The courts and the polls have said no to racial preferences. Richard Kahlenberg sees this as good news for Democrats, progressives and the cause of racial justice.

Category: Uncategorized

Weinstein Jr. for Forbes: College Closures (And Mergers) Will Accelerate Under President Trump

America’s colleges and universities are under duress. At least 76 public or nonprofit colleges have closed or merged since March 2020, and some experts believe more are on the way.

A big reason for this trend is the “enrollment cliff.” This year, the number of high school graduates will peak at around 3.9 million and then begin a gradual descent that will result in about 13% fewer by 2041.

In response, many institutions of higher learning have recruited students from overseas to backfill the declining domestic enrollments. In the 2023-24 academic year, a record number of international students attended U.S. colleges and universities, marking a 7% increase from the previous year. Altogether, international student enrollment contributed $43.8 billion to the U.S. economy last year.

Read more in Forbes.

Trump’s BBB is Shaping Up to Be an Even Bigger Mess Than Biden’s

From our Budget Breakdown series highlighting problems in fiscal policy to inform the 2025 tax and budget debate.

Donald Trump was elected in 2024 on a promise to “End Inflation and Make America Affordable Again.” He criticized “Joe Biden’s reckless spending spree, which is more reckless than anybody’s ever done or had in the history of our country.” And he complained that the incumbent Democrat was guilty of “weak, ineffective, and virtually nonexistent leadership.” In survey after survey, voters made clear they largely agreed with Trump’s assessment.

Perhaps no episode of Biden’s presidency better displayed the traits that fueled these criticisms than his failed effort to pass a sprawling “Build Back Better” domestic spending bill through the filibuster-proof reconciliation process in 2021. But as Congressional Republicans begin crafting a “big beautiful bill” to enact the bulk of Trump’s economic agenda through that process, there are early signs that they’re making all the same mistakes — or perhaps even more.

Although very different in their origins and ideological goals, these two BBBs have far more in common than just their initials. Both Biden’s BBB and Trump’s BBB seem crafted more to fulfill a lengthy wishlist for the president’s ideological allies than address a pressing national need. Both parties struggled to find a way to pay for these wishlists in large part because of shortsighted tax pledges their presidential nominee made during the previous campaign. Rather than right-sizing their ambitions, Republicans today are seeking to ram through their BBB using legislative tactics eerily reminiscent of those that backfired on Democrats in 2021. And both parties pursued their BBB with a cavalier disregard for their contributions to inflation, provoking voters’ ire on their top economic concern.

But there are many ways in which the 2025 Republican BBB is likely to be even more damaging — both economically and politically — by piling on debt and exacerbating inflation at a time when the country can least afford it. If Republicans continue going down this path, they risk betraying their electoral mandate to cut the cost of living and giving Democrats a perfect opportunity to regain something that’s long eluded them: public confidence on handling the economy.

Read the full comparative analysis.

Deeper Dive

- Trump Inherits a Broken Fiscal Policy He Seems Determined to Make Worse, by Ben Ritz and Alex Kilander

- The Inflationary Risks of Rising Federal Deficits and Debt, by Yale Budget Lab

- On Major Economic Decisions, Trump Blinks, and Then Blinks Again, by the New York Times

- Full Array of Republican Tax Cuts Could Add $9 Trillion to the National Debt, by the Peter G. Peterson Foundation

- Joe Biden was the president who could not choose, by Dylan Matthews

- The Post-Neoliberal Delusion And the Tragedy of Bidenomics, by Jason Furman

Fiscal Fact

House Republicans have claimed that their proposed tax cuts “will generate $2.5 trillion in additional revenue through economic growth,” but several independent analyses have found that they would actually shrink the economy over the next decade.

Further Reading

Other Fiscal News

- Trump sends a scorched-earth budget plan. GOP lawmakers hate it already, by Politico

- Estimates for Medicaid Policy Options and State Responses, by the Congressional Budget Office

- Fed Warns of Rising Economic Risks as It Leaves Rates Steady, by Wall Street Journal

- House Republicans Eye Scaled Back Tax Cut Amid Fights Over Spending, by Politico

More from PPI & The Center for Funding America’s Future

- GOP Defense Increase Gets Less for More, by Alex Kilander

- Congressional Republicans Take Dangerous Step Towards Ending Budget Enforcement, by Ben Ritz and Alex Kilander

- Opportunity Charter High Schools And Early Career Outcomes, by Bruno Manno

- The 1890s Were Not America’s ‘Wealthiest’ Age, by Ed Gresser

The 1890s were not America’s ‘wealthiest’ age

FACT: The 1890s were not America’s “wealthiest” age.

THE NUMBERS: U.S. share of world GDP, PPP basis* –

| 2024 | 15% |

| 2016 | 16% |

| 1950 | 27% |

| 1913 | 19% |

| 1890s avg. | ~15%? |

| 1870 | 9% |

| 1820 | 2% |

* Angus Maddison calculations for 1820-1950; IMF World Economic Outlook April 2025 for 2016 and 2024.

WHAT THEY MEAN:

The Trump administration’s binge of tariff decrees, proclamations, and amendments leaves the U.S. with a tariff rate hard to calculate since it changes every week, but likely somewhere between 15% and 25%. Internationally, this is a strange tax-and-trade neighborhood for America; the neighbors are a sketchy assortment of least-developed countries, failed states, shady tax havens, small islands, and rogue states. (See below for some examples.) But the administration and Mr. Trump personally justify high tariffs not by alluding to the success of modern high-tariff countries, but by looking a long way back through the American past. To cite an eccentric and frequently repeated comment:

“In the 1890s our country was probably the wealthiest it ever was because it was a system of tariffs.”

What to make of this?

It’s true that America had high tariff rates in the 1890s. The U.S. International Trade Commission’s table of tariff rates back to 1891 shows a “trade-weighted average” tariff averaging 27.9% from 1891 to 1900, over ten times the 2.4% of 2023. It’s wrong, though, to say American wealth peaked relative to other countries, let alone in absolute terms, at that time. Based on the research of Angus Maddison et al., the U.S.’ share of ‘global GDP’ in the 1890s was probably around 15%. This is a lot higher than it had been before the Civil War (which was also a high-tariff period), but well below the levels of the 1950s and 1960s (after 30 years of steadily falling tariffs), and about the same as it is today.

More important, Americans at the time didn’t feel rich at all. A four-part stat snapshot:

Short lives: America’s average life expectancy at birth in 1900 (Table 13) was 47. This is six years below today’s lowest in the world, the 53 years the World Bank reports for Chad and Lesotho. The short life expectancy in part reflects the extremely high pre-20th century infant mortality rate — more than one in ten American children died before the first birthday — but also frequent death in early life and middle age due to accidents, infections, and contagious diseases. No vaccines, no blood transfusion, no antibiotics, no anti-inflammatory drugs.

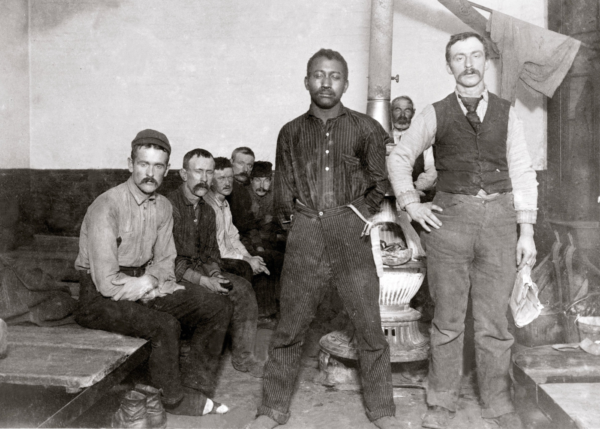

Injustice: Work and daily life in 1890s America were deeply unjust and growing rapidly worse. Between 1890 and 1895, 16 states adopted segregationist constitutions and laws covering employment, marriage, voting, education, railroad and streetcar travel, and other matters. The Supreme Court’s 1896 “Plessy v. Ferguson” decision accepted them all.

Bad economy: GDP accounting and data collection started in the early 1930s, so we don’t precisely know 19th-century growth rates.* (One reputable economic-history project guesses around 3.0% over the 1880s and 1890s.This is slightly below the 3.5% average over the Biden administration, and a bit above the 2.5% average since the 2008/2009 financial crisis.) The decade’s main economic event, though, was the four-year Depression following the “Panic of 1893.” It introduced the word “unemployment” to common American discourse, and prompted the first mass protest march in U.S. history, when “Coxey’s Army” of 6,000 desperate Ohio and Pennsylvania workers marched to the National Mall to appeal (unsuccessfully) for federal relief. Those who had jobs, meanwhile, worked on average for 2980 hours a year – 1200 hours more than modern-day workers, meaning 10 hours a day, six days a week, with no holidays.

Widespread poverty: Americans were poor and used most of their income for life necessities. The Bureau of Labor Statistics’ “100 Years of Consumer Spending” reports that in 1900, the average American family spent 58% of its income on food and clothes. Today the comparable share is 12%. Even the top end of “Gilded Age” society had only 8,000 automobile owners and 600,000 mostly communal telephones, in a country of 76 million.

As to the role of tariffs in all this: Gilded Age tariff system defenders argued that high tariffs protected Americans from “low-wage” European and Asian competition. Critics said it mainly protected monopolies, while encouraging political corruption and depressing middle-class living standards. Public opinion polls weren’t invented until the 1930s, so we don’t really know how the public in general felt. But opposition to high-tariff policy in the 1890s and 1900s was strong, organized, and persistent enough to convince 42 state legislatures to pass an amendment to the Constitution in 1913 authorizing the creation of the income tax, which replaced the tariff as the main federal revenue source.

So, not an era of wealth and not a tax policy the public loved. Nor a time anyone should want to revisit.

FURTHER READING

PPI’s four principles for response to tariffs and economic isolationism:

- Defend the Constitution and oppose rule by decree;

- Connect tariff policy to growth, work, prices and family budgets, and living standards;

- Stand by America’s neighbors and allies;

- Offer a positive alternative.

Laura Duffy for PPI on why tariffs are a bad form of taxation: can’t raise enough money to support a modern government; non-transparent; inequitable; harm to downstream industries.

Back then:

Two book recs for those wanting a deep dive into Gilded Age tariff debates:

Pioneer journalist Ida Tarbell’s contemporary take in The Tariff in Our Times (1915) associates high-tariff policy more with monopolies, high prices, and corruption than with “wealth”. Samples: “extortion and brigandage”, “jobbery”, “shameless looting”, etc.

Doug Irwin’s magisterial Clashing Over Commerce (2017) reviews U.S. trade and tariff history from the 18th century forward: the First Congress, the “Tariff of Abominations” and the nullification crisis, McKinley and Hoover, Wilson’s replacement of tariffs with the income tax and Roosevelt’s Reciprocal Trade Agreements Act, 20th-century liberal internationalism and its critics, the first Trump administration and the equivocal Biden term.

Big picture:

Via the OECD, Angus Maddison’s data on world GDP, growth, population, etc., 1-2,000.

And economic-history consortium “Measuring Worth” tries to calculate growth, inflation, and other data back to the 18th century.

Now:

A tariff rate between 15% and 25% puts Americans in the world’s highest tariff bracket. Per the World Bank’s “weighted-mean” calculations, only three jurisdictions have tariff rates above 20%, and 21 have rates between 12% and 21%. They’re very diverse — small islands, tax havens, least-developed countries, conflicted or failed states, a few bad actors — but share a common theme of inability, as being too small, too poor, or too disorderly, to operate broader-based, fairer taxes on incomes or consumption. The top three are Bermuda at 29.5%, the Solomon Islands at 20.7%, and the Cayman Islands at 20.4%. Here are ten of the 21 between 12% and 20%:

18.2% Congo (Republic)

17.6% Djibouti

16.8% Chad

16.3% Bahamas

14.7% Nauru

14.6% Barbados

14.5% Central African Republic

12.7% Ethiopia

12.6% Venezuela

12.1% Iran

For an alternative source, the WTO’s Tariff Profiles 2024 gets somewhat different numbers because it uses ‘simple averages’ and ‘trade-weighted averages’ rather than ‘weighted means’, and doesn’t cover all the small islands. But the picture is pretty similar.

And last:

A mordant sound-track for the next few months from folk legend Pete Seeger: Big Muddy.

ABOUT ED

Ed Gresser is Vice President and Director for Trade and Global Markets at PPI.

Ed returns to PPI after working for the think tank from 2001-2011. He most recently served as the Assistant U.S. Trade Representative for Trade Policy and Economics at the Office of the United States Trade Representative (USTR). In this position, he led USTR’s economic research unit from 2015-2021, and chaired the 21-agency Trade Policy Staff Committee.

Ed began his career on Capitol Hill before serving USTR as Policy Advisor to USTR Charlene Barshefsky from 1998 to 2001. He then led PPI’s Trade and Global Markets Project from 2001 to 2011. After PPI, he co-founded and directed the independent think tank ProgressiveEconomy until rejoining USTR in 2015. In 2013, the Washington International Trade Association presented him with its Lighthouse Award, awarded annually to an individual or group for significant contributions to trade policy.

Ed is the author of Freedom from Want: American Liberalism and the Global Economy (2007). He has published in a variety of journals and newspapers, and his research has been cited by leading academics and international organizations including the WTO, World Bank, and International Monetary Fund. He is a graduate of Stanford University and holds a Master’s Degree in International Affairs from Columbia Universities and a certificate from the Averell Harriman Institute for Advanced Study of the Soviet Union.

Read the full email and sign up for the Trade Fact of the Week.

Kahlenberg for The 74: A Way Out of SCOTUS Charter School Ruling Mess: Focus on Mission, Not Religion

On April 30, the Supreme Court heard oral arguments in a case that could compel states with charter school laws to authorize religious charters. Reporters from the New York Times, the Washington Post, the Wall Street Journal and The 74 said the court’s conservative majority bloc appeared “open to” religious charter schools.

Such a ruling would be bad for the country and deeply disruptive. It could upend the charter school sector, raising questions about the constitutionality of the federal charter school law and the laws in 47 states, all of which require charters to be nonsectarian. It could lead to blue states cutting back on charter schools and red states seeing a flood of religious charters open up, which would further balkanize an already divided country.

Is there any hope? The best outcome would be if one of the conservative justices — most likely Chief Justice John Roberts — ended up siding with the liberal justices and rejecting a requirement that authorizers must permit religious charter schools. The second-best outcome would be if policymakers took creative steps (as I outline below) to comply with an adverse Supreme Court ruling while preserving social cohesion and retaining for charter schools the flexibility they need to flourish.

Jacoby for Washington Monthly: Poland’s Trump Conundrum—and Vice Versa

Every country, from Canada to Vietnam, is facing the same high-stakes conundrum: Is it wiser to try to placate Donald Trump or to push back against his bullying and outlandish demands?

Arguably, no nation is in a more difficult position than Poland. Historically one of America’s closest European allies, it’s also the country with the most to lose if a revanchist Russia, emboldened by a skewed peace in Ukraine, sets its sights on regaining its traditional sphere of influence not just within the former Soviet Union but also beyond it.

Imagine a spectrum with China on one end and Italy on the other. Beijing has defied Trump’s tariffs and hit back hard with retaliatory levies. Italian Prime Minister Georgia Meloni, the only European leader to attend Trump’s second inauguration, never misses a chance to flatter the 47th president and is angling for a trade deal.

In between, Japan and South Korea say little in public while pursuing bilateral agreements with Washington. Britain and France make nice in the Oval Office but still strive, with charm and diplomacy, to persuade Trump to block Vladimir Putin’s bid to dominate Ukraine. Incoming German Chancellor Friedrich Merz has taken a tougher stance, vowing European “independence from the USA.” So has Canada, where Prime Minister Mark Carney, fresh off a stunning electoral triumph for his once-seemingly-doomed Liberal Party, has accused the American president of “trying to break us so he can own us.”

Both leaders of Poland’s two-headed “cohabitation” government—national conservative President Andrzej Duda and centrist Prime Minister Donald Tusk—were once touted as “Trump whisperers” who could wrangle the U.S. president on behalf of Europe. Neither has managed to capture that mantle—if indeed there is such a thing. Several Polish officials, all of whom I spoke to this month, were wary of the term and requested anonymity as their nation heads into a presidential election.

Read more in Washington Monthly.

Manno for Forbes: Opportunity Charter High Schools And Early Career Outcomes

Celebrating National Charter School Week – May 11 to 17

“The federal Charter Schools Program has turned out to be one of the larger and more successful examples of government-supported research and development in the K-12 realm, in ways that have fostered considerable innovation,” writes K-12 policy expert Chester E. Finn, Jr. This year’s National Charter School Week celebrates the 30th anniversary of that Program’s first funding awards to charter schools in 1995. Nearly half of today’s charter schools have received Program funds.

The Charter Schools Program was created with the passage of the Improving America’s Schools Act, which “New Democrat” President Bill Clinton signed into law on October 20, 1994. The bipartisan Act was approved in the U.S House of Representatives by a vote of 289 to 128 and in the U.S. Senate by a vote of 94 to 6.

The program now provides federal financial assistance to open new public charter schools, expand existing high-quality schools, and increase access to school facilities. Current federal funding has reached $440 million, up from $4.5 million in 1995. The Trump administration has proposed increasing federal support to $500 million for the next funding year.

Read more in Forbes.

What Jamelle Bouie Gets Wrong About My Views on DEI

I often admire Jamelle Bouie’s work, so I was deeply disappointed that his recent New York Times articleincluded a gross mischaracterization of my thinking on Diversity Equity and Inclusion (DEI) policies.

Bouie writes:

Consider this line of thought from Richard Kahlenberg of the Progressive Policy Institute, a curiously named group founded as the primary think tank of the centrist Democratic Leadership Council in 1989. According to Kahlenberg, observations that the Trump administration is not interested in fairness as such are “over the top.” To him, the president simply wants the government to “treat different racial groups the same.”

If someone didn’t click to the link Bouie provided to my report for the Progressive Policy Institute, “A Way Out of the DEI Wars,” a reader might reasonably assume I’m some sort of Trump apologist who agrees with his approach on DEI. The reader would presumably be surprised to learn that in the report, I’m deeply critical of Trump. I write:

After a tragic airplane crash, at a moment when the president should have been consoling the country, Trump cast blame on DEI policies despite lacking any evidence. The administration also hired an acting Under Secretary of State for Public Diplomacy who wrote in October, “Competent white men must be in charge if you want things to work.” As outlined below, Trump issued anti-DEI executive orders that were vague, and his purge of DEI staff in the federal government swept up some people who had merely attended DEI sessions. He has targeted for elimination not only racial preference policies, but also President Lyndon B. Johnson’s requirement that, before firms evaluate candidates in a race-neutral fashion, they engage in outreach efforts to make sure a diverse group of applicants are aware of opportunities. Trump has claimed to defend “merit” and then appointed cabinet members who are utterly unqualified. In short, if one wanted to find someone to make a principled case against DEI excesses, it is hard to think of a worse candidate than Donald Trump.

In the report, I called Bouie’s critique of Trump’s opposition to racial preferences “over the top” when he compared it to the actions of President Woodrow Wilson. Bouie wrote that Trump’s “move to end D.E.I. is of a piece with Woodrow Wilson’s successful effort, in his first administration, to resegregate the federal workforce.”

Wilson’s horrific policy included racially segregated lavatories and lunchrooms. In one case, a Black postal worker “had the humiliating experience of being surrounded by screens so that white workers would not have to look at him.” I disagree with Trump’s excesses on DEI, but I doubt those subject to Wilson’s vicious behavior would find Trump’s actions equally troubling.

In my DEI report, I call for a new program of “Integration, Equal Opportunity, and Belonging.” Unlike many on the right, I’m in favor of proactive programs to bring students of different racial and economic backgrounds together in education settings. I’m for genuine equal opportunity, which requires investments in schooling and housing. And I’m for creating a sense of belonging on campuses for students of all backgrounds. That doesn’t sound like the ideas of a Trump apologist. It sounds like a good faith effort to get beyond the DEI wars.

PPI Report Warns Trump’s ‘Big Beautiful Bill’ is Doubling Down on Biden’s ‘Build Back Better’ Mistakes

WASHINGTON — As President Donald Trump and Congressional Republicans begin drafting a sweeping “Big Beautiful Bill” to implement their second-term economic agenda, a new report from the Progressive Policy Institute (PPI) warns that the GOP’s reconciliation effort risks repeating — and exacerbating — the economic and political mistakes of President Biden’s failed “Build Back Better” plan.

The report, “How Trump’s BBB is Shaping Up to Be an Even Bigger Mess Than Biden’s,” authored by Ben Ritz, PPI’s Vice President of Policy Development, argues that despite the difference in their origins and ideological goals, the BBBs of Joe Biden and Donald Trump have far more in common than just their initials. The two presidents’ signature spending plans share deep structural flaws stemming from poor leadership, unreasonable campaign promises, misleading budget gimmicks, and a refusal to reckon with inflationary risks.

“Joe Biden’s approach to party-line reconciliation bills was arguably the biggest failure of his presidency,” said Ritz. “Trump and Congressional Republicans are now on track to make all the same mistakes — but on a much larger scale, with even greater risks to the economy and their own political standing.”

In the report, Ritz outlines a series of parallels — and troubling new developments — that suggest Trump’s BBB could be even more economically reckless and politically damaging than the one pursued by his Democratic predecessor:

- Both Overpromised And Refused to Set Priorities: Biden refused to set realistic priorities or grapple with tradeoffs as he sought to pass a grab bag of policies from the wishlists of left-leaning interest groups. But Trump has demonstrated even weaker leadership by seeking to incorporate a cacophony of even more costly and conflicting demands within his BBB.

- Both Tied Their Hands With Shortsighted Tax Pledges: Whereas Biden’s pledge never to raise taxes on any household earning under $400K made it impossible to fully pay for his spending priorities, Trump’s campaign promises to cut taxes on tips, overtime pay, Social Security benefits, and more could deepen deficits by nearly $9 trillion over 10 years.

- Both Relied on Procedural Gimmicks Masking Real Tradeoffs: Democrats used procedural tricks to make their BBB appear deficit-neutral and punt difficult political decisions until it was too late. Republicans are now utilizing similar gimmicks but aren’t even attempting to achieve deficit-neutrality. Even worse, they’re attempting to employ new gimmicks that would permanently erode the integrity of the budget process and open the door to tens of trillions of dollars in new deficit spending down the line.

- Both Exhibited A Cavalier Attitude Towards Inflation: When confronted with rising inflation, the Biden administration paid lip service to cutting costs but continued to pursue inflationary policies. Trump has doubled down on this attitude during his second term, relying on the exact same excuses and scapegoats to justify his budget-busting policies.

- Costs Are Greater Today Than in 2021: Unlike in Biden’s first year, today’s high interest rates and record debt servicing costs mean fiscal recklessness will inflict even greater harm on American families. Independent estimates show that Trump’s BBB could reduce real wealth by more than $36,000 per household and put the U.S. economy in unprecedented peril.

“Donald Trump and Congressional Republicans were elected on a promise to ‘End Inflation and Make America Affordable Again,’” Ritz said. “If they insist on betraying their democratic mandate by doubling down on inflationary economic policy, they should expect the same political fate as their predecessors.”

Read and download the report here.

Launched in 2018, the Progressive Policy Institute’s Center for Funding America’s Future works to promote a fiscally responsible public investment agenda that fosters robust and inclusive economic growth. To that end, the Center develops fiscally responsible policy proposals to strengthen public investments in the foundation of our economy, modernize health and retirement programs to reflect an aging society, transform our tax code to reward work over wealth, and put the national debt on a downward trajectory.

Founded in 1989, PPI is a catalyst for policy innovation and political reform based in Washington, D.C. Its mission is to create radically pragmatic ideas for moving America beyond ideological and partisan deadlock. Find an expert and learn more about PPI by visiting progressivepolicy.org. Follow us @PPI.

###

Media Contact: Ian O’Keefe – iokeefe@ppionline.org

How Trump’s BBB is Shaping Up to Be an Even Bigger Mess Than Biden’s

Donald Trump was elected in 2024 on a promise to “End Inflation and Make America Affordable Again.” He criticized “Joe Biden’s reckless spending spree, which is more reckless than anybody’s ever done or had in the history of our country.” And he complained that the incumbent Democrat was guilty of “weak, ineffective, and virtually nonexistent leadership.” In survey after survey, voters made clear they largely agreed with Trump’s assessment.

Perhaps no episode of Biden’s presidency better displayed the traits that fueled these criticisms than his failed effort to pass a sprawling “Build Back Better” domestic spending bill through the filibuster-proof reconciliation process in 2021. But as Congressional Republicans begin crafting a “big beautiful bill” to enact the bulk of Trump’s economic agenda through that process, there are early signs that they’re making all the same mistakes — or perhaps even more.

Although very different in their origins and ideological goals, these two BBBs have far more in common than just their initials. Both Biden’s BBB and Trump’s BBB seem crafted more to fulfill a lengthy wishlist for the president’s ideological allies than address a pressing national need. Both parties struggled to find a way to pay for these wishlists in large part because of shortsighted tax pledges their presidential nominee made during the previous campaign. Rather than right-sizing their ambitions, Republicans today are seeking to ram through their BBB using legislative tactics eerily reminiscent of those that backfired on Democrats in 2021. And both parties pursued their BBB with a cavalier disregard for their contributions to inflation, provoking voters’ ire on their top economic concern.

But there are many ways in which the 2025 Republican BBB is likely to be even more damaging — both economically and politically — by piling on debt and exacerbating inflation at a time when the country can least afford it. If Republicans continue going down this path, they risk betraying their electoral mandate to cut the cost of living and giving Democrats a perfect opportunity to regain something that’s long eluded them: public confidence on handling the economy.

BUDGET-BUSTING BILLS BACKFIRE WHEN THEY IGNITE INFLATION

After voters rewarded their parties with narrow but decisive victories in 2020 and 2024, respectively, both Biden and Trump believed they had a mandate to pass sweeping policies in partisan megabills through reconciliation. At the time of its passage, 63% of voters supported Biden’s first reconciliation bill — the $1.9 trillion American Rescue Plan, which was intended to support the economy through the final stage of the COVID-19 pandemic. But the inflationary effect of this bill drowned out the popularity of the individual policies contained within it and the subsequent legislation Biden sought to pass.

In an incisive post-mortem of the failures of Biden’s economic policy, Jason Furman — the former Chairman of President Obama’s Council of Economic Advisors — explains how excessive government spending during the Biden Administration helped push inflation to heights not seen in decades. Moreover, this inflation effectively reversed the policy accomplishments Democrats thought Biden had achieved, such as by canceling out the spending increase from the bipartisan infrastructure law passed in 2021 or causing real wages to fall below their pre-pandemic level.

Inflation reversed not only the economic benefits of Biden’s policies but also their political benefits. Polling of working-class voters conducted later in the Biden administration by PPI found that 69% of respondents said the rising cost of living was the greatest economic challenge facing the United States, with 55% of those voters believing the primary cause was government overspending. No matter how popular Biden’s programs may have been in the abstract, voters didn’t support them at the expense of keeping the cost of living down.

Democrats suffered both because the unpopularity of inflation outweighed the popularity of their policies, and because their programs were perceived as worsening it. That experience should be a warning for Republicans as they pursue their own party-line reconciliation bill. In isolation, any one of Trump’s proposed tax cuts may poll well. But if they worsen inflation and further increase the cost of living, Republicans are unlikely to reap any political benefits.

TWO FAILURES OF LEADERSHIP

Over the first 100 days of his second term, Donald Trump has repeated many of the missteps that Biden took toward developing budget-busting bills that worsened inflation and his party’s political prospects — starting with an inability to effectively lead.

From the very beginning, Joe Biden’s economic agenda was undermined by the fact that neither he nor Congressional Democrats were willing to define top priorities and make trade-offs. When crafting the American Rescue Plan, they opted to pursue a $1.9 trillion price tag that several experts (including myself) warned was too big and likely to invite inflation. Subsequent reporting has revealed that Biden agreed to this figure not because he believed it was the was the right level of spending to meet the country’s macroeconomic needs, but because it was the amount Senate Majority Leader Chuck Schumer needed to fund a running list of requests from his members — and neither of them was willing to tell anyone “No.”

When it came time to craft a second reconciliation bill to implement their longer-term “Build Back Better” priorities, Democrats again struggled to prioritize. Previously successful party-line reconciliation bills focused on addressing a specific national goal, such as Barack Obama’s Affordable Care Act (health-care reform) or Donald Trump’s Tax Cuts and Jobs Act (tax reform). In contrast, Biden’s BBB was a grab bag of policies from the wishlists of left-leaning interest groups and their Congressional champions. Voters had a hard time making sense of this mishmash of health care, energy, child care, infrastructure, education, elder care, tax policy, and more.

Although polls found solid majorities in support of the constituent policies in Biden’s BBB, only about 40% of voters supported the package as a whole at the time it collapsed. Many Democrats still believe this disconnect — and the party’s generally low approval rating on economic issues throughout the Biden era — simply amount to a “messaging problem.” But the real explanation is that there is far more support for individual spending proposals in isolation than for doing all of them together, especially when voters were already blaming a lack of fiscal discipline for inflation. In the abstract, who doesn’t want to expand access to life-saving health care or reduce the financial burdens of raising children on hard-working parents? But budgeting is about trade-offs and voters did not believe Democratic leaders were capable of making them.

Donald Trump has thus far shown himself even more incapable of setting clear priorities. The 119th Congress began amid internal Republican debates over how to advance Trump’s energy and security spending priorities while also extending and expanding upon the expiring provisions of the Tax Cuts and Jobs Act passed in his first term. Senate Republicans preferred to pass the spending priorities in one reconciliation bill followed by a second reconciliation bill with the tax priorities, while the House preferred to do it all at once. Trump waffled for months, leaving both chambers to go down divergent procedural routes before settling on his demand for “one big beautiful bill.”

Even now, the president continues to give Congressional Republicans conflicting guidance about the composition of his BBB and how he intends to pay for it. He has told House Republicans he supports cutting more than $1 trillion from mandatory spending while telling Senate Republicans he does not support cutting the programs that would be necessary to achieve those savings. The poorly targeted cuts identified by Trump’s “Department of Government Efficiency” are on track to save just a few billion dollars, while the deeper cuts to discretionary spending proposed in the administration’s “skinny budget” last week were immediately criticized as unworkable by their own Congressional allies. The few tax loopholes Trump has expressed willingness to close — such as for carried interest and sports stadiums — also wouldn’t raise a significant amount of revenue.

By far, the biggest “offsets” Trump has proposed are his sweeping tariffs, which the president is imposing through executive actions but his advisors are clearly linking to the BBB reconciliation bill. Trump aide Peter Navarro claimed the tariffs enacted on “Liberation Day” would raise $6 trillion over 10 years to help pay for tax cuts. But that faulty calculation does not account for falling revenues as the economy slows down or the tens of billions of taxpayer dollars Trump is planning to spend compensating farmers for destroying their export markets. Still, even critics of the policy agree Trump’s tariffs could raise roughly $2 trillion over 10 years if left in place.

But the reality is that nobody knows if that’s the plan — least of all Trump. Some Trump advisors, such as Navarro, believe tariffs should be the permanent foundation of our tax system. Most others have suggested the purpose of tariffs is to give him leverage to negotiate better trade deals and foreign policy concessions. If the latter is true, then these tariffs are temporary and won’t even come close to paying for a fraction of the reconciliation bill Republicans are pursuing. This chaos is further evidence that Trump is at least as bad, and likely even worse, at setting priorities as his predecessor was.

TWO PRESIDENTS BOUND BY SHORTSIGHTED TAX PLEDGES

Both Biden and Trump struggled to cover the costs of their BBB in large part because of shortsighted tax pledges they made during the heat of a presidential campaign.

During the 2020 presidential election, Biden pledged not to raise taxes on any household with an annual income under $400,000. That pledge was undoubtedly smart short-term politics: taxes on the ultra-rich are the only ones that poll well. But as a previous report of mine documented, it also made raising revenue extremely difficult by limiting potential tax increases to less than 2% of American taxpayers.

Even taxing all income not protected by the pledge at revenue-maximizing rates would not be enough to sustainably finance spending at the levels Biden proposed. Yet the tax increases Biden actually proposed were smaller than that, and a Democratic Congress still couldn’t pass them. If Democrats don’t believe they can convince voters that proposed programs are worth personally paying something for, it further suggests those programs aren’t as popular as Democrats wish they were.

Trump now faces a similar challenge of his own making. It would have been difficult enough to find the $4.2 trillion of savings needed over 10 years to offset the cost of making the tax cuts he passed in 2017 permanent. But during the 2024 presidential campaign, Trump made a cacophony of promises to eliminate taxes on tip income, overtime pay, Social Security benefits, auto interest loans, electric generators, and more.

Altogether, the Peter G. Peterson Foundation estimates that these policies could bring the 10-year cost of just the tax provisions in Trump’s BBB to roughly $9 trillion. To put into context how expensive that is: Republicans could completely eliminate Medicaid — the third-largest federal spending program — and still just barely break even.

TWO CONGRESSES USING PROCESS TO PUNT HARD DECISIONS

Knowing that they couldn’t possibly pay for everything their party’s president promised to do in their BBB, Biden’s Democrats and Trump’s Republicans both fell back on legislative shortcuts to mask or avoid difficult tradeoffs.

If enacted permanently, the full suite of BBB spending proposals Congressional Democrats sought to enact would have increased spending by nearly $5 trillion over the 10-year window used for official scorekeeping. But Sen. Joe Manchin — the most resolute deficit hawk in the Senate Democratic caucus — refused to support more than $1.5 trillion of new spending and insisted it all be fully offset. Sen. Schumer convinced Manchin to support a budget resolution with reconciliation instructions that would permit up to $3.5 trillion of new spending so that Congressional committees could begin drafting legislative language. But the two men privately agreed that Manchin’s red line remained unchanged, meaning Democratic leaders merely punted their disagreements rather than resolving them.

Because nobody in either the White House or Congressional leadership was willing to tell activist groups that their priorities had to get cut, they instead tried to circumvent Manchin’s demands using budget gimmicks. The House-passed BBB included tax increases that were permanent and thus effective for the full 10-year window, but spending programs had delayed starts or arbitrary expiration dates. In the official 10-year score, this gimmick made the bill appear roughly deficit-neutral. But in practice, spending programs would be adding to deficits every year they were in place if the law were passed and become increasingly expensive if they were later extended as many Democrats hoped.

Manchin steadfastly refused to engage with these shenanigans and prevented his party from passing a BBB that was deficit-increasing under any measurement. But the “fiscal conscience” of today’s Congressional Republicans is far weaker. While every iteration of BBB legislation Congress considered in 2021 was roughly paid for under traditional scoring methods, no Congressional Republicans are even trying to meet this standard today.

In February, House Republicans — including the most anti-deficit hardliners — voted to pass a budget resolution that would enable a reconciliation bill to increase deficits by up to $2.8 trillion. Senate Republicans, who balked at the trillions in spending cuts the House required to partially finance GOP tax priorities, passed an even more fiscally irresponsible budget resolution that allowed up to $5.8 trillion in bigger deficits.

Now Trump’s Republicans are trying to bridge the gap using tactics similar to those that backfired on Biden’s Democrats. First, House leaders — like Manchin did in 2021 — agreed to support the Senate’s budget resolution to keep the process moving forward, even though they would never agree to a BBB consistent with its instructions. Then, Republicans decided they would only seek to enact the new tax cuts Trump proposed during the 2024 election for four years — the same gimmick Democrats tried in 2021 to make their spending programs artificially appear cheaper.

But Senate Republicans are simultaneously trying to employ a dangerous new gimmick that undermines not just the credibility of the previous one but also the foundation of the Congressional budget process: claiming that extending any policy currently scheduled to expire should be scored as costless. As I and a bipartisan group of budget experts recently warned in a letter to Congress, this approach would enable future Congress to enact a massive policy for one year, then proceed to make it permanent in the second year while pretending it’s completely free. If Republicans rely upon this unprecedented maneuver to pass their BBB, they will be responsible not only for trillions of dollars the legislation itself adds to the debt, but also the tens of trillions they’ve invited future Congresses to pile on.

A PROBLEM OF ATTITUDE MORE THAN MAGNITUDE

Defenders of Biden’s economic management will argue that most of the inflation that materialized during his presidency was due to COVID-related supply chain disruptions and other factors outside Democrats’ control. Indeed, several analyses have concluded that Democrats’ fiscal policies added up to 3 percentage points to inflation in 2021 — that’s a significant contribution, but ultimately, not even a majority of the inflation experienced that year.

The biggest problem for Democrats wasn’t that they got the policy wrong. Rather, it was that they repeatedly demonstrated disinterest in even trying to get it right — a mistake the Trump administration is now replicating to a tee.

Anyone who argued that no economic data justified the need for a $1.9 trillion package in early 2021 was met not with a substantive rebuttal but with a dismissive statement along the lines of “the cost of doing too little is much higher than the cost of doing something big.” It was very reasonable to believe that an overshoot was preferable to an undershoot of equal magnitude, considering that insufficient stimulus likely slowed the recovery following the 2008 financial crisis. But surely a package that was 2% too small would have been preferable to one that was 200% too large.

One might reasonably argue that it was sensible not to adjust policies to prevent significant inflation when decades had passed since that was last an issue in the United States. But when their assumptions proved wrong and inflation did materialize, most Democrats refused to accept that their policies could be responsible and needed to change. The Biden administration first argued that inflation would merely be “transitory.” Then, when that proved untenable, they sought to pass the buck by blaming “corporate greed” for inflation (as if corporations suddenly got greedier in 2021).

Meanwhile, Democratic leaders did everything in their power to compound their mistakes. The version of BBB they passed through the House would have increased the federal budget deficit by roughly $200 billion in the first year alone. Biden later pursued costly executive actions such as trying to have taxpayers foot the bill for canceling as much student debt as possible, without any regard to the need or cost of such policies, and without doing anything to address the problems that created this debt in the first place. Progressives such as Sen. Elizabeth Warren even went so far as to pressure Federal Reserve Chairman Jerome Powell — who was responsible for curtailing inflation by raising interest rates — to keep interest rates low.

Donald Trump was elected in large part because of a backlash against this cavalier attitude. Yet as economists and business leaders have been sounding the alarm for months that their tax and trade policies will raise prices on American consumers, the Trump administration has responded almost exactly like Biden and his progressive allies did: Treasury Secretary Scott Bessent said inflation will be transitory. Federal Trade Commission Chairman Andrew Ferguson threatened to investigate companies for raising prices. President Trump himself said the economic pain his policies cause are “worth the price that must be paid.” And now, he is pressuring Chairman Powell to cut interest rates. It is no wonder that Republicans’ approval ratings on the economy — which consistently outpaced those of their Democratic rivals throughout Trump’s first term and the 2024 election — now trail them.

WHY THIS TIME IS WORSE

When Biden’s Democrats increased budget deficits, they did so after a decade filled with warnings about the consequences of rising debt that never seemed to manifest even as the debt steadily grew higher and higher. But over the past four years, it’s become clear that those consequences are finally starting to materialize at great expense to the American people. Trump’s Republicans are thus inexcusably seeking to blow up budget deficits at a time when everyone understands that doing so is increasingly costly.

The combination of increased debt to finance borrowing under Biden and higher interest rates on that debt has pushed the federal government’s annual spending on interest to nearly $1 trillion. As a result, the federal government now spends more money paying interest on the national debt than it does on national defense or Medicaid. Measured as a percent of gross domestic product, annual interest costs are higher than at any other time in American history. And if Republicans enact Trump’s BBB, those costs are likely to more than double over the next 30 years.

As was the case under Biden, consumers will also bear the burden of this runaway borrowing. A recent analysis from Yale Budget Lab estimates that a permanent increase in deficits on the scale of what it would take just to make the expiring tax cuts from 2017 permanent would reduce real wealth by up to $36,000 per household over the next 30 years. This is effectively a tax on young Americans that cancels out most of the benefit they would receive from the GOP’s BBB itself.

Importantly, all these estimates are predicated on current economic assumptions that could swiftly change. Bond markets — which determine the interest rate at which the federal government can borrow money — have been increasingly volatile as investors express growing concern about the Trump administration’s economic agenda and its implications for the long-term health of the U.S. economy. If Congress simply adds the cost of extending the expiring tax cuts to the national credit card and interest rates are just one percentage point higher than currently estimated, the Congressional Budget Office projects that debt would rise so high that its model can no longer function. Put another way: passing Trump’s BBB could be the tipping point for not just higher inflation but an unprecedented economic disaster.

Voters made clear in their rejection of Democrats in 2024 that they prioritize controlling the cost of living above all else. If Republicans betray their electoral mandate by continuing to pursue a BBB that’s as bad or worse than the one pursued by their predecessors, they will hand Democrats a perfect chance to seize the political opportunity they’ve squandered. But to achieve a win more durable than a typical midterm backlash, Democrats will have to chart a new course that convinces voters they can be trusted not to repeat the fiscally irresponsible and inflationary policy mistakes that shaped the BBBs of both Biden and Trump.

Ainsley in The New York Times: After 100 Years, Britain’s Two-Party Political System May Be Crumbling

Claire Ainsley, a former policy director for Mr. Starmer, said the results also reflected longer-term trends, including a breakdown of traditional class loyalties among voters, the increasing pull of nationalist politics and growing support for the centrist Liberal Democrats, the Greens and independent candidates.

“We have been seeing the fragmentation of society and that has flowed through to our politics,” said Ms. Ainsley, who now works in Britain for the Progressive Policy Institute, a Washington-based research institute. “There is multiparty voting now.”

The upshot is that both main parties are struggling as they find themselves competing not just with each other, but also with opponents to their political left and right.

Gresser in The Washington Post: The Math Doesn’t Work Anymore for the Internet’s Favorite $50 Sweater

“The tariff rate for a sweater made of polyester is 39.5 percent, said Ed Gresser, a former U.S. trade official now with the Progressive Policy Institute, a group that generally opposes tariffs.”

Read the full article in The Washington Post.

Canter for Real Clear Education: Dear Democrats, Republicans Are Eating Your Lunch on Education. What Are You Going to Do About It?

Early in my tenure at the education policy organization I founded, we barely had any money. No money meant no lobbyist, which left me, a complete stranger to the legislative process, to figure out how to pass meaningful policy.

A conversation I had with a Democratic legislator seen as an up-and-coming leader stands out among the blur of memories. He agreed to meet me at a local sandwich shop in downtown Jackson after I kept showing up at the Capitol, bright-eyed and brimming with optimism that Mississippi could, in fact, improve its public schools. I admit to feeling a little defeated that day after yet another uninspiring and unproductive education committee meeting, and I complained about it to him.

“Why don’t the Democrats seem to have any vision for education?” I asked in frustration. “Saying ‘no’ to everything the Republicans pose isn’t an agenda.”

“We’re the minority party,” he shot back. “It’s not our job to have a vision.”

I sat back in the chair, stunned, and thought to myself, “And that is exactly why you’ll always be the minority party.”

Read more in Real Clear Education.

GOP Defense Increase Gets Less for More

From our Budget Breakdown series highlighting problems in fiscal policy to inform the 2025 tax and budget debate.

Congressional Republicans returned to Washington this week to begin drafting sections of the “big beautiful bill” that contains the bulk of their legislative agenda. One of the first sections to be considered was their plan to increase defense spending by $150 billion over the next ten years. At a time of growing threats from China and Russia, the need for military readiness is clear. Yet this surge in defense funding comes amid a simultaneous push from the Trump administration to dismantle our global commitments, raising the fundamental question: what is the purpose of building up military power if the United States no longer intends to lead with it?

Top Republicans are heralding the proposed defense increase as a “generational upgrade” in our military readiness. While some provisions — such as the billions allocated for the so-called “Golden Dome” — appear to be driven more by Trump’s own personal fascination than strategic necessity, most of the spending increases are serious priorities to improve military readiness and capability. Amongst other worthwhile provisions, their plan earmarks billions for shipbuilding, ramps up munitions production, and scales up innovative commercial technologies for military use. One would reasonably expect that this investment into America’s national security would be used to reinforce our global leadership and international commitments.

But since returning to office, President Trump has done just the opposite, pursuing a chaotic foreign policy of disengagement and signaling that the United States will no longer meet its obligations to its allies and partners around the world. Trump has renewed attacks on NATO, explored reducing U.S. troop levels in both Europe and Asia, and steadily undermined security commitments to allies in Ukraine and Taiwan. His destabilizing trade wars have alienated key economic partners, while his erratic threats to annex Canada, Greenland, and the Panama Canal have only deepened tensions with long-standing allies. Finally, he has gutted vital tools of American soft power, decimating foreign aid and development programs such as USAID, sharply cutting US diplomatic presence in critical regions, and slashing funds for basic scientific research and development. With this chaotic foreign policy, it’s no surprise that global confidence in the United States has plummeted in the past few months.

Military capability is not an end in itself, but rather a tool to execute a broader, coherent strategy. The United States built its post-World War II military and defense posture not to act unilaterally, but to support a system of alliances, deterrence, and collective security that amplifies American power. In the absence of the trust, stability, and strategic advantages that this system provides, hundreds of billions more in defense spending will be far less effective at ensuring national security and advancing American interests. Furthermore, by alienating our allies, Trump is undercutting the military power we can call upon in a crisis — perhaps by more than the spending increases would augment it.

As PPI has previously argued, any greater investment in the U.S. military should go hand-in-hand with revitalizing our alliances, restoring global economic leadership, and strengthening our diplomatic and international development institutions. For all the Trump administration’s talk of cutting wasteful spending, there is no better example of government waste than spending more money on activities from which we intend to benefit less.

Deeper Dive

- Republicans Unveil Bill to Lift Defense by $150B, by Inside Defense

- Trump Has Launched a Second American Revolution. This Time, It’s Against the World, by the Carnegie Endowment for International Peace

- Trump’s ‘Iron Dome’ Space Weapons Plan Ignores Physics and Fiscal Reality, by Scientific American

- America’s Reputation Drops Across the World, by Ipsos

- How Trump is Making Peace in Ukraine Even Harder, by Eric Green

Fiscal Fact

During the first quarter of 2025, the economy shrank at a 0.3% annual rate — the largest decline in three years, driven by increased imports and the fear of Trump’s tariffs.

Further Reading

Other Fiscal News

- Capitol Agenda: The Megabill has Mega Issues, by Politico

- What’s in Those Trade ‘Proposals on Paper’ Countries Have Sent the White House? Depends Who you Ask, by Politico

- White House Sets New July 4 Deadline for Trump Tax Agenda, by the Hill

- ‘Are you out of your fricking mind?’ Republicans Balk at New Passenger Car Fee Proposal, by Politico

- Trump releasing 2026 budget tomorrow, by Axios

More from PPI & The Center for Funding America’s Future

- The Devastating Risks of Trump’s NOAA Cuts, by Mary Guenther

- Donald Trump’s Terrible, Horrible, No Good, Very Bad First Hundred Days On Foreign Policy, by Peter Juul

- How Democrats Can Rebuild Trust on National Security: Five Big Ideas to Start, by Peter Juul

- Congressional Republicans Take Dangerous Step Towards Ending Budget Enforcement, by Ben Ritz and Alex Kilander

- Alarm Clocks, Baby Strollers, Battery-Powered Sex Toys, and Thermos Bottles may vanish from American Stores by the End of May, by Ed Gresser

Kahlenberg for Kappan: Calling Bull**** on Contradictory College Diversification Claims

At a time when the Trump administration is attacking diversity, equity and inclusion (DEI) policies in K-12 schools and colleges and universities as part of a larger high-profile campaign against what Trump calls “woke ideology,” the press is faced again with the challenge of how to accurately report on these programs.

In the past, members of the media have not always risen to the challenge, downplaying education institutions’ economic incentives for racial preferences.

Polls show that most Americans support racial diversity in educational institutions, but most don’t like using racial preferences as the means of achieving that goal.

Read more in Kappan.

Guenther for Real Clear Science: The Devastating Risks of Trump’s NOAA Cuts

President Trump’s first budget request is slated to come out later this spring, but agencies are receiving drafts from the Office of Management and Budget (OMB) now — and the draft budget request for the National Oceanographic and Atmospheric Administration (NOAA) paints a dire picture as the agency is slated for a 25 percent cut.

Some of these cuts were foreshadowed by Project 2025, which paints NOAA as a primary component “of the climate change alarm industry.” Project 2025 is clear in its intent to halt independent government research on climate change and privatize the weather forecast data that Americans rely on to keep themselves safe.

However, it’s unclear why the administration is looking to change course from the policy on space safety created pursuant to a Space Policy Directive from the White House during Trump’s first term that the growing space industry relies on.