America’s massive health care industry faces three major challenges: how to cover everyone, reduce costs, and increase productivity. Telehealth – the use of technology to help treat patients remotely – may help address all three. Telehealth reduces the need for expensive real estate and enables providers to better leverage their current medical personnel to provide improved care to more people.

Despite its enormous potential, however, telehealth has hit legal snags over basic questions: who can practice it, what services can be delivered, and how it should be reimbursed. As is the case with any innovation, policymakers are looking to find the right balance between encouraging new technologies and protecting consumers – or, in this case, the health of patients.

Telehealth policy has come a long way in recent years, with major advances in the kinds of services that are delivered. Yet a simple change in Medicare policy could take the next step to increase access and encourage adoption of telehealth services. Currently, there are strict rules around where the patient and provider must be located at the time of service – these are known as “originating site” requirements – and patients are not allowed to be treated in their homes except in very special circumstances. To expand access to telehealth, Congress could add the patient’s home as an originating site and allow Medicare beneficiaries in both urban and rural settings to access telehealth services in their homes.

THE CHALLENGE: LEGAL BARRIERS LIMIT THE POTENTIAL FOR TELEHEALTH TO INCREASE ACCESS TO PATIENT CARE.

Under Medicare, telehealth is defined as “the use of electronic information and telecommunications technologies to support long-distance clinical health care” (1). Each program in Medicare – traditional Medicare, Medicare Advantage, and Medicare demonstration projects – has unique rules limiting when and how telehealth can be used. Because Medicare Advantage has different rules governing telehealth, this brief is specifically focused on the roughly 39 million seniors enrolled in traditional fee-for-service Medicare (2).

In traditional, fee-for-service Medicare, the Social Security Act defines how telehealth services may be covered. As amended in 1997, the law limits telehealth to services that are furnished to beneficiaries in certain types of geographic areas: either a rural health professional shortage area (HPSA) or a county outside of a Metropolitan Statistical Area (MSA). Besides being in a qualifying rural area, the originating site – or where the patient is located – is required to be at a physician office, hospital, rural health center, skilled nursing facility, federally qualified health center, community mental health center, or a hospital-based dialysis facility. In those facilities, patients can receive care remotely from 10 types of distant site clinicians qualified to deliver telehealth services. In other words, traditional Medicare beneficiaries, except in special circumstances, cannot receive telehealth services in their homes.

Though the Centers for Medicare and Medicaid Services (CMS) cannot authorize new originating sites without Congress, it does have the authority to decide which telehealth services are payable under the Medicare Physician Fee Schedule. In 2019, that schedule includes roughly 100 billing codes covering consultations, psychiatric care, smoking cessation, end-stage renal disease management, nutrition counseling, new and existing patient evaluation and management services, and post-nursing facility care. It’s clear that many of these services – particularly psychiatric care and smoking cessation – should not require the patient to drive into a qualifying medical facility and could be effectively delivered in the home.

More beneficiaries could benefit from increased access to telehealth.

To modernize telehealth delivery, Congress directed CMS under the 21st Century Cures Act and the Bipartisan Budget Act of 2018 to start relaxing some telehealth rules in 2019. Thanks to this legislation, beneficiaries under traditional Medicare now have access to a range of telehealth services that fall outside the parameters listed above, including at home. These include:

- Allowing Accountable Care Organizations (ACOs) to furnish telehealth services in the beneficiary’s home regardless of geographic location

- Permitting ACOs to use teledermatology and teleophthalmology services provided through asynchronous store-and-forward telehealth* technologies

- Expanding coverage of telestroke services – a service where emergency department clinicians can consult with stroke specialists in distant locations – to all geographic areas

- Providing individuals with end-stage renal (ESRD) disease monthly ESRD-related clinical assessments via telehealth at home after first receiving a face-to-face appointment

Despite these advances, there are still many instances where Medicare beneficiaries

could benefit from telehealth from home but are not permitted to do so under current rules.

It is no surprise that telehealth utilization in traditional Medicare remains low. Though utilization increased between 2014 and 2016, only 90,000 traditional Medicare beneficiaries used 275,199 telehealth services in 2016. This represents roughly a quarter of 1 percent (0.25 percent) of the more than 35 million fee-for-service Medicare beneficiaries included in CMS’s telehealth analysis. Interestingly, growth was highest among the oldest group – those beneficiaries over 85. The data show that 85.4 percent of the traditional Medicare beneficiaries using telehealth services had at least one mental health diagnosis – and that psychotherapy was one of the most used telehealth services. The data also show that telehealth use is higher in states with large rural areas or HPSA. This, no doubt, reflects the legal requirement that patients must be in such areas to receive telehealth services (3).

By adding the patient’s home as an originating site in traditional Medicare, patients in urban or other underserved areas could also benefit from using telehealth services in their homes. Roughly 80 percent of seniors have one chronic disease and 68 percent have two or more (4). Telehealth can help patients better manage their conditions in the convenience of their own home. According to a 2017 GAO report, a Veterans Health Administration’s (VHA’s) program – that provided home-based telehealth services to veterans with chronic conditions – resulted in a 40 percent reduction in hospitalizations (5).

Telehealth could reduce costs.

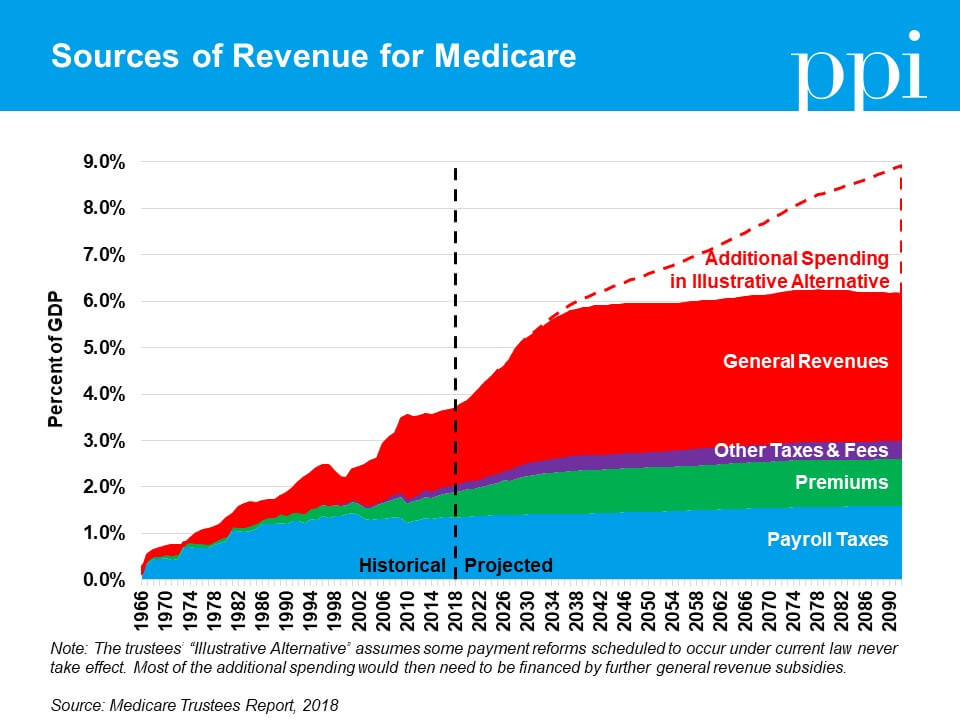

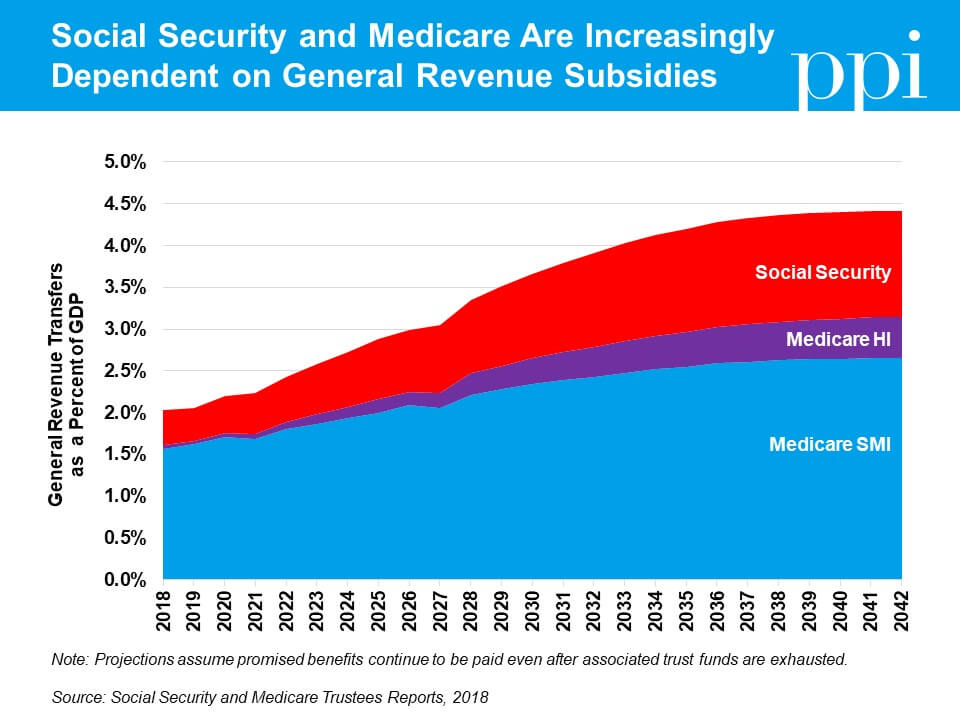

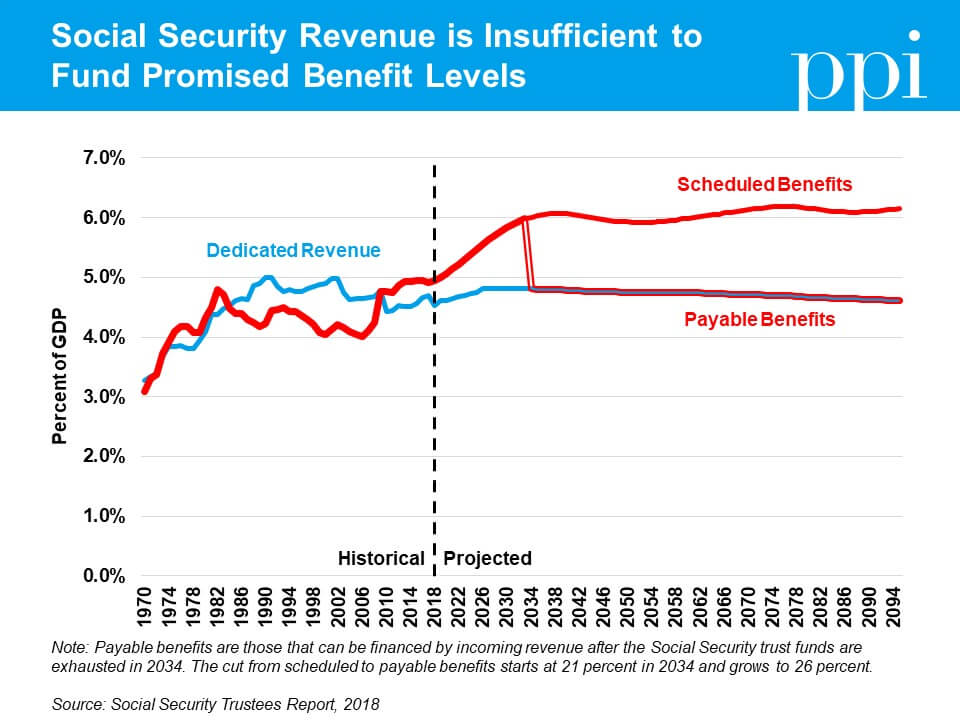

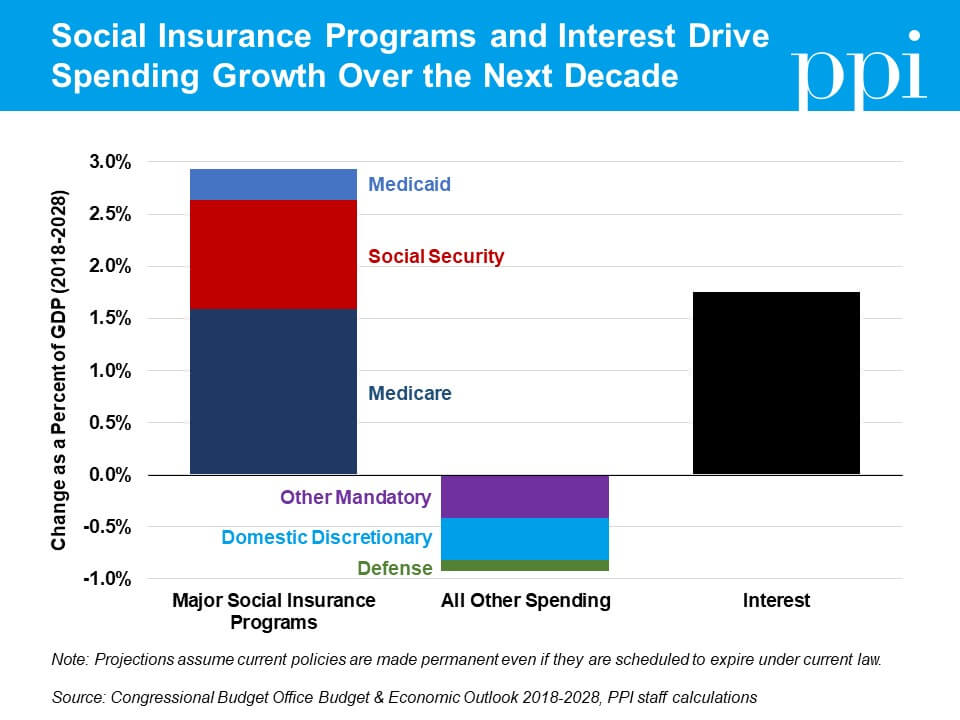

In addition to expanding access to high-quality medical services to people in underserved areas, telehealth may also save money. This is crucial because, as Medicare’s Trustees warn year after year, the nation’s health-care program for seniors faces serious financial challenges that threaten its ability to meet its obligations to future beneficiaries. Though it used to have budget surpluses, now, each year, the hospital insurance (HI) fund, which covers Medicare Part A, runs a chronic deficit (6).

Virtual visits are cheaper than in-person care, on average, in the commercial insurance market. In the commercial market, telehealth visits cost roughly $100 less per visit than in-person visits. Generally, virtual consultations are priced at $40–50, while office visits check in at $136–$176 (7). In Medicare, however, online visits are priced the same as in-person visits and usually involve a facility fee to cover the patient’s visit to a medical facility. Savings could be realized from serving patients in home and eliminating redundant facility fees (8).

THE GOAL: EXPAND ACCESS TO TELEHEALTH SERVICES AS A WAY TO IMPROVE ACCESS AND POTENTIALLY REDUCE MEDICARE COSTS

Commercial plans generally permit telehealth originating sites in both rural and urban areas, though they vary with coverage of services provided while the patient is at home. While expanding the coverage of telehealth services in Medicare may increase costs initially, those extra costs could be justified by both the expanded access and the better outcomes telehealth services could deliver. Moreover, in the long run, helping patients manage chronic conditions, avoid hospitalizations, and reduced facility fees will save money.

For example, one program focused on providing acute care at home for older, vulnerable patients with one of nine conditions – exacerbations of congestive heart failure, chronic obstructive pulmonary disease, community-acquired pneumonia, cellulitis, deep venous thrombosis, pulmonary embolism, complicated urinary tract infection or urosepsis, nausea and vomiting, and dehydration – found a 38 percent reduction in mortality for patients treated at home. Appropriately titled “Hospital at Home” outpatients had comparable or better clinical outcomes and saved an average of 19 percent relative to similar hospital inpatients. Among the important components of this program were “telehealth nurses,” who monitored patients’ vital signs remotely via telehealth units installed in patients’ homes (9).

There is an ongoing debate between advocates of telehealth who argue that expanding services increases access to care and other policymakers who caution that telehealth may not act as a substitution for in-person services and instead increase unnecessary utilization without improving outcomes. Because telehealth has been limited to-date, the data are mixed. However, there is clear potential to improve access and convenience, and, over time, that could improve outcomes.

THE PLAN: EXPAND ACCESS TO TELEHEALTH BY ALLOWING REIMBURSEMENT UNDER TRADITIONAL MEDICARE FOR APPROVED TELEHEALTH SERVICES DELIVERED TO PATIENTS’ HOME

Rather than slowly increasing the sites and services allowed under telehealth, Congress should allow CMS to authorize a patient’s home as an originating site so clinicians can deliver medically necessary services via telehealth to patients’ homes.

There’s a precedent for abolishing originating site rules. In 2016, the Department of Defense (DoD) announced that a patient’s home would qualify as an originating site as long as the provider worked at a military treatment facility. Additionally, California has recently proposed abolishing originating site rules in its Medicaid program, saying telehealth originating sites can include, but are not limited to, “a hospital, medical office, community clinic, or the patient’s home.” By expanding the definition of “originating site,” California is moving to allow clinicians to provide more telehealth services. These changes are too recent to have garnered data, but it is clear that other agencies are looking to expand access to telehealth.

Congress should follow suit. Lawmakers could significantly expand access to services by amending the Social Security Act clause that governs originating site rules and expanding the definition to include the patient’s home as a qualifying originating site.

Telehealth has come a long way since it was first authorized under Medicare in 1997. But the laws governing telehealth from 20 years ago are outdated. It’s time to allow Medicare recipients to get telehealth services in their home.

* When health-care providers review patient medical information like lab reports, imaging studies, videos, and other records at another location and at a time that is convenient for them. The service is not delivered in real time.

[gview file=”[gview file=”https://www.progressivepolicy.org/wp-content/uploads/2019/02/PPI_NewIdeas_Telehealth_FINAL.pdf”]

ENDNOTES

1) Health Resources and Services Administration Federal Office of Rural Health Policy. Available from: https://www.hrsa.gov/ruralhealth/telehealth/

2) Medicare Enrollment Dashboard, “Hospital/Medical Enrollment,” Centers for Medicare and Medicaid Services, October 2018. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Dashboard/Medicare-Enrollment/Enrollment%20Dashboard.html.

3) “Information on Medicare Telehealth,” Centers for Medicare & Medicaid Services, 2018.

https://www.cms.gov/About-CMS/Agency-Information/OMH/Downloads/Information-on-Medicare-Telehealth-Report.pdf.

4) “By the Numbers: The Impact of Chronic Disease on Aging Americans,” CVS Health, January 2017.

https://cvshealth.com/thought-leadership/by-the-numbers-the-impact-of-chronic-disease-on-aging-americans.

5) “Information on Medicare Telehealth,” Centers for Medicare & Medicaid Services, 2018.

https://www.cms.gov/About-CMS/Agency-Information/OMH/Downloads/Information-on-Medicare-Telehealth-Report.pdf.

6) “OASDI and HI Annual Income Rates, Cost Rates, and Balances,” Social Security Administration, 2018. https://www.ssa.gov/oact/tr/2018/lr6g2.html.

7) Daniel H. Yamamoto, “Assessment of the Feasibility and Cost of Replacing In-Person Care with Acute Care Telehealth Services,” Red Quill Consulting, December 2014.

https://www.connectwithcare.org/wp-content/uploads/2014/12/Medicare-Acute-Care-Telehealth-Feasibility.pdf.

8) Ibid.

9) Lesley Cryer, Scott B. Shannon, Melanie Van Amsterdam, and Bruce Leff, “Costs For ‘Hospital At Home’ Patients Were 19 Percent Lower, With Equal Or Better Outcomes Compared To Similar Inpatients,” Health Affairs 31, no. 6 (2012): 1237-1243, https://content.healthaffairs.org/content/31/6/1237.full.