Investment Heroes 2024: Faith in the Future

Introduction

The United States is going through turbulent times. The shock of the pandemic, followed by soaring inflation and high interest rates, buffeted Americans. Now, despite strong labor markets and continued economic growth, many people feel pervasive uncertainty about what’s next for the country.

Against this backdrop, some companies continue to show their faith in America’s future by putting their money on the line. PPI’s annual Investment Heroes report highlights how the country’s largest companies are investing in the United States using information from annual financial reports. This year’s 2024 Investment Heroes are the 25 companies with the highest capital expenditure investment in the United States in 2023, as measured by PPI’s methodology.

For the fifth consecutive year, Amazon was #1 on the list, investing an estimated $36.8 billion in the U.S. in 2023. Since 2019, Amazon has invested $183 billion in the U.S., according to PPI’s estimates. This staggering spending on productive capital has created hundreds of thousands of jobs, while holding down consumer price increases.

In the #2 spot of the 2024 Investment Heroes list is Alphabet, with an estimated $24.5 billion in domestic capital spending in 2023. It is followed by Meta, AT&T, Verizon, Walmart, Intel, Microsoft, Comcast, and Duke Energy.

Taken as a whole, this year’s top 25 Investment Heroes invested a record $328.3 billion in the United States in 2023, up 1.3% compared to 2022. In recent years, the growth of domestic capital expenditures by PPI’s Investment Heroes has outstripped the growth of overall U.S. nonresidential investment (Figure 1). For example, since 2019, domestic capex by PPI’s Investment Heroes has risen by 34.8%, compared to a 24.2% increase in total nonresidential investment over the same period.

Here’s another sign of growth, In 2021-2023, the first three years of the Biden-Harris administration, PPI’s Investment Heroes

invested more than $900 billion in the U.S. economy. That’s almost 40% more than the comparable total in the first three years of the Trump-Pence Administration.

This massive surge in capital spending has helped power job creation and economic growth. The U.S. economy is outperforming its industrialized peers in Europe and Japan, to a significant degree due to the domestic investments by the companies on this year’s list.

But there are more benefits to capital expenditures. Over the long run, more investment in capacity helps hold down price increases. In this report, we highlight the relationship between sectors with strong investment, such as e-commerce and wireless, and long-term low inflation trends for some goods and services.

In this report, we also consider patterns of spending on research and development, which boosts innovation and productivity growth. We note the reasons that R&D spending cannot be directly integrated into the Investment Heroes ranking. Nevertheless, many Investment Heroes have huge R&D budgets. Alphabet, for example, spent $45.4 billion on R&D in 2023. Some companies are making big investments in R&D, but do not appear on the Investment Heroes list because their spending is not reflected in their capital expenditures.

We examine patterns of domestic capital investment by sector and company. The biggest contributor to the Investment Heroes list is the tech/internet sector, with six companies on the list investing a total of $97 billion in the U.S. in 2023. The second biggest contributor is the broadband/wireless sector, with 4 companies and $68 billion in domestic capital investment.

Read the full report.

Paying for Progress: A Blueprint to Cut Costs, Boost Growth, and Expand American Opportunity

The next administration must confront the consequences that the American people are finally facing from more than two decades of fiscal mismanagement in Washington. Annual deficits in excess of $2 trillion during a time when the unemployment rate hovers near a historically low 4% have put upward pressure on prices and strained family budgets. Annual interest payments on the national debt, now the highest they’ve ever been in history, are crowding out public investments into our collective future, which have fallen near historic lows. Working families face a future with lower incomes and diminished opportunities if we continue on our current path.

The Progressive Policy Institute (PPI) believes that the best way to promote opportunity for all Americans and tackle the nation’s many problems is to reorient our public budgets away from subsidizing short-term consumption and towards investments that lay the foundation for long-term economic abundance. Rather than eviscerating government in the name of fiscal probity, as many on the right seek to do, our “Paying for Progress” Blueprint offers a visionary framework for a fairer and more prosperous society.

Our blueprint would raise enough revenue to fund our government through a tax code that is simpler, more progressive, and more pro-growth than current policy. We offer innovative ideas to modernize our nation’s health-care and retirement programs so they better reflect the needs of our aging population. We would invest in the engines of American innovation and expand access to affordable housing, education, and child care to cut the cost of living for working families. And we propose changes to rationalize federal programs and institutions so that our government spends smarter rather than merely spending more.

Many of these transformative policies are politically popular — the kind of bold, aspirational ideas a presidential candidate could build a campaign around — while others are more controversial because they would require some sacrifice from politically influential constituencies. But the reality is that both kinds of policies must be on the table, because public programs can only work if the vast majority of Americans that benefit from them are willing to contribute to them. Unlike many on the left, we recognize that progressive policies must be fiscally sound and grounded in economic pragmatism to make government work for working Americans now and in the future.

If fully enacted during the first year of the next president’s administration, the recommendations in this report would put the federal budget on a path to balance within 20 years. But we do not see actually balancing the budget as a necessary end. Rather, PPI seeks to put the budget on a healthy trajectory so that future policymakers have the fiscal freedom to address emergencies and other unforeseen needs. Moreover, because PPI’s blueprint meets such an ambitious fiscal target, we ensure that adopting even half of our recommended savings would be enough to stabilize the debt as a percent of GDP. Thus, our proposals to cut costs, boost growth, and expand American opportunity will remain a strong menu of options for policymakers to draw upon for years to come, even if they are unlikely to be enacted in their entirety any time soon.

The roughly six dozen federal policy recommendations in this report are organized into 12 overarching priorities:

I. Replace Taxes on Work with Taxes on Consumption and Unearned Income

II. Make the Individual Income Tax Code Simpler and More Progressive

III. Reform the Business Tax Code to Promote Growth and International Competitiveness

IV. Secure America’s Global Leadership

V. Strengthen Social Security’s Intergenerational Compact

VI. Modernize Medicare

VII. Cut Health-Care Costs and Improve Outcomes

VIII. Support Working Families and Economic Opportunity

IX. Make Housing Affordable for All

X. Rationalize Safety-Net Programs

XI. Improve Public Administration

XII. Manage Public Debt Responsibly

Read the full Blueprint.

Read the Summary of Recommendations.

Read the PPI press release.

See how PPI’s Blueprint compares to six alternatives.

Media Mentions:

Weinstein for Forbes: November’s Presidential Election Won’t Stop Fed From Cutting Rates

Last month, prices fell to their lowest levels almost two years. The June Consumer Price Index (CPI) dropped to 3.0% annually–down from 3.4% the prior month—and is now on the verge of hitting the Federal Reserve’s inflation target of 2%.

Almost immediately after the release of the CPI data, Republicans warned the Federal Reserve not to cut rates prior to the election in November. After Fed Chair Jerome Powell testified before the Senate Banking Committee Senator Kevin Cramer (R-N.D.) argued that “I personally don’t think they should…anything they do before November would be rightfully—would raise the question of their own independence.”

But will the Fed heed the call from Republicans to keep rates at their current level when its Federal Open Markets Committee meets on July 31 and September 18? Based on past history, the answer is a resounding no (assuming economic conditions require action).

Keep reading in Forbes.

Jacoby for Washington Monthly: Beacons of Hope for the Ukrainian Economy

By Tamar Jacoby

As donors and investors gather this week in Berlin for the Ukraine Recovery Conference, all eyes are on helping the besieged nation. In Mykolaiv, near the Black Sea, the Danish government assists by jump-starting local businesses, fighting corruption—and helping Ukraine shake off its Soviet economic legacy.

The damage is evident everywhere in Mykolaiv, once a bustling port and shipbuilding hub near the Black Sea, 85 miles east of Odesa. Russian and Ukrainian forces fought hand to hand in and around the city in March 2022, followed by eight months of relentless shelling by the frustrated invading army. In November, Ukrainian troops pushed the Russians out of range, and the invaders never made it to Odesa.

More than two years later, many of the windows in the working-class city are still covered with plywood. Parking lots are pocked with shell craters. There’s a gaping eight-story hole at the center of the empty regional administration building—a reminder of the missiles meant to assassinate popular Governor Vitalii Kim that killed 37 civil servants in late March 2022.

The city’s economic engine—the port—is idle. Russians still control the mouth of the channel that connects Mykolaiv to the Black Sea, and no cargo has come or gone since February 2022. The nearly 300-year-old town teems with displaced persons from southern Ukraine, but a quarter of the city’s prewar population of 480,000 has yet to return.

Keep reading in Washington Monthly.

PPI Comment on NPRM for Additional Student Debt Relief, Docket ID ED-2023-OPE-0123, Federal Register, 2024-07726

Although we at the Progressive Policy Institute (PPI) believe some modest relief from overly burdensome debt is warranted, we are concerned many of this rule’s provisions would provide generous windfalls to relatively affluent borrowers while providing little additional benefit for borrowers most in need. The rule also comes with a high cost to taxpayers — $147 billion by the department’s own estimates — yet has no offsets to pay for it, making it a clear violation of the Fiscal Responsibility Act’s administrative PAYGO provision. Proceeding with this rule as written would only worsen the existing bias that federal policy has towards the minority of young people who attend college, at the expense of the majority who do not yet will be saddled with the bill.

Founded in 1989, PPI – a 501(c)(3) think tank – is a force for radically pragmatic innovation in politics and government. Our mission is to develop a new progressive blueprint for change that can help center-left parties broaden their appeal and build stable governing majorities. PPI has been a prominent voice in fiscal policy through our Center for Funding America’s Future, which works to promote a fiscally responsible public investment agenda that fosters robust and inclusive economic growth. The Center has played a critical role in shaping fiscal policy debates around key legislation over the past five years and has been extremely involved in the national college affordability discussion.

In a previous comment, we applauded the administration’s efforts to expand and improve upon income-driven repayment programs, which we believe are the best mechanisms to help borrowers who are burdened by the debt of pursuing degrees from which they did not ultimately benefit. But we also warned that the Department’s SAVE plan was overly aggressive in scope, leading to the typical college graduate paying back only three fifths of what they initially borrowed — and not a dollar of interest. Providing such a generous subsidy is profoundly unfair to the majority of American taxpayers who didn’t attend college and are being asked to foot the bill for people who did, despite earning lower average incomes than them. Even worse, it is likely to further inflate the already high costs of college by incentivizing universities to hike tuition rather than control costs.

PPI is concerned that the current proposed rule would compound these mistakes. The rule’s most expensive provision, the cancellation of accumulated interest, will mostly benefit wealthy professionals while being redundant for low-income borrowers struggling with high debt burdens. Enrolling the SAVE plan already prevents borrowers with large loan balances and lifetime earnings equal to or below those of the average college graduate from having to pay any interest. But borrowers who enhance their future earnings by taking on large debts, such as lawyers, doctors, and other professional degree holders, will reap a significant windfall that they should not get if this rule is finalized as proposed. Currently, the rule proposes to cancel up to $20,000 of interest for those on standard repayment and an unlimited amount for those enrolled in IDR. We urge the department to set this interest cap as low as possible for all borrowers to limit these regressive impacts.

We are similarly concerned about the provision to forgive all loans after 20-25 years. Those enrolled in IDR plans even before the SAVE plan was enacted were on track to have their balances forgiven after 20-25 years of making the required payments. If someone is paying back student loans for more than 25 years, they are likely a professional degree holder with a large debt balance who has chosen to structure their repayment plans over a longer period of time. Giving forgiveness to a relatively affluent group in the last few years of their repayment is unnecessary and arbitrary, especially when the most vulnerable borrowers already benefit from a similar policy.

We are more sympathetic towards the provision providing relief to borrowers who attended low-value educational institutions. These students are most likely to be burdened by the debt of pursuing a degree from which they did not financially benefit. We applaud previous rulemaking from the department targeting these often fraudulent institutions, forcing them to transparently disclose the financial value they provide for students, cutting off future federal aid, and closing them if necessary. But we encourage the Department to work with Congress to ensure the costs of canceling this debt are borne by these predatory institutions as much as possible rather than asking taxpayers to foot the bill.

The administration has already spent more than $600 billion of American taxpayer money on executive actions to cancel student loan debt, most of which belonged to individuals with above-average lifetime earnings, without explicit approval from Congress. We urge the Department to work with lawmakers on developing progressive reforms to the SAVE plan, greater accountability for educational institutions, and other common-sense reforms to control the cost of higher education rather than pursuing more unilateral debt cancellation schemes.

Even in the absence of congressional action, we also encourage the Department to keep the above concerns in mind when developing their proposed regulations on “waivers for hardship,” as is mentioned to be forthcoming in the proposed rule.

Read the comment on the proposed Department of Education rule.

Kahlenberg in The Washington Post: To comply with court, federal agency lets White people claim social disadvantage

Richard Kahlenberg, director of the American Identity Project at the Progressive Policy Institute, said the shift away from race could help the MBDA focus more on socioeconomic status. But, he said, using a form to establish applicants’ disadvantage probably will not help the agency accomplish its goals, and he suggested the agency adopt an essay-writing process similar to universities and the SBA to help it focus on an individual’s need.

Kahlenberg, who testified for the plaintiffs in the Harvard case, has long criticized race-based affirmative action, arguing instead for a class-based approach.

“If you care about racial diversity, as I do, you want to find fairer ways to get to the same result,” he said.

“And it’s precisely because of the nation’s history of discrimination and the ongoing realities of discrimination by race that communities of color will disproportionately benefit from a needs-based approach to affirmative action,” he added. “And there’s no constitutional problem with that.”

The FTC’s Odd View of Online Inflation

During the inflationary surge of 2021-2022, PPI demonstrated that the inflation rate for digital goods and services was lower than the inflation rate for “physical-economy” goods and services such as food, energy, and housing. In the digital sector, price increases were moderated by faster productivity growth and higher investment rates. In particular, key digital sectors such as broadband and ecommerce did not experience the sort of capacity squeeze which drove up prices in other parts of the economy.

The Federal Trade Commission, however, takes the direct opposite position. In its antitrust complaint against Amazon, the FTC argues that Amazon is behaving in a way that drives up online prices — not just for Amazon, but for other online sellers. The FTC writes:

Amazon’s conduct causes online shoppers to face artificially higher prices even when shopping somewhere other than Amazon.

Amazon deploys a series of anticompetitive practices that suppress price competition and push prices higher across much of the internet by creating an artificial price floor and penalizing sellers that offer lower prices off Amazon.

In order to justify its claim of Amazon monopoly power, the FTC paints an odd picture of high and rising online prices relative to brick-and-mortar prices. In particular, the FTC’s complaint would imply that online inflation is higher than brick-and-mortar inflation.

What does the data show? To answer this question, we analyze private sector and government data from Adobe, the Bureau of Labor Statistics, and from the Census Bureau. Each of these have shortcomings, but together they tell a consistent story of online prices rising slower than offline prices.

We start with the Adobe Digital Price Index (ADPI), which tracks online prices for 18 different categories of goods, including books, groceries, electronics, pet products, and apparel. This index goes back to 2014, but we focused on the period since 2019, when the FTC’s argument would suggest that any potential Amazon effect on prices would be larger.

We matched inflation in 16 of the 18 ADPI categories with comparable categories in the BLS Consumer Price Index, which is mostly weighted towards brick-and-mortar sales. We found that the median online price increase was 3.1% for the four years ending December 2023. Over the same period, the median price increase across the comparable 16 BLS categories, including mainly brick-and-mortar sales, was 10.4%.

For example, in the category of appliances, the ADPI showed a price increase of 1.6% from December 2019 to December 2023, while the CPI showed a price increase of 9.3%. In the category of personal care products, the ADPI showed a price increase of 7.2%, compared to a 10.8% price increase for the CPI. And in the category of sporting goods, the ADPI showed a price increase of 4.4%, compared to a 9.9% increase for the CPI.

True, there are some categories where online prices have risen faster than the comparable BLS CPI index. For example, online apparel prices rose by 8.7% according to the ADPI, compared to 5.6% in the CPI. But overall, online prices rose slower in 10 of the 16 categories.

We now look at a different data set from the BLS, the producer price indexes for retail trade. These price indexes measure trade margins—that is, the difference between the acquisition price of a good and the sale price to consumers. If margins are expanding faster in a particular retail industry, that is a sign that prices to consumers are increasing faster than the acquisition price of good.

Through December 2022, the BLS published a margin price index for “electronic and mail order shopping.” That margin only rose by 3.2% from December 2019 to December 2022. Over the same period, the margin price index for general merchandise stories — including department stores and big box retailers such as Walmart and Target — rose by 24.2%. This sort of disparity is not consistent with the FTC’s story of online prices increasing faster.

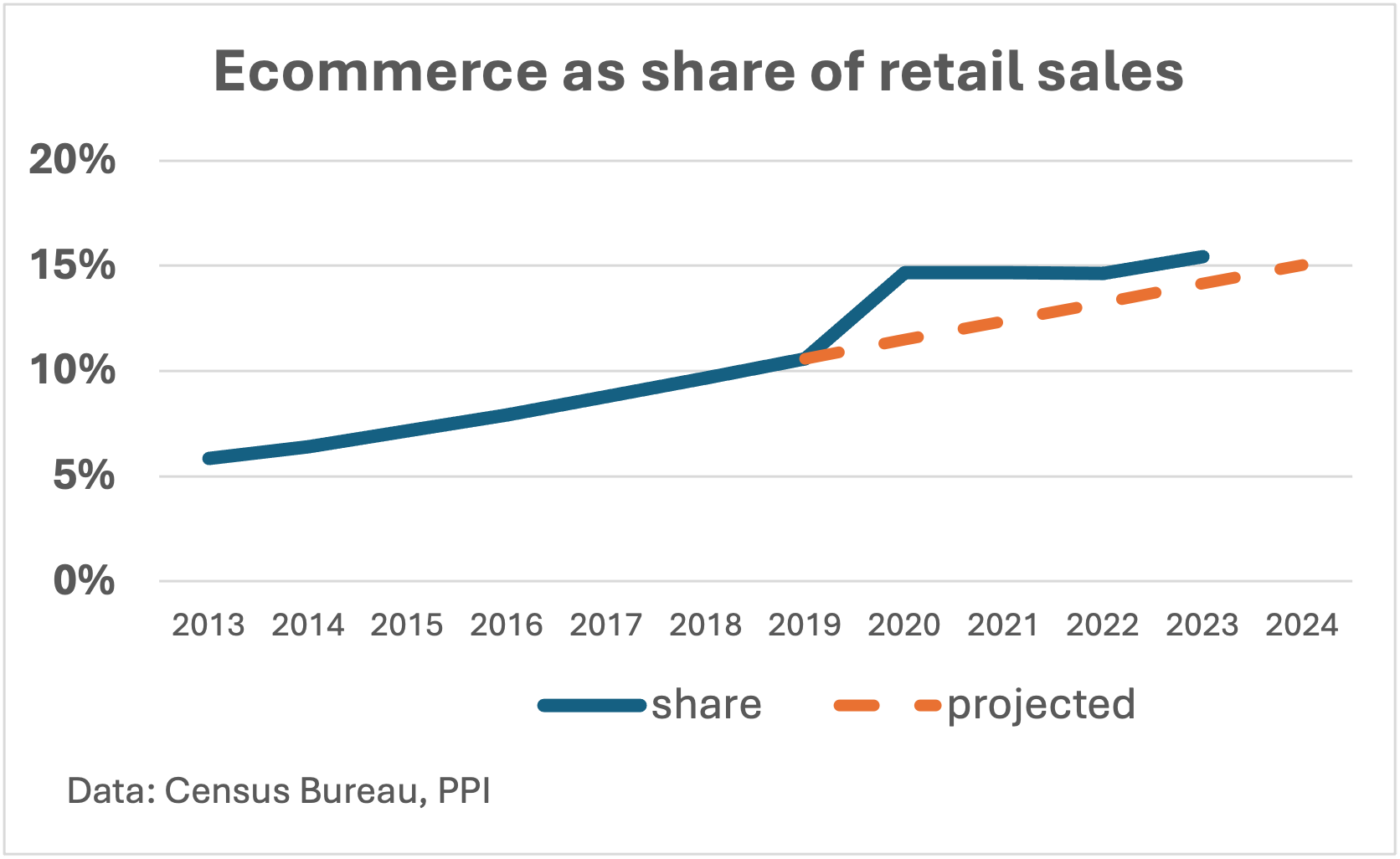

Finally, we look at the Census Bureau’s data on e-commerce spending as a share of total retail sales. Before the pandemic, the ecommerce share was rising at just under 1% per year. It obviously jumped during the pandemic, but then levelled off to 15.4% in 2023 (figure).

Based on pre-pandemic trends, we would have projected the ecommerce share to be 14.2% in 2023 and 15.0% in 2024 (the dashed line in the figure). To put it a slightly different way, the Census Bureau data suggests that the pandemic ended up moving the shift to ecommerce by only 1 year, or 1 percentage point.

This behavior is inconsistent with the FTC’s argument that online price inflation is higher than offline inflation. Higher online inflation, as the FTC claims, would have driven up the ecommerce share higher rather than lower, because consumers would have been spending more for the benefits of buying online. (To be a bit technical here, this conclusion also requires a low cross-price elasticity of demand between online and offline markets, which the FTC has already implicitly assumed in its complaint).

Indeed, the stagnation of the ecommerce share since the pandemic is more consistent with online inflation being slower than brick-and-mortar inflation, thus holding down ecommerce spending.

Let’s be clear: The data analyzed here are not perfect. Our analysis does not rule out the possibility that online prices basically track offline prices. Consumers are not dumb, and there’s nothing holding them back from buying at their local Target or Walmart rather than Amazon if particular online prices veer higher, or shift back to online purchases if offline prices go up. But the weight of the evidence suggests that online inflation has been lower than offline inflation across this period.

The Cautionary Tale of ESG Oversight: Arkansas Should Heed Texas’ $886 Million Cost for Prioritizing Politics

With the creation of a new ESG Oversight Committee, Arkansas has made a substantial shift in the state’s changing investment and sustainability landscape. The committee was fully formed last month when Governor Sarah Huckabee Sanders appointed Tom Lundstrom as the committee’s fifth and final member. This committee is charged with identifying financial service providers who are thought to discriminate against certain traditional value industries (fossil fuels, ammunition, etc.) based on ESG-related considerations under last year’s House Bill 1307, which is now Act 411.

The committee’s judgments will have a significant impact on Arkansas’s investment climate and economy as it advances, with noteworthy deadlines for delivering its preliminary and final lists of these financial providers. The recently released report, “The Potential Economic and Tax Revenue Impact of Texas’ Fair Access Laws”, conducted by the Texas Association of Business Chambers of Commerce Fund (TABCCF), is an important source the Arkansas committee should review in order to understand the possible harm that comparable anti-ESG legislation has caused states who have chosen to inject politics into their decision making.

According to the TABCCF study, during 2022-2023, the Texas anti-ESG legislation resulted in an estimated:

- $668.7 million lost in economic activity.

- $180.7 million in decreased annual earnings.

- 3,034 fewer full-time, permanent jobs.

- $37.1 million in losses to State and local tax revenue.

The study asserts: “These findings illustrate that when government attempts to mandate values, no matter what kind to businesses, the market loses.”

The report is built on earlier work included in a 2023 study titled “Gas, Guns, and Governments: Financial Costs of Anti-ESG Policies,” by Drs. Ivan Ivanov of the Federal Reserve Bank of Chicago and Dan Garrett of the University of Pennsylvania. The study looked at certain organizations that were thought to be boycotting due to their affiliations or fiduciary decisions that have been expelled or removed from the municipal bond market.

Their resulting analysis: this legislation did, in fact, limit competition in the public finance sector, raising interest rates by 0.144 percent.

Thanks to its pro-business environment, Texas now has the eighth-largest economy in the world. Less competition in the municipal bond market, however, is driving up interest rates, which puts more strain on local governments’ finances and adds to the costs borne by Texas taxpayers.

If that wasn’t enough, the underlying political effects of these politically driven policies continue to rear their head. Just this week, Aaron Kinsey, the Chair of the Texas State Board of Education (SBOE) announced the Texas Permanent School Fund Corporation divest approximately $8.5 billion of assets BlackRock currently manages for them – a move that will undoubtedly further increase costs while reducing returns for Texas schools.

This action, which allegedly came without a formal board vote, quickly upset Kinsey’s fellow SBOE board members. “We just can’t divest from them overnight. They’re very good moneymakers for us,” Republican SBOE board member Pat Hardy said of BlackRock, concluding, “They’ve been really good. They’ve been one of our main investment people for, gosh, 15 years.”

Given this context, Arkansas is presented with a cautionary tale that highlights the necessity for thoughtful assessment to prevent deterring business investments in the state and jeopardizing fund performance for political theater.

The position taken on this matter by the Arkansas Teachers Retirement System (ATRS) highlights the financial implications and practical difficulties associated with enacting a narrow boycott list. ATRS has emphasized that three BlackRock-managed funds, which have over $1.2 billion invested in them, do not exhibit bias against the energy, fossil fuel, weapons, or ammunition businesses. This disclosure is crucial because it demonstrates the system’s all-encompassing approach to guarantee that its investment managers respect Arkansas’s ESG standards while also being in line with the members’ financial interests.

Given the possibility of major financial ramifications, the Arkansas ESG Oversight Committee’s next judgments should be approached with prudence. The ATRS warning highlights the conflict between political goals and practical economic considerations on the potential costs of divesting from financial services companies—should they end up on the boycott list. Divestment of this kind might cost retired teachers in Arkansas alone at least $6 million.

The larger lesson is evident as Arkansas proceeds: establishing an ESG-related boycott list in a transition economy has complicated ramifications for retirees and private investors alike, in addition to the state’s budget and broader economy. The combination of ATRS’s proactive actions and Texas’ experience serves as a crucial reminder of the necessity for a nuanced, balanced approach that protects the interests of all parties involved. It will take careful thought and, most importantly, a clear understanding of the lessons gained from other jurisdictions to ensure that Arkansas maintains its inviting status for businesses.