FACT: The U.S. needs 8,000 tons of cobalt a year, and produces 300 tons.

THE NUMBERS: Cobalt reserves known as of 2024, worldwide* –

| World | 11.00 million tons |

| Democratic Republic of Congo | 6.00 million tons |

| United States | 0.07 million tons |

| All other countries | 5.30 million tons |

* U.S. Geological Survey, Mineral Commodity Surveys 2025

WHAT THEY MEAN:

Last March, Marco Rubio, the Secretary of State, announced cancellation of 5,200 U.S. Agency for International Development contracts — all but about 1000 of them – claiming that the projects they underwrote “did not serve, (and in some cases even harmed), the core national interests of the United States.” A PPI guest post today by former USAID economist Kevin Ward looks at one of these projects: an effort to secure American manufacturers’ supply of the “critical mineral” cobalt through a transport project in the Democratic Republic of Congo. Ward’s story illustrates the work USAID professionals actually do — often technical, designed for shared benefit, sometimes entailing personal risk — and also casts an ironic light on Mr. Rubio’s line about national interests and things that don’t serve, or sometimes even harm, them:

As a point of departure, the experts at the U.S. Geological Survey consider a mineral “critical” when it is (a) “essential to the U.S. economy and national security,” and (b) “ha[s] supply chains that are vulnerable to disruption.” Reliable access for American industry to these minerals is thus widely thought (including by the Trump administration) a “core national interest.” USGS’ official list has 50 of them, from arsenic and antimony to zinc and zirconium, complete with their uses, sources, production levels, trade flows, and availability in the U.S..

Cobalt, a bluish metal selling for $33,335 per ton on the London Metal Exchange today, is No. 10 on the list. Used for centuries for stained glass and deep-blue paints, it meets USGS’s two “critical” tests because it is (a) necessary for the heat- and wear-resistant ferroalloys used for aircraft engines, and the lithium-ion batteries that run smartphones and electric vehicles, and (b) in short supply. American factories need about 8,000 tons of cobalt each year, but the lone U.S. source is the Eagle Mine in Michigan, a mainly copper-and-nickel operation which also produces about 300 tons of cobalt, and is set to close in four years.

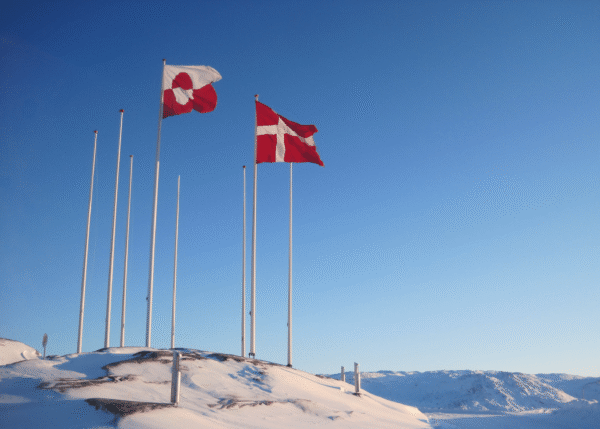

So most cobalt must come from somewhere else, and one country in particular has a lot. The Democratic Republic of Congo (in central Africa along the eponymous river, formerly Zaire, home to 84 million people) has 55% of the world’s 11 million tons of cobalt reserves, and produces 75% of the world’s 290,000 tons of annual mining output. But as Ward explains, geopolitical uncertainty makes this source “vulnerable to disruption”:

“Though the DRC is the world’s largest cobalt producer and the second largest copper producer, its mineral supply chains are tightly controlled by China: Chinese companies own the country’s largest mines, its local processing operations, and the railroad that takes its minerals to China for additional processing.”

This is where USAID came in. The contract Ward was working on last winter was clearing the way for American businesses to get access without relying on Chinese middlemen:

“To counteract China, USAID supported the growth of a copper processing industry in the DRC and various projects along the Lobito Corridor: an infrastructure initiative connecting the Copperbelt to Angola’s Port of Lobito, increasing access to the U.S. market. As part of that effort, I kicked off a new USAID activity in January of 2025 to help refurbish the railroad from the DRC’s Copperbelt to the Angolan border — a key segment of the Lobito Corridor.”

In sum, a modest U.S. investment would restore a dilapidated railroad outside Chinese control, running from mining areas in the interior to the coast through Angola. Railcars carrying cobalt along it could sell their cargo to American manufacturers. This was one part of a five-year, $235 million program, with additional financial backing from a third U.S. agency (the Development Finance Corporation) and several dozen USAID technical people on the ground. Not a luxury posting for them, to put it mildly — see the State Department’s “Level 4, Do Not Travel” advisory for civilians and CDC’s health warnings about endemic cholera, meningitis, etc. But the job is part of a mission to serve a widely agreed U.S. interest in reducing, or perhaps eliminating, a risk of supply shock for thousands of large American manufacturers, and is the sort of work USAID people regularly do. Ward laconically explains the project’s current status:

“[W]ork came to an abrupt stop on January 20, 2025.”

So: By canceling this particular project, the administration more or less concedes a Chinese monopoly on the largest supply of a critical mineral. In a few years, even designing such projects may be harder: per its 2026 budgeting, the administration hopes to cut USGS by 40%, so by 2027 the government may lack experts on critical mineral reserves and production. The administration is, though, offering a baffling substitute: Mr. Lutnick’s Commerce Department is proposing “national security” tariffs on critical minerals — that is, taxes of 25% or so on essential things not in sufficient supply at home. In practice, this is a chance for American auto, aircraft, and battery companies to pay $41,670 per ton of cobalt, rather than the $33,335 their overseas competitors pay.

Lots more stories like this among the other 5,199 cancellations, of course. So, in a sense, Mr. Rubio is right to say that some people are going around doing things that “do not serve (or even harm) the core national interests” of the United States. He won’t have to look hard to find them.

FURTHER READING

PPI’s four principles for response to tariffs and economic isolationism:

- Defend the Constitution and oppose rule by decree;

- Connect tariff policy to growth, work, prices and family budgets, and living standards;

- Stand by America’s neighbors and allies;

- Offer a positive alternative.

Kevin Ward on USAID’s Lobito Corridor railway project.

PPI’s February defense of the American foreign assistance tradition — ideals, interests, and aid — from Herbert Hoover’s World War I famine relief program through JFK’s launch of USAID to PEPFAR‘s HIV/AIDS prevention and treatment, the Millennium Challenge Corporation, and Feed the Future in the 21st century.

New Ukraine Project Director Tamar Jacoby on USAID in Ukraine.

… & Mr. Rubio in March.

Cobalt and critical minerals:

The U.S. Geological Survey explains the “critical minerals” concept and lists the 50 critical minerals.

… and summarizes the cobalt-mining world. The mine outputs in 2024:

| World: | 290,000 tons |

| Democratic Republic of Congo | 220,000 tons |

| Indonesia | 28,000 tons |

| Russia | 8,700 tons |

| Canada | 4,500 tons |

| Australia | 3,600 tons |

| United States | 300 tons |

| All other countries | 24,700 tons |

Cobalt prices at the London Metal Exchange.

… the Eagle Mine in Michigan’s Upper Peninsula is the sole U.S. cobalt producer.

… & the Commerce Department solicits ideas on how American firms can pay more.

The Royal Society of Chemistry’s interactive Periodic Table of the Elements has physical properties and uses for all 118 elements, with cobalt at atomic number 27.

Democratic Republic of Congo:

The Development Finance Corporation announces Lobito Corridor plans, December 2024.

The Democratic Republic of Congo Embassy.

The State Department’s travel advisory has some blunt advice for civilians – “Do not travel to the Democratic Republic of Congo due to Armed Conflict, Crime, Civil Unrest, Kidnapping, and Terrorism” – and the CDC has guidance on avoiding cholera, meningitis, schistosomiasis, malaria, and other ailments.

The Commerce Department’s guide for U.S. businesses in the DRC is a little more upbeat: “opportunities for firms with a high tolerance for risk and familiarity operating in complex or fragile environments”.

The Labor Department’s International Labor Affairs Bureau has been supporting work to reduce and eliminate child labor in DRC mining, including for cobalt specifically. Perhaps not much longer: as with USGS, the administration hopes to cut ILAB by about 40% this year, and confine its work mostly to issues linked in some way to “trade enforcement”.

ABOUT ED

Ed Gresser is Vice President and Director for Trade and Global Markets at PPI.

Ed returns to PPI after working for the think tank from 2001-2011. He most recently served as the Assistant U.S. Trade Representative for Trade Policy and Economics at the Office of the United States Trade Representative (USTR). In this position, he led USTR’s economic research unit from 2015-2021, and chaired the 21-agency Trade Policy Staff Committee.

Ed began his career on Capitol Hill before serving USTR as Policy Advisor to USTR Charlene Barshefsky from 1998 to 2001. He then led PPI’s Trade and Global Markets Project from 2001 to 2011. After PPI, he co-founded and directed the independent think tank ProgressiveEconomy until rejoining USTR in 2015. In 2013, the Washington International Trade Association presented him with its Lighthouse Award, awarded annually to an individual or group for significant contributions to trade policy.

Ed is the author of Freedom from Want: American Liberalism and the Global Economy (2007). He has published in a variety of journals and newspapers, and his research has been cited by leading academics and international organizations including the WTO, World Bank, and International Monetary Fund. He is a graduate of Stanford University and holds a Master’s Degree in International Affairs from Columbia Universities and a certificate from the Averell Harriman Institute for Advanced Study of the Soviet Union.