Learn more about Dr. Constance Lindsay here.

Learn more about the Reinventing America’s Schools Project here.

Learn more about the Progressive Policy Institute here.

Learn more about Dr. Constance Lindsay here.

Learn more about the Reinventing America’s Schools Project here.

Learn more about the Progressive Policy Institute here.

From infrastructure challenges to new digital trade policies, hear what these experts have to say about the future of internet access, adoption, and affordability.

Follow Ed Gresser on Twitter: @EBGresser

Follow Christine O’Connor on Twitter: @CNOConnor

Follow Meagan Bolton on Twitter: @MeaganSunn

Follow Mosaic on Twitter: https://twitter.com/MosaicPPI

Follow PPI on Twitter: https://twitter.com/ppi

Sterling silver spoons: 3.3%

Stainless steel spoons, ≥25 cents each: 6.8%

Stainless steel spoons, <25 cents each: 14.0%

* About 20% for a spoon valued at 25 cents on imports; 25% for a spoon costing 10 cents or less. Tariff lines are 71141130 for sterling silver, 82159930 for stainless steel spoons costing less than 25 cents each, and 82159935 for spoons at or above 25 cents each.

How is it that cheap spoons are taxed more heavily than sterling silver?

In his 1832 essay on the U.S.’ tariff law, the former Treasury Secretary Albert Gallatin — then a 70-year-old observer and occasional commentator on policy; in earlier life a teenage immigrant from Geneva in the 1780s, a Jeffersonian-Republican politician and founder of the Ways and Means Committee in the 1790s, and Treasury Sec. for the Jefferson and Madison administrations from 1801-1814 — makes a cautious case for progressive taxation:

“Higher duties on luxuries than on articles generally, and in some cases exclusively, used by the less wealthy classes of society are justified by the propriety of laying a heavier burden on those who are the best able to bear it.”

He then glumly notes that, tariffs being an especially opaque way to raise money, and businesses and wealthy people being more able to investigate and complain about their “burdens” than the public in general and the poor in particular, the tariff laws of 1816 and 1828 had done the opposite.

“The principal commodities which have been selected for special protection, iron and all the coarser woollen articles of clothing, are as well as salt, coal, and sugar, essentially necessary to all classes of society. The duties laid on such commodities fall therefore much more heavily, in proportion to their means, on the less wealthy classes; and it has already been seen with what singular ingenuity that on woollens has been so arranged, as to make the poor pay, in every instance, considerably more than the rich. This your memorialists consider to be one of the most obnoxious features of the restrictive system.”

Income and payroll taxes now far exceed the $90 billion tariff system as a U.S. revenue source. But 190 years after Gallatin’s essay, the case of spoons raises some strikingly similar questions. Buyers of cheap stainless steel spoons pay about four times the tax on wealthy neighbors buying sterling, to wit:

(1) Mass-market: Low-priced stainless steel spoons, imported at prices below 25 cents each, get a 14% tariff. For readers familiar with the D.C. metro area, think middle-class and low-income families in Rockville or P.G. County, or the Salvadoran and Ethiopian restaurants along Georgia Avenue just north of the District. No such spoons seem to be made in the U.S. at all.

(2) Luxury: The tariff on sterling silver spoons is 3.3%, a bit less than a quarter of the cheap-stainless rate. Say, McLean and Georgetown, the Mayflower and the Four Seasons, downtown law firms, etc. In this sector, American companies and individuals do make sterling silver spoons, sometimes in batches and sometimes as artisanal pieces, but the prices are high enough to make tariff rates irrelevant.

(3) Mid-tier: More expensive stainless steel falls in the middle, with a 6.8% tariff. One company in upstate New York, Sherill Industries, makes high-priced stainless steel silverware, whose prices seem to average around $4.00 per piece.

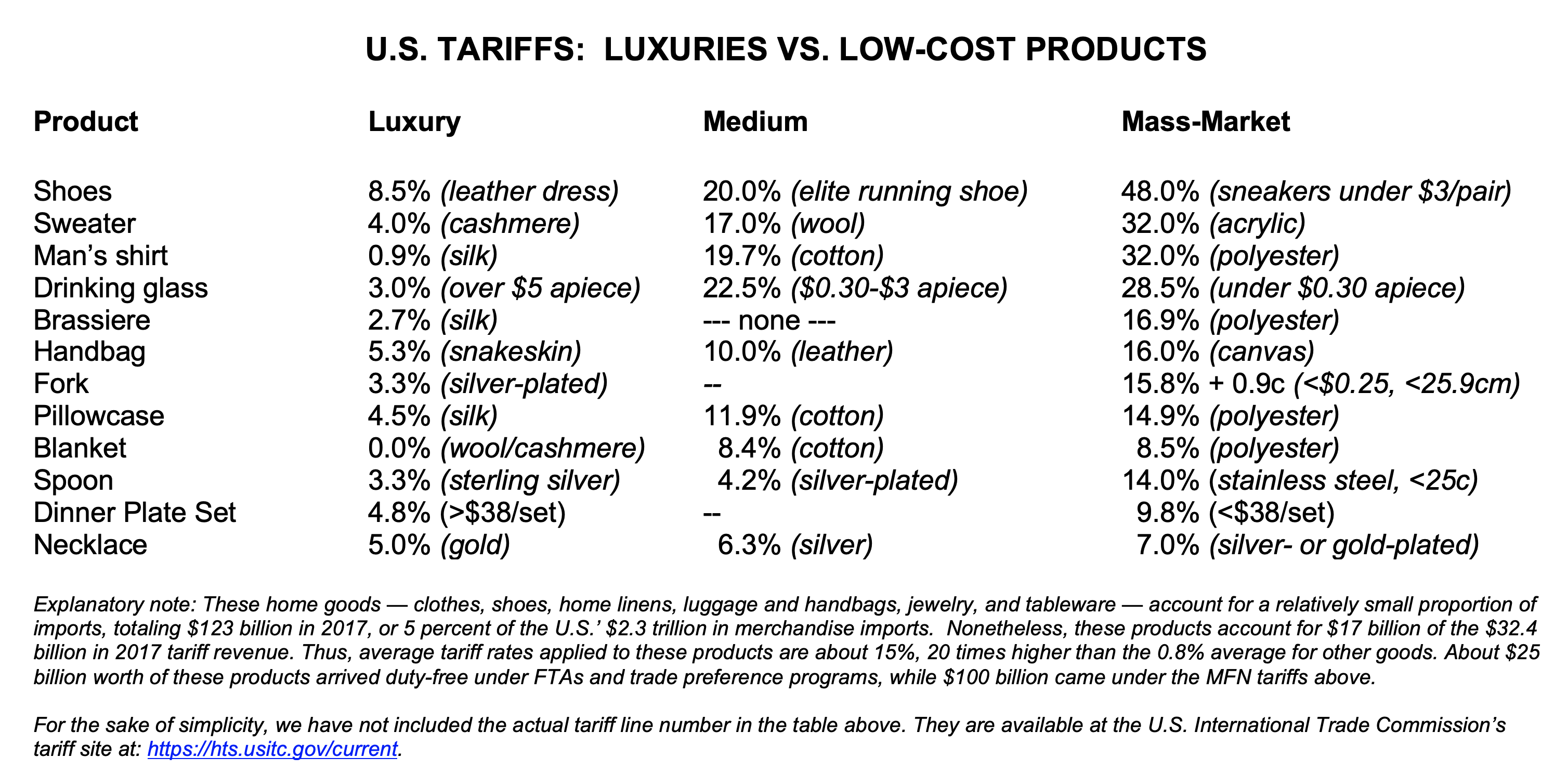

Gallatin’s term “obnoxious” is subjective, but doesn’t seem unreasonable here. Neither the cheap-spoon line (“82159930”) nor the sterling line (71141130”) appear to affect trade flows much, so in this case the tariff system is acting much more in its ‘tax’ role than its ‘trade’ role. There’s little doubt that in this case the poor are taxed considerably more than the rich, and the spoons case is more a typical case than a weird anomaly. An illustrative table of 12 products, drawn from PPI testimony to the International Trade Commission last year:

In this perspective, Gallatin seems to identify a structural challenge that remains powerful despite the passage of nineteen decades. Perhaps especially in tariffs as opposed to more transparent income or sales taxes, low-income people often don’t know when they are being taxed and aren’t in a position to ask for lighter burdens. And in the political system, most tariff analysis relates to trade policy rather than the role of tariffs in taxation; Gallatin’s Ways and Means Committee, in fact, appears not to have held a hearing on the tax implications of tariff policy since 1974. So with little knowledge about strange phenomena like the differential rates on stainless steel and sterling even among policymakers, policies rarely get critical examination and “the less wealthy classes” seem to wind up carrying the heavier burdens.

Analysis then and now:

Frederick Taussig’s State Papers and Speeches on the Tariff collection (1892), featuring Gallatin’s 1832 essay along with other 18th- and 19th-century trade policy luminaries (Alexander Hamilton, Daniel Webster, and the now-obscure Robert Walker, who was James K. Polk’s Treasury Secretary in the 1840s).

Economists Miguel Acosta and Lydia Cox trace the low-tariffs/luxury vs. high-tariff/mass-market skew of the U.S. tariff system back to agreements of the 1930s and 1940s.

PPI’s Ed Gresser looks at consumer goods tariff inequities in 2022 testimony to the International Trade Commission.

Tariff schedule:

The Harmonized Tariff Schedule; see Chapter 71, heading 7114 for sterling silver and other precious-metal “silverware,” and Chapter 81, heading 8215 for “base metal.”

And a summary of the 11,414 current U.S. tariff lines – how many “duty-free,” how many covered by tariffs, how many the various Free Trade Agreements waive.

And via the St. Louis Fed, a copy of the 1828 tariff law which so annoyed ex-Secretary Gallatin.

More on Gallatin:

The Treasury Department’s Albert Gallatin statue.

Nicholas Dungan’s admiring 2010 bio.

And a silverware-maker:

Ed Gresser is Vice President and Director for Trade and Global Markets at PPI.

Ed returns to PPI after working for the think tank from 2001-2011. He most recently served as the Assistant U.S. Trade Representative for Trade Policy and Economics at the Office of the United States Trade Representative (USTR). In this position, he led USTR’s economic research unit from 2015-2021, and chaired the 21-agency Trade Policy Staff Committee.

Ed began his career on Capitol Hill before serving USTR as Policy Advisor to USTR Charlene Barshefsky from 1998 to 2001. He then led PPI’s Trade and Global Markets Project from 2001 to 2011. After PPI, he co-founded and directed the independent think tank Progressive Economy until rejoining USTR in 2015. In 2013, the Washington International Trade Association presented him with its Lighthouse Award, awarded annually to an individual or group for significant contributions to trade policy.

Ed is the author of Freedom from Want: American Liberalism and the Global Economy (2007). He has published in a variety of journals and newspapers, and his research has been cited by leading academics and international organizations including the WTO, World Bank, and International Monetary Fund. He is a graduate of Stanford University and holds a Master’s Degree in International Affairs from Columbia Universities and a certificate from the Averell Harriman Institute for Advanced Study of the Soviet Union.

Read the full email and sign up for the Trade Fact of the Week

The federal tax code is riddled with provisions that benefit individuals and businesses working in certain sectors or engaging in specific activities. In 2019, these provisions — known as tax expenditures — cost the federal government 6.6% of gross domestic product (GDP) in lost revenue, which is greater than the amounts spent on Social Security (4.9% of GDP), Medicare (3.7%), national defense (3.2%), and the entire nondefense discretionary budget (3.1%). Although some tax expenditures help working-class people, 24.1% of their overall benefits go to the top 1% of income-earners, and 58.8% go to the top 20%. The regressive and economically inefficient nature of tax expenditures makes them a ripe target for progressive reform.

This isn’t to suggest that every expenditure helps special interests. For example, the earned income tax credit subsidizes the wages of low-paid workers and pulls four million Americans out of poverty every year. But according to the U.S. Treasury Department, the tax code is littered with over 160 expenditures, including highly regressive expenditures such as the mortgage interest deduction, the state and local tax deduction, the carried interest loophole, and the pass-through business loophole. These carveouts leave the federal government with a Swiss cheese tax code — one that fulfills its basic purpose but is littered with holes. Just as PPI has advocated a regulatory improvement commission to streamline economic regulations, the U.S. also needs to examine the many cracks and holes in the federal tax code.

A few large tax expenditures are already well-known. But most are quite small, and they survive largely by remaining out of sight and out of mind. They also sometimes benefit from lobbying efforts by well-connected industry leaders who prefer that their pet carveouts remain free from public scrutiny. This post, therefore, sheds light on five smaller tax expenditures — the types that don’t normally make the headlines — which ought to be eliminated to boost federal revenues and remove unfair loopholes. Specifically, Congress should:

These five changes, if enacted by themselves, would raise just under $31 billion over 10 years. But more importantly, these five arcane loopholes are just the tip of the iceberg — policymakers who are willing to take a deeper dive into the tax code will find even greater savings hidden under the surface.

By Tamar Jacoby

On the day the Russians invaded Ukraine, Patol Moshevitz, a landscape architect and painter, woke early and looked out the window of his apartment on the fourteenth floor of one of the newest, most desirable buildings in the city of Irpin. He could see for miles in almost every direction: Kyiv, Bucha, most of Irpin, and the Hostomel airfield just across the marsh to the north. A big bear of a man with a shaved head, he saw a swarm of Russian helicopters descending on the airport. The noise was deafening even where he was, and a dark plume of smoke rose on the horizon.

By Tamar Jacoby

One of the most popular memes circulating on Ukrainian social media in the past year used an image, first popularized on Russian social media, of a grotesque creature with the body of a fish and the snout of a pig—a shvino karas, or pig fish. “A few decades ago, almost all Ukrainian popular culture was derivative of something Russian,” online meme curator and web developer Bohdan Andrieiev, 32, explained. “Before independence and for more than a decade afterward, we had no popular culture of our own.” This has changed dramatically in recent years, culminating in a burst of new Ukrainian creativity since the Russian invasion in February 2022. Social media, meme culture, pop music, and viral jokes have emerged as powerful tools of national solidarity—the bottom-up, ironic Ukrainian equivalent of old-style totalitarian propaganda.

According to Andrieiev, virtually none of this new popular culture draws on Russian sources—that’s now widely seen as inappropriate. “But this is an exception,” he said, “because we’re inverting the reference. It’s like the word ‘queer.’ What was a slur is now a badge of pride. Russians call Ukrainians pigs and pig fish and look down on us. But if we’re so pathetic, how come we’re beating them on the battlefield?”

Even after a year of intensive media coverage of the war in Ukraine, it’s easy to forget how new the Ukrainian nation is. In 1987, when Ronald Reagan admonished Soviet leader Mikhail Gorbachev to “tear down this wall,” Ukraine was still part of the Soviet Union—the rough political equivalent of a U.S. state. Ukrainians had their own language and folk traditions and there had been a few short-lived attempts over the years to form a Ukrainian government. But not until 1991 did Ukrainians establish an independent nation—and even then, the shadow of the Soviet Union hung heavily over the new country, both politically and culturally.

Learn more about Dr. Charles Cole here.

Learn more about the Reinventing America’s Schools Project here.

Learn more about the Progressive Policy Institute here.

Last week, a Trump-appointed Texas District Court judge ordered the U.S. Food and Drug Administration (FDA) to take back its approval of mifepristone, a drug for inducing abortions, used safely in this country for 23 years. Despite abortion access being a winning issue with voters, the Republican Party is continuing to use legislation and right-wing judges to strip away bodily autonomy and the ability for Americans to make their own choices about their health care.

Erin Delaney, PPI’s Director of Health Care Policy, outlines the impact and consequences this decision has on the entire country in her latest post on Medium. She notes that with this latest ruling, 40 million more women could lose access to abortion care by removing a drug that has been proven safer than Tylenol or Viagra.

Erin writes, “Not only does it [the decision] abet the drive by Republican extremists to strip Americans of their reproductive rights, it sets a terrible precedent in which activist right-wing judges overrule the nation’s top health authorities for purely ideological reasons. Judge Kacsmaryk’s atrocious ruling hits a MAGA trifecta — at once undermining personal liberty, medical science, and the Constitution’s separation of powers.”

Read the full piece here.

The Progressive Policy Institute (PPI) is a catalyst for policy innovation and political reform based in Washington, D.C. Its mission is to create radically pragmatic ideas for moving America beyond ideological and partisan deadlock. Learn more about PPI by visiting progressivepolicy.org. Follow the Progressive Policy Institute. Find an expert at PPI.

###

Media Contact: Amelia Fox; afox@ppionline.org

By Erin Delaney

On Friday, a Trump-appointed Texas District Court judge unsurprisingly ordered the U.S. Food and Drug Administration to take back its approval of mifepristone, a drug for inducing abortions, used safely in this country for 23 years. U.S. District Judge Matthew Kacsmaryk also put a weeklong stay as part of his ruling, making mifepristone still available in all states at this time, unless his ruling stands. Nonetheless, last Friday’s ruling in Amarillo by Judge Kacsmaryk in Amarillo is shockingly dangerous.

Not only does it abet the drive by Republican extremists to strip Americans of their reproductive rights, it sets a terrible precedent in which activist right-wing judges overrule the nation’s top health authorities for purely ideological reasons. Judge Kacsmaryk’s atrocious ruling hits a MAGA trifecta — at once undermining personal liberty, medical science, and the Constitution’s separation of powers.

Prior to his appointment to the federal bench, Judge Kacsmaryk was a fixture of the radical right known for his attacks on contraception, abortion, gay marriage and protections for LGBTQ people. Although he promised in his Senate confirmation to set aside his personal views, there’s little evidence of a judicial temperament in his mifepristone ruling.

At the same time on Friday afternoon as his decision was released, Judge Thomas Rice from the U.S. District Court of Eastern District of Washington came out with a ruling challenging the FDA’s decision to impose restrictions on mifepristone prescribing and dispensing through the Risk Evaluation and Mitigation System (REMS) and that the restrictions imposed by the FDA are unnecessary and limit access. This ruling orders the FDA to maintain access to mifepristone in 17 states and Washington, D.C. Almost immediately after Judge Kacsmaryk’s decision, the Department of Justice filed a notice of appeal to the U.S. Court of Appeals for the 5th Circuit to request a stay while this appeal is considered to maintain access to mifepristone. If this stay is not granted by the 5th Circuit, then the FDA will likely appeal to the Supreme Court to block this ruling throughout the appeals process with the 5th Circuit. Unfortunately, if both courts do not provide a stay during the appeals process, then distribution of mifepristone could be halted across the country.

If President Biden delivers on his promise to bring a new era of jobs and prosperity to blue-collar America, it could be a game changer with working-class voters in the U.S. and beyond.

The Democrats may hold the presidency and, narrowly, the Senate, but their declining vote share among working-class voters and places means they face a much narrower path to victory. Combined with their falling support among Hispanic voters, and an electorate not confident that the country is on the right path, the Democrats face significant challenges ahead of the 2024 presidential election.

Looking across the Atlantic provides some painful lessons in what happens when center-left parties overlook their working-class base. Working-class voters began to pull away from the British Labour Party during the New Labour government years. But it wasn’t until the arrival of Boris Johnson’s brand of Conservatives in 2019 that Labour lost working-class voters and constituencies in historic numbers. That delivered the Conservatives an 80-seat majority in the House of Commons, and for Labour, its worst defeat since 1935.

Treasury Secretary Janet L. Yellen recently tied the failure to raise the debt limit in time to the prospect of more bank failures. The Secretary is absolutely right that if Congress wants to prevent more government bailouts of banks in the short-term, it can ill afford to wait to enact a clean debt limit increase. But in order to help bring down the inflationary pressures that helped undermine Silicon Valley Bank (SVB), President Biden and Democrats must find common ground with Republicans to stabilize the national debt.

While liberal Democrats point to the 2018 banking regulatory relief law and MAGA Republicans to so-called “woke” investments as the culprit of SVB’s collapse, the reality is that neither were to blame. First, SVB’s commitment to investments in renewable energy, community development, and affordable housing was about $16.2 billion, only 8% of its total assets. And these assets were not the ones “underwater.”

By Tamar Jacoby and Karolina Czerska-Shaw

Civil society in Ukraine has flourished in the decades after independence – a bright spot in a country that sometimes struggled with other aspects of democratic nation-building,

including electoral politics and the battle against corruption. It is therefore not surprising to see civil society emerge as a critical player in the war effort, sheltering internally displaced persons, providing humanitarian aid in occupied territories, supporting soldiers on the front lines, and more. The Ukrainian civil society isn’t active only inside Ukraine: Diaspora in neighbouring countries has also given rise to a vibrant third sector, and it too has transformed itself in the year since the full-scale Russian invasion.

This research report is the outcome of research looking at 20 civil society organizations active in neighbouring Poland since the invasion of February 2022, including nine in-depth interviews and one focus group. The report offers some modest recommendations for policymakers seeking to leverage grassroots groups to strengthen democracy in post-war Ukraine, including by enhancing ties between Ukraine and the rest of Europe.

The Progressive Policy Institute (PPI) has long been a leader in the fight for equitable access to high-speed internet service, and thanks to President Biden’s Infrastructure Investment and Jobs Act (IIJA), the United States is making historic investments to close the digital divide. For the first time, families across the country will have expanded availability and affordability that will transform the way communities access education, jobs, and health care needs.

Building upon this work, PPI’s Mosaic Project hosted its sixth cohort of experts as part of its Women Changing Policy workshop series to elevate women to the forefront of policy making. Nearly 20 women who are experts in broadband, telecommunications, and digital equity gathered in Washington, D.C., to meet with lawmakers and the media to learn how to engage in meaningful policy conversations.

The latest cohort heard from top journalists and reporters from The Hill, Meet the Press, and NBC News, and also met with key committee staff in the House and Senate to talk about internet access and affordability. They also met with the FCC to discuss telecommunication policies happening at the federal level.

The Women Changing Policy workshop is a two and a half day interactive training opportunity for women experts to hone the skills needed to communicate their work and ideas to policymakers and the media. The workshop is a chance for experts to expand their networks, while getting hands-on experience learning the ins and outs of Washington politics.

The sixth Women Changing Policy Cohort included:

The Mosaic Project is a diverse network of women with expertise in the fields of economics, technology, and more. Mosaic programming aims to bring new voices to the policy arena by connecting cohort members with opportunities to engage with top industry leaders, lawmakers, and the media.

The Progressive Policy Institute (PPI) is a catalyst for policy innovation and political reform based in Washington, D.C. Its mission is to create radically pragmatic ideas for moving America beyond ideological and partisan deadlock. Learn more about PPI by visiting progressivepolicy.org.

Follow the Progressive Policy Institute.

Follow the Mosaic Project.

###

Media Contact: Amelia Fox – afox@ppionline.org

The United States’ education system overemphasizes college advising and prep coursework, while work-based opportunities and career preparation programs are overlooked and under-resourced. The reality is that most Americans do not earn college degrees — either forgoing college altogether or enrolling in college but not finishing — often leaving them with crushing student debt.

In an effort to address a lack of career readiness in high school curriculums, the Progressive Policy Institute (PPI) released a new policy brief “Reinventing High Schools: The Importance of Exposing Every Young Person to the World of Work,” detailing innovative approaches to ensuring high-quality career instruction is infused in every young person’s educational experience. Report author Taylor Maag, PPI’s Director of The New Skills for a New Economy Project, offers policy recommendations and calls on leaders to adopt solutions that: ensure every high school student can participate in high-quality work-based learning; boost public investment, and make resources more effective; and build strong cross-sector partnerships which are critical for these efforts to succeed.

“Career learning and experiences are critical for an individual’s success after high school — preparing young people for the world of work and providing strong alternatives for those not interested in or unable to access a four-year degree,” said Tayor Maag. “It is time for our education system to undergo much-needed reform and finally reinvent high schools.”

Download the policy brief here.

The Progressive Policy Institute (PPI) is a catalyst for policy innovation and political reform based in Washington, D.C. Its mission is to create radically pragmatic ideas for moving America beyond ideological and partisan deadlock. Learn more about PPI by visiting progressivepolicy.org. Find an expert at PPI and follow us on Twitter.

###

Media Contact: Amelia Fox – afox@ppionline.org

It is the end of February in Indianapolis. I arrive at a newly developed building complex that houses Ascend Indiana — a nonprofit intermediary organization that connects Hoosiers to in-demand careers and regional employers to skilled talent, fostering cross-sector partnerships, building capacity, and developing insights that enable system-level change to transform the career trajectory of youth and adults in the community.

As part of their efforts, Ascend partners with EmployIndy, the local workforce board, to offer the Modern Apprenticeship Program (MAP). MAP is a three-year program designed to prepare Central Indiana high school students for the workforce with paid, hands-on experiences that complement their traditional academic coursework. Apprentices start in their junior year and pursue jobs in growing fields such as business, advanced manufacturing, and IT. Afterward, they can continue to college or jump right into their career.

While visiting Ascend, I had the pleasure of meeting three of these youth apprentices. They all are extremely impressive, going to school full-time while also advancing in their apprenticeship program — with positions working in human resources, talent acquisition, and business management. High school students earning college credits, a wage, and critical job skills; this type of opportunity was not available to me and my peers in high school.

In fact, most young people in our country still don’t have access to high-quality career learning experiences like MAP apprentices. This is a result of our nation’s education system over-emphasizing college prep coursework and advising, while career preparation programs are overlooked, under-resourced, and even discouraged by federal and state policy. While we know that college — specifically a bachelor’s degree — often leads to higher long-term earnings, most Americans still do not earn degrees, with many forgoing college altogether, and many — 39 million to be exact — enrolling in college but not completing a degree. They are left with student debt and without a credential of value.

This trend is expected to worsen as young people increasingly question the career and financial benefits of traditional higher education. As a result, students aren’t attending, or are postponing their college plans altogether, which is apparent in the sharp declines in college enrollment among recent high school graduates. Rather than just focusing on college prep in their academic curriculum, students seem to be looking for ways to infuse career relevance into their education.

Career education does exist in schools today, for example, through our nation’s Career and Technical Education (CTE) system. CTE funds most of career learning in K-12 and these programs seek to provide students with academic and technical skills and the guidance needed to make informed career choices. Data shows that CTE concentrators, or students that have completed at least two CTE courses in a pathway, have a 94% high school graduation rate, which is 8% points higher than the national average. Additionally, CTE concentrators are employed full-time at higher rates and earn more than non-concentrators throughout their career. Yet even with promising outcomes, one in four high schools don’t offer CTE at all and out of roughly 15 million public high school students across the country, only 3 million are CTE concentrators.

It is clear the CTE system has its limitations. Funding is a big one. The federal government spends over $57 billion annually on our nation’s secondary schools. This investment does not include the majority of public funds for K-12 which come from the state and local level or the $122 billion in relief from the American Rescue Plan Act. Of all that, the CTE system receives roughly $1.3 billion annually for both youth and adult career education. As a result, only $600 million of total CTE funds goes toward K-12 to support career learning and experiences.

Compared to other public resources for secondary education, that truly is a drop in the bucket. School districts trying to provide career learning opportunities cite insufficient funding as the biggest barrier to offering these options in high school. However, funding constraints are not the only challenge. Inconsistent state support and the stigma that often attaches to career-oriented coursework and its students result in programs of widely varying quality and accessibility. Additionally, logistical hurdles, like recruiting and retaining qualified instructors, inflexible scheduling of programming, and finding willing employers make it especially hard to offer a critical element of CTE: work-based learning.

Work-based learning programs, like MAP in Indianapolis, can include apprenticeships, pre-apprenticeships, internships, and on-the-job training, among other options. These opportunities help young people gain the knowledge, skills, and credentials needed to achieve strong career outcomes. Work-based learning is beneficial for all young people but can be especially useful for individuals from low-income backgrounds and others who may otherwise not have access to career exposure, educational opportunities, professional networks, and social capital that play a critical role in career success.

The popularity of work-based learning has surged in recent years, with new energy and activity from the public and private sectors. States and locals can now leverage federal CTE dollars for these activities while also including work-based learning as a program quality indicator. While roughly half of states selected work-based learning as a quality indicator for their CTE programs, early data from these efforts demonstrated mixed success, with fewer students than expected accessing high-quality opportunities. The pandemic was a factor in these outcomes, especially for young people in rural and underserved communities that lack an extensive employer base or access to the necessary digital tools to access virtual options.

Faced with these obstacles, it is no wonder schools have continued the outdated approach of focusing on college prep coursework and have generally ignored career education in high schools. However, it can’t be ignored any longer. These opportunities are critical for an individual’s success after high school — preparing young people for the world of work and providing strong alternatives for those not interested in or unable to access a four-year degree. It is time for our education system to undergo much-needed reform and finally reinvent high schools.

This brief calls on policymakers to do just that — elevating innovative approaches across the country, like MAP in Indianapolis, that can be replicated and scaled. It also offers policy recommendations, calling on leaders to adopt solutions that: ensure every high school student can participate in high-quality work-based learning, boost public investment, and make these resources more effective and build strong cross-sector partnerships, which are critical for these efforts to succeed. This work is more important now than ever to ensure our nation’s education system creates paths to greater economic opportunity and avoids leaving millions of young people behind, especially those who don’t go to college.

2020 31%

2019 29%

2012 26%

2002 26%

1992 25%

Here is J.M. Keynes, looking back from 1919 at the “globalized” world of the 1910s, from the perspective of a wealthy (male) Londoner:

“[For] the middle and upper classes, life offered, at a low cost and with the least trouble, conveniences, comforts, and amenities beyond the compass of the richest and most powerful monarchs of other ages. The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world, and share, without exertion or even trouble, in their prospective fruits and advantages; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend.”

Taking up his themes of easy and uninterrupted flows of investment and trade a century later, with some employment focus as against Keynes’ investor-and-consumer viewpoint–

The U.N. Conference on Trade and Development’s annual “World Investment Report”, reports that annual cross-border “foreign direct investment” flows have varied between $1 trillion and $2 trillion over the last decade, with the U.S. in most years both the largest source and recipient. Last year was a typical example, with the U.S. receiving $367 billion of the worldwide $1.6 trillion in total inbound FDI flows, and sending out $404 billion.

Reporting each year on these flows’ real-world manifestations, the Commerce Department’s Bureau of Economic Analysis publishes figures on international businesses’ employment, investment stocks, employment, R&D, payrolls, and so forth in the United States and abroad. Their most recent editions cover the year 2020 and find U.S. “affiliates” of foreign-based firms employing 8.6 million workers, and U.S.-based firms with overseas operations employing 28.4 million people in the U.S. (along with 14 million overseas). Together, then, internationally operating businesses employed 37 million private-sector workers, or 31% of the COVID-depressed 120 million total. Two bits of perspective on this:

(1) Economic role: The “multinational’ firms — both U.S. “parents” and foreign “affiliates” — are particularly employers in manufacturing (10 million of 12.2 million), retail (10 million of 17 million, and information industry (2.0 million of 2.7 million). They are also very prominent in private-sector science, together accounting for $430 billion of 2020’s $717 billion in U.S. R&D spending. (U.S.-based firms did most of this at $361 billion, not counting $59 billion in overseas R&D; U.S.-based affiliates of foreign firms contributed $73 billion in U.S.-based R&D. And they account for about two-thirds of U.S. goods trade, including $1.08 trillion of 2020’s $1.66 trillion in exports, and $1.43 trillion of the $2.35 trillion in imports.

(2) Over time: At least with respect to employment, multinationals’ role in U.S. economic life has been pretty stable over the last generation. The 31% share of employment in 2020 is at the high end of BEA’s records, but this is mainly because, before COVID vaccines, employment was especially depressed in industries with fewer multinationals, such as restaurants, hotels, beauty shops, and other small services businesses. Over the last 30 years, the “multinational” share of U.S. employment has varied between 25% and 29% of private-sector workers – or, to cite a few specific years, 26% of the 121 million private-sector workers in 2012, 26% of the 108 million in 2002, and 25% of the 90 million in 1992. Over this time, U.S.-based multinationals have added about 11 million employees in the U.S. (17.5 million then, 28.4 million in 2020), while simultaneously adding 10 million overseas. International firm employment in the U.S. has grown at a slightly faster pace in percentage terms but less sharply in total numbers, rising by about 80% from 4.8 million in 1992 to 8.6 million in 2020.

Lots of money and research, the various products of the world freely available, employment rising at typically modest but positive gradations each year. All this may feel a bit reassuring, as “geopolitics” grows steadily more menacing, and international institutions fray at the edges — but it also makes Keynes’s close, as he reflects on how fragile the apparent calm and stability of his own recent past were, especially unsettling:

“[H]e [the hypothetical upper-middle class Londoner, probably referring to himself] regarded this state of affairs as normal, certain, and permanent, except in the direction of further improvement, and any deviation from it as aberrant, scandalous, and avoidable. The projects and politics of militarism and imperialism, of racial and cultural rivalries, of monopolies, restrictions, and exclusion, which were to play the serpent to this paradise, were little more than the amusements of his daily newspaper, and appeared to exercise almost no influence at all on the ordinary course of social and economic life.”

More from BEA:

U.S.-based multinationals.

… and earlier reports on American multinationals 2004-2021, with a link to an archive dating back to 1982.

International firms in the United States.

… and the counterpart set of reports on foreign investment in the United States.

International perspective:

UNCTAD’s World Investment Report 2022.

Sources and destinations:

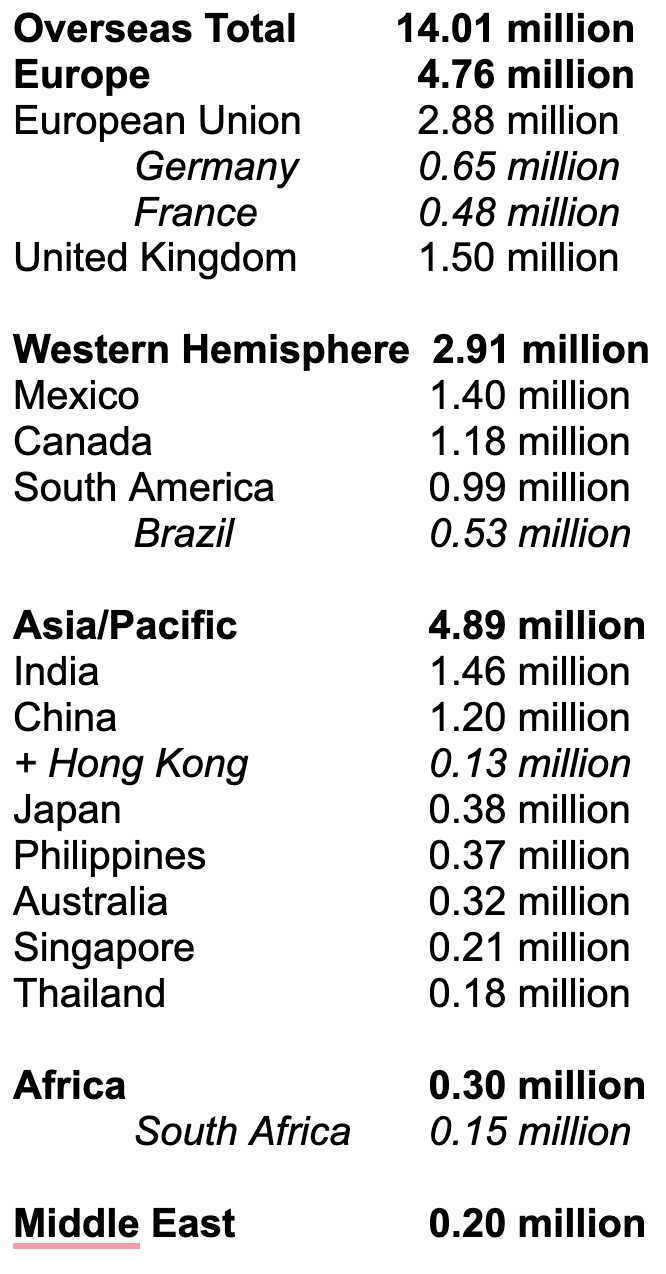

BEA’s figures look at U.S. private-sector investment abroad as well as multinationals operating here, with some detail on destinations for U.S. investment and the ownership of investment here. As both a destination and a source, Europe is the main partner and Canada is disproportionately large. By value (“investment stock”), Europe is home to $4 trillion of $6.5 trillion in U.S. FDI abroad (2020), with the U.K. at $1.0 trillion, EU members $2.7 trillion, and Switzerland, Norway, Iceland, and Turkey together $0.25 trillion. Latin American countries are at $0.25 trillion, led by Mexico at $110 billion; Asia and the Pacific are at $960 billion, topped by Singapore at $294 billion, Australia at $167 billion, and Japan and China both around $118 billion. Measured by jobs, though, U.S. firms employ about as many people in Asia as in Europe. A table of U.S. overseas employment by region:

Looking the other way, European firms are likewise the main international employers in the United States, at 5 million jobs or about 60% of the 8.6 million total. By country, U.K. firms led at 1.2 million, followed by Japanese at just above 1 million, Canadians just below, Germans at 885,000, French at 740,000, and Dutch at 569,000. Japanese firms employed a bit more than 1 million Americans, second only to the Brits; Canadians just a bit less at 940,000. Chinese firms, though receiving much attention and publicity, were modest employers of Americans at 153,000; Mexicans were at 89,000, and Indians 73,000.

And the ghost at the banquet:

Keynes’ The Economic Consequences of the Peace (1919).

Ed Gresser is Vice President and Director for Trade and Global Markets at PPI.

Ed returns to PPI after working for the think tank from 2001-2011. He most recently served as the Assistant U.S. Trade Representative for Trade Policy and Economics at the Office of the United States Trade Representative (USTR). In this position, he led USTR’s economic research unit from 2015-2021, and chaired the 21-agency Trade Policy Staff Committee.

Ed began his career on Capitol Hill before serving USTR as Policy Advisor to USTR Charlene Barshefsky from 1998 to 2001. He then led PPI’s Trade and Global Markets Project from 2001 to 2011. After PPI, he co-founded and directed the independent think tank Progressive Economy until rejoining USTR in 2015. In 2013, the Washington International Trade Association presented him with its Lighthouse Award, awarded annually to an individual or group for significant contributions to trade policy.

Ed is the author of Freedom from Want: American Liberalism and the Global Economy (2007). He has published in a variety of journals and newspapers, and his research has been cited by leading academics and international organizations including the WTO, World Bank, and International Monetary Fund. He is a graduate of Stanford University and holds a Master’s Degree in International Affairs from Columbia Universities and a certificate from the Averell Harriman Institute for Advanced Study of the Soviet Union.

Read the full email and sign up for the Trade Fact of the Week