Distressingly, the labor share of income in the US has been on a long -term downward trend. Indeed, the labor share is lower now than it was in 2006, before the last recession. Recent research has proposed that the labor share has fallen, in part, because market power has been increasing across the US economy.

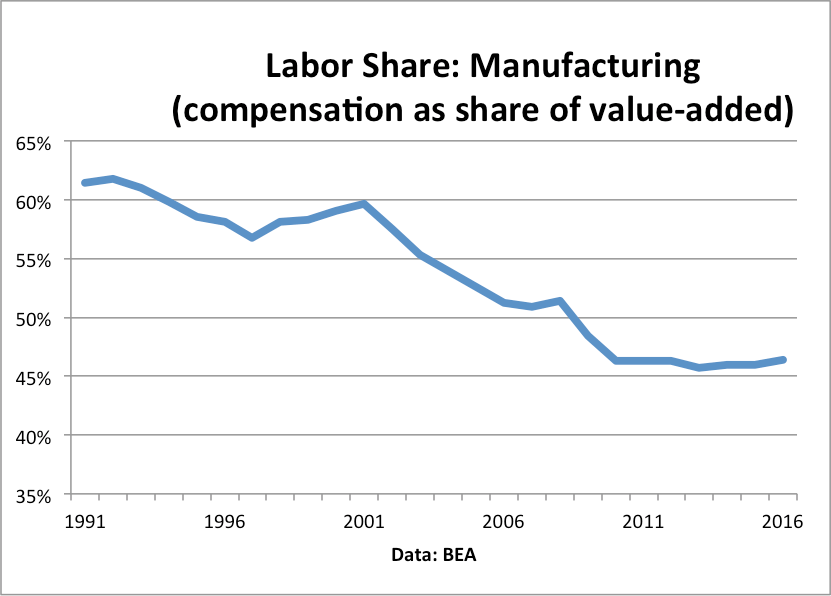

However, it’s important to understand that the fall in the labor share has been highly uneven. In particular, the manufacturing labor share has experienced a very deep plunge. The labor share of value-added in manufacturing has fallen from 61% in 1991 to 51% in 2006 to 46% in 2016.*

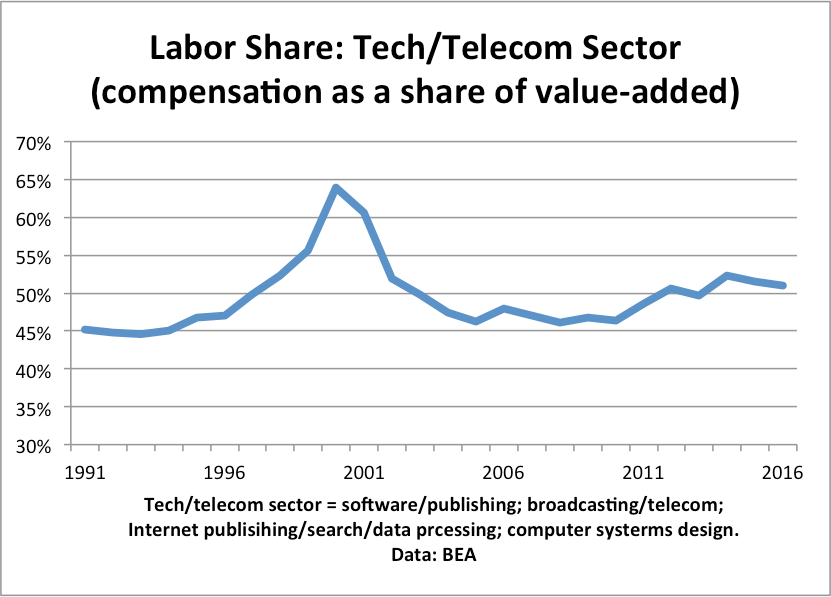

By contrast, the labor share in the tech/telecom sector has been on a mild upward trend, with the exception of a blip from the 2000 tech boom. The labor share in the tech/telecom sector was 45% in 1991, 48% in 2006, and 51% in 2016. (For the purposes of this analysis, we define the tech/telecom sector to include software and other publishing; broadcasting/telecom; internet publishing, search and data processing; and computer systems design).

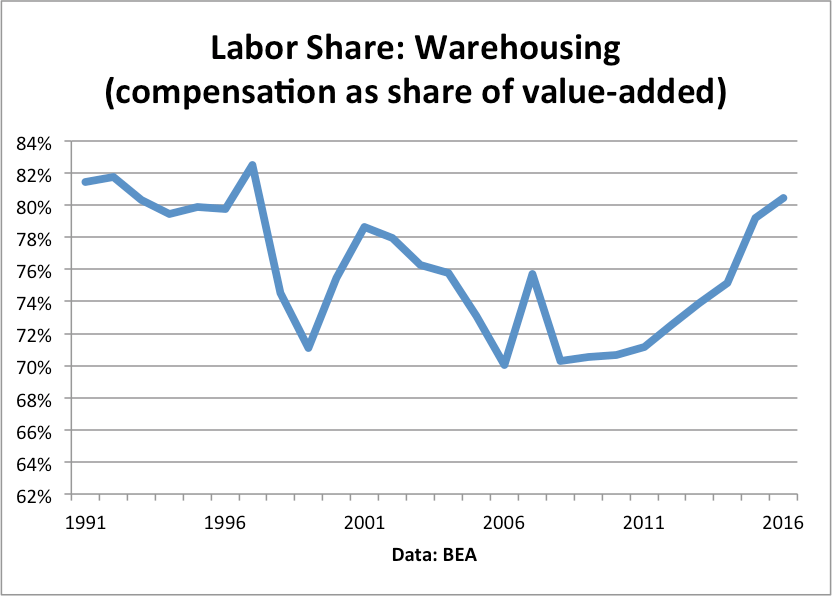

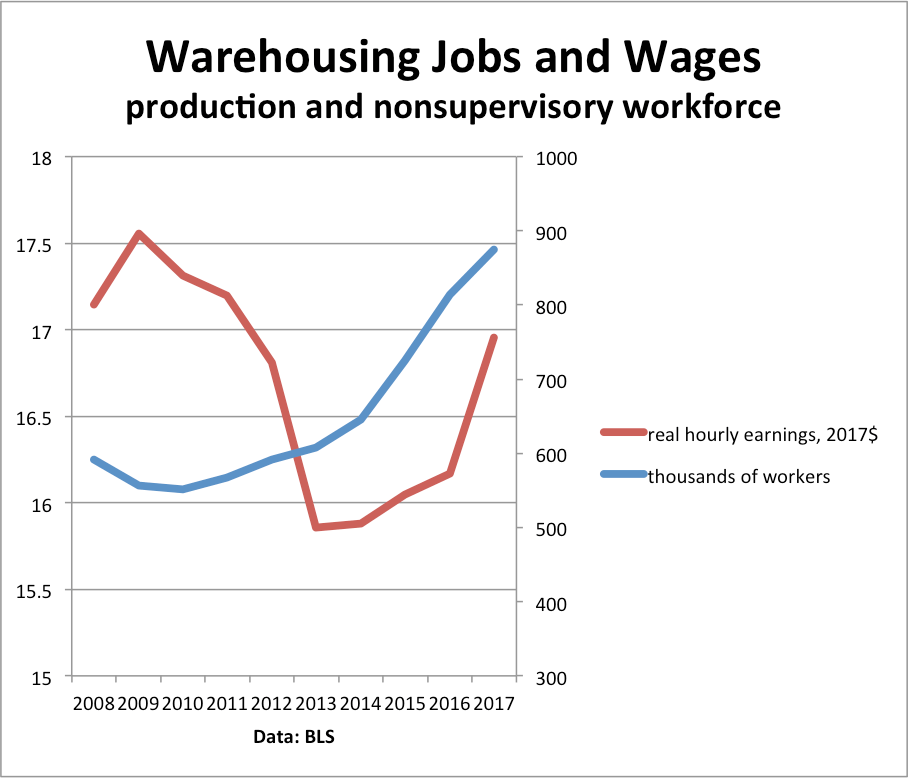

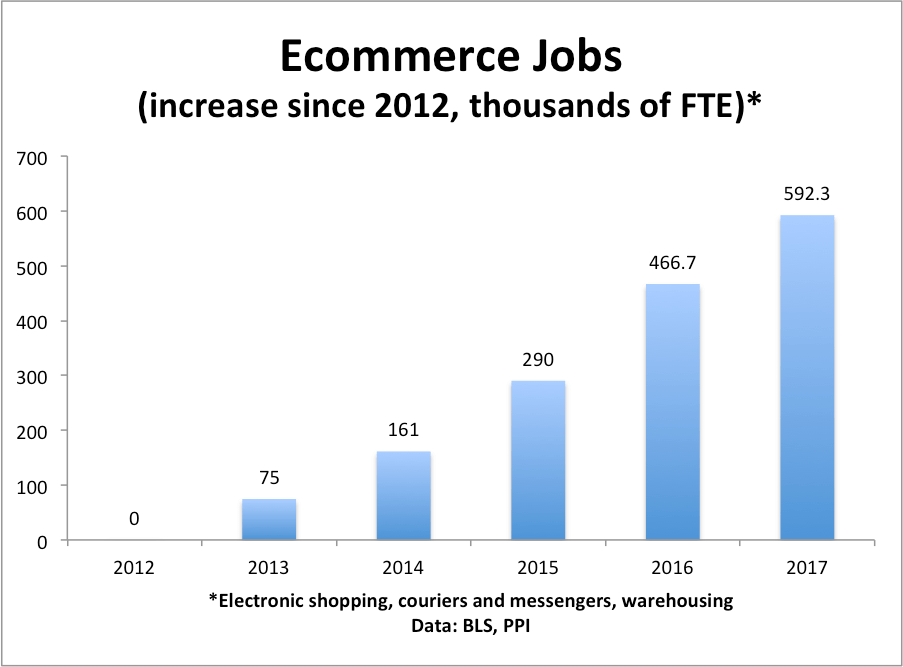

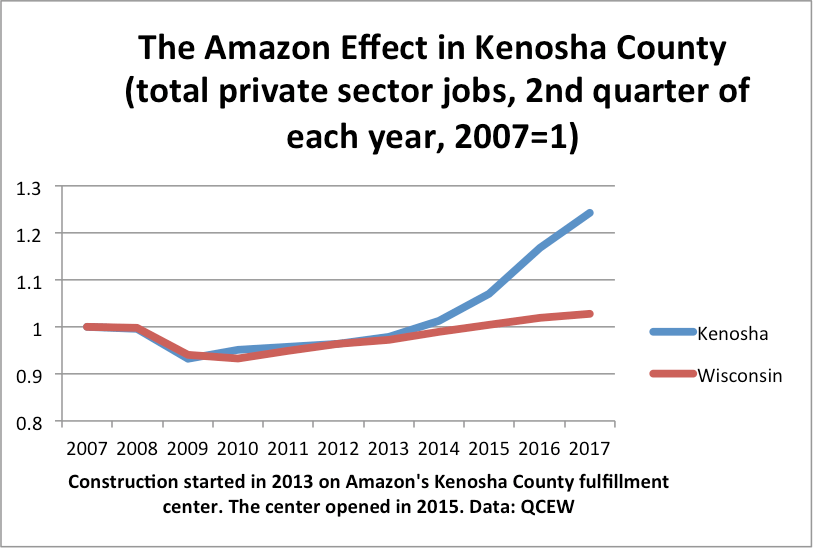

This definition of the tech/telecom sector excludes ecommerce fulfillment centers, which are mainly counted in the warehousing sector. We note that over the past ten years, labor share in warehousing has risen from 70% to 80%, coincident with the rapid expansion of ecommerce.

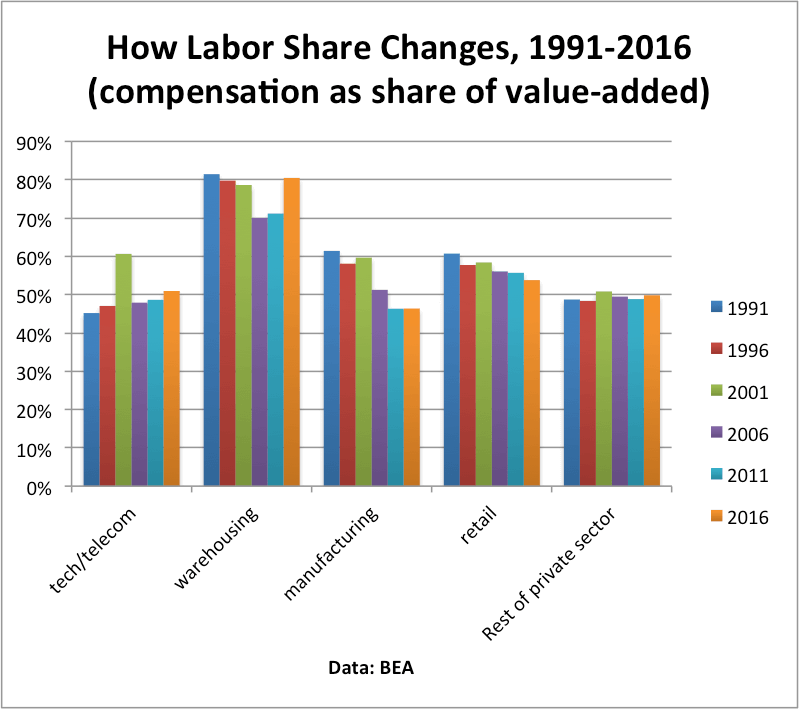

The figure below sums up this analysis. Note that tech/telecom labor share is on a mildly upward trajectory. Manufacturing and retail labor share are on long-term downward trends. And labor share in the rest of the private sector is basically flat, going from 49% in 1991 to 50% in 2016.

By this analysis, the fall in the overall private sector labor share over the past 25 years was almost entirely driven by sharply declining shares in manufacturing (responsible for 89% of the drop), with some contribution from retail. The interesting question, then, is why the manufacturing labor share fell so consistently–does increased concentration have a role? If we just look at domestic manufacturing, there has been an increase in concentration. In 2012, the top 100 US manufacturing companies accounted for about 40% of manufacturing shipments, up from 31% in 1997.

More work needs to be done. But it’s reasonable, at least, to consider the role of manufacturing concentration.

*These figures are derived from BEA’s data on compensation and value-added by industry, as last updated in November 2017.